P2P Property Investment Platform Assetz Exchange Rebrands as Housemartin

As regular readers of Pounds and Sense will know, I’m a fan of P2P property investment platform Assetz Exchange and have invested through them myself. AE have recently rebranded as Housemartin, so I thought I should write an update about this.

You can read my original detailed review of Assetz Exchange (as it was then) in this post. Much of this info still applies – so I won’t reproduce it all here – but certain things (as well as the name!) have changed.

Assetz Exchange began as a ‘traditional’ property crowdfunding platform, with investors coming together to buy a property. They then shared in the rental income received – and any profit if the property was subsequently sold – in proportion to the size of their investment. When I first wrote about Assetz Exchange they offered a variety of investment opportunities, including former show homes and development projects.

Nowadays, though, the company focuses on supported housing, working closely with charities and other organizations that assist people with physical and cognitive disabilities. These have generally proven the most reliable and hassle-free investments, so Housemartin have understandably chosen to concentrate on this.

Properties are generally let on long leases, with the charities taking responsibility for day-to-day management and maintenance. As mentioned, investors receive a share of the monthly rental received and any profits if/when the properties are sold (you can also potentially sell your holdings online at any time via the exchange, which serves as a secondary market). That puts these investments at the lower-risk end of the property investment spectrum (though there are, of course, still risks involved, and you should ensure you understand these and are comfortable with them before investing).

Assetz Exchange was originally part of the Assetz group of property investment companies that included Assetz Capital. In December 2023 Assetz announced it was withdrawing from the retail marketplace to work with institutional investors only. Partly as a consequence of this, the team behind Housemartin took the decision to part ways with the Assetz group and are no longer affiliated with them. Although they always operated separately from Assetz Capital, Housemartin is now an entirely independent P2P property investment platform. Regarding the name change, the company says:

“The name Housemartin reflects the company’s commitment to delivering robust, hassle-free, quality residential property investment opportunities that reward investors with monthly inflation-linked income. Just as the house martin bird is known for its sociability and adaptability, Housemartin aims to provide investors with an opportunity to pool funds with fellow investors to create much needed quality homes for people requiring support.”

Future Plans

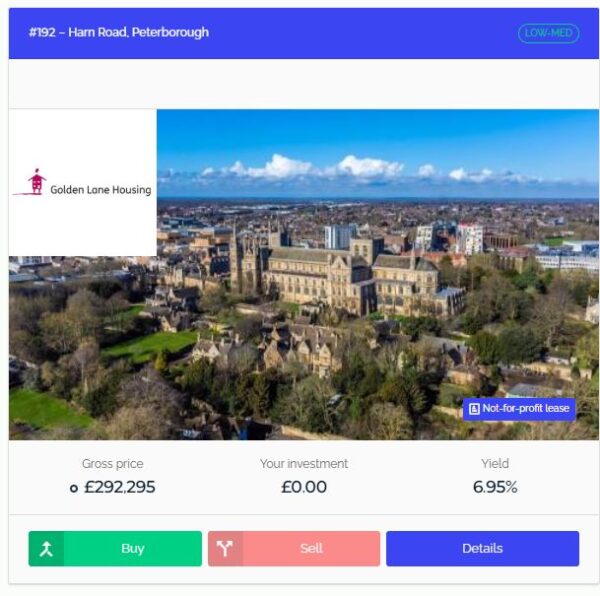

In its new guise as Housemartin, the company has big plans for 2025 and further into the future. They intend to stick to their strategy of working with partners in the supported housing sector, including (for example) Golden Lane Housing, Lets For Life and Halo Housing. A typical current opportunity from the website is shown below.

Peter Read, the MD of Housemartin, points out that with interest rates currently falling, this makes the returns of around 7% they can typically offer investors increasingly attractive (and of course there is the potential for capital growth as well). He also points out that rentals are raised every year in line with inflation.

Housemartin are currently launching a fundraising round on the investment platform Crowdcube. They are looking to raise additional capital which will be used to help the company expand and improve its offering. Anyone is welcome to invest via Crowdcube, though as this is a share offer it’s almost certainly riskier than investing via the platform itself, with no clearly defined exit route. Personally I do not plan to invest in Housemartin this way, but you can find out more if you wish by registering on the Crowdcube site.

My Own Experience

I put an initial £100 into the platform in mid-February 2021 and another £400 in April. In June 2021 I added another £500, bringing my total investment up to £1,000.

Since I opened my account, my portfolio has generated a respectable £227.35 in revenue from rental income. Capital growth has slowed, though, in line with UK property values generally.

At the time of writing, 12 of ‘my’ properties are showing gains, 3 are breaking even, and the remaining 20 are showing losses. My portfolio of 35 properties is currently showing a net decrease in value of £62.22, meaning that overall (rental income minus capital value decrease) I am up by £165.13. That’s still a decent return on my £1,000 and does illustrate the value of P2P property investments for diversifying your portfolio. And it doesn’t hurt that with Assetz Exchange the projects are socially beneficial as well.

The overall fall in capital value of my AE investments is obviously a bit disappointing. But it’s important to remember that until/unless I choose to sell the investments in question, it is theoretical, based on the latest price at which shares in the property concerned have changed hands. The rental income, on the other hand, is real money (which in my case I’ve reinvested in other HM projects to further diversify my portfolio).

To control risk with all my property crowdfunding investments nowadays, I invest relatively modest amounts in individual projects. This is a particular attraction of HM as far as i am concerned. You can actually invest from as little as £1 per property if you really want to proceed cautiously.

- As I noted in this blog post, Housemartin is particularly good if you want to compound your returns by reinvesting rental income. This effectively boosts the interest rate you are getting. Personally, once I have accrued a minimum of £10 in rental payments, I reinvest this money in either a new Housemartin project or one I have already invested in (thus increasing my holding). Over time, even if I don’t invest any more capital, this will ensure my investment with HM grows at an accelerating rate and becomes more diversified as well.

My investment on Housemartin is in the form of an IFISA so there won’t be any tax to pay on profits, dividends or capital gains. I’ve been impressed by my experiences with Housemartin and the returns generated so far, and intend to continue investing with them. If you wish you can also sign up for a no-obligation account on Housemartin directly via this link [affiliate]. Bear in mind that, as from this financial year (2024/25), you can open more than one IFISA per year so long as you don’t exceed your overall £20,000 ISA allowance.

Closing Thoughts

As I said earlier, I am a fan of Housemartin and have been investing with them for several years now. I have also spoken to their MD, Peter Read, on various occasions, and always found him open and honest.

My HM investments have performed well; and as far as I’m aware no investor has ever lost money through the platform. Obviously there are never any guarantees with investing – but if you like the idea of earning higher rates of interest than available from banks while helping vulnerable people secure a much-needed roof over their heads, Housemartin is certainly worth a look.

As always, if you have any queries about this blog post or Housemartin more generally, do leave a comment as usual.

Disclosure: As stated in this post, I am an investor with Housemartin and also an affiliate for them. If you click through my link and sign up, I may receive a commission for introducing you. This will not affect in any way the service you receive or the terms you are offered.

Please be aware also that I am not a professional financial adviser. You should always do your own ‘due diligence’ before investing and seek advice from a qualified adviser if in any doubt how best to proceed. All investing carries a risk of loss.