My Investments Update – February 2022

Here is my latest monthly update about my investments. You can read my January 2022 Investments Update here if you like

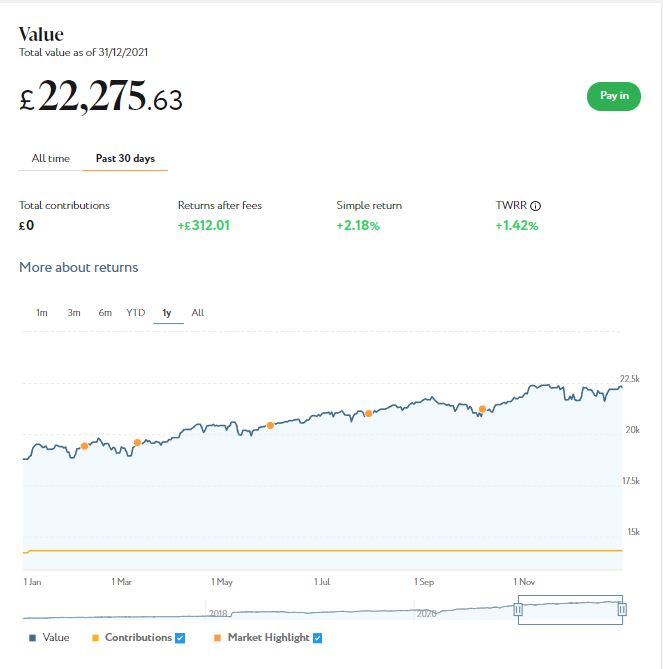

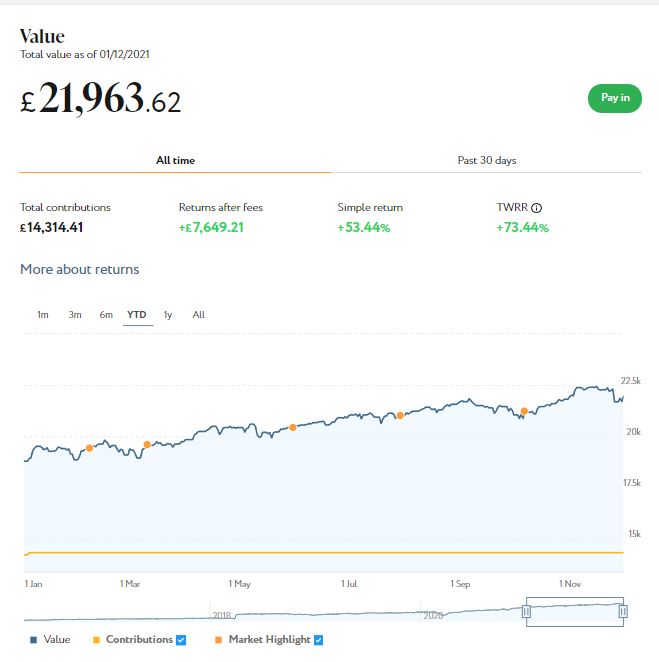

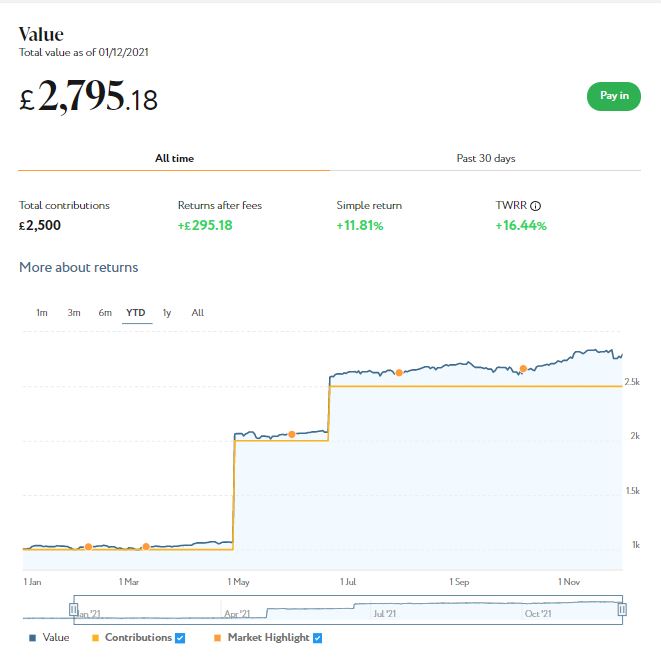

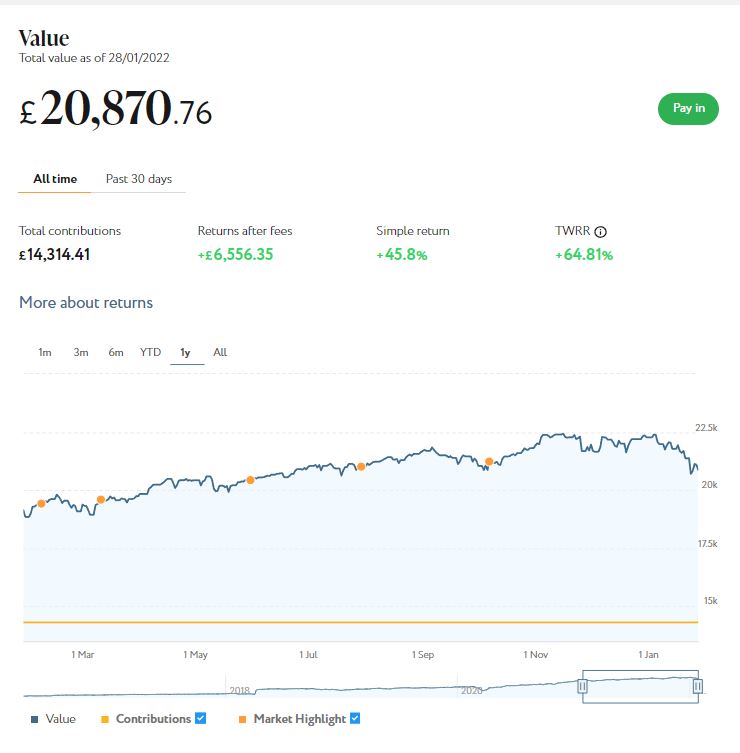

I’ll begin as usual with my Nutmeg Stocks and Shares ISA, as I know many of you like to hear what is happening with this.

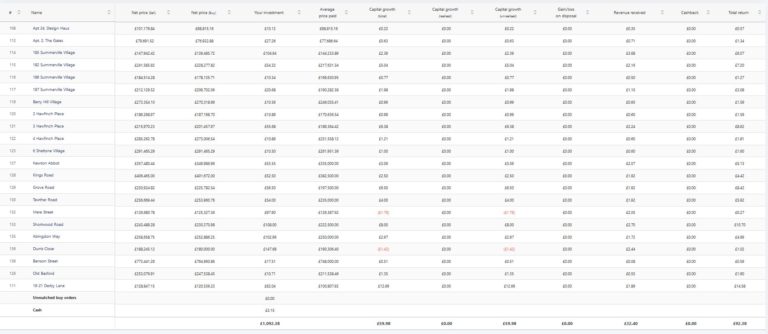

As the screenshot below shows, my main portfolio is currently valued at £20,870. Last month it stood at £22,275, so that is a fall of £1,405.

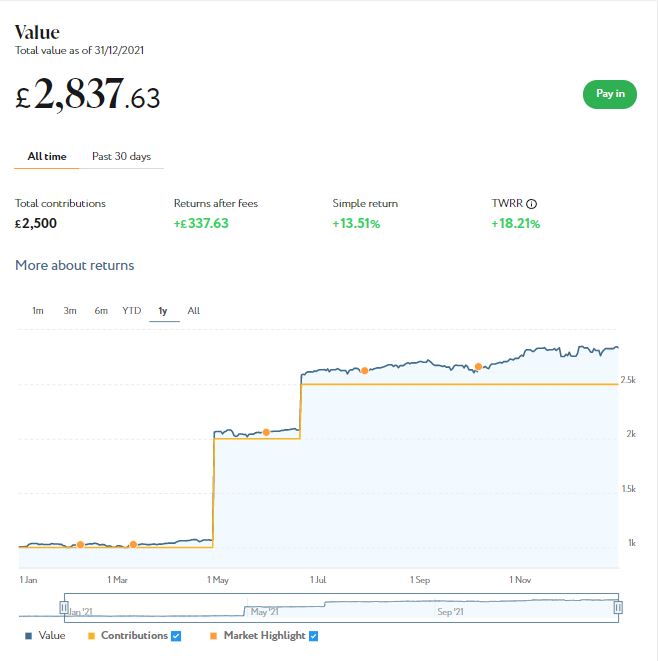

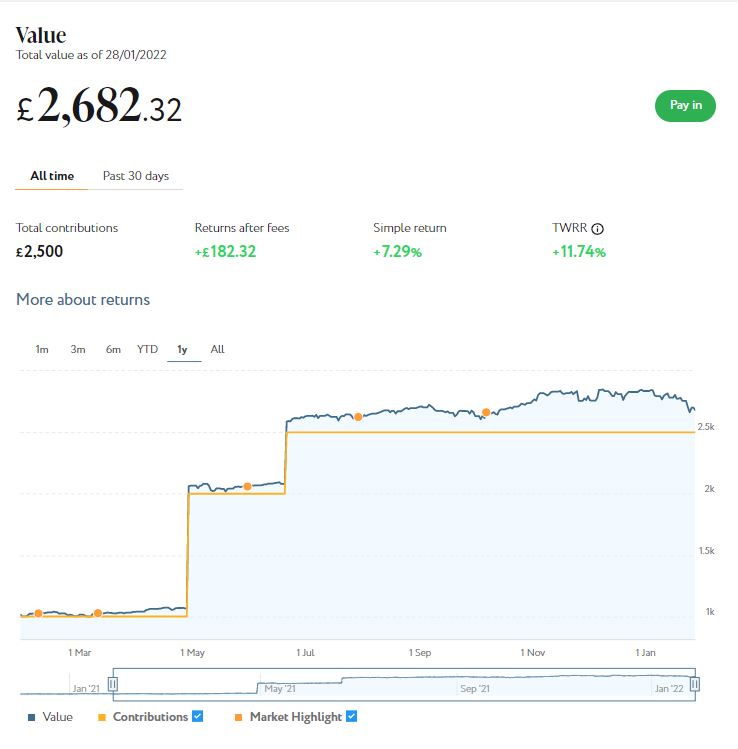

Apart from my main portfolio, I also have a second, smaller pot using Nutmeg’s Smart Alpha option. This is now worth £2,682 compared with £2,837 last month, a net fall of £155. Here is a screen capture showing performance over the last year.

There is no denying 2022 has got off to a disappointing start as far as these investments are concerned. Overall, they take the value of my portfolio back to where it was at the end of June 2021.

It is though worth noting that since I started investing with Nutmeg in 2016 I have still enjoyed a total return on my main portfolio of 45.8% (or 64.81% time-weighted). I should also mention that I have selected quite a high risk level for both my Nutmeg accounts (9/10 for the main one and 5/5 for Smart Alpha). This has served me well generally, but I’m sure investors who selected lower risk levels will have seen smaller falls this month.

Of course, it’s not just Nutmeg investors who have had a bad month. Equities generally have taken a tumble in the last few weeks. Commentators have varying opinions about this, but two reasons are typically mentioned: (1) the rising tensions (and threat of war) in Ukraine; and (2) rising inflation rates allied with the removal of monetary stimulus measures as we come out of the pandemic. Obviously nobody knows for sure which way things will go, but this recent post from the Nutmeg blog sets out some grounds for cautious optimism over the year ahead.

Personally I intend to take advantage of the current dip by topping up my Nutmeg investment while asset values are depressed. I plan to add to my Smart Alpha holding, as overall this has been doing slightly better than my main portfolio. I’m also conscious that the end of the 2021/22 tax year will soon be upon us. That means the end of the current year’s ISA allowance, so it really is a case of use it or lose it!

- The above is just my view, of course, and should not be construed as personal financial advice for anyone else to follow.

You can read my full Nutmeg review here (including a special offer at the end for PAS readers). If you are still looking for a home for your 2021/22 ISA allowance, based on my experience over the last six years, they are certainly worth considering.

If you haven’t yet seen it, check out also my blog post in which I looked at the performance of Nutmeg fully managed portfolios at every risk level from 1 to 10 (as mentioned, my main port is level 9). I was actually pretty amazed by the difference the risk level you choose makes. If you are investing for the long term (and you almost certainly should be) opting for a hyper-cautious low-risk strategy may not be the smartest thing to do.

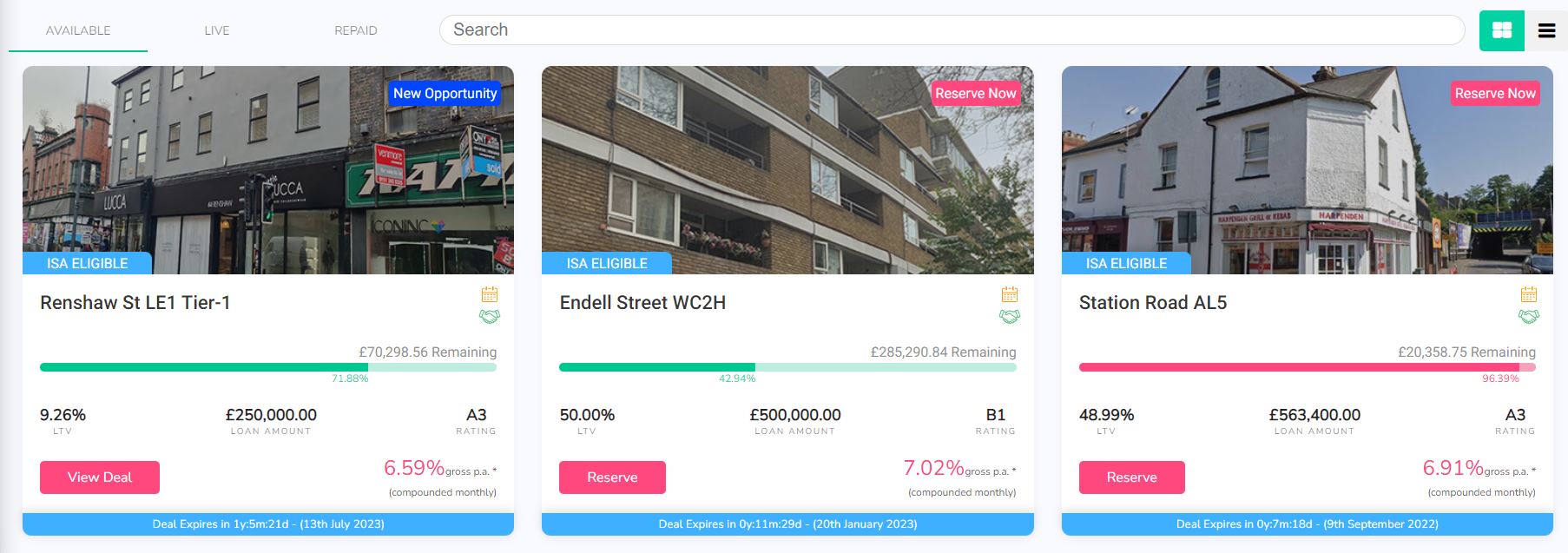

As regular readers will know, this year I am using Assetz Exchange for my IFISA. This is a P2P property investment platform that focuses on lower-risk properties (e.g. sheltered housing on long leases). I put an initial £100 into this in mid-February 2021 and another £400 in April. Everything went well, so in June 2021 I added another £500, bringing my total investment on the platform up to £1,000.

Since I opened my account, my Assetz Exchange portfolio has generated £37.18 in revenue from rental and £91.19 in capital growth, for a total return of £128.37. That’s an increase of £35.99 on last month alone, and does I guess illustrate the potential value of P2P property investment for diversifying your portfolio when equity markets are volatile.

I won’t bother publishing a statement on this occasion as it’s not massively different from last time. The bottom line is that I (still) have investments in 21 different projects with them and all are performing as expected, generating income and – in every case now – showing a profit on capital. So I am very happy with how this investment has been doing.

- To control risk with all my property crowdfunding investments nowadays, I invest relatively modest amounts in individual projects. This is a particular attraction of AE as far as i am concerned. You can actually invest from as little as 80p per property if you really want to proceed cautiously.

As mentioned, my investment on Assetz Exchange is in the form of an IFISA so there won’t be any tax to pay on profits, dividends or capital gains. I’ve been impressed by my experiences with Assetz Exchange and the returns generated so far, and intend to continue investing with them. You can read my full review of Assetz Exchange here. You can also sign up for an account on Assetz Exchange directly via this link [affiliate].

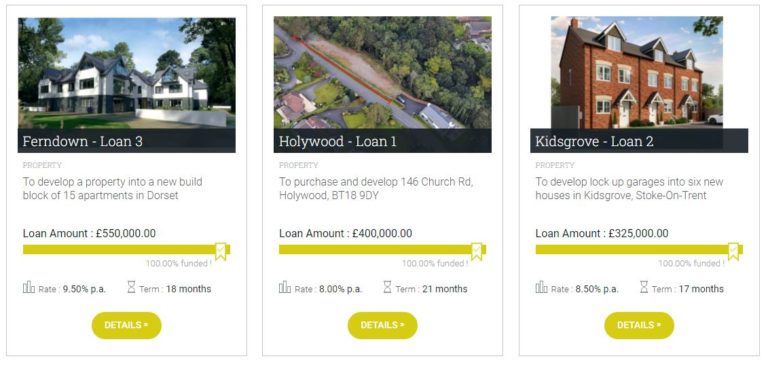

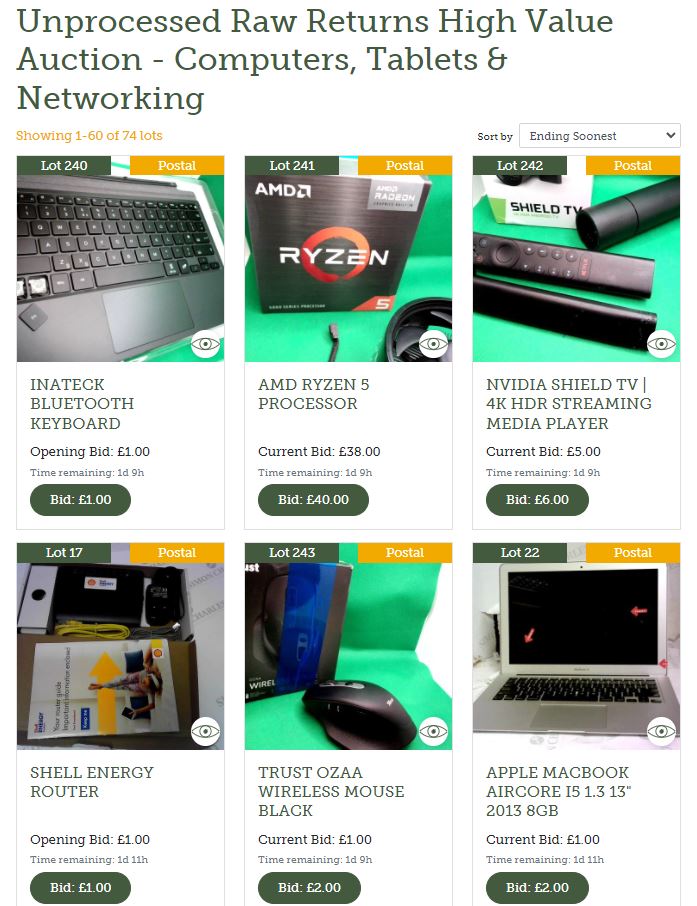

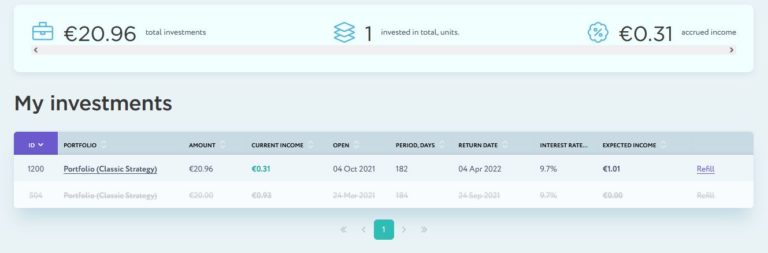

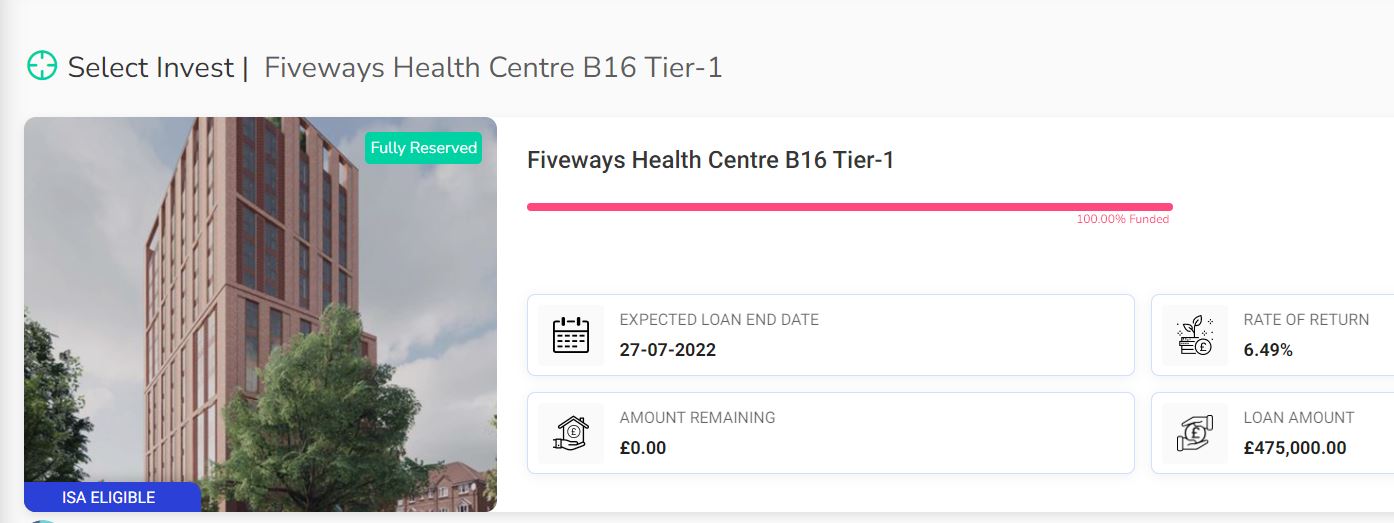

Another property platform I have investments with is Kuflink. They have been doing well recently, with new projects launching almost every day. I currently have just over £2,000 invested with them, quite a large proportion of which comes from reinvested profits. To date I have never lost any money with Kuflink, though some loan terms have been extended once or twice. On the plus side, when this happens additional interest is paid for the period in question.

Several of my Kuflink investments reached maturity in the last few weeks and I reinvested the capital released. Here is one of the new projects I invested in, a loan to convert a disused medical centre in Five Ways, Birmingham into residential accommodation. It looked a solid investment, and I also liked the fact that it was redeveloping a derelict building in Birmingham, a city where I lived for around twenty years.

My loans with Kuflink pay annual interest rates of 6 to 7.5 percent. As mentioned above, these days I invest no more than around £150 per loan (and often less). That is not because of any issues with Kuflink but more to do with losses of larger amounts on other P2P property platforms in the past. My days of putting four-figure sums into any single property investment are behind me now!

- Nowadays I mainly opt to reinvest the monthly repayments I receive from Kuflink, which has the effect of boosting the percentage rate of return on the projects in question

You can read my full Kuflink review here. They offer a variety of investment options, including a tax-free IFISA paying up to 7% interest per year with built-in automatic diversification. Alternatively you can now build your own IFISA, with most loans on the platform (including the one shown above) being IFISA-eligible.

I’d also particularly draw your attention to Kuflink’s revised and more generous cashback offer for new investors [affiliate link]. They are now paying cashback on new investments from as little as £500 (it used to be £1,000). And if you are looking to invest larger amounts, you can earn up to a maximum of £4,000 in cashback. That is one of the best cashback offers I have seen anywhere (though admittedly you will need to invest £100,000 or more to receive that!).

- I also recently published a blog post about another P2P property investment platform called BLEND. Like Kuflink, they offer the opportunity to invest in secured loans to experienced property developers. They offer (on average) somewhat higher rates of return than Kuflink, though arguably with a little more risk. As well as my blog post about BLEND, you can also check out what they have to offer on their website [affiliate link].

Next up, I wanted to give another plug for an excellent low-key sideline-earning opportunity I have mentioned previously on Pounds and Sense. This opportunity is based on matched betting, a sideline I have pursued for several years myself. Several PAS readers (including my sister Annie!) have signed up for this and are now enjoying a tax-free, hassle-free sideline income from it 🙂

I have been asked not to divulge too many details about this publicly, for good reasons I will explain privately to anyone who may be interested (and no, it’s not illegal!). It doesn’t require any financial outlay and is risk-free and entirely hands-off (once you have set up your account). No knowledge of betting is required and you don’t have to place any bets yourself (this is all done by the company’s clever software). You just have to set up a separate bank account for bets to go through, but running the account is entirely financed by the company.

The company has changed its terms somewhat for new members. You now get a larger £100 initial reward payment once your account is up and running, and then £25 every month you remain a member. I think this is a good move personally, as setting up the account does involve a little work on your part (though it’s certainly not like going down the mines). So the £100 in effect compensates you for your time, and once it’s done you continue to get £25 a month for no effort at all.

The company is constantly developing its offering, partly in response to feedback from PAS readers. They recently launched a new mobile-friendly website to make it even easier for new members to sign up (once you’re up and running you shouldn’t need to use the website at all). They also recently incorporated an Open Banking app so that members don’t have to provide their online banking info to the company, as some people were concerned about this.

Please note that this opportunity is only open to honest, trustworthy people who haven’t done matched betting before and have no more than two accounts already with online bookmakers. For more information (and to receive a no-obligation invitation) drop me a line including your email address via my Contact Me page. And yes, I will receive a reward for introducing you, but this will not affect the service or the rewards you receive.

- In the interests of full transparency, I should say that if you do matched betting yourself, you may be able to make more money than that being offered by the company. However, you will have to research the techniques in detail, place all bets yourself, and probably subscribe to a matched betting advisory service such as Profit Accumulator [affiliate link]. This opportunity is really for those who want an easy way to make some extra money without the hassle (or expense) of learning/applying matched-betting methods themselves.

Moving on, I have another article on the always-excellent Mouthy Money website. Coincidentally, this is about my experiences with P2P property investment over the last few years, both good and not-so-good. Do check it out! 🙂

I was also quoted by Jackie Annett of the Express newspaper in this article about working after retirement. It’s a short but interesting read, especially if you’re coming up to retirement (or already there) yourself.

That’s more than enough for now, so I’ll sign off till next time. I hope you are keeping safe and well, and (if you live in England especially) are enjoying the more relaxed Covid restrictions that now apply. Here’s hoping that normal life across the whole of the UK will be able to resume very soon!

Disclaimer: I am not a qualified financial adviser and nothing in this blog post should be construed as personal financial advice. Everyone should do their own ‘due diligence’ before investing and seek professional advice if in any doubt how best to proceed. All investing carries a risk of loss.

Note also that this post includes affiliate links (disclosed). If you click through and perform a qualifying transaction, I may receive a commission for introducing you. This will not affect the product or service you receive or the terms you are offered.

As mentioned,

As mentioned,