My Short Break in Aberystwyth

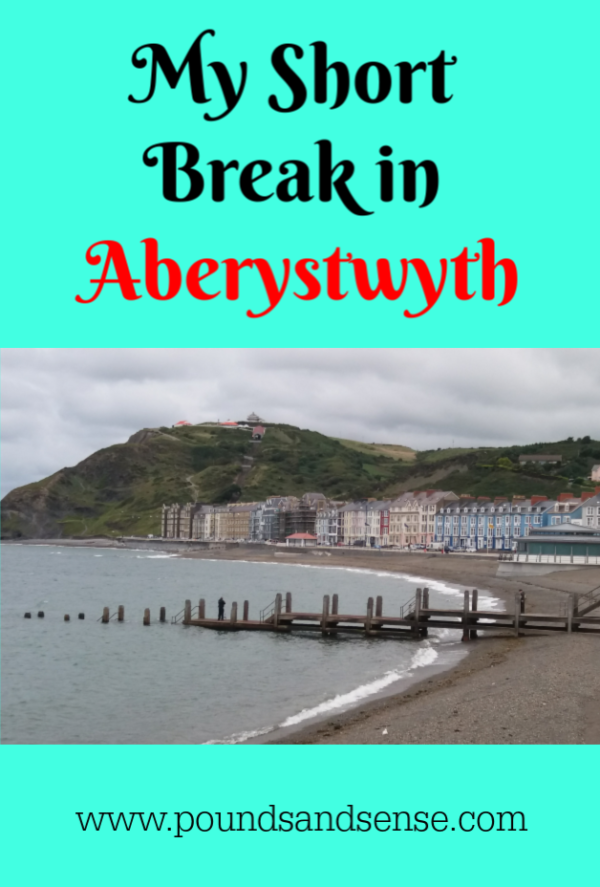

I have just returned after a three-day break in the Welsh coastal town of Aberystwyth.

It was actually my third visit to Aberystwyth. I first went there a couple of years ago on the recommendation of friends, and liked it so much I have gone every year since.

On previous occasions I stayed at the Marine Hotel on the seafront overlooking the North Beach. The Marine is a traditional seaside hotel and I do like and recommend it, even though the reception staff can be a bit glum 😀

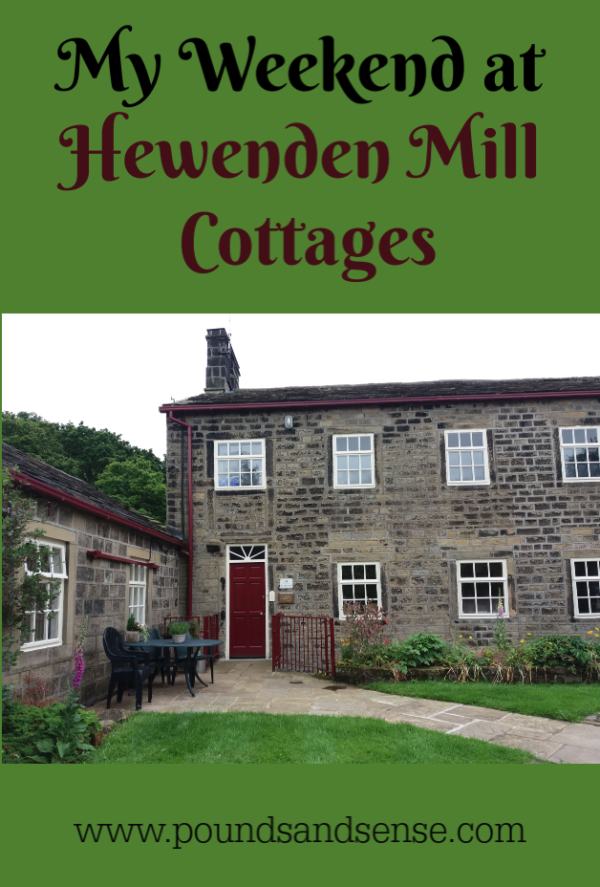

This time I fancied a change, though. I have been impressed by my recent forays into self-catering (especially on my recent visit to Yorkshire), so I decided to see what was available in that line in Aberystwyth. I ended up booking three nights at the Seabrin apartments, pictured below.

Seabrin is situated overlooking the seafront at the quieter South Beach, not far from the harbour. I have embedded a map of the area below (courtesy of Booking.com).

Table of Contents

The Accommodation

There are actually three apartments at Seabrin, all self-catering (at one time the owners offered B&B, but for various reasons they no longer do so).

The top floor apartment is the smallest and has one double bed. The second floor apartment (which I stayed in) has a double bed and a single bed, all in the same room. The first floor apartment is the largest with two bedrooms, so can easily accommodate three or four people. All three apartments have sea views.

The owners, Marise and Wilf, live on the ground floor, so they are usually around if you need anything.

I found my apartment comfortable and spacious. There was a lounge with TV and DVD player and a bay window with wonderful views overlooking the beach and sea. I spent quite a bit of time just sitting here looking out, hoping to see dolphins in the bay. Marise told me that dolphins had been spotted the week before, but the sea was probably just a little too rough while I was there. It was still wonderfully relaxing, though.

There was a separate kitchen, well equipped with electric cooker, dishwasher, microwave, fridge/freezer, and so on. The bedroom was at the back of the house, with a good-sized shower room a couple of steps down from it. The separate WC with wash hand basin was outside the bedroom at the end of a short corridor. It’s a slightly eccentric layout, but does mean that if there are two of you, one can take a shower while the other is, er, washing their hands.

The decor in the apartment was a little quirky – the glittering glass-covered kitchen wall reminded me of a nightclub – but obviously for a few days that’s not a problem. There were lots of books around the apartment which made me feel at home, and a selection of videos too.

As far as eating is concerned, Seabrin is only a short walk from the town centre, so there are plenty of restaurants nearby and shops for buying provisions. There is a large Marks and Spencer’s with a food hall, where I bought a couple of ready meals. On my last night I intended to eat out, but couldn’t get a table at The Olive Branch, the Greek restaurant I have been to before. I ended up getting a takeaway meal from The Seafront Palace (just round the corner from The Olive Branch) instead. I ordered Sweet and Sour Chicken Hong Kong Style with Egg Fried Rice. It was delicious, so I highly recommend it if you visit Aberystwyth and fancy a Chinese!

Seabrin has free wifi, which worked perfectly during my stay (not always the case in my experience). The location is quiet and peaceful, and I slept very well.

Financials

As Pounds and Sense is primarily a money blog, I should say a few words about this.

I paid £375 for my three-night stay in the one bedroom apartment at Seabrin, which I thought was reasonable. I paid an initial 70% deposit of £262.50 when I booked (in March 2019), with the balance of £112.50 payable a month before my holiday dates. Note that these payments are not refundable if you cancel, so you need to be pretty sure you are going before putting your money down. Or take out separate holiday cancellation insurance, of course.

Costs obviously vary according to the accommodation you want, when you want it, and for how long. The price I paid worked out to £125 a night, which – as I said above – seemed reasonable bearing in mind the location and what you get for your money. Of course, unlike most hotels, you don’t get a cooked breakfast, and neither is a daily housekeeping visit included. On the positive side, though, you do get much more space, a fully equipped kitchen, a separate lounge and bedroom, and complete privacy during your stay.

One other thing to bear in mind is that Seabrin do not allow dogs in the property or children under the age of 12.

You can check current prices and availability on the Booking.com website. You can book this way (which I did) or directly with the property. The latter method may or may not work out cheaper.

Things to Do

I shan’t give you a blow-by-blow account of what I did while I was there. However, I will highlight a few of my favourite attractions in and around Aberystwyth.

1. Constitution Hill

This is the famous promontory at the northern end of Aberystwyth (see cover photo). If you’re feeling energetic you can walk up it, or for a few pounds you can take the historic Cliff Railway. A standard return ticket on this costs £5, but over-60s pay just £3.50.

At the top you can enjoy spectacular panoramic views across Aberystwyth. You can also visit the Camera Obscura, which on a bright sunny day is very impressive (not so much when it’s cloudy, though). I also recommend a coffee and slice of cake at the Consti Cafe. They serve excellent cappuccinos, and also have free wifi which works without having to log in. I’ve spent an hour in here just enjoying coffee and Welsh cakes and reading my newspaper 🙂

2. Vale of Rheidol Railway

This heritage steam railway will take you on an hour-long journey from Aberystwyth along the beautiful Rheidol Valley to Devils Bridge. You can read more about it on the railway’s website and book tickets as well. It’s possible to upgrade to first class for £3 on the day (one-way only), but having done this I’d have to say I don’t see much point. I actually found the standard class carriages (and seats) more comfortable.

Devils Bridge itself is well worth a look if you have time before getting the train back. Three bridges were built here, one on top of the other (at different times, obviously). There are two walks you can take for a small fee. The Punch Bowl walk costs £1 and gives you a chance to view the three bridges and the the stream that flows under them. The other, longer walk takes you the other way from the bridges, past some stunning waterfalls. This costs a maximum of £4 at the time of writing, though there are some discounts for older people and children. As for why the place is called Devils Bridge, I’ll leave you to find that out for yourself!

3. Ceredigion Museum

The Ceredigion Museum in the centre of Aberystwyth is free to visit and a great option for a rainy day. It’s in a beautifully preserved Edwardian theatre, with many of the original fixtures and fittings still in place. There are fascinating displays here on all aspects of Welsh life and Welsh history.

4. Bwlch Nant yr Arian

I visited this ‘forest centre’ a few miles out of Aberystwyth on the A44 for the first time this year. There are various scenic trails you can walk (or run) from the centre, and a number of mountain biking trails as well. The highlight for me, though, was the Red Kite feeding, which takes place at 3 pm every day in the summer. Once their food has been put out, the skies fill with these magnificent birds (I counted over 100). Whether or not bird-watching is your thing normally, it’s something to marvel at. Here’s a link to the website for more info. And yes, there’s a nice coffee shop as well!

Final Thoughts

As you may gather, I enjoyed my short break in Aberystwyth staying at Seabrin Apartments, and am happy to recommend both the town and the accommodation for a short break. Aberystwyth is a bit quieter and less commercialized than Llandudno (though I also like it there), and the fact that it’s a university town means it has quite a cosmopolitan feeling. It’s a good place to chill out, but there are lots of interesting things to see and do as well.

As always, if you have any comments or questions about this post, please do leave them below.