My Investments Update – August 2022

Here is my latest monthly update about my investments. You can read my July 2022 Investments Update here if you like

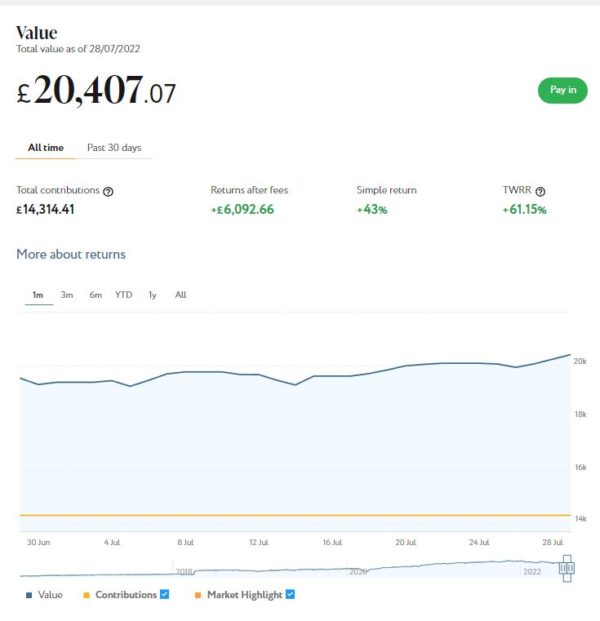

I’ll begin as usual with my Nutmeg Stocks and Shares ISA. This is the largest investment I hold other than my Bestinvest SIPP (personal pension).

As the screenshot below of performance last month shows, my main portfolio is currently valued at £20,407. Last month it stood at £19,357 so that is a (very welcome) rise of £1,050.

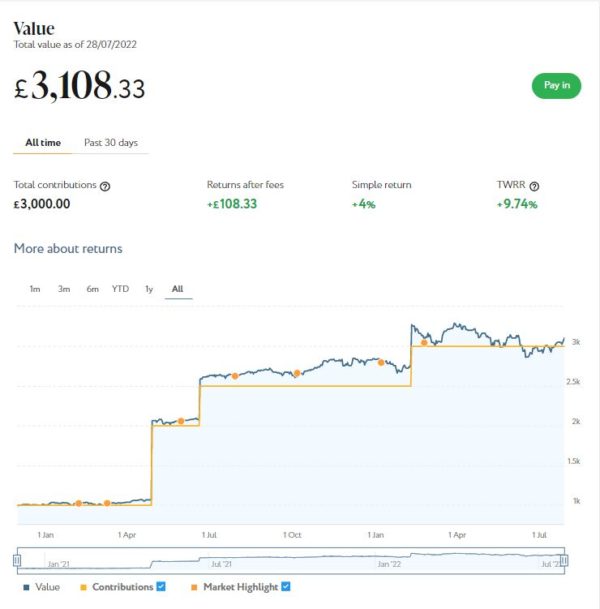

Apart from my main portfolio, I also have a second, smaller pot using Nutmeg’s Smart Alpha option. This is now worth £3,108 compared with £2,942 a month ago, a rise of £166

Here is a screen capture showing performance since January 2022. As you may be able to see, I have topped up this account several times this year.

The rises in July are obviously encouraging. In particular, it is nice that my Smart Alpha portfolio (which I haven’t had as long) is worth more than I put into it once again!

Nonetheless, this month’s rises still don’t quite cancel out the falls of last month. And the total value of my Nutmeg portfoiio is still around 8% less than it was at the start of 2022.

As I’ve noted previously on PAS, you do have to expect ups and downs with equity-based investments. And this year there has been no lack of volatility in world markets, caused by rising inflation, the war in Ukraine and the aftermath of the pandemic (among other things).

Even so, since I started investing with Nutmeg in 2016 – and despite everything that has happened this year – I have still made a total net return on capital of 42.56% (or 61.15% time-weighted) on my main portfolio.

I should say as well that I selected quite a high risk level for both my Nutmeg accounts (9/10 for the main one and 5/5 for Smart Alpha). This has served me well generally, but I’m sure investors who selected lower risk levels will have seen smaller falls over the last few months. If you also have a Nutmeg portfolio and plan to withdraw from it soon, there may well be a case for switching to a lower risk level now.

You can read my full Nutmeg review here (including a special offer at the end for PAS readers). If you are looking for a home for your annual ISA allowance, based on my experience over the last six years, they are certainly worth considering.

If you haven’t yet seen it, check out also my blog post in which I looked at the performance of Nutmeg fully managed portfolios at every risk level from 1 to 10 (as mentioned, my main port is level 9). I was actually pretty amazed by the difference the risk level you choose makes. If you are investing for the long term (and you almost certainly should be) opting for a hyper-cautious low-risk strategy may not be the smartest thing to do.

I talked about the performance of my Assetz Exchange investment in my July update and also in this recent blog post about ethical investment options. I don’t therefore intend to provide an in-depth report about it on this occasion. I will just say that AE continues to provide steady returns for me, with a lot less ‘excitement’ than my equity-based investments. And as mentioned in my recent post, I like the fact that my money is being used ethically as well (e.g. to provide accommodation for people with learning difficulties or physical disabilities). You can read my full review of Assetz Exchange here. You can also sign up for an account on Assetz Exchange directly via this link [affiliate].

Another property platform I have investments with is Kuflink. They continue to do well, with new projects launching almost every day. I currently have around £2,200 invested with them in 14 different projects. To date I have never lost any money with Kuflink, though some loan terms have been extended once or twice. On the plus side, when this happens additional interest is paid for the period in question. At present all my Kuflink loans are performing to schedule, though two are showing as ‘pending status update’, which may translate to a delay in repayment.

My loans with Kuflink pay annual interest rates of 6 to 7.5 percent. These days I invest no more than £200 per loan (and often less). That is not because of any issues with Kuflink but more to do with losses of larger amounts on other P2P property platforms in the past. My days of putting four-figure sums into any single property investment are behind me now!

- Nowadays I mainly opt to reinvest the monthly repayments I receive from Kuflink, which has the effect of boosting the percentage rate of return on the projects in question

Obviously a possible drawback with Kuflink and similar platforms is that your money is tied up in bricks and mortar, so not as easily accessible as cash savings or even (to some extent) shares. They do, however, have a secondary market on which you can offer any loan part for sale (as long as the loan in question is performing and not in arrears). Clearly that does depend on someone else wanting to buy it, but my experience has been that any loan parts offered are typically snapped up very quickly. So if an urgent need arises, withdrawing your money (or part of it) is unlikely to be an issue.

You can read my full Kuflink review here. They offer a variety of investment options, including a tax-free IFISA paying up to 7% interest per year with built-in automatic diversification. Alternatively you can now build your own IFISA, with most loans on the platform (including the one shown above) being IFISA-eligible.

My investment in European crowdlending platform Nibble continues to perform as advertised. My latest investment was in their Legal Strategy. These are loans that are in default and facing legal action. Nibble buy these loans at a heavily discounted rate and then seek to recover as much as possible of the money owed. The minimum investment is 10 euros and the minimum period is six months. I invested 100 euros for 12 months initially at a target annual interest rate of 12.5%.

The Legal Strategy comes with a deposit-back guarantee. This is a guarantee to return the full investment amount at the end of the investment period and a minimum yield of 9% per year. The actual yield depends on how successful recovery efforts prove, so in practice you may end up with a return of anywhere between 9% and 14.5%. All has gone to plan so far, but I will obviously continue to report on this in the months ahead.

- I recently updated my original review of Nibble, which you can read here if you wish. You can also sign up directly on the Nibble website if you like [affiliate link].

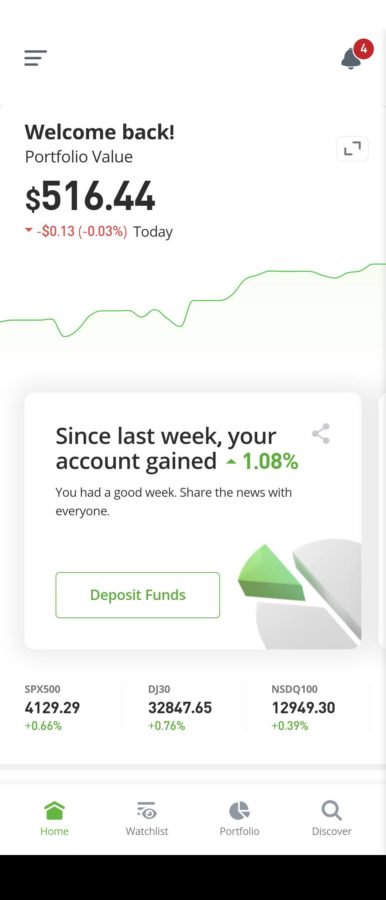

As mentioned last time, I recently set up an account with investment and trading platform eToro, using their popular ‘copy trader’ facility. I chose to invest $500 (about £412) copying an experienced eToro trader called Aukie. My investment initially dipped, but as the screen capture below (of the app page on my mobile phone) shows, I am now about $16 in profit. That’s an increase of over 3% in just over a month. Obviously if it continues to do as well as this, I shall be delighted 🙂

In any event I am looking on this as a long-term investment so won’t be judging it yet. I am also considering a further investment with eToro, possibly in one of their themed portfolios. You can read my full in-depth review of eToro here if you like.

Moving on, I had another article published on the always-excellent Mouthy Money website. This one is titled Is Car Leasing Right For You? I found this very interesting to research and it gave me food for thought about what I may do when the time comes to bid goodbye to my current vehicle.

Turning to non-financial matters. I hope you are enjoying the (mostly) fine summer weather and making the most of our greater freedoms as we (hopefully) leave the pandemic behind. I recently enjoyed a day out with my friend Jeff at the National Trust’s Snowshill Manor and Gardens in Gloucestershire (pictured in the cover photo).

It was my first visit and I found it a fascinating place. The manor was owned by Charles Wade, an eccentric ex-Army officer. He used it to house his extensive collection of objects of all kinds, from musical instruments to children’s toys, bicycles to Samurai armour (see my photo below). I will try to find time to write a proper review of my trip to Snowshill soon.

And on the subject of summer, can I also remind you about the collaborative Summer Giveaway I am sponsoring in association with other UK bloggers. It’s free to enter, and the lucky winner will receive not only an MSpa hot tub worth almost £1,000 but a range of other great prizes as well. The contest closes on 14 August 2022. Here’s a link to my blog post with details of how to enter.

That’s enough for today. As always, if you have any comments or queries, feel free to leave them below. I am always delighted to hear from PAS readers 🙂

Disclaimer: I am not a qualified financial adviser and nothing in this blog post should be construed as personal financial advice. Everyone should do their own ‘due diligence’ before investing and seek professional advice if in any doubt how best to proceed. All investing carries a risk of loss.

Note also that posts may include affiliate links. If you click through and perform a qualifying transaction, I may receive a commission for introducing you. This will not affect the product or service you receive or the terms you are offered, but it does help support me in publishing PAS and paying my bills. Thank you!