Three Ethical Investment Options For You to Consider

More and more people are looking to invest ethically nowadays. As well as wanting decent returns from their money, they wish to ensure it is being used for purposes that will benefit the planet and local communities too.

So today I thought I would spotlight three ethical investment opportunities of which I have some experience and/or knowledge. There is nothing particularly scientific about this and I am certainly not saying these are the ‘best’ such opportunities. But based on my personal experience and feedback from colleagues and PAS readers, I am happy that they merit the ‘ethical’ description and are well-established and reputable.

Table of Contents

Nutmeg Socially Responsible Portfolios

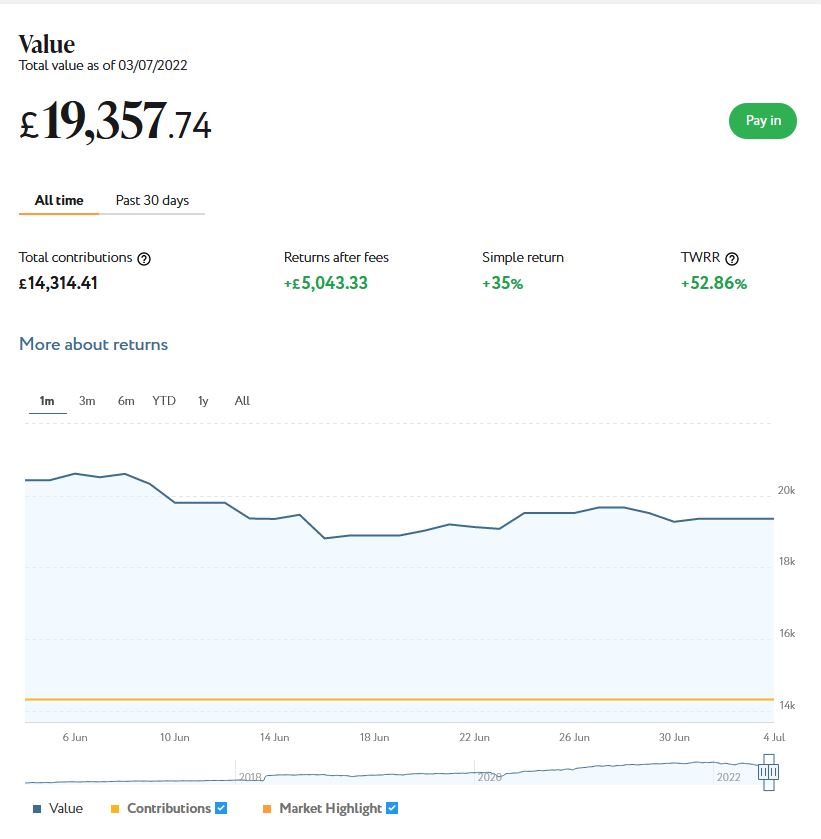

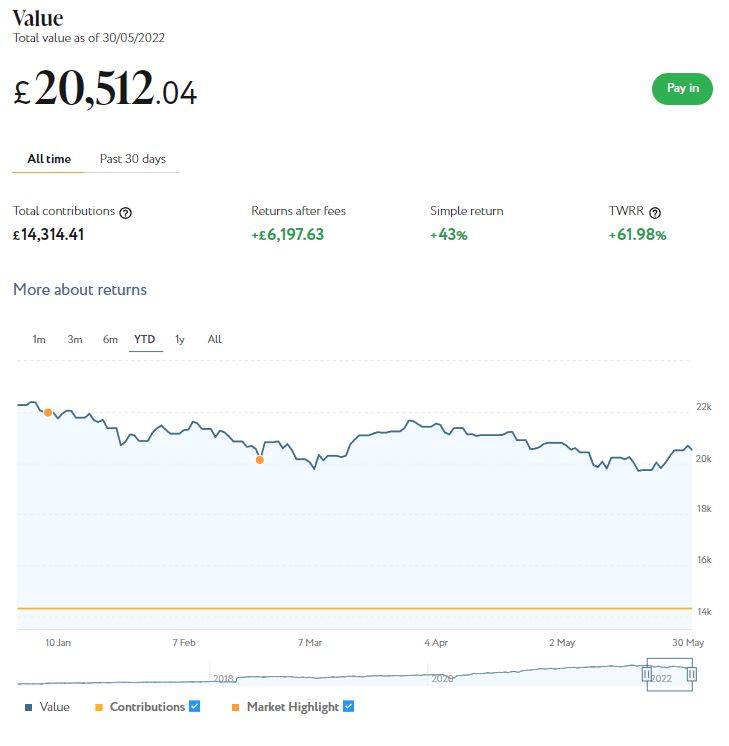

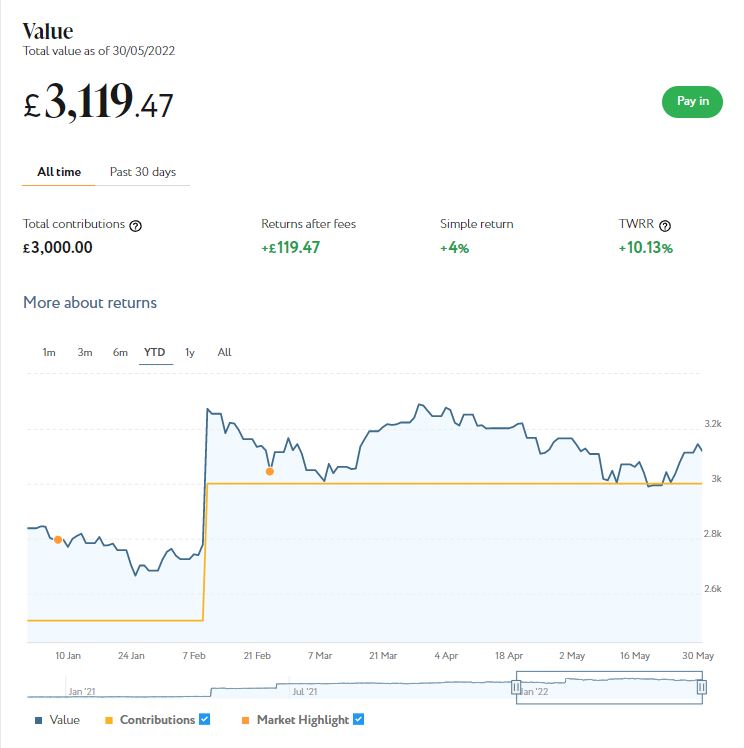

Regular readers of PAS will know that I am a fan of the robo-adviser platform Nutmeg and have a fairly substantial ISA investment with them.

As you probably know, an ISA is a tax-free wrapper that can be used for a range of investments. Every year you get an annual ISA allowance, which is currently £20,000. If you exceed your annual allowance (or invest it elsewhere) you can still invest in an ordinary Nutmeg account, which will be subject to taxation as usual.

Socially Responsible is an option you can choose for your Nutmeg portfolio (or one of them – you can have several). Your money is then invested in a managed, diversified fund which focuses on the environment, social values and good governance (ESG for short).

Nutmeg invest in exchange traded funds (or ETFs) that avoid companies engaged in controversial activities, while focusing on those that lead their peers on ESG. The screen capture below, taken from the Nutmeg site, shows the sort of things that are covered under ESG criteria.

As with all Nutmeg accounts, you can set your preferred risk level on a scale of 1-10 (you might like to check out this article in which I reveal why choosing a very low risk level when investing for the long term may not be the best idea).

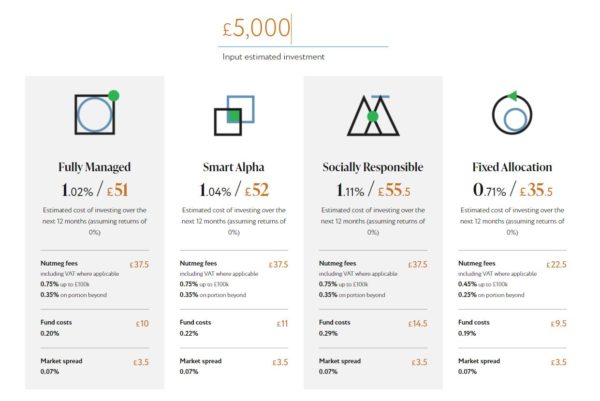

There are, of course, management and other fees to pay. For Socially Responsible portfolios these fees are slightly higher than the standard Fully Managed portfolios, but still moderate overall. Example costs for a £5,000 portfolio are shown below. On the Nutmeg website [affiliate link] you can enter any amount and see the likely fees you would be charged over a year.

- You might wonder if choosing the Socially Responsible option means sacrificing performance, but Nutmeg say this is not the case. Since they started offering this option, performance has been roughly the same as their Fully Managed portfolios. Of course, the fact that charges are slightly higher means you may make a little less profit overall, but even so the difference should only be marginal.

For more information about Nutmeg, you may like to check out my in-depth review, which includes details of how my Fully Managed Nutmeg portfolio has performed since I opened it six years ago.

Assetz Exchange

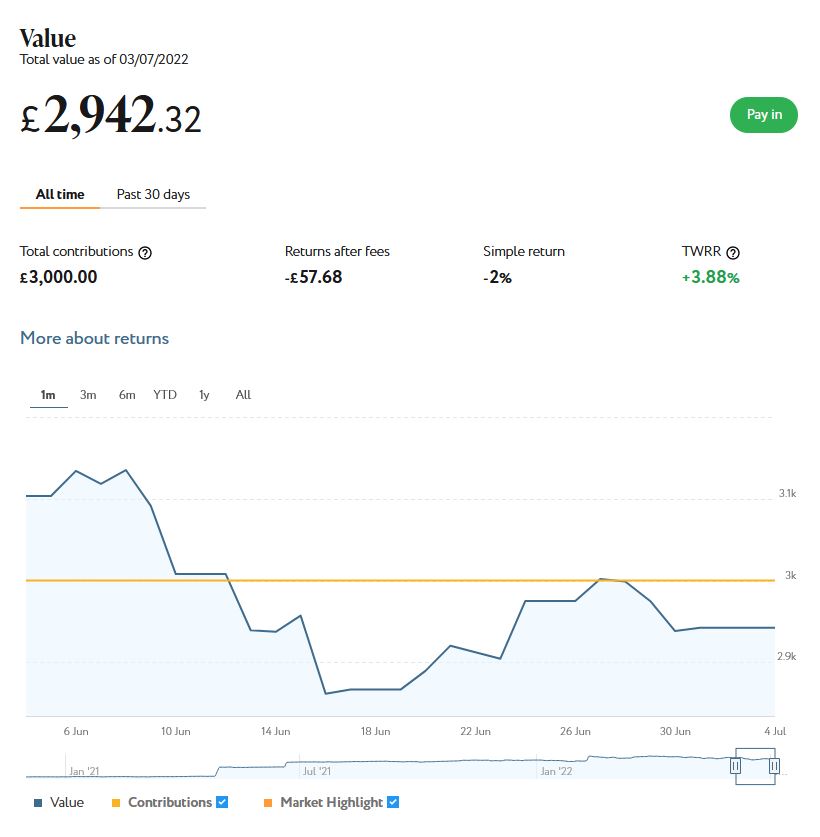

Assetz Exchange is not an equities-based platform. Rather, it is a P2P property platform. I have been investing with Assetz Exchange since January last year and have gradually built up the amount I have with them (see below).

Assetz Exchange focuses on lower-risk properties, such as supported housing for people with learning difficulties or physical disabilities. Properties are bought jointly by investors under the usual crowdfunding/P2P model. Most are then leased to charities and housing associations. This means they are securely funded and there is a low risk of defaults.

- Of course, defaults could still happen in certain circumstances – but as investors jointly own the property in question, ultimately you could still expect to get your capital (or most of it) back when the property is sold.

Although AE does also list some other types of property (e.g. show homes for new housing developments), you can of course choose which properties you wish to invest in. You could choose entirely charity/housing association projects – such as the one below – if you like.

I put an initial £100 into AE in mid-February 2021 and another £400 in April. In June 2021 I added another £500, bringing my total investment up to £1,000. Since I opened my account, my AE portfolio has generated £65.52 in revenue from rental and £70.97 in net capital growth, a total of £136.49. That’s a decent rate of return on my £1,000 (staged) investment and does illustrate the value of P2P property investment for diversifying your portfolio when equity markets are volatile (as at the moment).

I now have investments in 23 different projects and all are performing as expected, generating rental income and – in all but two cases – showing a profit on capital. So I am very happy with how this investment has been doing, and the fact that projects are generally beneficial to society as well.

To control risk with all my property crowdfunding investments nowadays, I invest relatively modest amounts in individual projects. This is a particular attraction of AE as far as I am concerned. You can actually invest from as little as 80p per property if you really want to proceed cautiously.

My investment on Assetz Exchange is in the form of an IFISA so there won’t be any tax to pay on profits, dividends or capital gains. I’ve been impressed by my experiences with Assetz Exchange and the returns generated so far, and intend to continue investing with them. You can read my full review of Assetz Exchange here. You can also sign up for an account on Assetz Exchange directly via this link [affiliate].

Abundance

Abundance is a well-established investment platform (launched 2012) for green energy projects. Cards on the table, I haven’t invested directly through them myself, but I do have friends and colleagues who have done so with good results.

Abundance offers peer-to-peer lending for green infrastructure projects to help combat climate change. You can invest in projects operated by businesses and also projects run by local councils. Business projects tend to be riskier but offer higher potential returns.

When I checked just now, there were two council projects offering annual returns of around 2% and three business projects offering returns of up to 9%. An example of the latter is Carbon Plantations, a project to fund new sustainable hardwood trees that capture more carbon and help regenerate farmland. This project was offering a return of 8% a year over a ten-year period.

One thing which put me off Abundance in the past is that the investments are typically quite illiquid. You were locked into an investment of (typically) 5 to 10 years, with interest paid annually (or more often) but no way of getting your capital back until the end of the investment period. In common with other P2P platforms, however, they now have a secondary market where investments can be bought and sold by members. Of course, there is no guarantee that anyone else will want to buy your investment if you need to sell up early or what price you will get for it.

On the plus side, if you want your money to be used for green, ethical purposes, Abundance certainly ticks that box. I also like the fact that there is a low minimum investment of just £5. There are no hidden fees, and you can invest tax-free within an IFISA if you like. As with all investments, money is at risk, and I highly recommend diversifying across a range of platforms and projects.

For more information about Abundance, do check out their website [non-affiliate link].

Closing Thoughts

In this article I have set out three different ethical investment opportunities for your consideration. While there are never any guarantees, if investing ethically is a priority for you, in my view they are all worth checking out.

As I always say, I am not a registered financial adviser and nothing in this post should be construed as personal financial advice. You should always do your own ‘due diligence’ before investing and seek professional advice if in any doubt how best to proceed. All investing carries a risk of loss.

As always, if you have any comments or questions about this post, please do leave them below.

Note: Articles on Pounds and Sense may include affiliate links. If you click through these and make a purchase (or perform some other qualifying transaction) I may receive a fee for introducing you. This will not affect the price you pay or the terms you receive.

tic a way as he is doing!

tic a way as he is doing!