Review: Make a Will Online – A Solicitor-Checked Online Will Writing Service

I was recently invited by a company called Make a Will Online to review their solicitor-checked online will writing service.

I have written before on Pounds and Sense about the importance of making a will, and the dangers (of which I have first-hand experience) of not doing it properly. In particular, I am very dubious about using ‘DIY wills’ and non-legally-trained will-writers, as I know all too well the problems that can occur when mistakes are made.

Make a Will Online (MAWO) offers solicitor-checked wills starting from just £29.95 for a single will or £39.50 for a pair. This is substantially cheaper than most similar services, e.g. FareWill charge £90 for a single will and £140 for a pair. MAWO also have mostly five-star reviews on TrustPilot. I was therefore keen to find out more about the service they offer.

Table of Contents

How It Works

Creating a will with Make a Will Online involves a three-step process as follows…

1. Complete an Online Questionnaire

At the start of this you are asked to provide your address and contact details. These are used for the production of the will, to allow you to log in if you don’t complete your will in a single session, and to send you the completed document (via email).

You then answer a series of questions about whom you want to manage your estate (your executors, in other words), whom you would like to look after your children (if you have any), whom you would like to inherit your possessions, any special gifts or bequests you want to make, and any conditions you wish to attach to your will. You can also specify whether you prefer to be buried or cremated, and any special instructions you may have about the funeral.

2. Review, Confirm and Pay

At the end of the online questionnaire you are shown a summary of the information you have entered and can go back and make any amendments you wish. You then make a secure payment of £29.50 for a single will or £39.50 for a pair of wills. You can pay by credit/debit card or via your PayPal account if you have one.

3. Receive Your Will, Sign and Witness

Once you have made your secure payment, the will document is emailed to you, along with detailed instructions for making the will legal and a receipt for payment. Shortly afterwards, a solicitor will check the document to make sure that everything is in order. If anything is unclear, a member of the MAWO team will contact you by email.

The main thing you have to do to make the will legal is (of course) get it signed and witnessed. This has to be done by two adults who are not beneficiaries in the will. Full instructions for doing this are included in the email you receive once you have completed your payment.

You can choose to receive a printed version by post for £15.00 for a single will or £20 for a pair (though see below for a £5 discount voucher). Alternatively you can simply print out the emailed version of the will, staple the pages together as per the instructions provided, and have it signed and witnessed as above. Either way, you will then have a legal will which needs to be kept somewhere safe and secure until such time as it has to be referred to. Again, information about all this is included in the email you receive.

When you have finished making your will online, you can log in and make free changes to the document for 28 days. After that you can sign up for an optional lifetime updates service, which allows you to update your will at any time. This is free for the first year and then £10 per will per year (so in the case of a couple it would cost £20 a year).

My Experience

I created what was basically a duplicate of my existing will in order to try out the MAWO system.

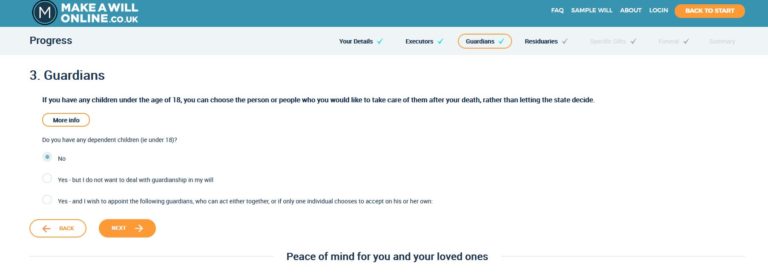

I found the step-by-step process for completing the online questionnaire generally quick and intuitive. There are six main pages: Your Details, Executors, Guardians, Residuaries, Specific Gifts, and Funeral.

The Guardians section (see picture below) is only relevant if you have children; it allows you to specify whom you would like to look after them following your death.

Residuaries is where you name the people who are to receive the balance of your estate once any specific gifts (including donations to charity) have been disbursed. By default this is divided equally among the beneficiaries, but you can specify different proportions if you want.

The Funeral section is where you state whether you want to be buried or cremated, and any instructions surrounding the arrangements. You don’t have to complete this section if you don’t want to, though personally I think it’s wise to say whether you prefer to be buried or cremated at least, so your next of kin don’t have to agonize over this.

One thing I liked about all the pages is that there are ‘More Info’ buttons you can click on for more detail about the topic in question if you need it.

It’s also worth mentioning that different boxes open according to the selections you make. If you click on ‘Yes’ on the Guardians page (above), for example, new boxes will open allowing you to enter details of the person or persons concerned.

Finally, you are taken to a page where you can review what you have put, alter this if necessary, and proceed to payment. As already mentioned you can pay with a credit or debit card or via PayPal.

Once I had paid I received an email almost immediately with my will attached and a page of instructions for making it legal. About two hours later I received an email confirming that a solicitor had checked my will and not found any issues with it. Had I so wished, I could then have printed out the will document, stapled it together, and got it signed and witnessed. It would then have been fully legal.

Final Thoughts

Overall, I was impressed with the speed and simplicity of Make a Will Online. If you have a fairly straightforward will (as most people do) I see no reason not to recommend it. Of course, if your personal circumstances are complicated, or you have a substantial estate which may incur death duties, there is no substitute for seeing a solicitor face to face. This will inevitably cost quite a bit more, however.

One small reservation is that it’s still up to you to arrange to have your will signed and witnessed to make it legal. Full instructions are provided for doing this, and it’s not exactly rocket science. It is up to you, though, to ensure that you follow the rules correctly – no-one else will check this for you.

As always, if you have any comments or questions about this post or Make a Will Online, please feel free to post them below as usual. If I can’t answer a query myself, I will ask my contacts at MAWO for their response.

- Special Offer – As an affiliate for Make a Will Online I can offer a discount code to anyone signing up via this blog post. Just enter the code MAWO5 at the checkout to get £5 off the price of a printed will. That’s a letter O in the code, not a number zero, by the way!

Disclosure: Make A Will Online kindly gave me the opportunity to try out their service free of charge. In addition, this post includes affiliate links. If you click through and make a purchase, I may receive a commission for introducing you. This will not affect the price you pay or the service you receive.

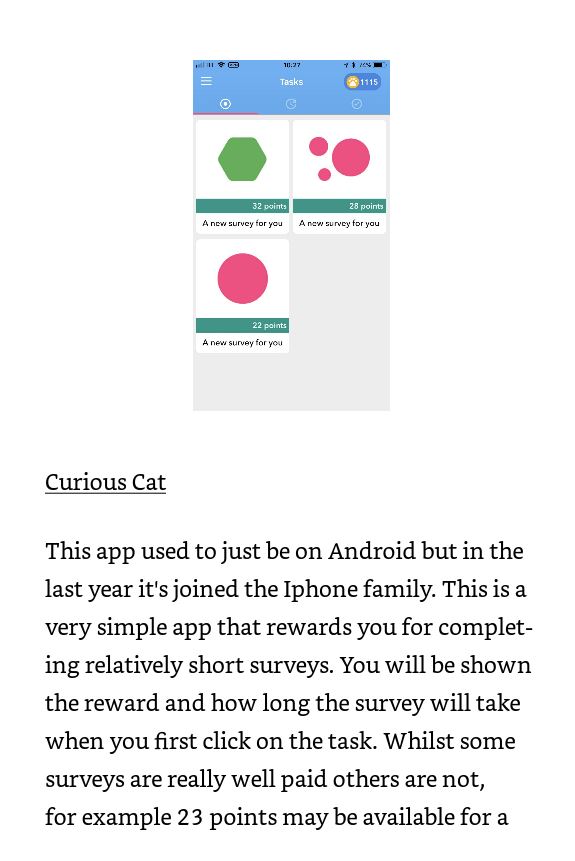

In some cases the download link takes you to the website for the app, but in others it takes you to to the Apple (iOS) App Store. It is a pity there aren’t also links to the Google Play Store for Android users (like myself). This means the book is probably best suited for iPhone users. Android users can benefit from it as well, but they may have to search for the relevant app themselves in the

In some cases the download link takes you to the website for the app, but in others it takes you to to the Apple (iOS) App Store. It is a pity there aren’t also links to the Google Play Store for Android users (like myself). This means the book is probably best suited for iPhone users. Android users can benefit from it as well, but they may have to search for the relevant app themselves in the