Review: The New Trading 212 Cash ISA

Updated 19 February 2025

Trading 212, a well-known platform in the UK for trading stocks and shares, recently introduced a new product to its lineup: the Trading 212 Cash ISA.

This addition comes as part of the company’s efforts to diversify its offerings and cater to a broader range of financial needs. Today I’ll be delving into the details of this new product, highlighting its pros and cons. I’ll also reveal why I decided to open a Trading 212 Cash ISA myself.

Let’s start with the basics though…

What is a Cash ISA?

A Cash ISA (Individual Savings Account) is a tax-free savings account where the interest earned is not subject to income tax. Each tax year, individuals can deposit up to a certain limit, which for the 2024/25 tax year is £20,000. Cash ISAs are a popular choice for those looking to save money without the risk associated with investments in the stock market.

Pros and Cons of the Trading 212 Cash ISA

Pros

- Tax-Free Interest: Like all ISAs, the interest earned in a Trading 212 Cash ISA is completely tax-free. This makes it an attractive option for savers looking to maximize their returns without the burden of paying income tax on their earnings.

- Competitive Interest Rate: The current rate is 4.9% per annum, which puts it at or near the top of the Best Buy tables. Rates are variable and can fluctuate based on market conditions, so it’s possible they will fall in future (UPDATE: The rate is falling to 4.5% from 1st March 2025). The platform will want to remain competitive with other financial institutions, however.

- No Fees: The Trading 212 Cash ISA is an entirely fee-free account.

- User-Friendly Platform: Trading 212 is known for its intuitive and user-friendly interface. The same ease of use applies to their Cash ISA, making it simple for users to manage their savings, check balances and track interest earned. You can manage your account via the Trading 212 website or an app on your phone.

- Low Minimum Investment: You can start with as little as £1 if you like. There is no upper limit other than the annual £20,000 ISA allowance (for all ISAs you hold).

- Security: Funds held in a Trading 212 Cash ISA are protected under the Financial Services Compensation Scheme (FSCS) up to £85,000 per individual. This provides peace of mind to savers, knowing their money is secure.

- Accessibility: You can withdraw whenever you want and as often as you want.

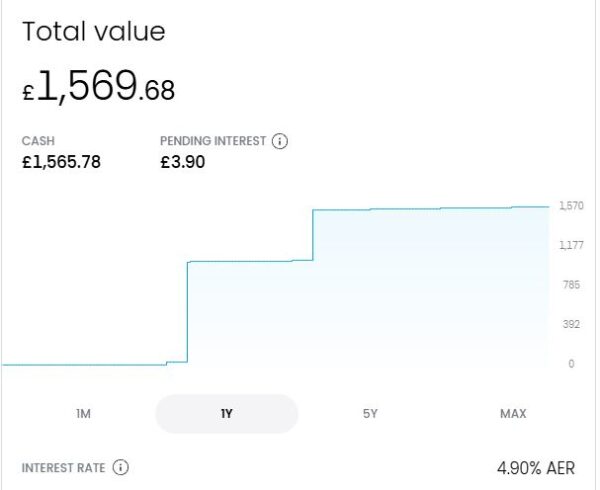

- Daily Interest Payments: Interest is credited to your account daily and added to your account at the end of each month (before that it is shown as ‘pending’). There is no need to wait up to a year to receive interest as with some other savings accounts.

- Integration with Other Products: For existing Trading 212 users, the Cash ISA seamlessly integrates with other accounts and products on the platform such as the Trading 212 Stocks and Shares ISA and general investment account.

- Easy Transfers: You can transfer in your ISA from another provider and you’ll be able to freely transfer between your Trading 212 Stocks and Shares ISA as well.

- Flexible ISA: You can withdraw from it and return your funds in the same tax year without it counting twice against your annual ISA allowance. For example, if you invest £10,000 and then withdraw £5,000, you can still invest £15,000 in that tax year (the remaining £10,000 of your £20,000 allowance plus return of the £5,000 you withdrew). Not all cash ISAs currently offer this.

Cons

- Interest Rate Variability: As mentioned above, while Trading 212 currently offers a competitive rate, this may change and it may not always be the highest on the market. It’s always a good idea to compare rates with other providers to ensure you are getting the best deal. That obviously applies especially if you are reading this article some time after it was first published (though I will endeavour to update it from time to time).

- Not Instant Access: You can withdraw money any time via the website or app but it may take up to three days to arrive in your bank account. So it is quick access but not instant.

- No High Street Presence: Trading 212 operates entirely online. They do have a customer service department which you can contact by phone or email. They are not set up to provide telephone banking, though.

- Limited Track Record: As a fairly new product, the Trading 212 Cash ISA does not have a long track record. Some more cautious savers might prefer established Cash ISA providers with a proven history.

- No Investment Growth: Unlike a Stocks and Shares ISA, a Cash ISA does not offer the potential for investment growth. While it is safer, it may yield lower returns in the long term compared with investment-based ISAs. Of course, there is no reason why you can’t have both.

- Inflation Risk: The interest earned on a Cash ISA may not always keep pace with inflation, potentially diminishing the real value of savings over time.

- Contribution Limits: The annual contribution limit of £20,000 applies across all ISAs. If you are already investing in a Stocks and Shares ISA or other type of ISA, the amount you can contribute to a Cash ISA will be reduced.

APR vs APY

One other thing to note is that the interest rate quoted by Trading 212 is described as APY. This is short for annual percentage yield. This is another term for AER (annual equivalent rate) which I discussed a while ago in this blog post.

What this means is that the rate quoted by Trading 212 – currently 4.9% – incorporates the compounding of interest payments. As mentioned above, in the Trading 212 Cash ISA interest is credited daily, and once it is in your account you get interest on the interest as well. That is obviously a good thing, but it does mean the advertised 4.9% APY already accounts for this. If the interest rate was quoted instead as an APR, it would actually be slightly lower (about 4.8%).

Does this matter? Well, yes and no. If you keep your money in the account for a full year, you will get the full rate of interest quoted (as APY). But if you withdraw it earlier – after six months, say – you won’t receive exactly half of this, as the compounding effect won’t have had as long to work. So instead of half the quoted 4.9% (currently) for six months, you would receive marginally less. It would only make a very small difference, but is worth bearing in mind if you are saving for a short-term goal in particular.

My Own Example

As mentioned above, I have opened a Trading 212 Cash ISA myself. I already had a Trading 212 General Investment account, so that made the decision easier. But I was also attracted by the competitive interest rate and the fact that interest was calculated daily.

A further consideration is that from this year there is no limit to the number of different ISAs you can open (as long as you don’t exceed the overall £20,000 annual limit). So opening a Trading 212 Cash ISA this year doesn’t preclude opening another Cash ISA with a different provider later in the year if circumstances change. It is also easier now to transfer money from one ISA to another.

I currently have a Santander Edge account which comes with a linked Edge Savings account (non-ISA) paying a market-leading 7% (AER) on balances of up to £4,000. I have maxed this out, however, so was looking for an alternative, tax-efficient home for the balance of my short- to medium-term savings (the other savings offers from Santander are a lot less appealing). The Trading 212 Cash ISA seemed ideal for me, therefore. I started by depositing £25 and as that went fine I then added another £1,000. Interest has been credited every day as promised, and as of 19 February 2025 my original £1,025 has grown to £1,569.68 (see screen capture below). Note that the total quoted includes £3.90 in pending interest accrued so far during February, which (as mentioned above) will be credited to my account at the end of the month.

Conclusion

In my view, the new Trading 212 Cash ISA is an enticing addition to the range of financial products available to UK savers.

It combines the tax-free benefits of a traditional ISA with the user-friendly experience Trading 212 is known for. And the interest rate (at present anyway) is very competitive. But obviously you should weigh up the pros and cons set out above carefully before deciding if it’s right for you. As always, it’s wise to compare options and consider your financial goals – both short and longer term – before proceeding.

As always, if you have any comments or questions about this post, please do leave them below.

Disclaimer: I am not a professional financial adviser and nothing in this post should be construed as personal financial advice. You should always do your own ‘due diligence’ before investing and take professional advice if in any doubt how best to proceed.

February 19, 2025 @ 11:18 am

Sounds really good doesn’t it?

In reality it’s not. Just had a message to say that the cash isa interest rate is going down by 0.4% from 4.91 to 4.5

I know the base rate went down by 0.25% but cannot understand why 212 have reduced it even further which has made me seriously unhappy.

With Reeves jumping all over pensioners this big reduction is another blow.

February 19, 2025 @ 12:17 pm

Thanks, Colin. It’s clearly disappointing but reflects a general trend at the moment. If you want an instant access cash ISA, you still won’t do much better than the 4.5% Trading 212 are offering from March 2025. Plum and Chip (both app-based) have slightly higher headline rates but with a few strings attached. And obviously it’s always possible they will reduce their rates too.

February 21, 2025 @ 4:08 am

Can I ask when is the daily pending interest added to the total of pending interest as mine has not moved ?

February 21, 2025 @ 3:50 pm

As far as I know it is added to the pending total daily. In my case interest is typically credited at about 2.30 am each day and I assume it is then added automatically to the pending total. If your pending total isn’t increasing daily, you might want to take it up with Trading 212. The only other thing I can think of is if you only have a very small amount of money in your account and no interest has therefore accrued.