My Coronavirus Crisis Experience: October Update

Regular readers will know that I have been posting about my personal experience of the coronavirus crisis since the original lockdown started (you can read my September update here if you like).

As previously I will discuss what has been happening with my finances and my life generally over the last few weeks, while trying to avoid being too repetitive!

As always, I will start with the money side of things.

Financial

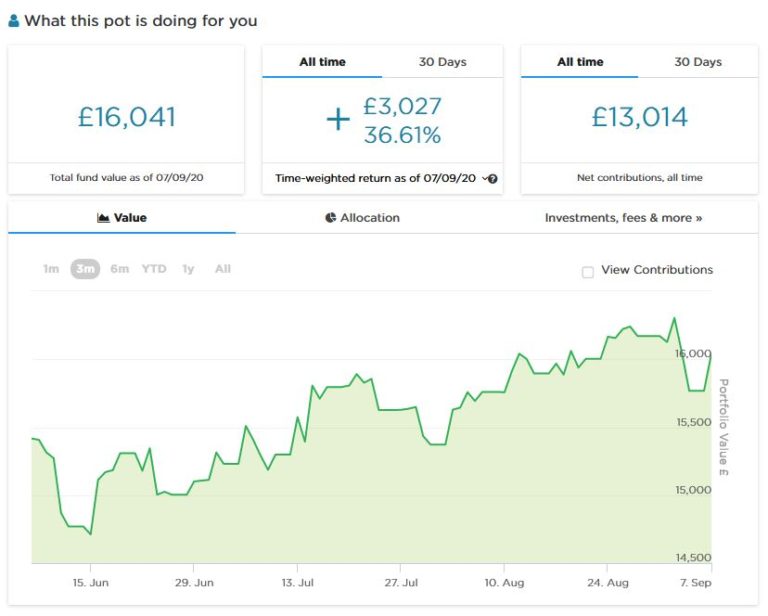

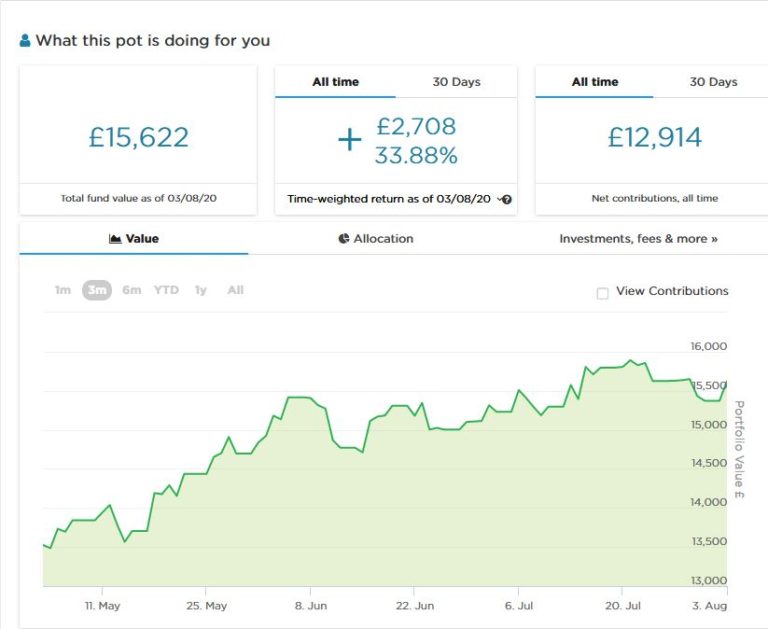

As I’ve done before, I’ll begin with my Nutmeg stocks and shares ISA. This has gone up and down over the last few weeks, but currently stands at £16,578. That is over £500 up on last month, so I’m happy with that! Here is a screen capture covering the last three months…

You can read my in-depth Nutmeg review here if you like.

My Property Partner and Kuflink investments are still both ticking along satisfactorily. Property Partner has resumed paying dividends on some properties, which is appreciated. The five-year sales process has also resumed. There is a backlog, though, so it will probably be longer than five years till the properties I hold shares in can be sold at the current, independently-assessed market price (or retained, of course).

There is nothing really to report about The House Crowd. I assume that the sales of the two properties in which I hold £1,000 shares are progressing, but can understand that it is a slow process at present. At least rental payments are still accruing, which should help to defray some of the selling costs.

There has been no further word either regarding my investments with Crowdlords. As I said last month, I have two remaining investments with them, Kennington Road eco-houses and Trent House. I was told they hope to have exit options for these properties by the end of the year, but I’m not holding my breath. On the plus side, they are paying 6 percent interest on my Trent House investment, which is quite generous in these days of ultra-low interest rates.

Personal

It’s been an eventful few weeks one way and the other.

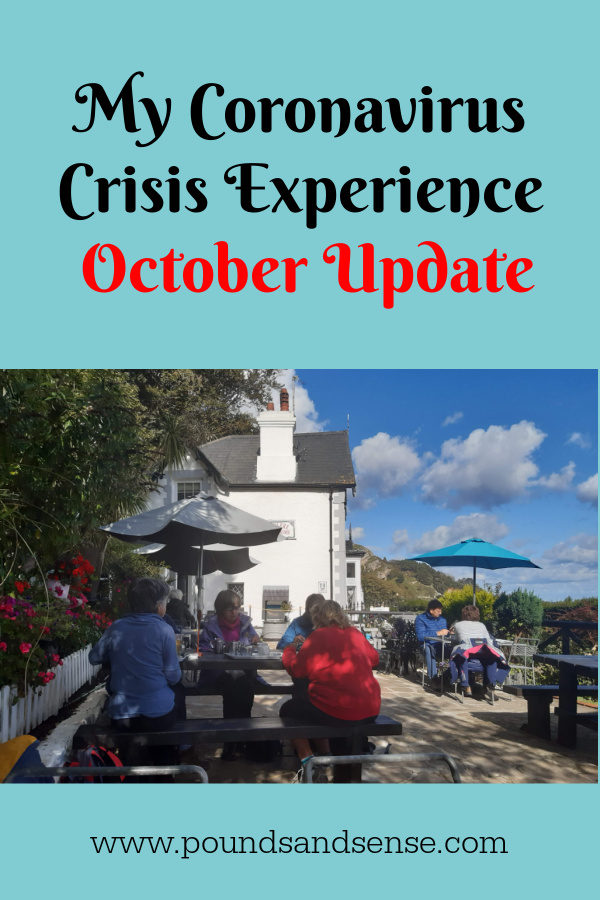

As mentioned previously, I had booked a short break in Llandudno (see cover image) near the end of September. Thankfully I was able to go. If I had left it just a few days later I would have had to cancel, as the Welsh Assembly has decided to lock down the whole of the Llandudno and Conwy area due to rising infection rates. That means no-one can currently go in or out of the area without a compelling reason (and having a holiday booked there doesn’t count).

Anyway, I enjoyed my visit. I stayed in a self-catering apartment, which turned out to be a good choice in most respects. It was on two floors, with a lounge and well-equipped kitchen on the lower floor and a double bedroom and bathroom on the upper. The location was central but quiet, yet just five months’ walk from the sea. The only drawback was that parking was on the street and finding a spot was a bit of a lottery. I was lucky to get somewhere close when I arrived, but later in the holiday had to park on another road half a mile away, which was a bit of a pain. I paid £255 for my three-night stay via Booking.com, which I thought was reasonable. By comparison, the seafront hotels I checked out were charging over £600 for three nights’ bed and breakfast.

Not surprisingly Llandudno was quieter than usual for the time of year, but there were still plenty of visitors, and many of the small hotels and boarding houses had ‘No Vacancies’ signs in their windows. While some places and amenities were closed, many others were open, and I was pleased to find that the pier was fully operational (see photo below). Professor Codman’s famous Punch and Judy show on the promenade wasn’t running, though – a shame, as there were lots of young children who might have enjoyed it.

On my first day I left my car at the apartment and took a couple of bus tours. The first was the open-top bus that takes a circular route between Llandudno and Conwy and includes a running commentary. I have done this trip before and noticed that the recorded commentary hasn’t changed this year. Mind you, that may be just as well, as a post-Covid commentary would have had to include details about all the hotels and other places that have closed due to the virus, the seafront theatre that became a Covid field hospital, and so forth…

The other trip was on a vintage bus (see photo) around the Great Orme, one of the two promontories at either end of Llandudno’s seafront. This had a knowledgeable driver/guide, who provided an interesting – and up-to date – commentary. I must admit I particularly enjoyed seeing ‘Millionaire’s Row’ at the far side of the Orme. There are some amazing houses here, owned by people who like to preserve their privacy. Obviously the coach passes from a distance, but it was still a good opportunity to gawp at how the super-rich live. I particularly enjoyed hearing about the house that has its own private lift down to the beach!

On the second day of my visit I drove to the medieval walled town of Conwy, which is about three miles away. I booked a ticket online to see Plas Mawr, a restored Elizabethan town house (photo below). It was fascinating, and I was glad I took the option of borrowing one of the free electronic guides. You use these to scan a QR code in each room and it provides a commentary on the room itself and various interesting historical tidbits associated with it.

As with my visit to Dunster Castle near Minehead earlier in September, all the usual anti-virus measures were in place. I had to wear a face covering throughout, and staff ensured that there were no more than two households in a room at any one time. It worked pretty smoothly, although you had to follow a set route and there was no possibility of returning to a room once you had left it.

- In case you’re wondering, the photo in my cover image shows the Haulfre Gardens Tearoom on the lower slopes of the Great Orme. It’s one of my favourite places in Llandudno, and I was pleased to find it was still open. I enjoyed afternoon tea in their lovely garden on both days of my visit. As you can see, I was pretty lucky with the weather!

As mentioned above, I was very glad to be able to make my trip before the current lockdown would have made it impossible. I feel very sorry for people who booked after me and were unable to go, especially as I have heard that some are now having problems getting their money back. But I am sorry also for the hotels and other businesses who have been left high and dry by the lockdown. I really hope for their sake it doesn’t go on too long 🙁

Moving on, I had an experience I would rather not have had in the last few weeks too. At a routine eye examination my optician saw something she didn’t like the look of in the retina of my left eye. So she packed me off to the eye clinic at Queens Hospital, Burton. The doctor there told me I had a perforation of the retina, and gave me laser treatment then and there. It wasn’t painful but it was obviously nerve-racking. The doctor did say it was a good thing my optician had spotted the problem, as it could have led to a detached retina if left untreated, which is clearly more serious. I have to go for a follow-up check this weekend, but touch wood the problem has been repaired. I guess if nothing else this does show why it’s so important to have your eyes checked regularly even if you don’t think there is anything wrong with them. That applies doubly to older people and those who (Iike me) are very short-sighted, as we are especially susceptible to this sort of thing.

On the Covid front, clearly most of the news hasn’t been good recently. Mind you, in most parts of the UK hospital admissions and deaths remain a lot lower than at the peak of the pandemic in the spring. I have seen the current situation described as a ‘casedemic’, which seems a pretty apt description. Clearly it’s important to protect the elderly and vulnerable at this time. Young people don’t typically suffer severe reactions to the virus, however, so I do wonder if some of the more extreme measures aimed at them are fair or necessary. Personally I am taking what I consider reasonable precautions but still trying to live my life as normally as possible. I volunteered for the UCL Virus Watch panel a few weeks ago and fill in a weekly questionnaire saying whether I have any possible Covid symptoms (none so far). They have also just asked me to take a blood test to see if I have any antibodies or other natural resistance to the virus. I’ll be interested to see the results of that!

As regards masks and such matters, I have been wearing a half-face shield in supermarkets (as a mask sceptic I’m not going to other shops till masks are voluntary again, though I might make an exception if the shop clearly states that they welcome non-mask-wearers). I find this better than the full face shield I was wearing before, as it doesn’t interfere with my vision. Shields are also much easier to breathe through than cloth masks, and I haven’t yet been challenged by any staff members or self-appointed mask police. In case you are interested, here’s an Amazon ad (affiliate) for some half-face shields similar to the type I am now using.