Here’s Why I Changed My Mind About EDF Energy’s ‘Sunday Saver’ Challenge

In this post a few weeks ago I discussed EDF Energy’s ‘Sunday Saver’ challenge. I explained why I had some reservations about the scheme and wasn’t therefore taking it up.

The post attracted a lot of interest. It actually generated more comments than any other post I have made on Pounds and Sense. Various people (especially Harry and KenM – thanks, guys!) posted in some detail about their experiences with the scheme. As a result I changed my opinion somewhat and decided to sign up when the opportunity arose the following month.

In this update I thought I would talk about why I changed my mind and the results I have achieved myself over the last few weeks. But first, a word of explanation…

What is EDF’s Sunday Saver Challenge?

This scheme is intended to reward EDF customers for switching some of their energy usage away from peak times.

The way it works is that you’re given targets to shift your electricity consumption on weekdays away from peak hours (4pm-7pm). When you hit your weekly target (which is set individually for each user by EDF), you earn free electricity the following Sunday.

EDF say, ‘The more you shift, the more you earn – reduce your weekly peak usage by 40% and you could earn up to 16 hours of free electricity per week.’ The challenge takes place monthly, starting on the first Monday of each month.

Why Did I Have Reservations?

As I said above, I had various reservations about the scheme prior to signing up. I have copied below the relevant paragraphs from my original post.

- To benefit from this scheme you have to cut your daily energy usage every weekday between 4pm and 7pm. That’s quite a long period (three hours), and coincides with when I would normally be cooking my evening meal. To have any realistic chance of cutting my energy use during this time, I would have to eat either ridiculously early or significantly later than normal. For various reasons, including my health, I prefer to eat between 6 and 7 pm and no later. So that in itself is a big ask and would impact drastically on my normal routine.

- Free electricity on Sunday sounds great, but the devil is in the detail. EDF say that you will get ‘up to 16 hours’ of free electricity if you meet their targets, but are very vague about what this means in practice. Specifically, they don’t explain how your energy-saving targets are calculated, how any reduction in usage translates to free hours, or when on Sunday you will be able to use the free electricity awarded.

- In addition, they say there are ‘fair usage’ limits to how much free electricity you can have. Again, they are vague about what this means in practice. The obvious way to use your free electricity would be to charge your EV, and I strongly suspect limits would be placed on this. As for me, I don’t have an EV and don’t want one, so my options for benefiting from the free electricity would be limited. I could shift use of appliances like my washing machine to Sunday but doubt if I could save more than a few kw/h this way (obviously the exact number would depend on how many free hours I was allocated, which is anyone’s guess). That means my free electricity would likely benefit me by no more than a pound or two.

- Lastly, as a solar panel owner I already get some free electricity anyway. My panels obviously generate less in the winter, but during daylight hours they still produce something. That means any benefit from free electricity on Sundays will be reduced, especially if (as is likely) the free hours are in the day rather than at night.

So What Changed?

The comments and info posted by readers who had signed up for the challenge and (in general) had benefited from it changed my views somewhat. They also addressed some of the doubts I had expressed in my original post.

As regards the free hours on Sunday, depending on how much you reduce your usage you can get anything from 4 hours to a maximum of 16. The free hours always start at 8 am and go on until as late as 12 midnight if you achieve the full target saving.

There are indeed ‘fair usage’ limits for the free hours you are awarded. They are as follows: 11.25 kWh with 4 free hours; 22.5 kWh with 8 free hours; 33.75 kWh with 12 free hours; and 45 kWh with 16 hours. EDF say these amounts are subject to change.

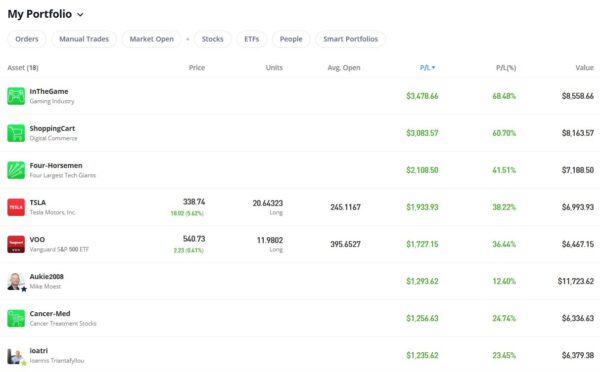

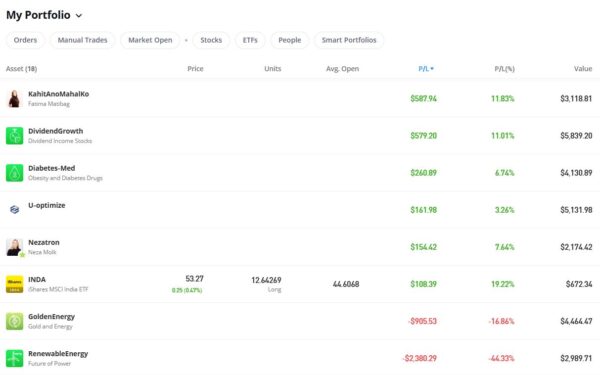

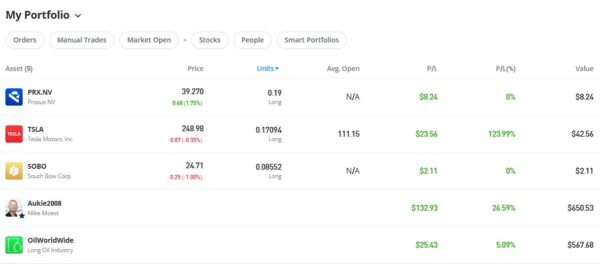

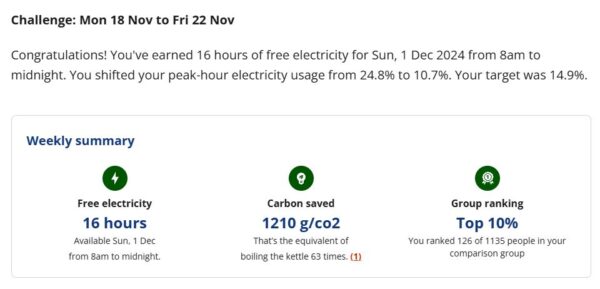

I still don’t know how exactly the saving targets are set, but here is a screen capture showing the ones I was set last week and the results I obtained.

As you can see, that was a successful week! I’ll talk more about my personal experiences with the Sunday Saver challenge below.

I also realised that, while I don’t have an EV, I could use a fair-sized portion of my free electricity charging my home storage battery from the grid. This wasn’t something I had done before (I got my battery mainly to store power generated by my solar panels) but obviously I knew it was possible. As things turned out (see below) it wasn’t without its challenges. But without doing this I’m not convinced I could have used enough free electricity to make the scheme worthwhile.

I do, incidentally, still think that EDF should make the terms and conditions of the challenge clearer prior to signing up. But anyway, based on info received from my readers, I felt it was worth giving it a try. So here’s a bit about my experiences with the November challenge.

So What Happened?

When I decided to do the EDF Sunday Saver challenge, I was clear I wasn’t going to cause myseff a ton of hassle cutting my electricity usage to the bone (I live on my own these days, incidentally). I decided I could probably defer starting my (electric) cooking till 7 pm. That was a minor inconvenience, but so far anyway I’ve been getting around it by eating meals that are quick to cook (yesterday I had gnocchi with pesto and spinach, for example). I’ll admit I’ve had a few microwave meals as well. I did also do some healthier batch cooking on one of the Sundays to produce meals I could quickly heat up during the week.

Shifting my main cooking time has undoubtedly done more than anything to reduce my peak-time energy use. Apart from that I have done little. I wouldn’t normally be hoovering or using the washing machine at peak times anyway. I have made a point of turning off my desktop computer by 4 pm (something I should probably have been doing anyway). I’ve also been a bit more careful about switching off lights when I don’t need them. And obviously I don’t use any electric heating during peak hours (thankfully I have gas central heating and a separate gas fire in the lounge). And that’s it really. For the first three weeks of the November challenge I achieved my targets fairly easily, earning the maximum 16 hours for two of them and 12 hours for the other.

I saved all my hoovering and clothes washing for Sundays to make use of the free electricity. In addition, as mentioned above, I set my home battery to charge from the grid that day. Unfortunately because I hadn’t done this before – and the software isn’t as intuitive as it should be – the first time it didn’t work at all. The following Sunday I got it working but somehow must have set it to charge every day in the evening. So on the Monday the battery started charging at the maximum rate (6 kw/h) at 5 pm. Unfortunately I didn’t notice this until around 6 pm, so that drove a coach and horses through my weekly energy-saving target. At the time of writing, my weekly dashboard shows that I am currently using 97.5% of my electricity during peak hours and – unsurprisingly – am ‘not on target’ to achieve the 14.9% set for me. Obviously, then, I will have to write off this week. I just hope that my poor performance will encourage EDF to set me generous targets in December!

Closing Thoughts

Overall, my experiences have been positive enough to want to continue the Sunday Saver challenge. I will have saved some money by doing it, which will be credited to my account in December.

It will be interesting to see what usage targets EDF set me next month, especially after I messed up the final week of the challenge. But in any event, EDF have also let me know that anyone signing up for the December challenge will get an automatic eight hours of free electricity on Christmas Day regardless of any energy savings they make. So that is another incentive to sign up for December (which I have already done),.

So those were my experiences with the EDF Sunday Saver challenge in November. I’d be interested to hear how you got on if you did it too, and whether you will be continuing the challenge. Also, if you are on a similar scheme with another energy company, I’d love to hear how that’s going for you. Please post any comments below as usual, not forgetting to allow me a few hours to approve them.

- As I have said before on PAS, I can offer anyone switching to EDF £50 off their bills if they use my refer-a-friend link at https://edfenergy.com/quote/refer-a-friend/sunny-koala-9462 when applying. I will also get £50 off my bill if you do this (£75 till 12 December 2024), which is duly appreciated