AdviceBridge: A Personalized, Affordable Retirement Planning Service

Today I’m spotlighting a pension advisory service called AdviceBridge that may be of interest to any Pounds and Sense readers who are planning for their retirement.

There is no doubt that in recent years retirement planning has become more challenging. The pension reforms introduced by George Osborne in 2015 gave people much more freedom over how and when they can access their retirement savings. There are many benefits to those reforms – and I’m a fan of them myself – but it does mean most people now have big decisions to make over how to finance their retirement.

A further factor is the decline of ‘defined benefit’ pensions. These guaranteed a certain pension usually based on how long you had worked for an employer and how much you earned during your career. The great majority of working age people nowadays have ‘defined contribution’ pensions, where you build up a pension pot over the course of your working life. This then provides you with an income (alongside the state pension and any other investments) when you retire. Anyone with a pension of this type will have important choices to make over how, when and where to save for their pension, and what to do with it once they reach retirement age. Many people who are not financial services professionals understandably struggle with this and need some expert help (I did myself).

Getting professional financial advice can be expensive – typically pension advisers in the UK charge £2,000-£3,000 up front and then 0.5% a year. But a new service called AdviceBridge promises a personalized, affordable retirement planning service. Indeed, they say they can do this for as little as a tenth of the average adviser fee, partly by running the service online and over the phone (no face-to-face meetings required).

Although it is a low-cost service, AdviceBridge is staffed by fully trained and regulated financial advisers, and the company is authorized and regulated by the Financial Conduct Authority (FCA). AdviceBridge never holds investors’ money, even when they assist in the implementation of a retirement plan. The advice they give is though covered by the Financial Services Compensation Scheme (FSCS), which means clients can claim compensation of up to £85,000 if they receive bad advice.

Table of Contents

Who Is AdviceBridge For?

In order to keep their charges low, AdviceBridge say that at the moment they are only able to help clients who meet the following criteria:

- You are resident and domiciled in the UK.

- You are generally in good health.

- You do not have any unsecured loans.

- You are not currently contributing to pensions with safeguarded benefits such as a final salary pension.

- You do not own any buy-to-let property or any non-standard investments.

- You do not receive any means-tested benefits.

- You would like to plan individually, not as a couple.

How Does It Work?

Assuming you meet the criteria above, you start by filling in an online questionnaire and completing some electronically-signed compliance documents.

As well as the usual contact information, the questionnaire covers such matters as:

- your age

- your employment status

- your annual income

- any existing private or company pensions

- whether you will qualify for a full state pension

- other savings and investments

- your target retirement age

- how much income you hope to have in retirement

- any major outgoings in future you need to plan for

- and so on

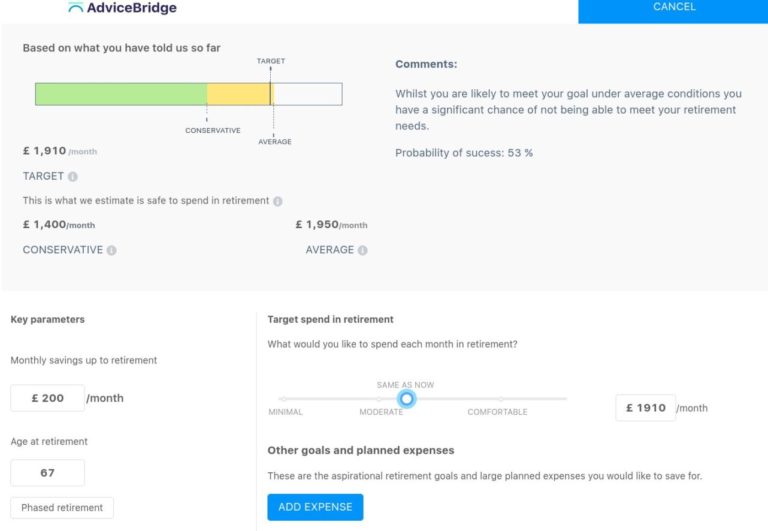

Once you have entered this information, you can create and log in to your account to see an overview of your financial situation. You can adjust the parameters in order to achieve a realistic and sustainable level of retirement income. Here is a screen capture showing part of this (an example account, not mine personally!).

Personalized Plan

Naturally, the above is just the first stage of the process. Once you have provided this information and set up your account, the AdviceBridge advisers will crunch the numbers and (with the aid of their specialist software) produce a personalized plan for you.

This is obviously a key document. The sample plan I saw came to 39 pages in PDF form. It was divided into three sections: About You, Our Recommendations and Advice, and Appendices.

About You sums up the information you have provided to AdviceBridge via the questionnaire. It covers your personal circumstances, your retirement savings and investments, and your progress so far towards achieving your retirement goals.

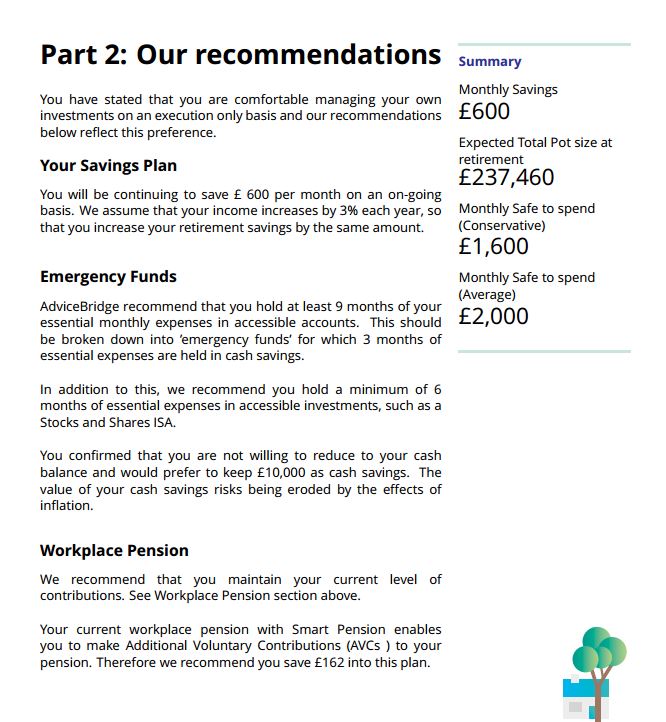

Our Recommendations and Advice is the longest section of the plan. It presents recommendations on every aspect of managing your finances for retirement, including restructuring your investment portfolio if required (with specific recommendations for low-cost personal pensions and ISAs). It also examines the likely outcome of following the recommendations, including both average and conservative projections. A sample page from this section of the plan is shown below.

Finally, the Appendices section includes a range of supplementary information, including more detail about the UK state pension, rules about annual pension allowances and taxation, your options for accessing your pension (drawdown, annuities, etc), and more.

It doesn’t end there, though. Once you have had a chance to read and digest your plan, you can arrange a call with a personal financial adviser from AdviceBridge to talk through the advice and recommendations and help you decide how to proceed. The advisers are not paid commission on product sales, so they are able to give unbiased advice about what investments may be best for you based on your specific circumstances.

So What Does It Cost?

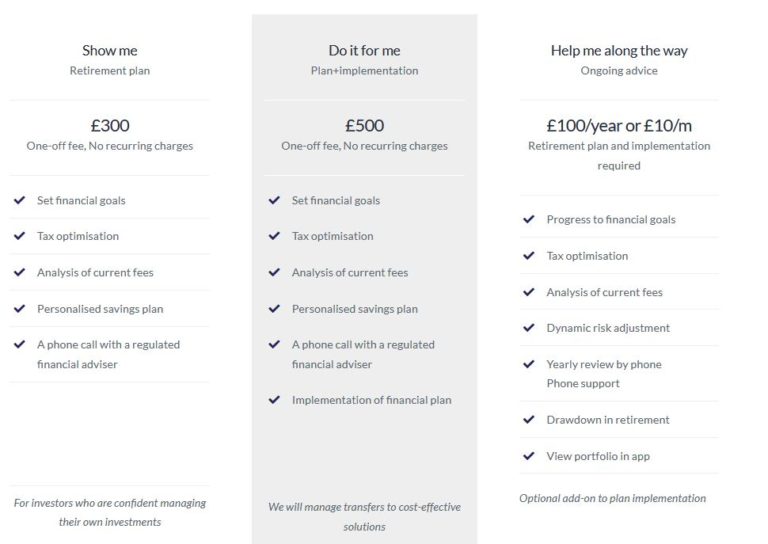

For the basic AdviceBridge service as described above, there is a one-off fee of £300 with no recurring charges. This service will suit people who are happy to arrange their own investments based on the advice given and the telephone call with an adviser.

If you want AdviceBridge to set up the recommended investments for you – to implement your financial plan, in other words – they will do this as well for an inclusive fee of £500, again with no recurring charges.

Finally, if you opt for the Plan+Implementation service and want ongoing support and assistance too, including dynamic risk adjustment, an annual telephone review, ongoing telephone support, assistance putting your pension into drawdown, and the opportunity to monitor your portfolio online using a dedicated app, AdviceBridge offer all this for an additional £100 a year or £10 a month.

All of the above is summed up in the table below which I have copied from the AdviceBridge website.

My Thoughts

Overall, I have been very impressed by AdviceBridge, both in terms of what they are offering and the prompt and friendly support they provided while I was writing this article. Here are some of the main things I like about their service:

- much lower fees than traditional financial advisers

- all fees quoted include any taxes due – what you see is what you pay

- range of options according to how much (or little) work you want to take on yourself

- non-commission-based advisers, so unbiased advice on what investments will suit you best

- advisers are free to recommend across the entire range of investment opportunities

- all digital process – no need for personal visits or face-to-face meetings

- fully FCA authorized company and advisers

- advice is covered up to £85,000 under the Financial Services Compensation Scheme (FSCS)

- all personal information is securely encrypted

- in-depth written advice and recommendations on your retirement finances backed up by telephone support

Any negatives? Well, the only real one I could find is that various groups are currently excluded from the service, e.g. buy-to-let landlords and holders of ‘non-standard investments’. I guess the latter might include me, as I have a proportion of my portfolio in P2P lending and property crowdfunding.

I do of course appreciate that to keep their service so inexpensive AdviceBridge have to streamline their service, but it is a pity if this excludes a significant proportion of people who could benefit from it. I understand that this is something that AdviceBridge keep under review and in future they may remove some of these restrictions. In the mean time, if you aren’t sure whether you are eligible, it is well worth giving them a ring or contacting them via the website to ask (without obligation).

In my opinion, if your circumstances match their criteria, AdviceBridge are well worth checking out. I particularly like their £500 Plan+Implementation service, which covers not only researching and producing a retirement plan for you but implementing it as well. I would also seriously consider paying the extra £100 a year (or £10 a month) for the ongoing service. Obviously that brings the price up a bit further, but it is still far less than you would pay a traditional financial adviser for a similar service.

As always, if you have any comments or questions about this post, please do leave them below.

Disclaimer: This is a sponsored post for which I am receiving a fixed fee (but no commission). Please note also that I am not a professional financial adviser and nothing in this post should be construed as individual financial advice. Everyone should do their own ‘due diligence’ before investing and take professional advice as appropriate. All investment carries a risk of loss.

March 18, 2020 @ 11:54 pm

This is really useful, thanks. I do need to get my pensions sorted, I am seeking advice now. It’s good to see the requirements for fitting this service. Mich x

March 19, 2020 @ 6:47 am

Thanks, Michelle. Yes, most people will need help and advice with their pensions. AdviceBridge is a good low-cost option for those who meet their criteria.

March 19, 2020 @ 9:11 am

Sorting my pension is one of those things that is always on my to-do list but I never quite get around to doing – fearing that it will be difficult to do. However, it is reassuring to see that AdviceBridge is able to offer the necessary guidance.

March 19, 2020 @ 4:14 pm

Thanks for your comment. Yes, lots of people are guilty of putting this off, but the sooner you get started the better, as your money has more time to grow.