Ten Tips for Saving Money on Your Supermarket Shopping

Many of us today do most of our shopping in supermarkets. Although of course it’s important to support local/specialist shops, supermarkets typically offer a much wider range of products at prices small stores find hard to match.

But there are still lots of ways savvy shoppers can save money on their supermarket shopping. Here are ten top tips to shave a few pounds (or more) off your shopping bills…

Table of Contents

Make the Most of Loyalty Cards

All the big name supermarkets have these, though some (e.g. Morrisons) are switching from plastic to app-based cards. The benefits on offer vary, but typically you get points which can be exchanged for discounts and gifts. I shop mainly at Morrisons and Waitrose, as they have branches closest to me.

With Morrisons, their (now virtual) More card gives you special offers based on things you normally buy anyway. I have had some great discounts on my groceries with these offers, but you do of course need to remember to ‘swipe’ the app barcode at the checkout.

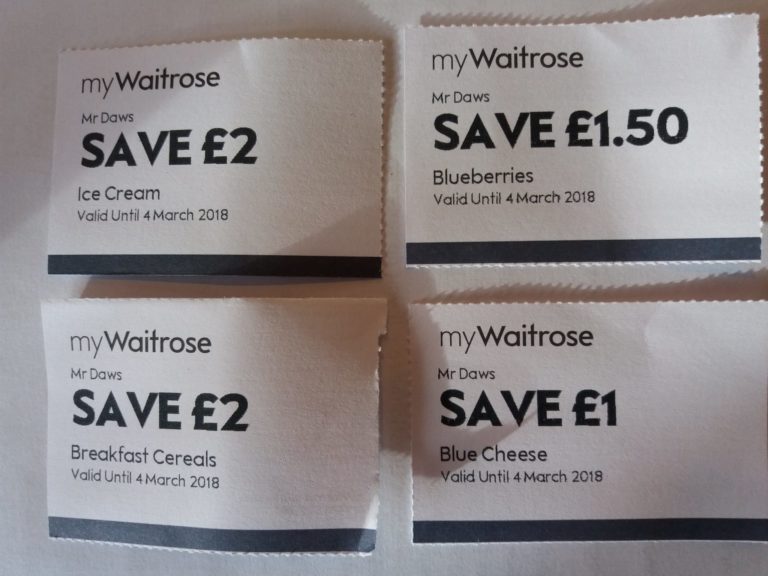

I also have a myWaitrose card. With this you can get a free newspaper with your shopping (subject to a £10 minimum spend). You can also get a free hot drink. You get vouchers sent in the post as well, such as the ones pictured below. It surprises me a bit when someone in the queue in front of me says they don’t have a myWaitrose card, but perhaps if they shop regularly at Waitrose they don’t have to worry too much about saving money 😉

Shop Late in the Day

Late in the day – ideally the hour before the store closes – is the best time to look for bargains. The shops will have stock they want to get rid of, probably because it is coming up to its ‘best before’ date. These items will often be marked down substantially, as the stores want to get at least some money for them rather than have to throw them away. Bear in mind that you can always freeze many foods if you can’t use them immediately – and in any event ‘best before’ dates aren’t set in stone.

Use Cashback Sites

I’ve talked about cashback sites like Quidco and Top Cashback on this blog before (e.g. in this post). If you shop online, you can get money back by clicking through to the retailer from the link on the cashback site. The most generous offers are generally reserved for new customers, e.g. on Top Cashback right now new Sainsbury’s online customers can get 16.5% cashback on Click and Collect orders of over £40. But even existing customers can get 5.5% cashback on Click and Collect orders of over £40 (all details correct at time of writing).

Plan Your Meals Ahead

We all lead busy lives these days. But it’s still good to devote some time to planning ahead where meals are concerned. Try to incorporate things you have in stock already, especially perishables which may not last more than a day or two. And rather than buying unusual/expensive ingredients for one dish only, see if you can find other recipes to use them up.

Batch cooking, where you make enough of a dish to last two days or more, is another great way to cut the cost of shopping. Of course, most dishes can be frozen if you can’t face having curry three days in a row!

Shop Online

Aside from the convenience of having goods delivered to your door, a big advantage of online shopping is that you will be less likely to succumb to impulse buys. Just make a list of what you need, visit the website, and add the items on your shopping list to your basket.

Admittedly you may have to pay a delivery fee, but many supermarkets now offer this free for new customers or for orders above a certain value. There are also in many cases ‘free delivery’ codes online if you search for them. And don’t forget to use cashback sites where possible as well (see above).

Search for Money Off Coupons and Vouchers

This is an old school method but it can still produce big savings. Look out for money-off vouchers in newspapers, magazines and the stores themselves. You can also search online if there are particular products you want to buy. This method can work particularly well with larger items such as dishwashers and tumble dryers [sponsored link], but it’s also worth searching for money-off vouchers for smaller/cheaper items, especially if they are things you buy regularly.

Try Own-Brand Products

All supermarkets have their own-brand products, and usually they cost less than heavily promoted consumer brands.

Many stores also have rock-bottom priced ‘Saver’ ranges. Sometimes these are not as good as more expensive branded or own-brand products. Other times, though, they are indistinguishable. For example, I now always buy Morrisons’ lowest-priced butter from their Savers range. I find it tastes just as good as the more expensive alternatives.

Use Discount Supermarkets and Stores

It’s easy to get in the habit of a weekly trip to Tesco or Sainsbury’s, but if you haven’t yet done so it’s well worth trying out discount supermarkets such as Iceland, Aldi and Lidl. They aren’t always the most attractive places to shop, but they make up for this with some amazingly low prices. Admittedly you won’t always recognize the brand names, but that doesn’t mean they aren’t high quality. Staples like bread, fruit and vegetables are often cheaper as well.

- Iceland have a long-running special discount offer for over-60s. You can read more about it here.

Make Money From Your Receipts

There are various apps and companies that will reward you for scanning and submitting your shopping receipts to them. One I’ve belonged to for some years now is ShopandScan. You can read more about this opportunity here.

ShopandScan pays in vouchers rather than cash, but the options include Amazon vouchers, which are of course nearly as good. I have received several thousand pounds worth of vouchers from ShopandScan since I started with them. As I say in my review, acceptance isn’t automatic, but if you apply there is every chance you will be sent an invitation within a few weeks.

Grow Your Own Food!

You can save significant sums of money by doing this. This summer I didn’t buy any tomatoes from July till mid-October, as I was eating ones I had grown myself. I highly recommend tomatoes, incidentally, not least as they are easy to grow in the garden, in a tub or hanging basket, or even on your window sill. They taste a lot better than most shop-bought varieties as well!

There are, of course, plenty of other things you can grow to save money, even if space is at a premium. Fresh herbs are one possibility, as are many types of berry (strawberries grow like weeds in my garden). I’ve also had some success with runner beans, courgettes and garlic, and salad vegetables such as chard, radishes and spring onions.

This year I also grew a pot of cut-and-come-again lettuce and was amazed by how much I got from this. It’s perfect for people who live alone like me, as you can just pick a few leaves when you want them, rather than buy a bag of salad leaves and have most of them go to waste.

I hope you’ve enjoyed this post and it has given you a few ideas for saving money on your supermarket shopping. If you have any other tips or comments, please do post them below!