How to Check What Your State Pension Will Be

Today I thought I would discuss the state pension. This is a subject that concerns everyone, but may be of particular interest to readers of this blog who are approaching retirement age.

Of course, many people have one or more workplace or private pensions. However, the state pension is still a very important component of most people’s income in later life.

And unlike many workplace/private pensions, it rises automatically every year at the rate of inflation or above (under the current triple lock guarantee). That makes it increasingly valuable as you get older.

In this article I’ll be revealing how to check how much state pension you are due and when. But I’ll start with a look at the various changes to the state pension in the last few years and how they affect anyone coming up to pensionable age now.

Speaking of which, let’s start with one of the biggest changes…

Table of Contents

Your State Pension Age

It’s unlikely to have escaped your notice that the pension age is rising. At present men can access their state pension at 65 while women get it at around 64. The age for women is in transition at the moment as it rises to equalize with men in 2018.

By 2020, the pension age for both men and women will go up to 66. Between 2026 and 2028 it is due to rise again to 67, and under current government plans it will go up again to 68 in 2037.

You can check when exactly you can start to claim the state pension by entering your date of birth and gender at this government website.

The New Flat Rate Pension

This is the other major change to the state pension in recent years.

Prior to April 2016 everyone received a basic pension (currently £122.30 a week). This was (and still is) topped up by additional state pension elements (S2P and Serps) which you accrued during your working life.

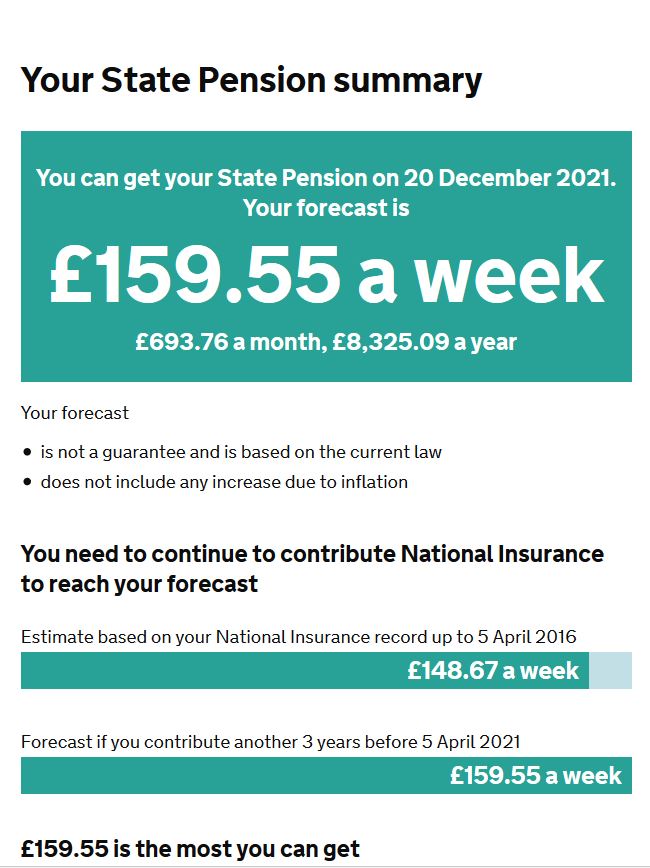

Anyone retiring from April 2016 onwards now receives a ‘flat rate’ pension currently worth £159.55 a week. If, however, you ‘contracted out’ of S2P and Serps at some point in your working life, you may get less than this. The presumption is that your contracted-out pension will provide another source of income for you, so you don’t need (or qualify for) the full flat-rate pension.

A further complication is that the government doesn’t want people who accrued large state pension entitlements under the old scheme (basic pension plus S2P and SERPS) to miss out. So when you reach pension age your entitlement under both the old and new methods of calculation will be worked out and you will receive the larger of the two. That means some people could actually qualify for more than the new flat-rate pension (£159.55 currently). If this is the case, it will be shown separately as a ‘protected payment’ on your state pension statement.

Also, to get the maximum new flat-rate pension you need to have at least 35 years of qualifying National Insurance contributions at the full (non-contracted-out) rate. If you have less than that you will get a reduced pension; and if less than 10 years, nothing at all.

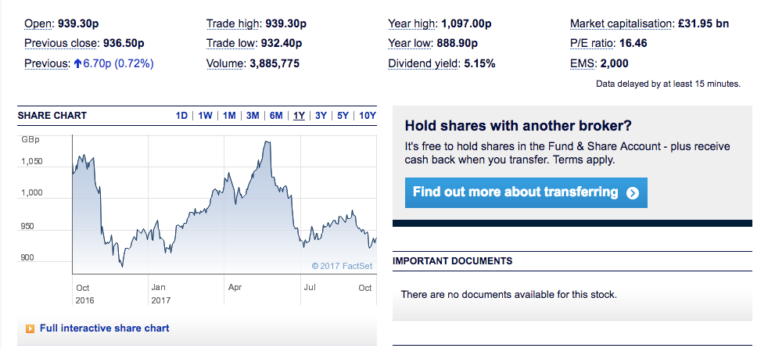

In some circumstances – which I’ll discuss shortly – you may be able to pay a lump sum to fill in gaps in your record. Even if you do have 35 years or more of contributions, though, it may not entitle you to a full pension. The government website (see below) tells me I have 37 years of contributions, but because I was contracted-out for some of these years and so paying a lower rate of National Insurance I still have to contribute for another three years to get the full flat-rate pension. Here’s a screen capture of my actual statement:

If you’re confused by all this, I’m not surprised. The rules are complicated and still being tweaked. So to avoid any nasty surprises it’s important to check what you are due to receive as well as when you are due to do so. There is now an official website where you can access all this information in one place.

Checking Your State Pension

Anyone aged 55 or over who has lived and worked in the UK for 10 years or more (even if they are not British citizens) can now visit https://www.gov.uk/check-state-pension to get an estimate of how much state pension they will receive when they retire.

Doing this is a bit more involved than just checking your start date on the pension age site mentioned earlier. You have to sign in with proof of identity, so allow a bit of time for this. If you already have an HMRC online tax account, the good news is you can use this to log in.

Once you’ve done so, you will see a forecast of how much state pension you will get once you’re eligible to start receiving it. This is based on current figures, so if you won’t reach retirement age for a few years yet, it will of course have risen by that time.

Boosting Your State Pension

If you’re disappointed by the amount forecast, one thing you can do to boost your state pension is defer taking it. Under the new rules you will receive an extra 1% for every 9 weeks you put off claiming.

Obviously, to benefit from this overall you should be in good health. For women especially, as their life expectancy tends to be a few years longer than men, deferring your pension (if you can afford to do so) could well be a profitable option. In a way this is a form of investment, underwritten by the government.

No special action is required to defer taking your pension. You just delay claiming and it will be assumed that you wish to defer it.

Another thing you may be able to do to boost your state pension is buy extra voluntary contributions to fill in any gaps in your record. Buying a year of extra contributions (normally Class 3 National Insurance) costs around £733 and will boost your pension by around £230 or £4600 over a 20-year retirement. This can be well worth doing if, for example, you were contracted out for several years.

There are some restrictions, however. In particular, as a general rule it must be done within six years of the end of the tax year concerned. So if the gaps in your record go back further than this, it’s unlikely you will be allowed to make up the whole shortfall in this way.

There’s also the question whether paying voluntary contributions to fill gaps in your record will be cost-effective for you. There is no easy way of calculating this, and I highly recommend getting advice from an independent financial adviser specializing in pensions if you are thinking of going down this route. It’s also a good idea to contact the government’s Future Pension Centre to find out what your options are.

Finally , it should be said that while the state pension provides a baseline income (currently equivalent to around £8,300 a year), on its own it won’t stretch to many (or any) luxuries. Most people will have private or workplace pensions and perhaps other investments as well, and this will be very important if you hope to enjoy your retirement rather than merely survive it. I will look at these in more detail in future posts.

As ever, if you have any comments or questions on this post, please do leave them below.

Many thanks to Lewys (pictured, right) for an eye-opening article.

Many thanks to Lewys (pictured, right) for an eye-opening article.