Surviving The Covid Winter

2020 has been a year like no other. And while the first vaccine has just been approved, for many of us this winter still looks like being a long, hard and stressful one.

There is no doubt many people’s mental health has been impacted both by the threat of the virus and the measures taken by government to try to control it. Add to that, many people have seen their income reduced or lost their jobs altogether, causing financial hardship as well.

Clearly we all need to find methods for getting through this difficult time. So I asked some of my fellow bloggers to share any tips they might have, including things they are doing to help them (and their families) cope. I have listed their answers below, with my own reactions in italics afterwards where relevant. I will then say a bit about how I am planning to get through the Covid winter myself.

Bloggers’ Tips

Jo Jackson who blogs at Tea and Cake for the Soul says, ‘List your outgoing payments and see what can be got rid of or reduced. List all of your utility accounts, insurances and entertainment packages then look at comparison sites to see if you can get better deals elsewhere.’

Always a good idea and can save you a lot of money. Check out cashback websites as well, as they may offer cashback if you switch to a new supplier.

Sally Allsop of Life Loving says, ‘Buy yourself a big thermos or two and fill them with hot drinks and homemade soup. Then you can still go for days out without having to worry about mingling and queuing at eateries/cafes. You’ll also be able to keep yourself warm on theoretically safer outside winter activities.’

Hayley Muncey, who blogs as Miss Manypennies, says, ‘I’ve applied for the 30 hours’ free childcare funding for my 3-year-old. Normally I love taking her out and about to playgroups, the library and meeting to play with her little friends, but since everything is cancelled, closed and we’re not allowed to meet anyone (local lockdown), preschool is basically the only social activity she’ll have, so I’m going to up her hours. I think she’ll have more fun there than stuck at home! Plus it gives me more time to concentrate on working from home, so hopefully I can bring in a bit more money.’

I didn’t know anything about this scheme, but there are more details on this government website if you may be eligible. In England you need to have a child who is 3-4 years old. Other schemes apply in different parts of the UK.

Jennifer Graudenz of Monethalia says, ‘Sign up at your local library. Many libraries let you take out eBooks, so you will always have something to read, no matter how many lockdowns we have.’

Good idea. You can still borrow ordinary print books as well but special Covid precautions are likely to apply. Ask at your library for more info.

Ryan Maley who blogs at A SIngle Step says, ‘Try to keep some sort of routine, even if you are stuck in the house all day. If you’re working from home, make sure you stick to set hours with a lunch break, and have a separate space in which to work. Organise calls, video calls, quizzes and virtual catch-ups with friends and family. Try to get fresh air or exercise whilst following the rules. A run after work or exploring some local countryside can do wonders. Or even dancing along to a YouTube video in your bedroom. Most of all, if you are struggling, make sure you speak to friends or family. A problem shared really is a problem halved.’

Some great tips there from Ryan. And yes, if you’re struggling, don’t hesitate to reach out for help. See also my blog post titled Looking After Your Mental Health in the Coronavirus Crisis.

Claire of Stapo’s Thrifty Life Hacks writes, ‘We are a family of three and a few weeks ago we invested in waterproofs for the whole family. We started walking a lot at the start of lockdown and as things ramp up again, we know that we will want to get out and explore where we can. As we now have all the right gear, we are hopeful that the rain and wind won’t put us off getting out there as autumn turns into winter.’

Fiona Hawkes who blogs at Savvy in Somerset says, ‘We’ve started planning at-home Christmas activities, as trips to visit Father Christmas and big family gatherings won’t be happening this year. I’m making my daughter an activity advent calendar for us to enjoy during December which includes things like Christmas story books, festive cake making, writing letters and cards to family we won’t see and making lovely decorations for our home.’

Human Carley, who blogs at the wonderfully named Unicorn Puffs and Rainbows, says, ‘Make your house as cosy as you can. Clear out anything you can now whist charity shops and recycling centres are open. Having as much usable space as possible will be important, as we will have much less time outside.’

You could sell anything you no longer need on eBay or similar sites to boost your income as well. There are some great tips about selling on eBay in this guest post by Lucy Olivia.

Anisa Alhilali who blogs at Two Traveling Texans says, ‘Feed your travel wanderlust. Even if you can’t travel there are ways to have “travel-like experiences” from home. You can take a virtual tour, have a travel-themed night, read a travel book, and more.’

Love this idea. You could start planning for future post-Covid adventures.

And Anisa also has a blog called Origami Expressions. She writes: ‘Take advantage of the time at home and learn origami. It is great for mindfulness and you will be amazed at all the things that you can make with just a sheet of paper!’

And it costs almost nothing as well. I may just try this myself!

Victoria Sully who blogs at Healthy Vix says, ‘Make sure you have ways to relax and chill at home to reduce the stress. This year I have just invested in a bath pillow, fluffy bath mat, candles and some soothing bath foam to indulge in some some luxurious baths this winter to take the stress away! Even something as simple as lighting candles in the evening can be calming and help to reduce stress.’

Anne Fraser who blogs at The Platinum Line says, ‘My lifesaver at the moment is our local leisure centre. Although a lot of classes have been cancelled they are still hosting an over 60s lane swim twice a week. I think it is important to find an indoor activity you enjoy and if it makes you healthier so much the better.’

Absolutely. I love swimming and was so relieved when my local leisure centre and pool reopened.

Vicky Smith of More Than A Mummy says, ‘For Christmas we will only buy gifts for the kids in the family. Will save valuable cash at a time when our business has been hit hard by the pandemic. We actually started doing this last year and it saved me hundreds as our family is huge!’

Jenny Tate of The Life Stuff says, ‘Check with your current suppliers to see if you can make any savings i.e. gas, electric, TV, internet providers. My internet bill was put up last week to £54/month so I called up the provider and got the exact same package for £26!’

There is often scope for renegotiating your broadband bill. See my blog post How I Saved £252.72 on my Virgin Media Broadband Bill.

Shelley Whitaker who blogs at Wander & Luxe says, ‘We are preparing at home by making sure we have plenty of things to entertain ourselves and our toddler. For example, crafts, puzzles, things to cook and DIY bits for around the house. We are also purposely not watching too many movies or TV shows so we have things we want to watch if needed. For now I am trying to get out each day and do normal things that I am able to (restrictions permitting), and basically just take each day as it comes.’

Sarah Bailey of Life in a Breakdown says, ‘Think about making some family time using a video calling service. Some of them cost after so long but some don’t, so shop around and don’t just use the one most spoken about. It will allow you to keep in touch with family during this time should the worst happen!’

Great advice. See also my blog post, What Are the Best Video Calling Tools for Older People?

Emma Reid who blogs at Emmareid.net says, ‘Just because it’s chilly doesn’t mean you can’t still go exploring and get outdoors. We are doing 1000 hours outside challenge and we still have a bit of a way to go to hit it so I am making the most of the days we have left to get outside whatever the weather. As long as you have the right gear, you can still have fun.’

Finally, Emily Jane of Emily Underworld says, ‘While winter means Christmas and the season of giving, don’t forget to practise self-care. This can be anything from rest to time alone for meditation. As my budget for Christmas this year is low, I’ll be supporting small UK businesses, as well as making some gifts myself. Getting creative is great for self-care, and it’s also great for my bank balance.’

Yes, as well as being kind to others we also need to be kind to ourselves at this difficult time. And I do agree as well with supporting local businesses, many of whom are having a very tough time of it.

My Own Thoughts

I have also been thinking a lot about how to stay sane and well over the coming months.

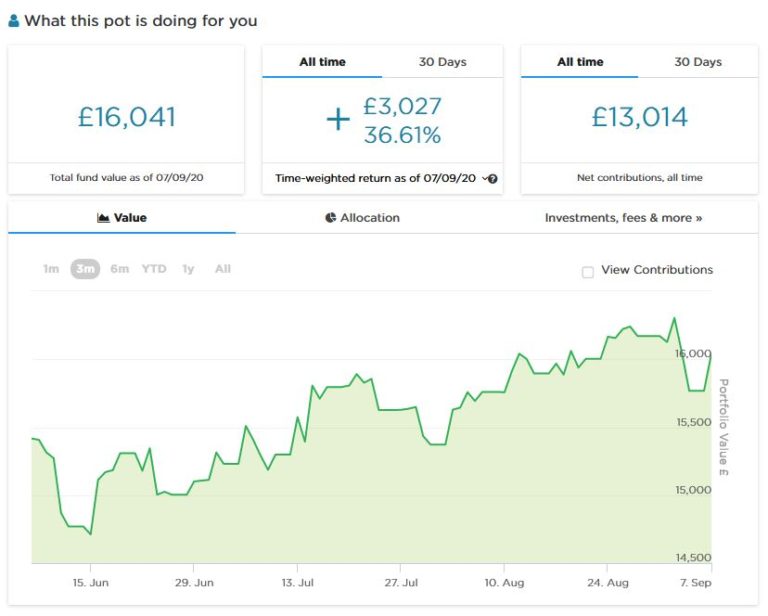

As you probably know, I’m semi-retired and live alone. Nowadays blogging is my main source of earned income. It doesn’t make me a fortune – far from it – but I’m lucky enough to have savings and investments and a small personal pension as well to keep my finances ticking over.

As well as being a source of income, working on the blog gives my days a bit of structure, which we all need at the moment. I typically spend a few hours each morning on it, then do other things (e.g. going for a swim or a walk) later. I feel as though once I have got my ‘work’ out of the way I have earned the right to do other things I enjoy. Though I do enjoy writing and blogging as well, of course!

I am planning other activities as well. Some friends told me recently that over the winter they intend to get on with some decorating projects. While that doesn’t appeal so much to me, there are a number of jobs around the house and garden that I really do need to tackle. I plan to make a list of them and see how many I can tick off before the spring!

I am also considering getting into video gaming – though as I spend a lot of time anyway at a computer or watching TV, I am not entirely sure I should be lining myself up for more hours staring into a screen.

I’m also thinking of teaching myself a musical instrument – possibly tenor ukulele, as I have heard they are among the easiest instruments to learn, although I am open to other suggestions 😀

I am also trying my best to keep some sort of social life going, even in the face of mounting restrictions. I don’t live in an area under lockdown (yet) so am hoping and planning to go on meeting friends for pub lunches. I am also keeping in touch with friends/relatives as much as possible using video calling and traditional phone calls. It has been particularly good to be in more regular touch with my sister Annie, who also lives alone. We speak on the phone most weekends now, and it’s been great to hear what’s been going on in her life and her job (she works as a librarian).

I agree with my fellow bloggers who pointed out the importance of staying active even in the cold winter months. I aim to go swimming at least once a week and really enjoy this, not least because it’s something normal I can still do at a time when our freedom of action is increasingly limited. I also try to go for a walk every day, though as the weather worsens I suspect I won’t be doing this quite as often.

Finally, although I did say I’m wary of spending any more time than I do already staring at a screen, I’m considering taking out a Britbox subscription for the long winter nights. They have a lot of classic BBC and ITV series that I would enjoy watching (or re-watching). And I must admit I wouldn’t mind giving the new Spitting Image a try as well!

I’d like to close this post by thanking my fellow bloggers for their varied and thought-provoking suggestions for surviving this Covid winter. I hope you may want to check out at least some of their blogs.

And, of course, if you have any comments or questions about this post, or any other suggestions for coping over the coming months, I’d love to hear them. Please leave a comment below as usual.