Spotlight: The Bestinvest Investment Platform

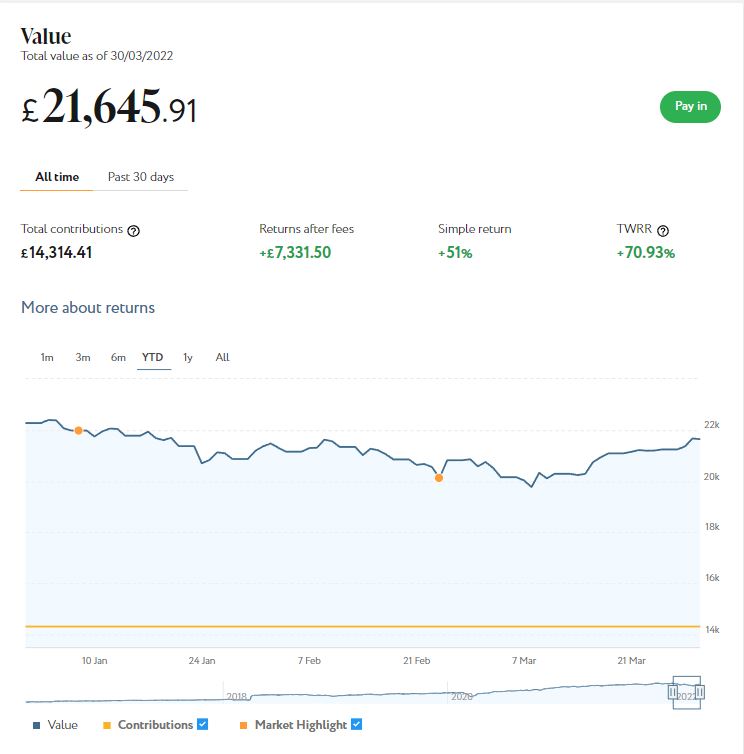

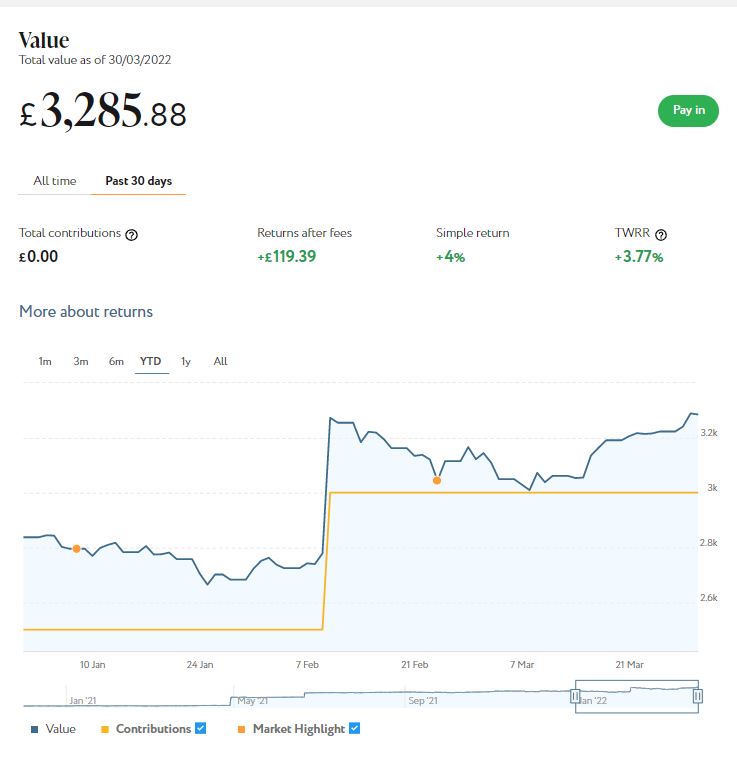

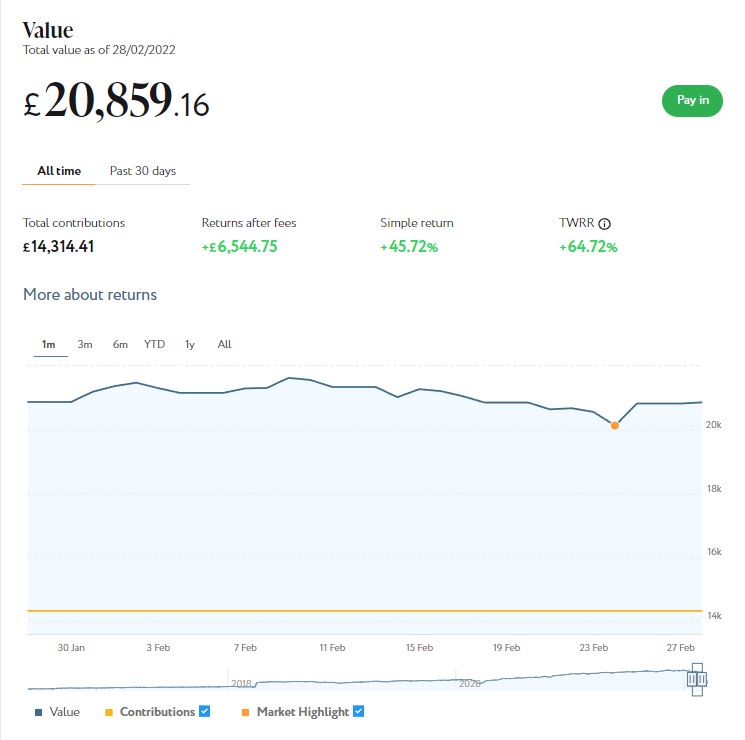

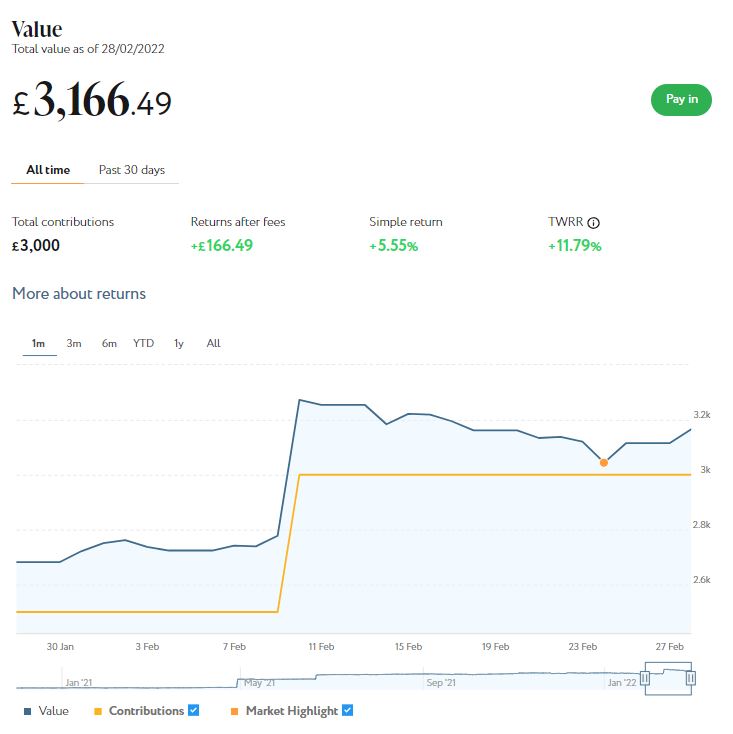

Today I’m looking at Bestinvest, an investment platform I have used myself for many years. My SIPP (Self Invested Personal Pension) is held with them.

Bestinvest was founded in 1986, so it is one of the UK’s longest established platforms. In 2014 they merged with Tilney, and the company rebranded as Tilney Group in 2017.

Bestinvest has around £2.7 billion in assets under management (AUM). This puts it in the mid-size category, some way behind the UK’s three biggest investment platforms, Hargreaves Lansdown, AJ Bell YouInvest and Interactive Investor.

Of course, size isn’t everything. As a well-established platform with competitive fees and a reputation for high-quality customer service, Bestinvest has plenty to offer discerning investors.

Table of Contents

What Does Bestinvest Offer?

Bestinvest offers four main types of account. These are:

- Stocks and Shares ISA

- Junior ISA

- SIPP (Self Invested Personal Pension)

- General Investment Account

General Investment Accounts can be used for investments outside your tax-free allowance (e.g. the £20,000 annual ISA allowance). You can also use this account for day-to-day share trading. But be aware that any income or capital gains generated within this account (above your personal allowance) may be liable for income tax, dividend tax and/or capital gains tax.

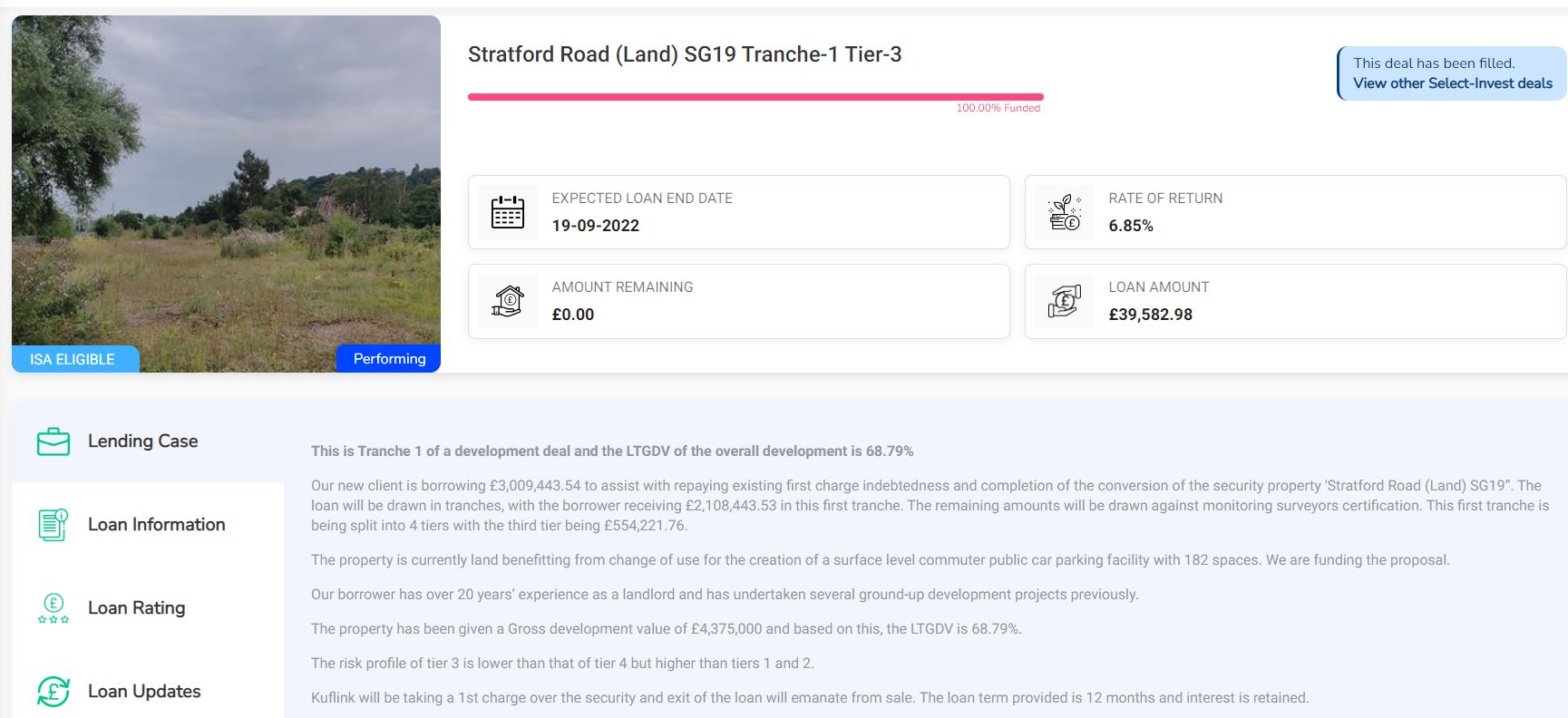

Within their accounts, investors can select from a wide range of funds and individual company shares. You can choose from over 2,500 funds, UK shares, ETFs, and investment trusts. There is no access to US shares, though. So if that is something you might require, another platform such as Hargreaves Lansdown or eToro might be a better choice for you.

- As someone asked me this, I should maybe clarify that while you can’t buy US shares directly on Bestinvest, you can of course buy funds investing in the US market if you wish. Personally I have some of my SIPP money invested in the HSBC American Index C fund.

What Are The Charges?

Bestinvest recently revamped and in many cases reduced their charges. They are now highly competitive in many areas.

For most accounts there is a tiered platform fee. This begins at 0.4% for the first £250,000, 0.2% for the next £250,000, 0.1% for £500,000 to £1,000,000, and zero over that.

Bestinvest do, however, offer a range of ready-made portfolios, where the fee for the first £250,000 is just 0.2%. This is half the standard rate (and makes them extremely competitive with other platforms). For more information about fees and charges, see the Bestinvest website.

Buying and selling funds on Bestinvest is free (though you will of course still have to pay fund charges). Bestinvest recently slashed their share dealing charge to £4.95 per deal.

Information and Advice

Bestinvest is aimed at people who are comfortable choosing their own investments. They do, though, offer plenty of information and advice for investors, much of it for free.

As mentioned above, they have a range of ready-made portfolios you can choose from. Bestinvest charge half their normal fee for these (0.2% rather than 0.4% for the first £250,000). They comprise a carefully selected collection of investments, so you don’t have to spend time choosing yourself. They have two fund ranges, Expert and Smart. Each has different investment portfolios, from defensive to maximum growth and everything in between. If your focus is sustainability or income, they have funds for those as well.

But if you prefer to choose your own investments, Bestinvest have tools and articles to assist with this too. Their investment search tool lets you search according to a wide range of criteria. You can then access in-depth information on any potential investments that look appealing.

Advice from registered financial advisers is also available via the Bestinvest platform. If you plan to invest over £20,000 in ready-made portfolios, personalized advice about choosing the best option/s for you is available for free. You can also get free ‘coaching’ calls, and more in-depth personal financial advice, for which there is a charge. Again, see the Bestinvest website for more information.

What Are the Pros and Cons of Bestinvest?

PROS

- Well-established platform with a large client base

- Range of accounts to meet most needs

- Well-designed, user-friendly website

- No dealing fees when buying or selling funds

- Reasonable fees (£4.95) when buying shares

- Low minimum investment (just £50 in most cases)

- Highly rated UK-based customer service

- Information, advice and ready-made portfolios available

- Ready-made portfolios are exceptionally good value

- User-friendly investment research tools

- Bestinvest pay up to £500 towards any exit fees your current providers charge when you transfer your investments to them

CONS

- No access to US shares

- No mobile app currently

- Some users have had issues with the website (though see below)

What Do Users Think?

On the independent TrustPilot website, Bestinvest has an average rating of 3.8 (‘Great’) at the time of writing, with 38% of users awarding them a maximum five stars rating. That is roughly on a par with other leading UK investment platforms.

Positive comments typically emphasize the high-quality customer service and range of advice and information available. Some of the negative comments concern issues with the website, though it is worth noting that this has just been revamped.

- Bestinvest has also received various industry awards, including Best Customer Service at the 2021 Shares Awards run by Shares Magazine, and Best ISA Provider in the 2020 COLWMA Awards. You can see a full list of their recent industry awards here.

Closing Thoughts

If you are planning to start investing (or switch from your current platform) Bestinvest is certainly worthy of your consideration. It is a popular, well-established platform with a good range of accounts and services. Their charges are competitive, and (as I can testify from my many years as a client) their UK-based customer service is first rate.

The Bestinvest SIPP is widely considered their flagship product, and as I have one of these myself (now in drawdown) I wouldn’t argue with that. There are no set-up fees, no fund-dealing charges and they pay up to £500 towards your exit fees if transferring from another provider. The Bestinvest SIPP has recently become even more competitive with the scrapping of the £100 (plus VAT) administration fee and certain other charges. Note that there is still a minimum charge of £120 per annum, though.

Bestinvest’s ready-made portfolios are an attractive (and great value) option for novice investors and those who don’t have time to research all their investments themselves. But equally, if you are happy to pick your own funds and shares, Bestinvest has all the information and tools you will need.

While Bestinvest’s share-trading fees are relatively low, if you’re planning to buy and sell individual shares regularly, a low-cost dealing service such as eToro might be better for you. They offer commission-free trading on shares and charge no monthly account fee. That makes them ideal for short-term traders and investors looking to build a portfolio of shares cheaply. Of course, this is a riskier approach to investing, and not recommended for those new to the field.

As ever, if you have any comments or questions about this blog post or Bestinvest in particular, please do leave them below.

Disclaimer: I am not a qualified financial adviser and nothing in this blog post should be construed as personal financial advice. Everyone should do their own ‘due diligence’ before investing and seek professional advice if in any doubt how best to proceed. All investing carries a risk of loss.

Note also that this post includes affiliate links. If you click through and perform a qualifying transaction, I may receive a commission for introducing you. This will not affect the product or service you receive or the terms you are offered.