My Coronavirus Crisis Experience: April 2021 Update

It’s the start of April, so time for another of my monthly Coronavirus Crisis Updates. Regular readers will know I’ve been posting these updates since the first lockdown started in March 2020 (you can read my March 2021 update here if you like).

As ever, I will begin by discussing financial matters and then life more generally over the last few weeks.

Financial

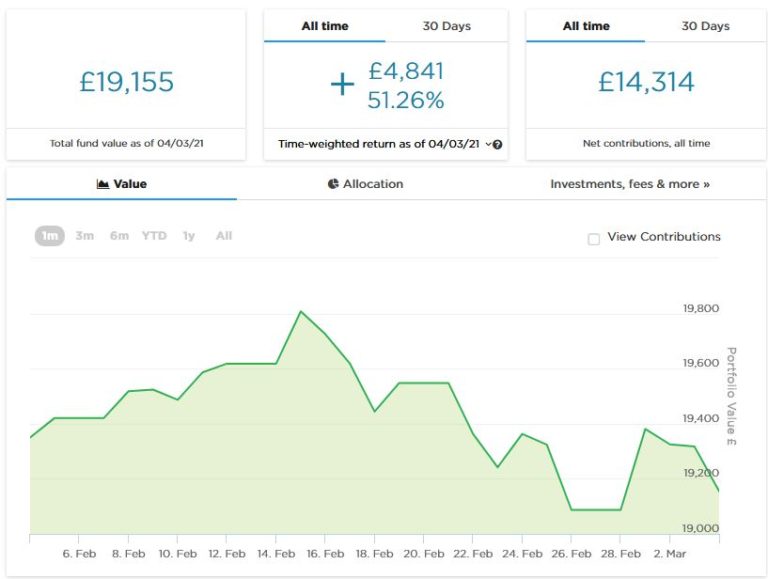

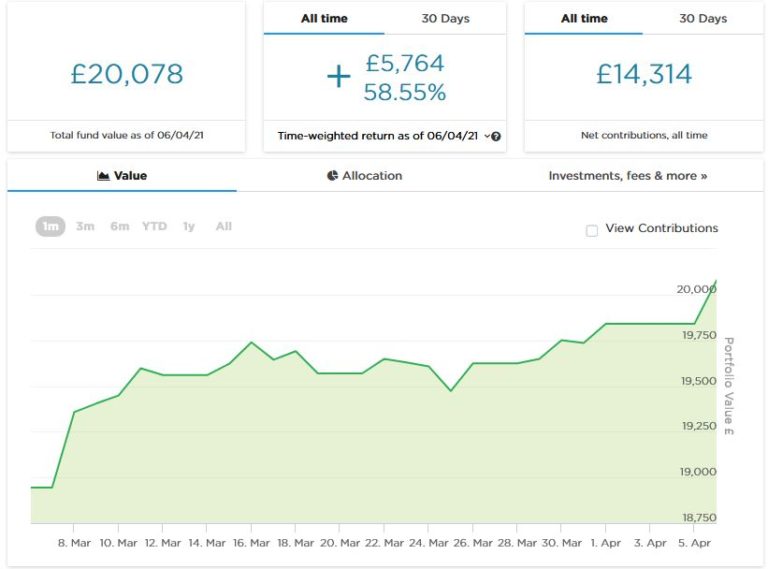

I’ll begin as usual with my Nutmeg stocks and shares ISA, as I know many of you like to hear what is happening with this.

As the screenshot below shows, following a dip in early March my main portfolio has generally been on an upward trajectory. It is currently valued at £20,078. Last month it stood at £19,155, so overall it has gone up by £923. I am very happy with that, obviously.

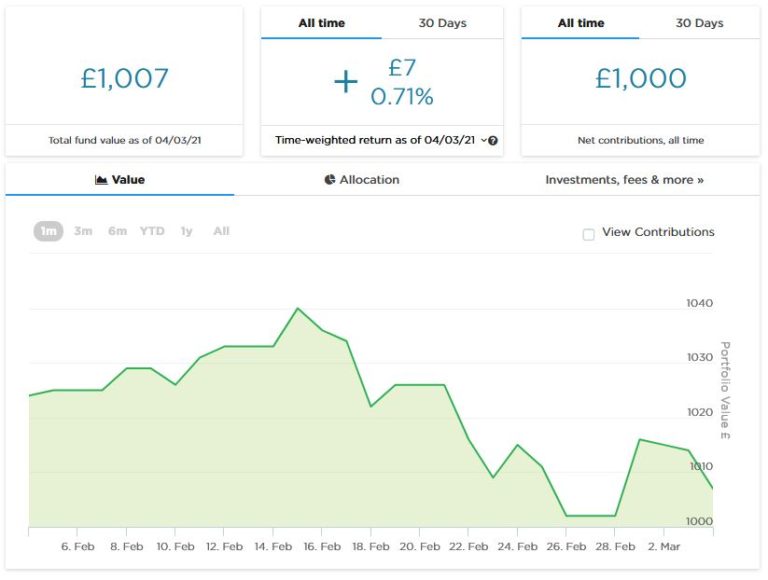

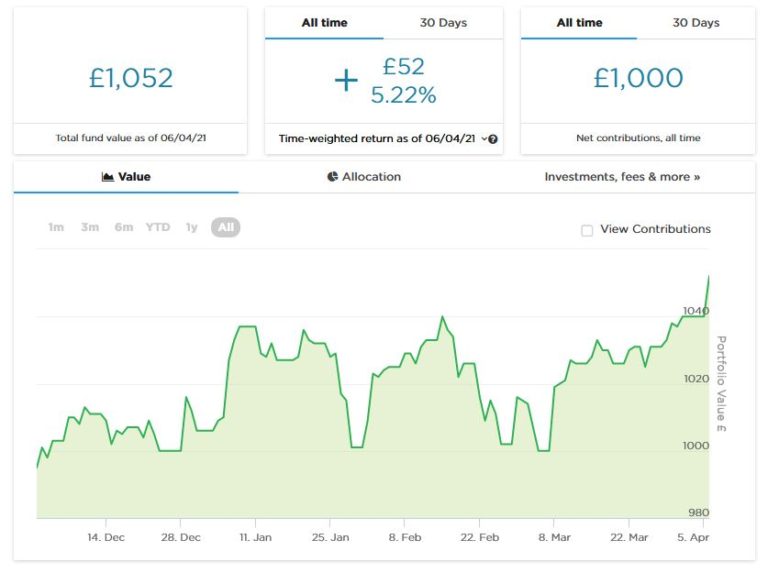

Apart from my main portfolio, four months ago I put £1,000 into a second Nutmeg pot to try out Nutmeg’s new Smart Alpha option. This pot has seen some ups and downs, but right now it is up to £1,052. That’s an increase of 5.22% in four months, equivalent to nearly 16% annually. Here is a screen capture showing performance to date. Obviously, though, it is still too soon to draw any firm conclusions from this.

You can see my in-depth Nutmeg review here (including a special offer at the end for PAS readers). If you are looking for a home for your new 2021/22 ISA allowance, based on my experience they are certainly worth a look.

That aside, last month was a mixture of good and bad news on the investment front. Probably the worst news was discovering that Buy2LetCars had gone into administration. Regular readers will know that I invested in two cars with this car loan platform. For three years everything went like clockwork, but then the FCA stepped in and froze their bank accounts due to concerns over how the company recorded the value of car leases in their accounts. This happened just before monthly payments were due to go out to investors in February. Initially Buy2LetCars said they would engage with the regulator to address their concerns, but then everything went quiet till it was announced that an administrator had been appointed to take over the company.

I don’t know any details of what has been going on with Buy2LetCars. I am still not entirely convinced that the FCA acted in investors’ best interests by freezing the company’s bank accounts just as they were about to make payments to investors. But it does certainly appear that the directors of Buy2Let Cars have questions to answer as well.

Personally I am most sorry for people who invested large sums with Buy2LetCars in recent months, including in some cases (I understand) their entire pensions. To be clear, though in the past I did recommend Buy2LetCars based on my experiences as an investor with them, I have never advocated putting all your money into this (or any other) investment platform. As things stand now, when you deduct the monthly repayments received from the capital I originally invested, I am about £10,000 down. That is clearly a major blow but not a total disaster for me.

As I said above, the company is now in the hands of the administrators and I have sent my claim form to them. It’s important to note that Buy2LetCars does still have assets including the cars themselves and the value of the leases, which their key worker clients are still paying. So in due course I am hopeful that some payments will be made to investors, though obviously it will only be a fraction of what we were promised. The letter from the administrators says they will be writing to the company’s creditors ‘within 8 weeks’ with their proposals, so hopefully I will hear something by mid-May. But any payouts are likely to take a lot longer than that to arrive, of course.

On a brighter note, I had all my money returned as promised by P2P lending platform RateSetter after the company was sold to Metro Bank. I didn’t invest a lot with them, but it was nice to get my capital back plus interest and the £100 bonus on offer when I first invested. I shall be reinvesting this money soon 🙂

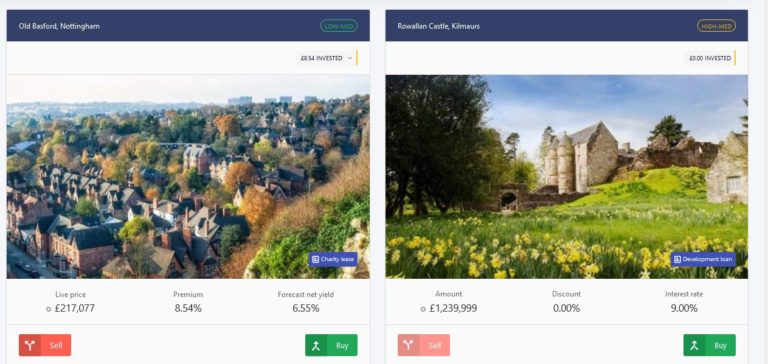

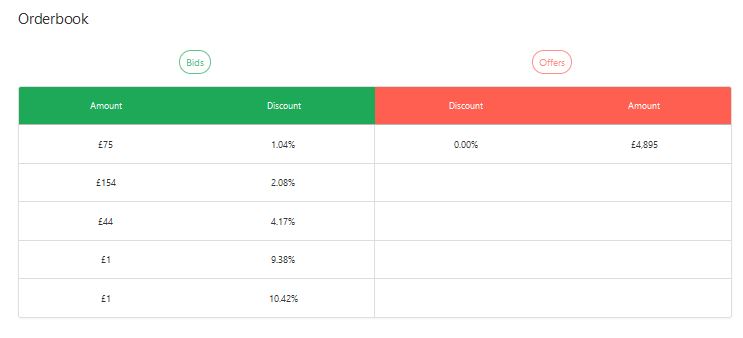

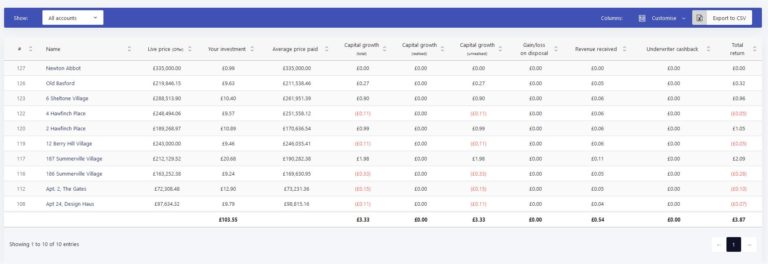

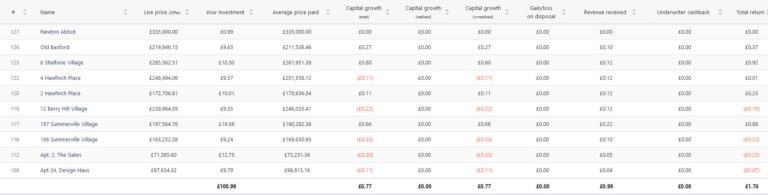

You may also recall that last month I made test investments with two other platforms. One of these, Assetz Exchange, is a P2P platform that focuses on lower-risk property investments (e.g. sheltered housing on long leases). I put £100 into this in mid-February. Since then my portfolio has generated 77p in capital growth and 99p in revenue received, so £1.76 in total. Obviously that doesn’t sound like much, but it works out as an annual interest rate of around 10.50%. Here’s my current statement in case you’re interested:

My investment is in the form of an IFISA, so there won’t be any tax to pay on profits, dividends or capital gains. I have been impressed by my initial experiences with Assetz Exchange and intend to invest more with them soon. You can read my full review of Assetz Exchange here if you like. You can also sign up for an account on Assetz Exchange directly via this link [affiliate].

I also put a small amount into the European loan crowdfunding platform Nibble (the first time I’ve tried investing with a non-UK platform). It’s all going well so far and I get weekly updates from them confirming how much interest has been added to my portfolio. Again, it’s too early to offer any firm opinions about Nibble, but so far everything appears to be on track. My full review of Nibble can be found here.

Finally, a couple of the loans I invested in with the P2P property investment platform Kuflink were repaid (with interest) last month, and I duly reinvested the money in other loans.

I have a diversified portfolio of loans with Kuflink paying annual interest rates of 6 to 7.5 percent. These days I generally invest a few hundred pounds per loan at most (and often £100 or less). My days of putting four-figure sums into any single property investment are definitely behind me now!

You can read my full Kuflink review here. They recently passed the milestone of £100 million loaned, and say that since their launch no investor has lost money with them. They offer a variety of investment options, including a tax-free IFISA paying up to 7% interest per year, with built-in automatic diversification. And I’d particularly draw your attention to their revised and more generous cashback offer for new investors. They are now paying cashback on new investments from as little as £500 (it used to be £1,000). And if you are looking to invest larger amounts, you can earn up to a maximum of £4,000 in cashback. That is one of the best cashback offers I have seen anywhere (though admittedly you will need to invest £100,000 or more to receive that!).

- You might also enjoy reading this post titled Home Finance Tips for the Rest of 2021 on the Cibes Lifts website, to which I contributed some suggestions.

Personal

March was another dreary month of lockdown, though it was at least nice to see the schools back (albeit with mandatory masks in classrooms).

The vaccine roll-out continues to go well and the numbers of Covid cases, hospital admissions and deaths are all falling rapidly, giving hope for the weeks and months ahead. And, of course, we are into the spring now, with longer, brighter days and – at some point – the prospect of some warmer ones!

I have gone ahead and booked a short break in North Wales at the start of July. It’s at an Airbnb apartment near Abersoch in North Wales. Here’s a photo from the Airbnb website…

The apartment has a wonderful, near-beachside location with good facilities and great sea views, so I’m really looking forward to going. It will be my first ever visit to Abersoch (and the furthest I have ever ventured along the Lleyn Peninsula). I did try to get there last year but sadly had to cancel due to Covid.

Even a few weeks ago when I booked, only limited dates were available. So if you’re planning a UK holiday this year – and I guess many of us will be – my top tip is to book as soon as possible. In case it helps, here’s a link to my blog post about booking a holiday with Airbnb, and here’s one to my recent post about UK holiday destinations I have visited myself over the last few years.

In March I had my annual review with my financial adviser, Mike (if you want to know why a money blogger needs a personal financial adviser, here’s a link to my blog post where I discuss this). Of course we did this as a video call this year. We used Microsoft Teams, a software tool I hadn’t tried before, but it all worked smoothly enough. I am certainly learning a few new IT skills as a result of lockdown!

I talked about my discussion with Mike and some issues it threw up in this recent blog post, so I won’t go over all that again here. Suffice to say, it made me think hard about how my financial situation will change (for the better) when I qualify for the state pension later this year. I didn’t entirely agree with all of Mike’s advice, although I do understand that it was prudent and sensible. But as I should be in quite a healthy financial situation when my pension kicks in, I intend to start spending a bit more rather than simply letting it accumulate year on year till finally it passes on to my sisters (much as I love them). If you haven’t read my post about this, do take a look, and let me know which of us you agree with!

I had hoped by now to have had my first swim since Christmas. But my local David Lloyd Leisure opened their outdoor pool on Monday last week only to close again on the Tuesday (when I went!) due to a problem with the water chemicals (I suspect this could be a euphemism…).

This week it’s too cold for outdoor swims – for me at any rate – so I am counting off the days till Monday 12th April, when they will be able to open their indoor pool as well. The changing rooms will be open too, and I assume I will be able to get a warming mug of hot chocolate in the club room, even if I have to stand up to drink it 🙂

Obviously it is good news that the country is (very) slowly coming out of lockdown. I am also looking forward to meeting friends and family in pubs and restaurants again, though until mid-May this will only be permitted outside in England, so a lot will depend on the weather. But even if I end up waiting till hospitality venues are open inside as well as out, I will look forward to seeing the garden of my local pub full of visitors again!

It does worry me that the government keeps moving the goalposts with regard to easing lockdown measures. In particular, while we were originally told that all restrictions would end by June 21st, it seems increasingly likely this may not be the case. It’s particularly disappointing to hear some of the government’s scientific advisors saying we may be stuck with mandatory face-masks and social distancing well into next year or even longer. I really hope this isn’t the case. The vast majority of vulnerable people have been vaccinated now and this is reflected in the big falls in deaths and hospital admissions. We need to accept that risk can never be entirely eliminated and get back to normal life again now.

As always, I hope you are staying safe and sane during these challenging times. If you have any comments or questions, please do post them below.