Is It Time for Investors to Look Again at P2P/Crowdlending Platforms?

There isn’t much doubt this year has been a challenging one for stock market investors.

The war in Ukraine, rising inflation, and lingering fallout from the pandemic have all conspired to damage investor confidence. As a result, what we’re seeing now is a bear market, with share values falling across the board. How long this will continue I don’t know, though one thing I can say for certain is that there will be an upswing sooner or later.

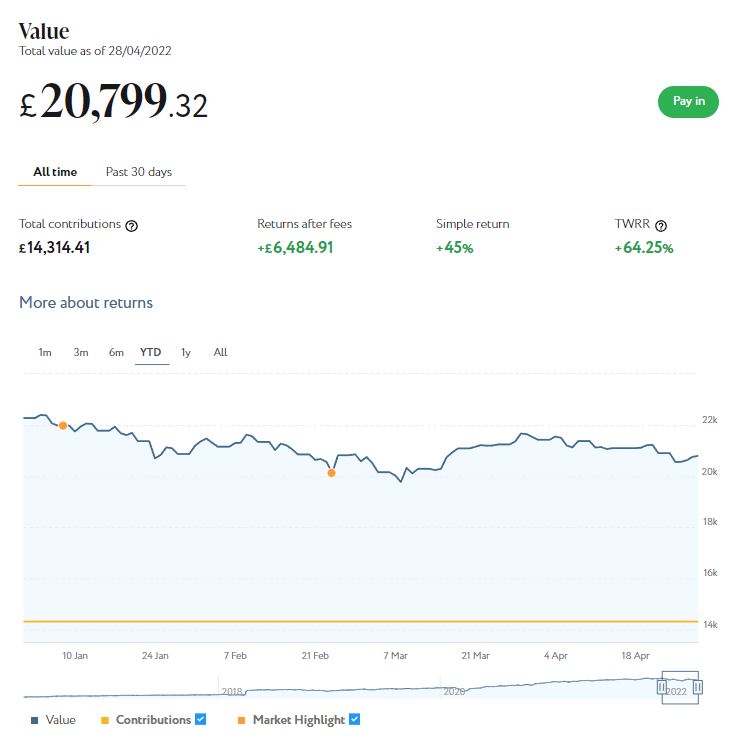

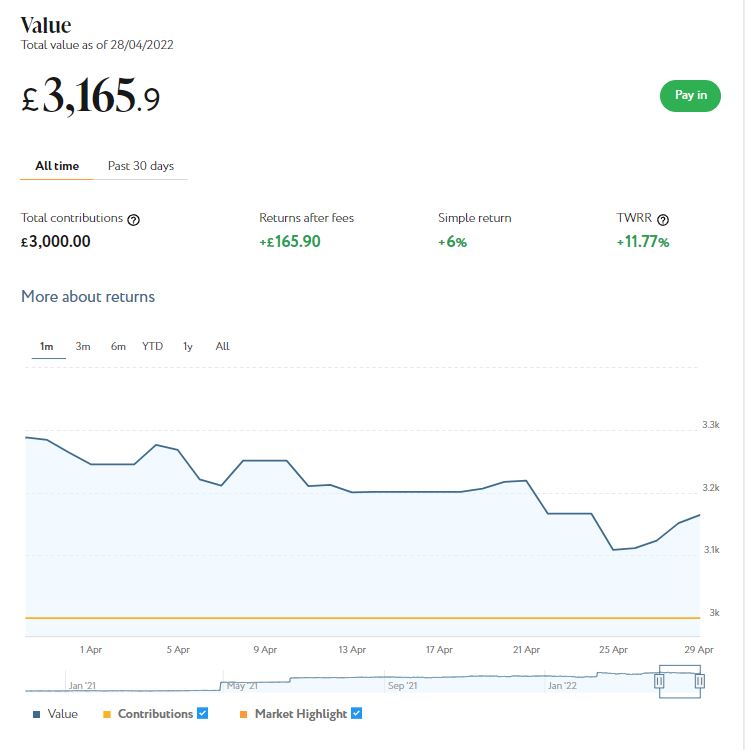

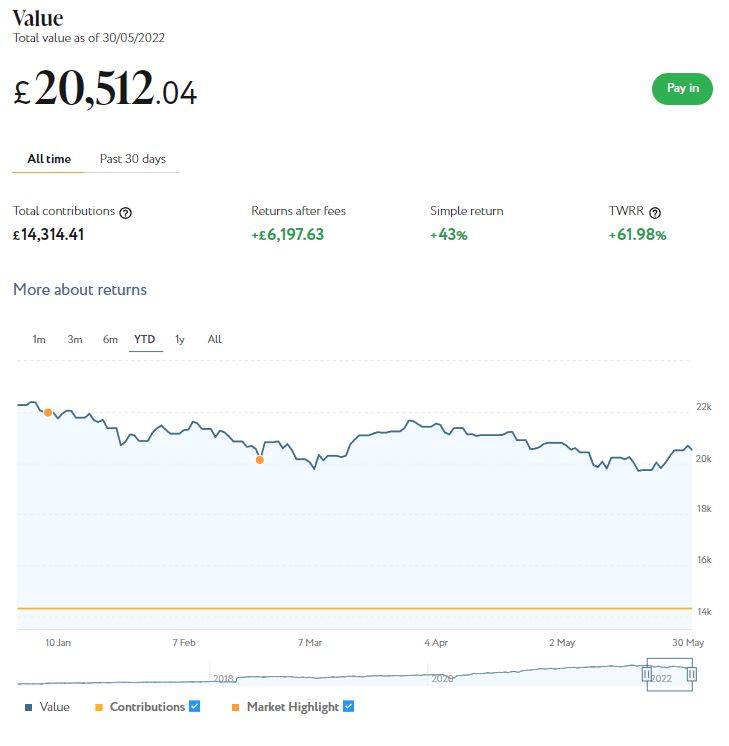

I have witnessed this with my own equity investments and it hasn’t been pretty. My Nutmeg Stocks and Shares ISA has fallen by 11% in value since January 2022. My Bestinvest SIPP (personal pension) has fallen by a roughly similar amount (I’ve suspended withdrawals from it as a result, to avert the risk of pound-cost ravaging). I’m not panicking about this, as all equity investments have their ups and downs. And since I started both of these investments, I am still well up overall.

There is indeed an argument that now could be a good time to invest, while asset values are depressed. Nonetheless, I do of course understand why many people are wary of investing in stocks and shares at the moment, as markets may well have further to fall.

So today I thought I’d talk about an alternative approach that has fallen out of favour in the last year or two, but still has the potential to generate good returns for your money even when stock markets are in turmoil.

Table of Contents

P2P/Crowdlending

I am, of course, talking about P2P/crowdlending. A few years ago these platforms were being touted as an exciting new alternative to banks, allowing individuals the opportunity to club together to buy property or lend to people/businesses. Investors could then benefit from interest paid, rentals received and/or capital gains made.

While initially everything went well, Covid in particular put a big spoke in the P2P sector’s wheel. More borrowers went into default, and platforms struggled to stay afloat as a result. Some (e.g. The House Crowd and Lendy) went bust. Others (e.g. Zopa and Ratesetter) decided to withdraw from P2P lending. Still others (e.g. Bricklane and Crowdlords) continue to operate but have closed to new investors and begun a process of winding down.

While that might sound depressingly negative, it’s not all doom and gloom. A number of P2P/crowdlending platforms are still running and indeed thriving. Three I have investments with myself are Kuflink, Assetz Exchange and Property Partner.

Interestingly, these are all property investment platforms. Kuflink offers secured loans to property developers, while the other two are more ‘conventional’ property crowdfunding platforms where investors jointly purchase a property and share pro rata in rental received and any capital gains on sales. P2P platforms that lend directly to individuals and businesses without the security of property are a lot scarcer nowadays than they used to be.

Regular PAS readers will know I have money in all three platforms mentioned above and am still actively investing in two of them (I am gradually winding down my Property Partner portfolio, though I do still recommend them). One big attraction of property platforms is that investment outcomes are not directly linked to the performance of stock markets. Yes, where the economy is rocky, this might ultimately impact on some commercial properties. Overall, though, these platforms are much less affected by market fluctuations than equity-based investments. That means they can offer an attractive alternative at times (like now) of high volatility.

In this article I’d like to highlight my two current favourite P2P/crowdlending platforms, Kuflink and Assetz Exchange. I will say a word about each and explain why I am still enthusiastic about them and continue to invest with them.

Kuflink

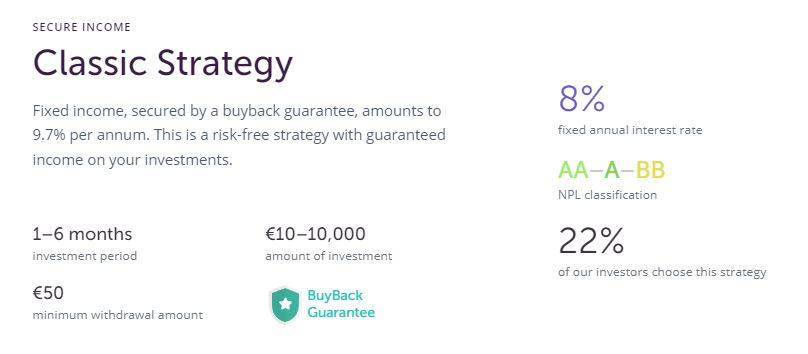

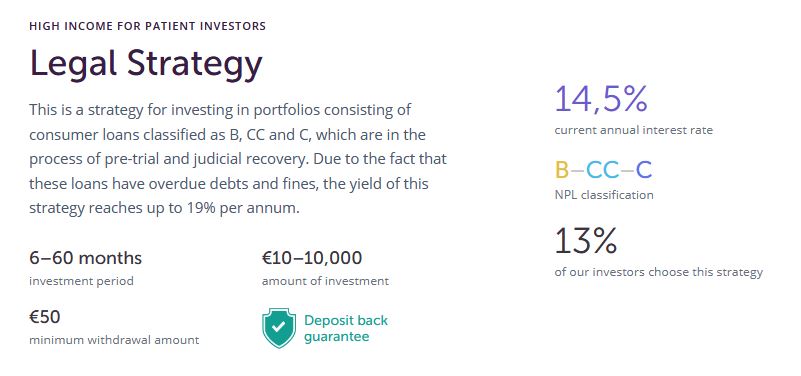

Kuflink offers opportunities to invest in loans secured against property. These loans are typically made to developers who require short- to medium-term bridging finance, e.g. to complete a major property renovation project, before refinancing with a commercial mortgage. They offer three types of investment, as follows:

- Select-Invest (individual loans)

- Auto-Invest

- Tax-free IFISA (Innovative Finance ISA)

Auto Invest and IFISAs both automatically invest your money across a number of loans and pay a fixed interest rate, typically between 5 and 7%. You can choose a 1-year, 3-year or 5-year term, and interest is paid annually. The Auto-Invest product is basically the same as the IFISA, but without the tax-free wrapper. Self-Invest loans can also be put in an IFISA, with most (not all) loans on the platform being eligible.

I have been investing with Kuflink for nearly five years now. My experiences have been entirely positive and my investments have been generating the promised returns. I started cautiously with them, but have gradually built up the amount I have invested. Although – like all property P2P platforms – they were adversely affected by the pandemic, they appear to have come through it strongly, with new loans now being added almost daily.

There have been no defaults so far on any of my loans, and Kuflink say on their website that to date nobody has lost a penny on their platform. I have experienced short delays with loans being repaid, but in such cases you continue to earn interest, of course.

Although Kuflink don’t pay the highest rates in P2P lending, I think the returns on offer are realistic and sustainable. The steady expansion of the platform seems to testify to this, as does the fact that they have received several industry awards. .

Kuflink are also highly rated on the independent TrustPilot website, with an average 4.7 out of 5 (‘Excellent’). At the time of writing 80% of reviewers award them the maximum five-star rating, which is among the highest figures I have seen for a financial services platform.

As with all P2P lending, your money doesn’t enjoy the same level of protection as bank and building society accounts, which are covered (up to £85,000) by the Financial Services Compensation Scheme. Nonetheless, the rates of return on offer are significantly better than those from most financial institutions. And the fact that all loans are secured against bricks and mortar – and Kuflink themselves have cash invested in them – clearly offers some reassurance.

From my experience, Self-Select loans tend to fill up quickly. On the positive side, this shows investors have confidence in Kuflink and want to invest through the platform. On the minus side, it means there are typically no more than two or three new loans open for investment at any time.

You can read my full review of Kuflink in this blog post, or sign up directly here if you wish [affiliate link].

Assetz Exchange

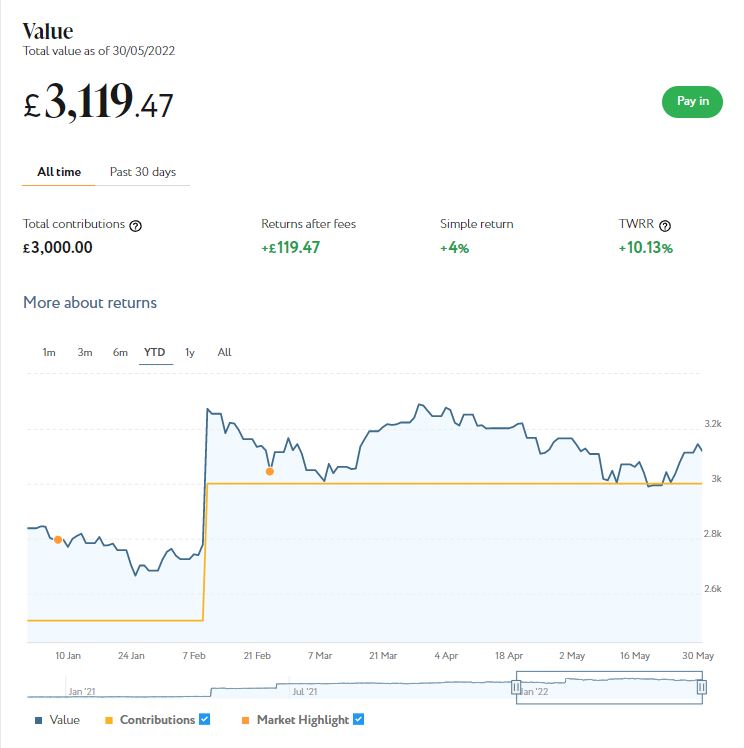

Assetz Exchange is a P2P property investment platform focusing on lower-risk properties (e.g. sheltered housing). I put an initial £100 into this in mid-February 2021 and another £400 in April. In June 2021 I added another £500, bringing my total investment up to £1,000.

Since I opened my account, my AE portfolio has generated £59.49 in revenue from rental and £60.93 in net capital growth, a total of £120.42. That’s a decent rate of return on my £1,000 investment and does illustrate the value of P2P property investment for diversifying your portfolio when equity markets are volatile (as at the moment).

I now have investments in 23 different projects and all are performing as expected, generating rental income and – in all but three cases – showing a profit on capital. So I am very happy with how this investment has been doing. And it doesn’t hurt that most projects are socially beneficial as well.

To control risk with all my property crowdfunding investments nowadays, I invest relatively modest amounts in individual projects. This is a particular attraction of AE as far as I am concerned. You can actually invest from as little as 80p per property if you really want to proceed cautiously.

My investment on Assetz Exchange is in the form of an IFISA so there won’t be any tax to pay on profits, dividends or capital gains. I’ve been impressed by my experiences with Assetz Exchange and the returns generated so far, and intend to continue investing with them. You can read my full review of Assetz Exchange here. You can also sign up for an account on Assetz Exchange directly via this link [affiliate].

Final Thoughts

Clearly, no-one should put all their spare cash into Kuflink, Assetz Exchange or any other P2P/crowdlending platform. Nonetheless, in my view it’s certainly worth considering as part of a diversified portfolio. Not only are the rates of return higher than those currently on offer from banks and building societies, they are relatively unaffected by ups and downs in the stock markets. P2P loans aren’t a way of hedging your equity-based investments directly, but they definitely do help spread the risk.

If you have any comments or questions about this post, as always, please do leave them below.

Disclosure: I am not a registered financial adviser and nothing in this post should be construed as personal financial advice. You should always do your own ‘due diligence’ before investing, and seek advice from a qualified financial adviser if in any doubt how best to proceed. All investing carries a risk of loss.

This post (and others on PAS) includes affiliate links. If you click through and perform a qualifying transaction, I may receive a commission for introducing you. This will not affect the product or service you receive or any fees you may pay.

tic a way as he is doing!

tic a way as he is doing!