My Investments Update – July 2024

Here is my latest monthly update about my investments. Note that this month due to other commitments I am publishing this post a few days early. You can read my June 2024 Investments Update here if you like.

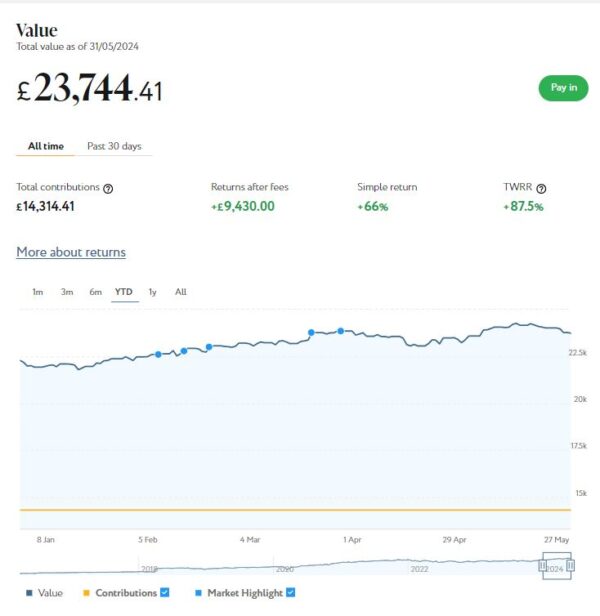

I’ll begin as usual with my Nutmeg Stocks and Shares ISA. This is the largest investment I hold other than my Bestinvest SIPP (personal pension).

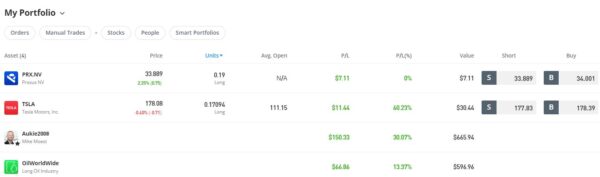

As the screenshot below for the year to date shows, my main Nutmeg portfolio is currently valued at £24,250. Last month it stood at £23,744, so that is an increase of £506.

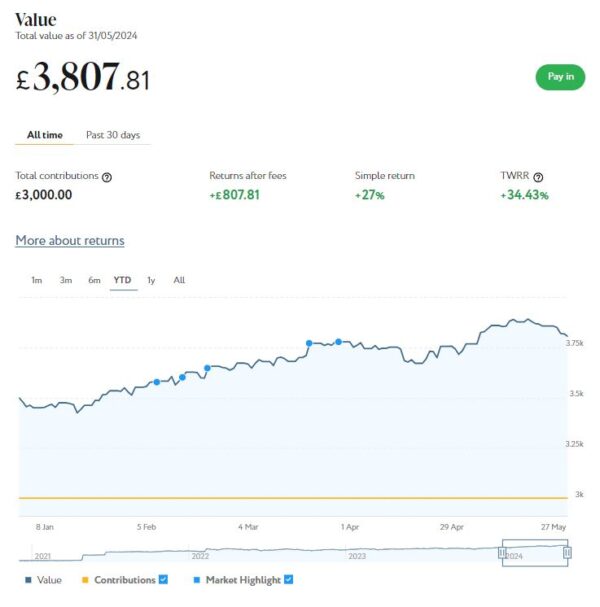

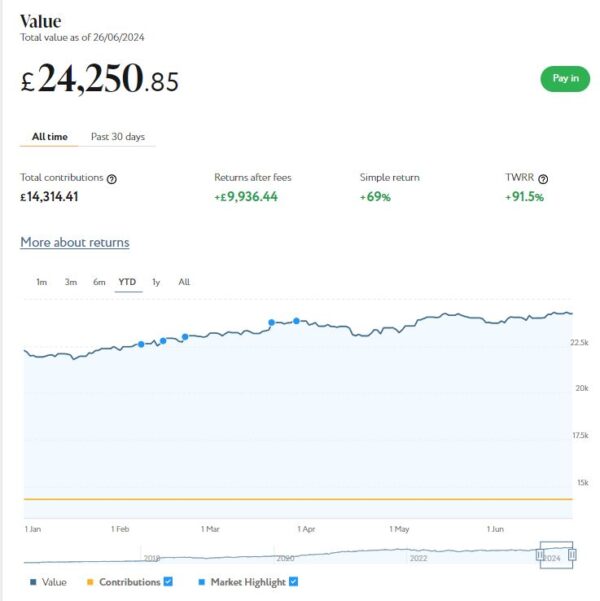

Apart from my main portfolio, I also have a second, smaller pot using Nutmeg’s Smart Alpha option. This is now worth £3,911 compared with £3,808 a month ago, a rise of £103. Here is a screen capture showing performance over the year to date.

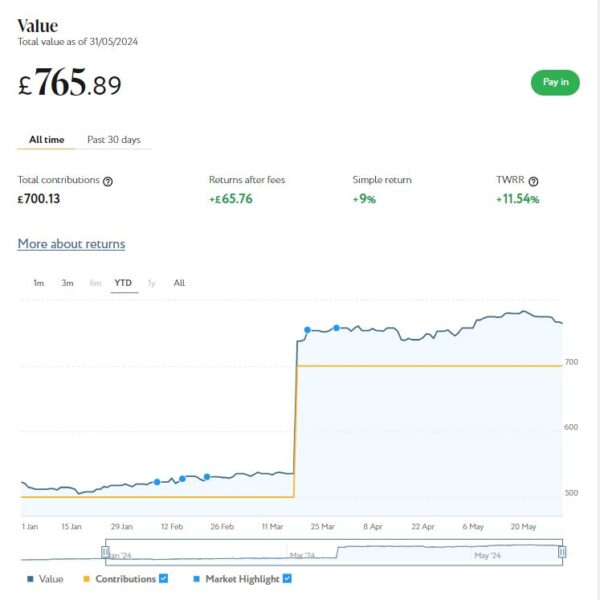

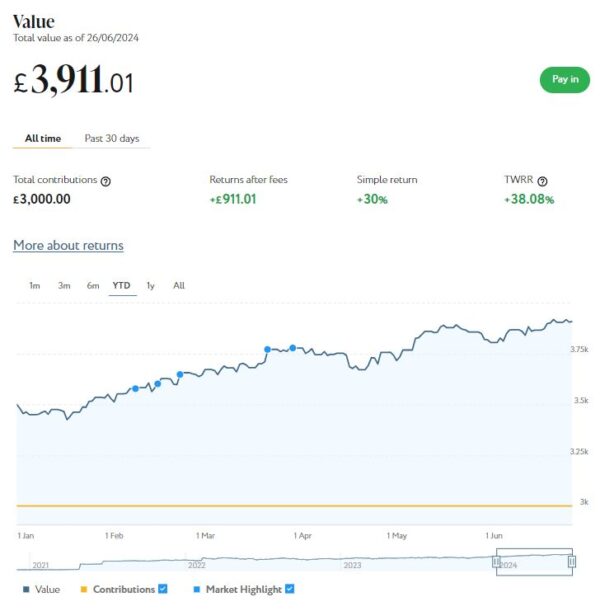

Finally, at the start of December 2023 I invested £500 in one of Nutmeg’s new thematic portfolios (Resource Transformation). In March I also invested a further £200 from ‘Refer a Friend’ bonuses. As you can see from the screen capture below, this portfolio is now worth £772 compared with £766 last month, a small rise of £6.

As you can see from the charts, June was generally a decent month for my Nutmeg investments. Their overall value has risen by £615 or 2.18% since the start of June. They are also up by £2,618 or 9.95% in the six months since the start of the year.

You can read my full Nutmeg review here. If you are looking for a home for your annual ISA allowance, based on my overall experience over the last eight years, they are certainly worth considering. They offer self-invested personal pensions (SIPPs), Lifetime ISAs and Junior ISAs as well.

- You may like to note that I am no longer an affiliate for Nutmeg. That means you won’t find any affiliate links in my review (or anywhere else on PAS). And you will no longer see the no-fees-for-six-months offer I used to be able to promote as an affiliate. However, the better news is that you can still get six months free of any management fees by registering with Nutmeg via my Refer a Friend link. I will receive a gift voucher if you do this, which is duly appreciated

Don’t forget, also, that the new tax year began on 6 April 2024 and and you now have a whole new £20,000 tax-free ISA allowance for 2024/25. In a change to the rules, you can now open any number of ISAs with different providers in the same tax year, as long as you don’t exceed your overall £20,000 allowance. So opening a stocks and shares ISA with Nutmeg won’t prevent you from also opening one with another S&S ISA provider (should you so wish) later in the financial year.

Moving on, I also have investments with the property crowdlending platform Kuflink. They continue to do well, with new projects launching every week. I currently have around £833 invested with them in 7 different projects paying interest rates averaging around 7%. I also have £540 in my Kuflink cash account after another loan was recently repaid. I am still considering whether to reinvest this money with Kuflink or withdraw it and invest the money elsewhere.

To date I have never lost any money with Kuflink, though some loan terms have been extended once or twice. On the plus side, when this happens additional interest is paid for the period in question.

There is now an initial minimum investment of £1,000 and a minimum investment per project of £500. Kuflink say they are doing this to streamline their operation and minimize costs. I can understand that, though it does mean that the option to test the water with a small first investment has been removed. It also makes it harder for small investors (like myself) to build a well-diversified portfolio on a limited budget.

One possible way around this is to invest using Kuflink’s Auto/IFISA facility. Your money here is automatically invested across a basket of loans over a period from one to five years. Interest rates range from 7% to around 10%, depending on the length of term you choose. Full up-to-date details can be found on the Kuflink website.

You can invest tax-free in a Kuflink Auto IFISA. Or if you have already used your annual ISA allowance elsewhere, you can invest via a taxable Auto account. You can read my full Kuflink review here if you wish.

Moving on, my Assetz Exchange investments continue to generate steady returns. Regular readers will know that this is a P2P property investment platform focusing on lower-risk properties (e.g. sheltered housing). I put an initial £100 into this in mid-February 2021 and another £400 in April. In June 2021 I added another £500, bringing my total investment up to £1,000.

Since I opened my account, my AE portfolio has generated a respectable £188.95 in revenue from rental income. As I said in last month’s update, capital growth has slowed, though, in line with UK property values generally.

At the time of writing, 12 of ‘my’ properties are showing gains, 2 are breaking even, and the remaining 16 are showing losses. My portfolio is currently showing a net decrease in value of £32.84, meaning that overall (rental income minus capital value decrease) I am up by £156.11. That’s still a decent return on my £1,000 and does illustrate the value of P2P property investments for diversifying your portfolio. And it doesn’t hurt that with Assetz Exchange most projects are socially beneficial as well.

The overall fall in capital value of my AE investments is obviously a little disappointing. But it’s important to remember that until/unless I choose to sell the investments in question, it is largely theoretical, based on the most recent price at which shares in the property concerned have changed hands. The rental income, on the other hand, is real money (which in my case I’ve reinvested in other AE projects to further diversify my portfolio).

To control risk with all my property crowdfunding investments nowadays, I invest relatively modest amounts in individual projects. This is a particular attraction of AE as far as i am concerned (especially after Kuflink raised their minimum investment per project to £500). You can actually invest from as little as 80p per property if you really want to proceed cautiously.

- As I noted in this recent post, Assetz Exchange is particularly good if you want to compound your returns by reinvesting rental income. This effectively boosts the interest rate you are receiving. Personally, once I have accrued a minimum of £10 in rental payments, I reinvest this money in either a new AE project or one I have already invested in (thus increasing my holding). Over time, even if I don’t invest any more capital, this will ensure my investment with AE grows at an accelerating rate and becomes more diversified as well.

My investment on Assetz Exchange is in the form of an IFISA so there won’t be any tax to pay on profits, dividends or capital gains. I’ve been impressed by my experiences with Assetz Exchange and the returns generated so far, and intend to continue investing with them. You can read my full review of Assetz Exchange here. You can also sign up for an account on Assetz Exchange directly via this link [affiliate]. Note that as from this financial year (2024/25), you can open more than one IFISA per year.

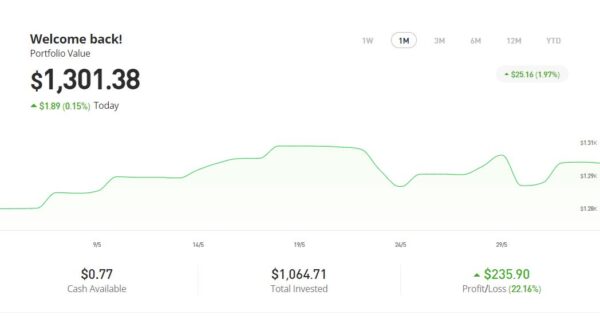

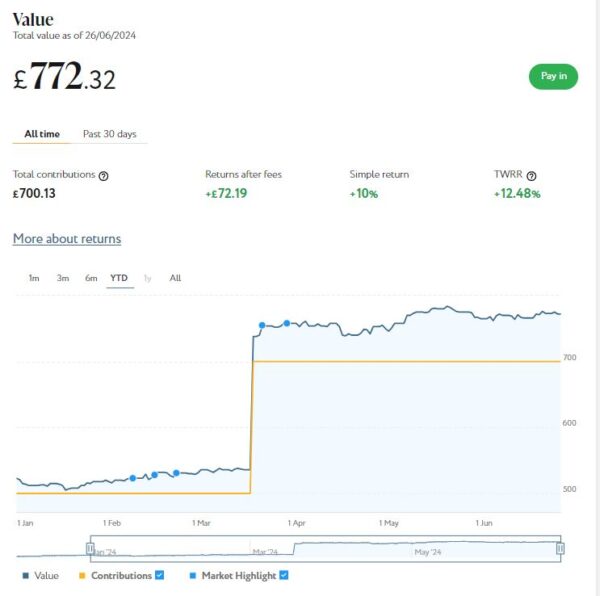

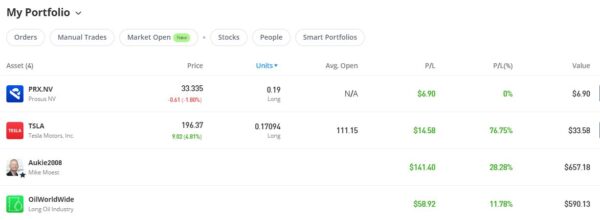

In 2022 I set up an account with investment and trading platform eToro, using their popular ‘copy trader’ facility. I chose to invest $500 (then about £412) copying an experienced eToro trader called Aukie2008 (real name Mike Moest).

In January 2023 I added to this with another $500 investment in one of their thematic portfolios, Oil Worldwide. I also invested a small amount I had left over in Tesla shares.

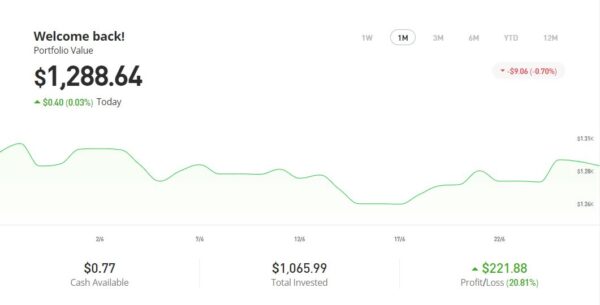

As you can see from the screen captures below, my original investment totalling $1,022.26 is today worth $1,288.64 an overall increase of $266.38 or 26.06%.

You can read my full review of eToro here. You may also like to check out my more in-depth look at eToro copy trading. I also discussed thematic investing with eToro using Smart Portfolios in this recent post. The latter also reveals why I took the somewhat contrarian step of choosing the oil industry for my first thematic investment with them.

As you can see, my Oil WorldWide investment is showing just under 12% profit. That’s okay but not spectacular. Obviously my copy trading investment with Aukie2008 has been doing better. The Oil WorldWide port is currently being rebalanced by eToro, so I am hoping this may boost its performance. The investment team at eToro periodically rebalance all smart portfolios to ensure that the mix of investments remains aligned with the portfolio’s goals, and to take advantage of any new opportunities that may present themselves.

- eToro also offer the free eToro Money app. This allows you to deposit money to your eToro account without paying any currency conversion fees, saving you up to £5 for every £1,000 you deposit. You can also use the app to withdraw funds from your eToro account instantly to your bank account. I tried this myself and was impressed with how quickly and seamlessly it worked. You can read my blog post about eToro Money here. Note that it can also serve as a cryptocurrency wallet, allowing you to send and receive crypto from any other wallet address in the world.

I had three more articles published in June on the excellent Mouthy Money website. The first is How to Save Money on Your Purchases by Haggling. In this I set out a range of tips for saving money by haggling. As I say in the article, you might think this is an ancient practice reserved for bustling bazaars or flea markets in distant lands. But it’s actually a skill that can serve you well in everyday life, even in the modern shopping landscape of the UK.

Also in Mouthy Money last month I revealed How to Cash in on Your Old Gadgets. In this article I described various ways you may be able make money from your old tech (mobile phones, tablets, cameras, satnavs, games consoles, and so on) even if – in some cases – it’s no longer working.

My third article in Mouthy Money in June was Could You Save Money With Home Wind Power? In this article I looked at home wind turbines – what they are, how they work, and the pros and cons of installing one. I also revealed an alternative way of saving money through wind power by investing in a wind farm with Ripple Energy (something I have done myself – see below).

As I’ve said before, Mouthy Money is a great resource for anyone interested in money-making and money-saving. From the wide range of articles published in June, I particularly enjoyed Things We Can Learn From Other Countries About Money by MM’s editor, Edmund Greaves. Ed has lived and worked in various countries around the world, from Argentina to South Africa. He has some eye-opening observations about attitudes to money in these different countries and what we in Britain can learn from them.

I also published several posts on Pounds and Sense in June. Some are no longer relevant due to closing dates having passed, but I have listed the others below.

In How to Ensure You Can Cast Your Vote in the General Election, I set out some tips to ensure you are able to cast your vote in the General Election on 4th July 2024. Among other things, I highlighted some issues that older people may face. I also discussed the requirement to bring some form of photo ID to the polling station with you.

Also in June I published How to Protect Your Savings and Investments Under a Labour Government. With the likelihood of this increasing, in this post I set out some hints and tips to help preserve your assets in light of the tax and other economic changes that Labour may introduce. Of course, many of these tips would apply equally to a new government of any persuasion in these challenging times.

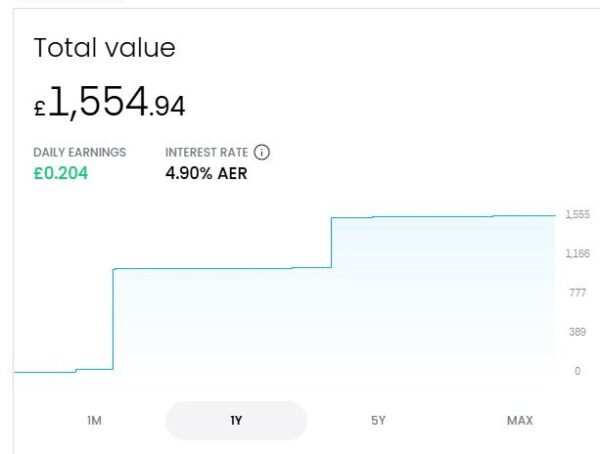

Another post was my Review of the New Trading 212 Cash ISA. This new product from the popular Trading 212 platform has been generating a lot of interest, so in this post I took a closer look, setting out the pros and cons as I see them. I also explained why I have opened a Trading 212 Cash ISA myself

A little to my surprise, Trading 212 also reopened their free share offer last month, so I updated and republished my blog post Get a Free Share Worth Up to £100 With Trading 212. This explains how, if you haven’t done so already, you can get a free share when you open a new Invest or Stocks ISA with Trading 212. Note that opening a Cash ISA alone will not qualify you for a free share, but of course you can do both. My advice is to start by opening a Stocks ISA or (non-ISA) Invest account to qualify for your free share, and apply for the Cash ISA after that.

Finally, I published Could You Benefit From Help to Save? This is a government-backed savings account that offers a generous bonus to low-income earners. Launched in September 2018, it aims to encourage regular savings by offering a 50% bonus on the amount saved over four years. There are no age limits to apply, but you must be in receipt of one of three work-related benefits. See my blog post for more information.

Next, a few odds and ends. Last time I mentioned that I recently invested some money (just over £1,000) in a Scottish wind farm project via a platform called Ripple Energy. The way this works is that you pay a one-off fee towards building the wind farm, and in exchange receive lower-cost, ‘green’ electricity once the wind farm is up and running. This will continue for the life of the wind farm (an estimated 20 years). The original closing date for this was the end of May, but the date was extended and the share offer is still open at the time of writing.

If you’re interested in learning more, you can visit the Ripple website via my referral link. If you then decide to invest yourself, you will get a £25 bonus credited to your account when generation starts (and so will I). Note that you will need to invest a minimum of £1,000 to qualify for the £25 bonus, but you can invest from as little as £25 if you like.

Also as mentioned last time, I recently invested a small amount (£500) via a property loan investment platform called Crowdstacker. I have followed Crowdstacker for some time but never got around to investing with them. They are somewhat similar to Kuflink, but their minimum investment per project is lower (just £100) which makes building a diversified portfolio easier. In addition, rates of return are higher, typically 12% to 16%. Obviously higher returns are generally associated with higher risks, and it’s important to bear this in mind when investing – though as all loans are secured against property, you do have some protection. All investments are available in the form of a tax-free IFISA within your overall £20,000 annual ISA allowance.

Crowdstacker doesn’t have a referral programme as far as I know, so I am just sharing this info out of interest. If anyone has any questions or comments about Crowdstacker, feel free to leave them below as usual.

Finally, my usual reminder that you can also follow Pounds and Sense on Facebook or Twitter/X. Twitter/X is my number one social media platform these days and I post regularly there. I share the latest news and information on financial (and other) matters, and other things that interest, amuse or concern me. So if you aren’t following my PAS account, you are definitely missing out!

That’s all for today, except to remind you to get out and vote on 4th July. I know apathy holds sway across large parts of the country right now, but unless you cast your vote in the general election you can’t really complain about how things turn out subsequently!

As always, if you have any comments or queries, feel free to leave them below. I am always delighted to hear from PAS readers

Disclaimer: I am not a qualified financial adviser and nothing in this blog post should be construed as personal financial advice. Everyone should do their own ‘due diligence’ before investing and seek professional advice if in any doubt how best to proceed. All investing carries a risk of loss. Note also that posts on PAS may include affiliate links. If you click through and perform a qualifying transaction, I may receive a commission for introducing you. This will not affect the product or service you receive or the terms you are offered, but it does help support me in publishing PAS and paying my bills. Thank you!