My Investments Update – February 2025

Here is my latest monthly update about my investments. You can read my January 2025 Investments Update here if you like.

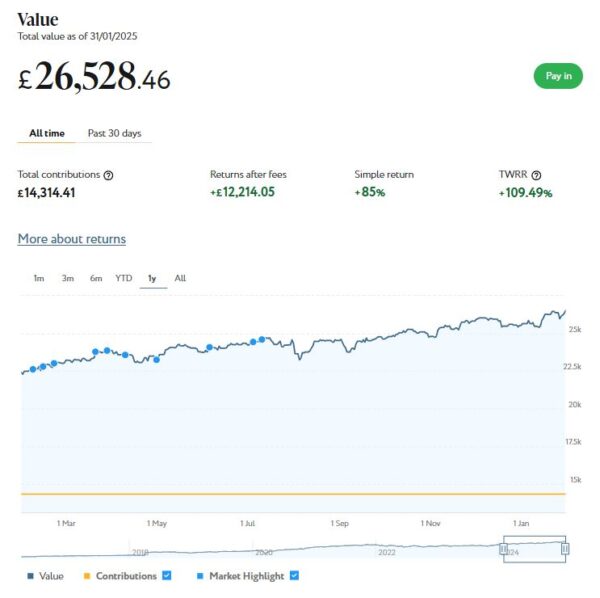

I’ll begin as usual with my Nutmeg Stocks and Shares ISA. This is the largest investment I hold other than my Bestinvest SIPP (personal pension).

As the screenshot below for the last twelve months shows, my main Nutmeg portfolio is currently valued at £26,528. Last month it stood at £25,513, so that is an impressive rise of £1,015.

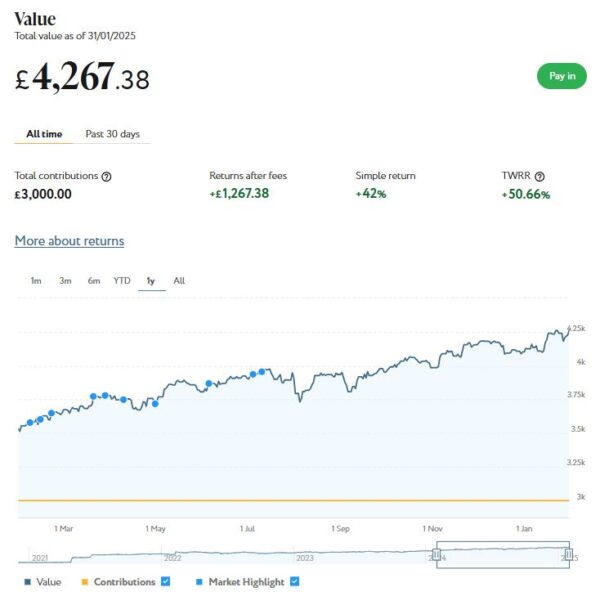

Apart from my main portfolio, I also have a second, smaller pot using Nutmeg’s Smart Alpha option. This is now worth £4,267 compared with £4,103 a month ago, a rise of £164. Here is a screen capture showing performance over the last twelve months.

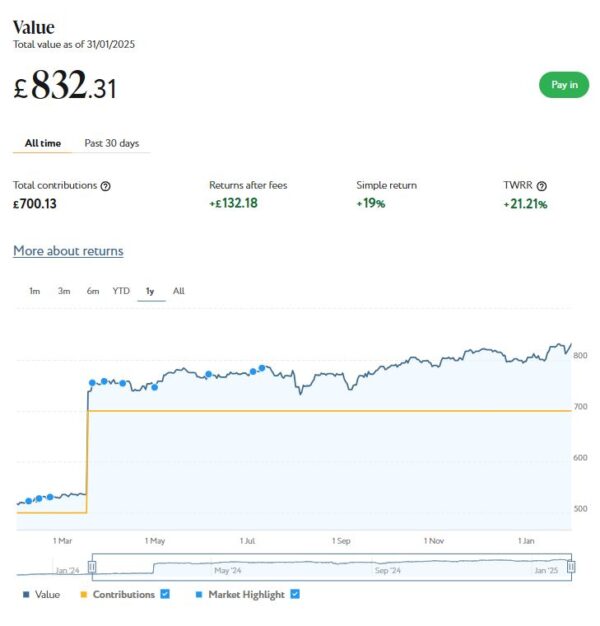

Finally, at the start of December 2023 I invested £500 in one of Nutmeg’s new thematic portfolios (Resource Transformation). In March I also invested a further £200 from referral bonuses. As you can see from the screen capture below, this portfolio is now worth £832 compared with £798 last month, a rise of £34.

January has clearly been a good month for my Nutmeg investments. Their overall value has grown by £1,213 or 3.94% since the start of the year. And their value has increased by £5,193 or 19.65% in the twelve months since 31st January 2024.

You can read my full Nutmeg review here. If you are looking for a home for your annual ISA allowance, based on my overall experience over the last eight years, they are certainly worth considering. They offer self-invested personal pensions (SIPPs), Lifetime ISAs and Junior ISAs as well.

Moving on, I also have investments with P2P property investment platform Assetz Exchange. As discussed in this recent post, the company has just rebranded as Housemartin.

My investments with Housemartin continue to generate steady returns. Housemartin focuses on lower-risk properties (e.g. sheltered housing). I put an initial £100 into this in mid-February 2021 and another £400 in April. In June 2021 I added another £500, bringing my total investment up to £1,000.

Since I opened my account, my HM portfolio has generated a respectable £229.98 in revenue from rental income. Capital growth has slowed, though, in line with UK property values generally.

At the time of writing, 15 of ‘my’ properties are showing gains, 2 are breaking even, and the remaining 18 are showing losses. My portfolio of 35 properties is currently showing a net decrease in value of £55.21, meaning that overall (rental income minus capital value decrease) I am up by £174.77. That’s still a decent return on my £1,000 and does illustrate the value of P2P property investments for diversifying your portfolio. And it doesn’t hurt that with Housemartin most projects are socially beneficial as well.

The overall fall in capital value of my Housemartin investments is obviously a little disappointing. But it’s important to remember that until/unless I choose to sell the investments in question, it is largely theoretical, based on the latest price at which shares in the property concerned have changed hands. The rental income, on the other hand, is real money (which in my case I’ve reinvested in other HM projects to further diversify my portfolio).

To control risk with all my property crowdfunding investments nowadays, I invest relatively modest amounts in individual projects. This is a particular attraction of Housemartin as far as i am concerned. You can actually invest from as little as £1 per property if you really want to proceed cautiously.

- As I noted in this blog post, Housemartin is particularly good if you want to compound your returns by reinvesting rental income. This effectively boosts the interest rate you are receiving. Personally, once I have accrued a minimum of £10 in rental payments, I reinvest this money in either a new HM project or one I have already invested in (thus increasing my holding). Over time, even if I don’t invest any more capital, this will ensure my investment with Housemartin grows at an accelerating rate and becomes more diversified as well.

My investment on Housemartin is in the form of an IFISA so there won’t be any tax to pay on profits, dividends or capital gains. I’ve been impressed by my experiences with Housemartin and the returns generated so far, and intend to continue investing with them. You can read my full review of Assetz Exchange/Housemartin here. You can also sign up for an account directly via this link [affiliate]. Bear in mind that, as from the current financial year (2024/25), you can open more than one IFISA per year.

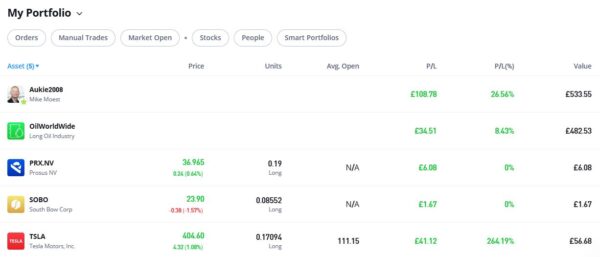

In 2022 I set up an account with investment and trading platform eToro, using their popular ‘copy trader’ facility. I chose to invest $500 (then about £412) copying an experienced eToro trader called Aukie2008 (real name Mike Moest).

In January 2023 I added to this with another $500 investment in one of their thematic portfolios, Oil Worldwide. I also invested a small amount I had left over in Tesla shares.

As you can see from the screen captures below, my original investment (total value £888.36 in pounds sterling) is today worth £1,081.19, an overall increase of £192.16 or 21.71%.

- Note: eToro now displays the value of investments in your native currency, although you can change this if you wish.

You can read my full review of eToro here. You may also like to check out my more in-depth look at eToro copy trading. I also discussed thematic investing with eToro using Smart Portfolios in this recent post. The latter also reveals why I took the somewhat contrarian step of choosing the oil industry for my first thematic investment with them.

As you can see, my Oil WorldWide investment is showing a profit of 8.43%. That’s not overly exciting but the portfolio has just been rebalanced by eToro, so hopefully that will improve its performance going forward. The investment team at eToro periodically rebalance all smart portfolios to ensure that the mix of investments remains aligned with the portfolio’s goals, and to take advantage of any new opportunities that may present themselves.

My copy trading investment with Aukie2008 has been doing better, with an overall 26.56% profit. To be fair, I have held the latter investment a bit longer.

My Tesla shares, which I bought as an afterthought with a bit of spare cash I had in my account, have done particularly well in recent months. If only I had put a bit more money into this!

You might also notice that I have small holdings in Prosus NV, a Dutch internet group, and South Bow, a Canadian energy infrastructure company. To be honest I don’t understand how I acquired these, but I assume they are some sort of bonus I have been awarded. In any event, I am happy to have them in my portfolio!

- eToro also offer the free eToro Money app. This allows you to deposit money to your eToro account without paying any currency conversion fees, saving you up to £5 for every £1,000 you deposit. You can also use the app to withdraw funds from your eToro account instantly to your bank account. I tried this myself and was impressed with how quickly and seamlessly it worked. You can read my blog post about eToro Money here. Note that it can also serve as a cryptocurrency wallet, allowing you to send and receive crypto from any other wallet address in the world.

If you would like more information about setting up an eToro account, please click on this no-obligation website link (affiliate).

I had another article published in January on the excellent Mouthy Money website. This is How to Make Money Through Bank Account Switching. In this article I discussed an easy method for generating handy lump sums by taking advantage of switching incentives offered by some UK banks. The banks are currently battling one another for your custom, and they are offering some enticing cash bonuses (and sometimes other freebies/benefits as well) to get you to sign up.

As I’ve said before, Mouthy Money is a great resource for anyone interested in money-making and money-saving. From the range of articles published in January, I particularly enjoyed 16 Ways to Be More Frugal and Save Money in 2025 by regular MM contributor Shoestring Jane. Jane writes mainly about money saving and frugal living. You can see all of her articles for Mouthy Money via this web page.

I also published several posts on Pounds and Sense in January. Some are no longer relevant, but I have listed the others below.

As mentioned earlier, I published a post titled P2P Property Investment Platform Assetz Exchange Rebrands as Housemartin. In this I discussed the recent rebrand of this P2P property investment platform, which I invest through myself. The post also discusses how the platform has changed since I first featured it here on Pounds and Sense.

In Here’s Why Most Over-50s Need More Protein in Their Diet I discussed a subject that will be relevant to many readers of this blog (which is of course aimed especially at over-50s). I must admit I hadn’t realised just how important this was until I saw the topic being discussed on GB News last month. I wanted to learn more and researched the subject with the aid of AI program ChatGPT. This blog post was the result.

In Take the Plum 52-Week Saving Challenge, I shared a method you can use to set aside a handy lump sum of up to £1,378 in a year. As you may gather, the method involves using the smart money app Plum [affiliate link]. This automates the whole process for you, making saving as easy and painless as possible. Read the article for full details!

Also in January I published a guest post on the subject Dos and Don’ts for Divorce in 2025. Written by an experienced divorce lawyer, this article sets out tips and guidelines to make the divorce process as pain-free as possible if, sadly, your marriage has run its course.

Finally, on a happier note, I published Planning a UK Holiday This Year? Here Are Some Ideas For You. In this article (which I update and republish annually) I set out a range of suggestions for short break (or longer) holidays in the UK, along with links to blog posts I have written about the destinations concerned.

Lastly, a reminder that you can also follow Pounds and Sense on Facebook or Twitter (or X as we have to call it now). Twitter/X is my number one social media platform and I post regularly there. I share the latest news and information on financial matters, and other things that interest, amuse or concern me. So if you aren’t following my PAS account on Twitter/X, you are definitely missing out.

- I am also on the BlueSky social media network under the username poundsandsense.bsky.social. For the time being anyway, Twitter/X will remain my primary social media platform, but I will also post details of my latest blog posts, third-party articles and other financial news and resources on BlueSky for those who may prefer to follow me there.

That’s all for today. As always, if you have any comments or questions, feel free to leave them below. I am always delighted to hear from PAS readers

Disclaimer: I am not a qualified financial adviser and nothing in this blog post should be construed as personal financial advice. Everyone should do their own ‘due diligence’ before investing and seek professional advice if in any doubt how best to proceed. All investing carries a risk of loss.

Note also that posts on PAS may include affiliate links. If you click through and perform a qualifying transaction, I may receive a commission for introducing you. This will not affect the product or service you receive or the terms you are offered, but it does help support me in publishing PAS and paying my bills. Thank you!