My Coronavirus Crisis Experience – August 2021 Update

Another month has passed, so it’s time for another Coronavirus Crisis Update. Regular readers will know I’ve been posting these since the first lockdown started in March 2020 (you can read my July 2021 update here if you like).

As ever, I will begin by discussing financial matters and then life more generally over the last few weeks.

Financial

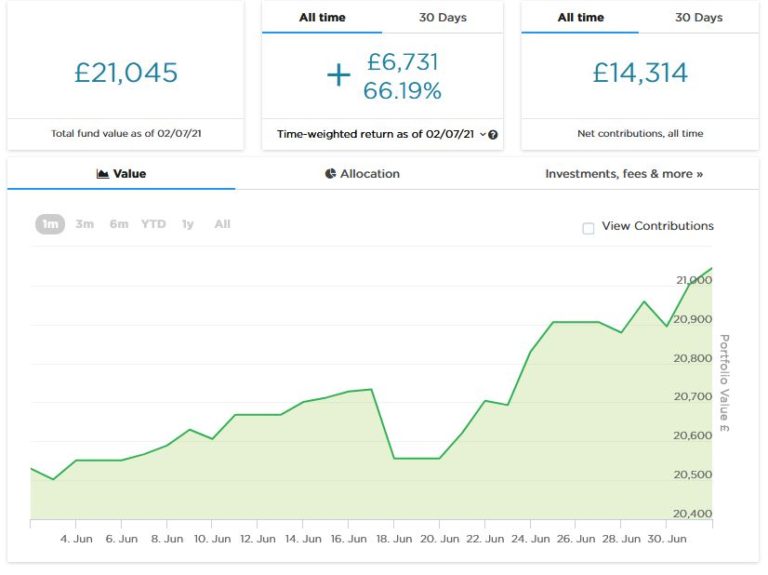

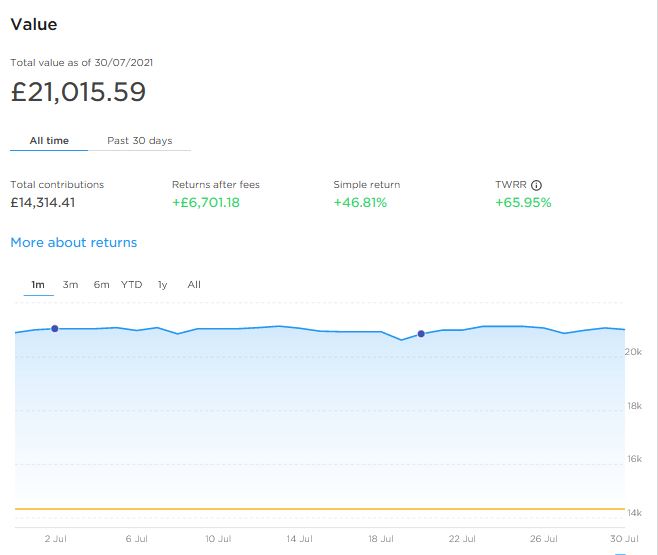

I’ll begin as usual with my Nutmeg stocks and shares ISA, as I know many of you like to hear what is happening with this.

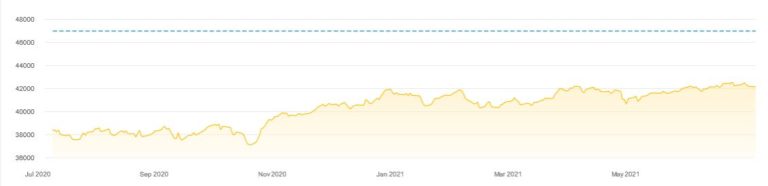

As the screenshot below shows, the value of my main portfolio remained pretty steady in July. It is currently valued at £21,015. Last month it stood at £21,045, so that is a slight drop of £30.

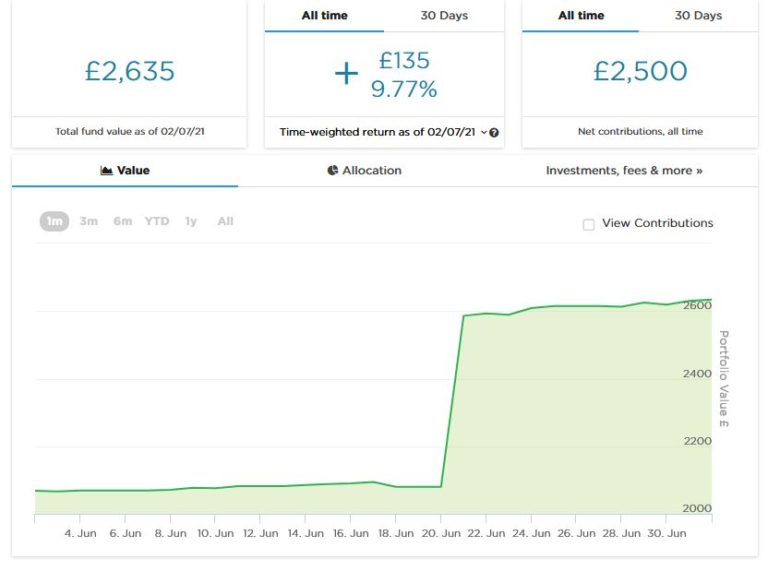

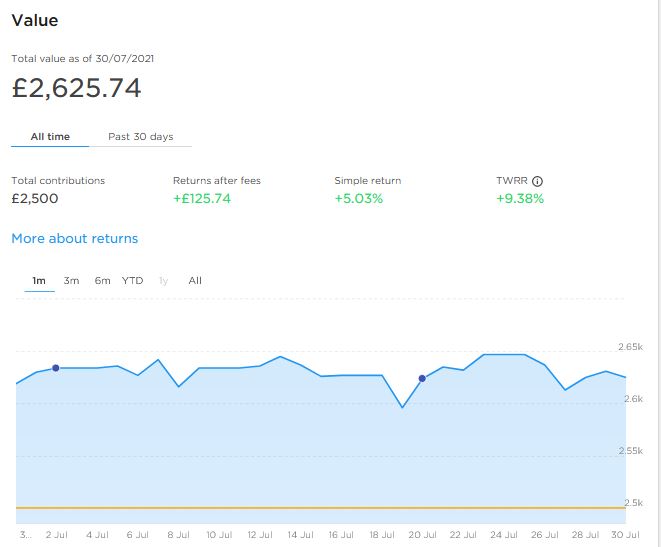

Apart from my main portfolio, I also have a second pot using Nutmeg’s new Smart Alpha option. This pot is now worth £2,625, compared with £2,635 last month, so a small decrease again. Here is a screen capture showing performance in July 2021.

Although it’s a little disappointing both portfolios are down slightly, over the last six months (and longer) both are still well up overall, so I’m certainly not going to lose any sleep over this. This is a long-term investment and some ups and downs are to be expected. In 2021 the overall trend has been mainly upwards, so I hope and expect this to be resumed soon.

You can read my full Nutmeg review here (including a special offer at the end for PAS readers). If you are still looking for a home for your 2021/22 ISA allowance, based on my experience they are certainly worth considering.

- If you haven’t yet seen it, check out also my recent blog post in which I looked at the performance of Nutmeg fully managed portfolios at every risk level from 1 to 10 (my main port is level 9). I was actually amazed by the difference the risk level you choose makes.

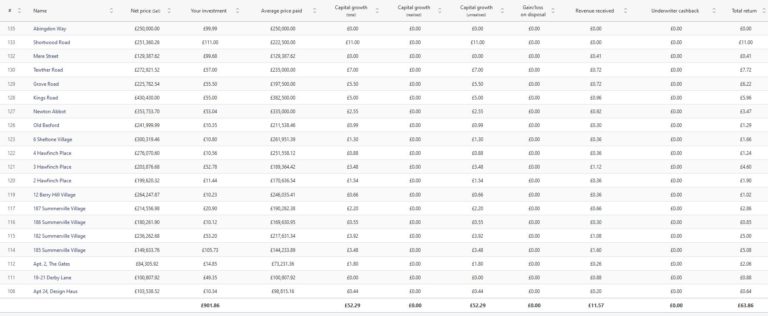

.As regular readers will know, this year I am using Assetz Exchange for my IFISA. This is a P2P property investment platform that focuses on lower-risk properties (e.g. sheltered housing on long leases). I put £100 into this in mid-February and another £400 in April. Touch wood, everything has been going well, so in June I added another £500, bringing my total investment on the platform up to £1,000.

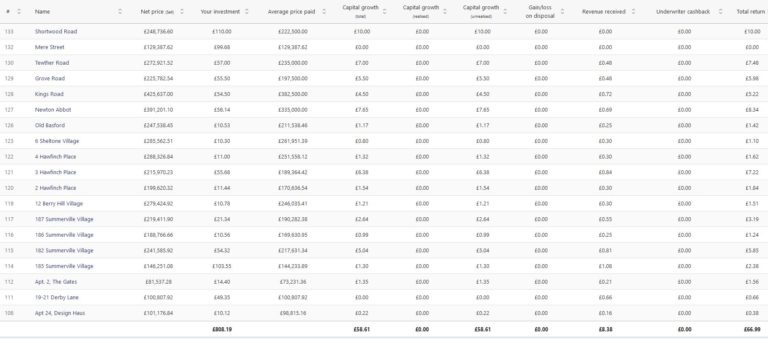

Since I opened my account, my portfolio has generated £11.57 in revenue from rental and £52.29 in capital growth, for a total return of £63.86. Here is my current statement:

As I said last time, to a degree Assetz Exchange has been a victim of its own success. They have had a big influx of new members, meaning all available investments were quickly snapped up. At the same time, some of the new projects that were due to launch were delayed. As a result I still haven’t invested all the money in my holding account. One new project did come on stream last week, so I put £100 into that.

My colleagues at Assetz Exchange assure me that more new projects are coming very soon. They are also limiting how much members can invest in the first few weeks of any new launch, so that everyone has a fair chance to purchase shares. And as time goes on more members may opt to offer their shares for sale on the exchange, opening up additional buying opportunities.

I am investing relatively modest amounts in new projects as they come onto the platform, so I don’t therefore put more than around £100 into any one project. As you can see, I already have a well-diversified portfolio comprising 20 different projects. This is a particular attraction of Assetz Exchange in my view. You can actually invest from as little as 80p per property if you really want to proceed cautiously.

As mentioned above, my investment on Assetz Exchange is in the form of an IFISA so there won’t be any tax to pay on profits, dividends or capital gains. I’ve been impressed by my experiences with Assetz Exchange and the returns generated so far, and intend to continue investing with them. You can read my full review of Assetz Exchange here if you like. You can also sign up for an account on Assetz Exchange directly via this link [affiliate].

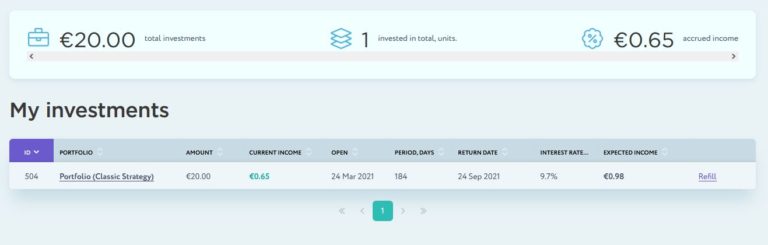

I haven’t mentioned my trial investment on European loan crowdfunding platform Nibble for a while, so thought I should remedy that this month. This has been proceeding without any issues and my initial test investment of 20 euros has accrued income of 0.65 euros, corresponding to an annual interest rate of 9.7 percent (see screen capture below).

I get weekly updates from Nibble confirming how much interest has been added to my portfolio. Based on my experiences to date I am considering investing a more substantial sum with them soon. My full review of Nibble can be found here.

Finally, in July 2021 two more PAS readers signed up with the low-key sideline-earning opportunity mentioned in previous updates. They will have received their initial £100 reward payments about now. I still have a few more invitations available if anyone else would like to take advantage.

This opportunity is based on matched betting, a sideline I have been pursuing for several years myself. I was asked not to divulge too many details about it publicly, for good reasons I will explain privately to anyone who may be interested (and no, it’s not illegal!). It doesn’t require any financial outlay and is risk-free and entirely hands-off (once you have set up your account). No knowledge of betting is required and you don’t have to place any bets yourself (this is all done by the company’s clever software). You just have to set up a separate bank account for bets to go through, but running the account is entirely financed by the company.

The company has changed its terms somewhat for new members. You now get a larger £!00 initial reward payment once your account is up and running, and then £25 every month you remain a member. I think this is a good move personally, as setting up the account does involve a little work on your part (though it’s certainly not rocket science). So the £100 in effect compensates you for your time, and once it’s done you continue to get £25 a month for no effort at all. The company is constantly developing its offering, partly in response to feedback from PAS readers. They recently launched a new mobile-friendly website to make it even easier for new members to sign up (once you’re up and running you shouldn’t need to use the website at all). They also recently incorporated an Open Banking app so that members don’t have to provide their online banking info to the company, as some people were concerned about this.

Please note that this opportunity is only open to honest, trustworthy people who haven’t done matched betting before and have no more than two accounts already with online bookmakers. For more information (and to receive a no-obligation invitation) drop me a line including your email address via my Contact Me page. And yes, I will receive a reward for introducing you, but this will not affect the service or the rewards you receive.

- Finally, in the interests of full transparency, I should say that if you do matched betting yourself, you may be able to make more money than what is being offered by the company. However, you will have to research the techniques in detail, place all bets yourself, and probably subscribe to a matched betting advisory service such as Profit Accumulator [affiliate link]. This opportunity is really for those who want an easy way to make some extra money without the hassle (or expense) of learning/applying matched-betting methods themselves.

Personal

The big news in July – in England at any rate – was that so-called Freedom Day took place as promised on 19th July 2021. Most of the legal restrictions on our lives, including mandatory masks and social distancing, were lifted from that date.

Since then – to the surprise of many experts and pundits (though not me) – new case numbers have been falling steadily week on week. Hospitalizations and deaths were slower to fall, but are now starting to follow the same path.

It is of course far too soon to say that the pandemic is over – and Covid is, in any event, likely to remain with us in some form for the foreseeable future. But it is all very encouraging, especially in the face of predictions from doom-mongers such as Professor Neil Ferguson that daily case numbers could reach 100,000 or even 200,000 as a result of restrictions easing.

In my view it is now high time we got back to something close to normal life and learned to live with the virus. But while out and about I notice that people generally are still being ultra-cautious. That is particularly the case in shops and supermarkets, where I should say that four out of five people are still wearing masks (though the numbers without are slowly increasing). On trains I would say it is about two in three, though on a couple of occasions when I travelled in the evening recently (after 7 pm) mask-wearers were in a minority.

I don’t use buses so can’t comment about them. At my local gym and swimming pool, however, almost nobody is wearing a mask now. Assuming that the numbers keep going in the right direction, I hope that more people will find the confidence to ditch the masks. It is wonderful to be able to see smiles and happy faces again after all this time!

In July I took a rail trip to Swindon to visit my old friend Jeff, who at the start of this year moved to Wiltshire. Unfortunately we chose what was probably the hottest day of the year. The whole round trip involved seven trains from three different train companies. So I can report that by far the best company for aircon, wifi, drinks/snacks service, and general all-round comfort, was Great Western Trains. Second were Cross Country, and last were West Midlands Railway. I travelled on three WMR trains in total and I don’t believe any of them had working aircon (one seemed to have the heating turned on despite the fact that the temperature outside was over 30). WMR had also by far the worst wifi, something I’ve experienced on many occasions before. I think West Midlands Mayor Andy Street should be turning his attention to improving this service rather than indulging in virtue-signalling gestures like offering passengers free masks. That aside, I did of course enjoy seeing Jeff again and also visiting Swindon for the first time. I would happily go back there, but hopefully on a cooler day!

As I said last time, I recently subscribed to Britbox and have been making good use of this. I really enjoyed watching all three series of the original House of Cards trilogy featuring Ian Richardson. I remembered the original series the best, but thought the second series (To Play the King) was equally good. I didn’t like the last series (The Final Cut) quite as much. It was never going to be quite the same without Michael Kitchen or Colin Jeavons, and I thought the ending was a bit of a let-down. But if you haven’t seen them before, I highly recommend watching all three.

Last week Britbox added Dennis Potter’s Lipstick on Your Collar (see image below) to their platform. I am very much enjoying watching this again almost 30 years since it first aired. I am a huge fan of Dennis Potter’s work and think he is probably our greatest-ever TV writer. His masterpiece was undoubtedly The Singing Detective, but Lipstick on Your Collar runs it pretty close. As with The Singing Detective, the series intersperses the action with lip-synched musical numbers, in this case classic 1950s rock ‘n’ roll. It has drama, comedy, great characters and some amazing music. What more could you possibly want?!

As I mentioned last time, now that Freedom Day has happened, this will be my last Coronavirus Crisis Update. I plan to continue with my monthly investment updates, and will also do more personal/general ones as and when the occasion arises.

I do hope you have enjoyed these monthly updates and found them of value. I have enjoyed writing them, and find it interesting looking back over them now as a sort of diary of the pandemic. I have listed them all below for convenience.

If you have any comments or questions about this post, as always, please do leave them below.