Two Places You Really Shouldn’t Turn for Tax Advice (and One You Definitely Should)

Today I thought I’d set out my views on where best to seek advice on tax-related matters. From feedback received I know that this is a topic that concerns a lot of people, especially the growing number who are turning to ‘side hustles’ to help make ends meet.

I’ve been self-employed for around 30 years now and have quite strong opinions on this subject, especially as I see a lot of dodgy advice about tax being bandied about. So let me start by setting out the two places that in my view you shouldn’t generally turn for tax advice (and you definitely shouldn’t rely on).

1. Social Media

I am thinking especially here about Facebook groups and online forums (or messageboards). These are popular places for people with a shared interest to ask (and answer) questions about subjects that concern them.

I belong to various groups and forums aimed at UK writers and bloggers, and get a lot of useful information and support from them. However, I regularly see people asking questions on them about tax matters, and I’m not at all convinced that this is useful or sensible.

What typically happens in these cases is that other members weigh in with their advice and opinions. Although these are offered with the best of intentions, they are often contradictory and sometimes downright wrong. I imagine that in many cases the original questioner ends up more confused than when they started. Or – perhaps worse – they proceed on the basis of dubious advice which could result in them facing fines and penalties or, conversely, paying more tax than they need to.

Most people in these groups are not trained accountants, but that doesn’t stop some of them airily dishing out tax advice anyway. Replies beginning with phrases such as ‘I’ve always understood’ or ‘I’m pretty sure that’ or ‘As far as I know’ or ‘I could be wrong, but’ should always be regarded with considerable scepticism.

Groups also often have ‘gurus’ who claim (and may or may not have) a deeper knowledge of these matters. Their pronouncements may be treated as akin to holy writ by other members. Again, be cautious about blindly following advice from these individuals, even if they apparently have qualifications and/or professional experience. I have seen advice from such people that is definitely wrong or at least highly questionable, but nobody in the group dares challenge them about it. This happens in other fields as well as tax, incidentally.

I would also extend my caution about getting advice from social media to blogs (yes, including mine). I have seen some good advice on blogs, but also plenty I would regard as debatable to say the least. Definitely don’t take anything you read about tax on a blog as gospel, even if the person in question does have thousands of followers!

2. HMRC

Yes, you read that correctly. In my view, HMRC should seldom be your first port of call for tax advice.

There are various reasons for this. One is that, when you phone HMRC, the person you will generally speak to is a call handler. They will (or should) obviously have a reasonable working knowledge of how the tax system works, but they are definitely not expert in every aspect. If you ask them complex questions about (say) what expenses you can and can’t claim against income or what counts as a capital gain as opposed to taxable income, you are likely to get different and contradictory advice according to whom you speak to. Or they may simply tell you that advising you about this is outside their remit.

In addition, it’s important to bear in mind that HMRC are not in business for your benefit. Their job is to maximize tax revenues for the government. They can’t and won’t advise you on how to legally organise your affairs in such a way as to minimize your tax liabilities (which every taxpayer is perfectly entitled to do).

That being said, there are certain occasions when you can and should contact HMRC. This is when you have specific questions about your taxes, e.g. whether a certain tax payment has been received, what is your tax code, when is your next tax payment due, and so on. The call handlers should have this information easily accessible on their computers and will be happy to pass it on to you.

So Where Should You Turn for Tax Advice?

You may have guessed already, but if not I won’t keep you in suspense. The answer is a professional accountant.

Accountants are trained and experienced in all aspects of the tax system. They have both theoretical and practical knowledge of how the system works and how the (complex) rules are typically interpreted by HMRC. And they have to keep themselves up to date with the endless legal and procedural changes.

Also, unlike HMRC, an accountant is four-square on your side. They will advise you on the best way to organize your affairs to minimize your tax liability. They will answer any questions you may have, e.g. what records you need to keep. When the time comes, they will (if you want them to) compile your accounts and submit the relevant figures to HMRC in your tax return. And if any queries or problems arise, they will act on your behalf to try to resolve them.

A further benefit of having your accounts prepared by an accountant is that HMRC will know that a finance professional – someone who speaks their language – has compiled them. Other things being equal, this is likely to mean they will be more inclined to accept the figures and not dispute them.

Even if you prefer to prepare your own accounts (perhaps using accounting software online), having an accountant check your work (and maybe submit it on your behalf) can be a shrewd policy and reduce the risk of HMRC querying your tax return.

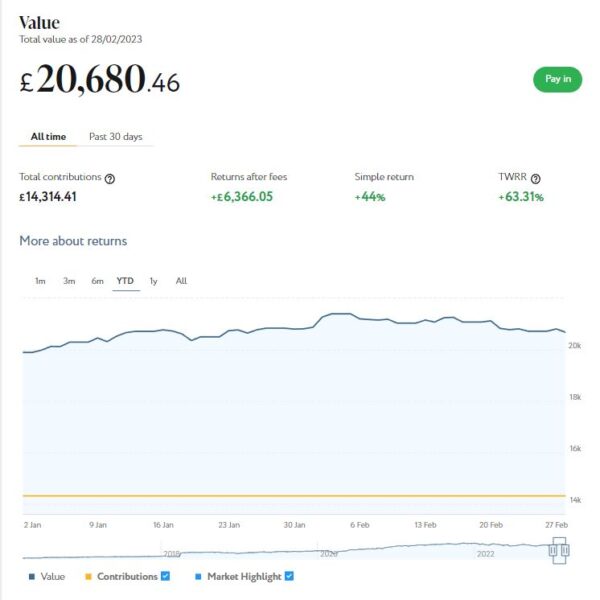

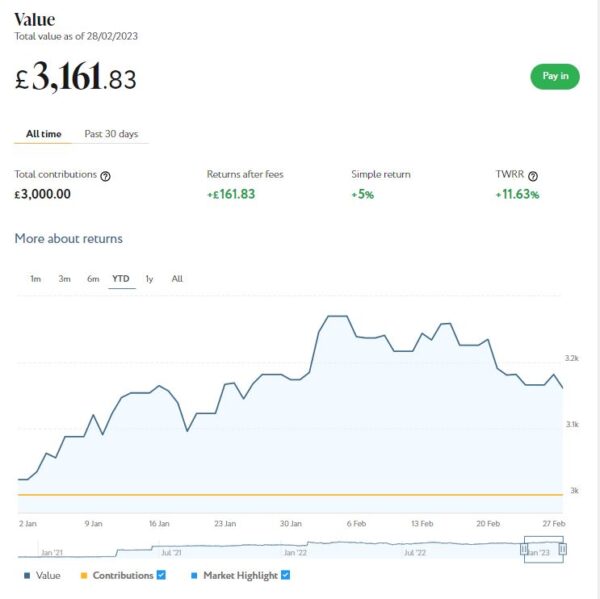

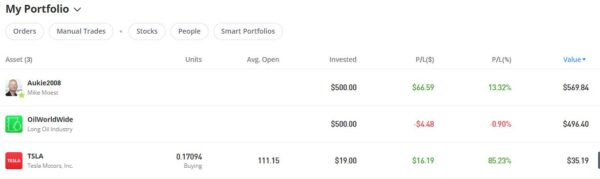

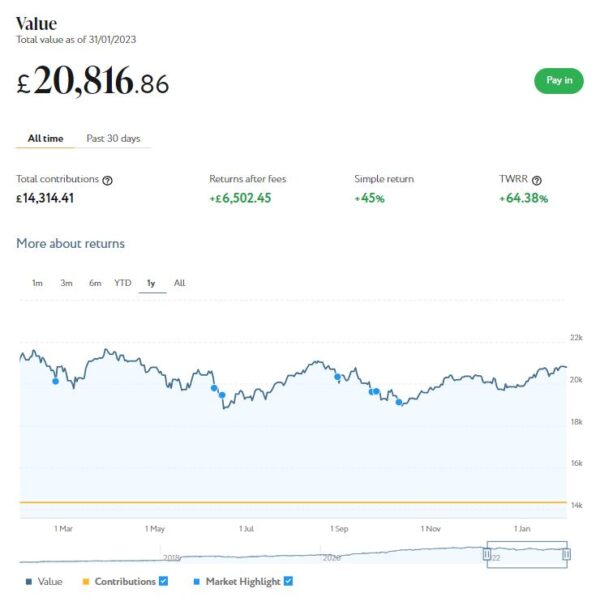

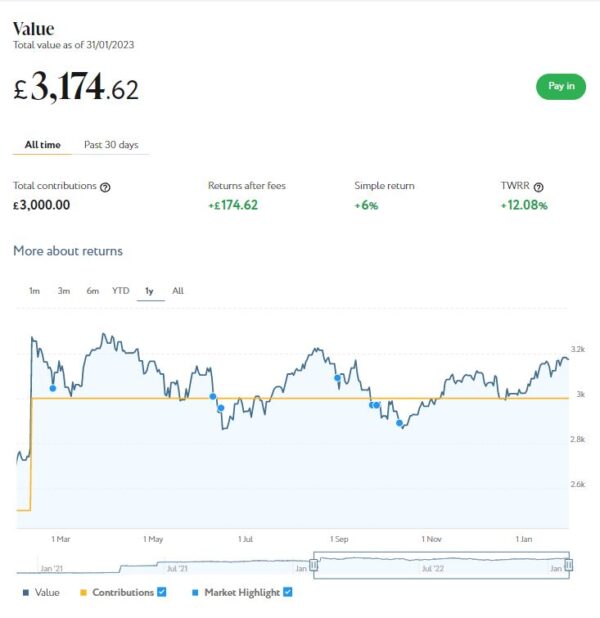

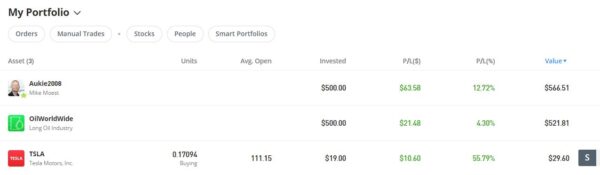

Even if you aren’t running any sort of business, there may still be a case for getting an accountant to help with your taxes. Many older people, for example, have multiple streams of income, from stocks and shares to ISA accounts, property rentals to pensions. Some of this income may be taxable and some not, and varying tax rates and tax-free allowances may apply. Most accountants are more than happy to provide a service to people in this situation as well.

There is, of course, one drawback to engaging an accountant, and that is the cost. This will probably amount to a few hundred pounds a year (maybe more in some cases). Not to pay this, however, is in my view a false economy. A good accountant is likely to save you at least as much in unnecessary tax as they cost you. And the reassurance (and relief) of having a finance professional available at the end of a phone when any queries with taxation arise is impossible to put a price on (but extremely valuable).

After thirty years of self-employment (and being semi-retired now), I still wouldn’t dream of not having an accountant. And since I’m mentioning this, a shout-out here for my own accountant, Rob Ollerenshaw, who has looked after my tax affairs for over twenty years. I recommend him without reservation to anyone in the North Birmingham/South Staffordshire area, or indeed further afield (he tells me he has clients as far away as Cornwall!).

So those are my thoughts about where best to get tax advice, but what do YOU think? Please post any comments or questions below as usual.

This is a revised and updated version of my original post.