Cardeo – My Review of This Credit Card Management App

Today I’m looking at Cardeo, a new, free credit card management app. It is designed to help save you money on your credit cards.

Table of Contents

How Does Cardeo Work?

Cardeo brings together data from all your credit cards into a single app using open banking.

It then gives you insights into your borrowing and spending. Their payment plan works out how long it will take to pay off your cards. You can set a repayment target, decide how to get there, and repay all your cards through a single monthly payment (you can also use it with just a single credit card). Reminders make sure that you never miss a repayment.

You can change the payment plan as much as you like: edit the date, target or the monthly amount, make extra one-off payments, and pause/restart the plan as it suits you.

Cardeo works with most (though not yet all) UK credit cards. You can view the entire list here. All the most popular credit card providers appear to be covered, including Barclays, HSBC, Santander, MBNA, Virgin Money, and so on.

How Can Cardeo Save You Money?

First and foremost, payment reminders from Cardeo help you pay your cards on time each month. That way you avoid extra interest and late payment fees from your card provider. If – like me – you are prone to forget these payments on occasion, this is a valuable money-saving feature in its own right.

The Cardeo payment plan offers a choice of repayment strategies, including the so-called avalanche method. This repays the highest interest rate cards first (after minimum payments are covered). By this means you will minimise interest charges and pay off your cards in the shortest possible time.

Cardeo gives you insights into your credit card usage, helping you make smarter decisions about your spending and saving. Finally, Cardeo also offer deals from other parties which are designed to save you money.

How Does Cardeo Make Money?

As already mentioned, the Cardeo app is free to download and to use, with no in-app purchases or charges.

Cardeo say they make a small amount of money from deal providers each time a customer takes up a deal from the Cardeo app (e.g. a low-interest loan).

My Experience

I found downloading and installing the Cardeo app straightforward – I got mine from Google Play as I have an Android phone.

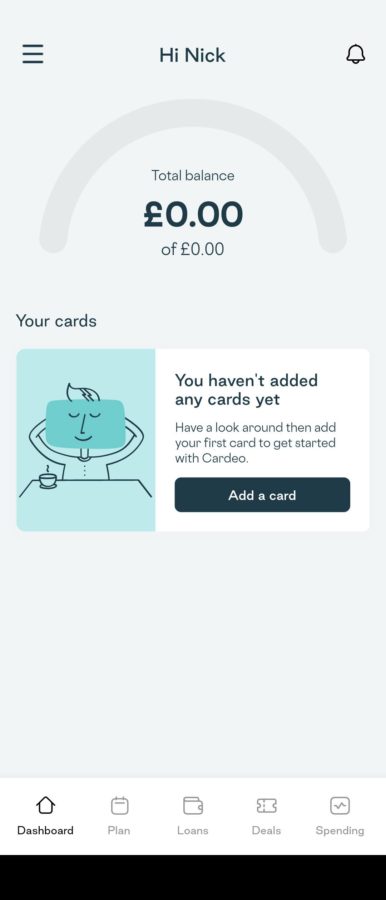

When you first open the app you have to put in certain details, including your full name and address, phone number (for log-in purposes), and so on. You may also be required to enter an email invitation code. All this took me maybe five minutes at most. I then saw the screen below…

After that, I clicked on ‘Add a Card’ and selected the name of my credit card provider, MBNA. I then had to follow a link to their website and log in with my usual online security credentials to authorize open banking.

Frustratingly, this took me a few attempts. MBNA required me to answer an automated call from them and enter a four-digit code on the telephone keypad to complete the process. Initially it told me I had got the code wrong, despite the fact that I had copied it from the MBNA site. I persevered, however, and eventually the card was linked to my Cardeo account 🙂

- As a side note, I am probably not the ideal candidate for Cardeo, as these days I only have one credit card and use it just once or twice a year. The rest of the time, I use my bank debit card instead. I am in the fortunate position of having enough income/savings that I don’t need to borrow on my credit card. On the odd occasion I do use it, it is typically for larger purchases to take advantage of the extra legal protections you get with credit card purchases over £100.

Nevertheless, I am happy to confirm that everything in the Cardeo set-up process went smoothly for me, with the sole exception of the hiccup regarding authorizing open banking with MBNA. The latter wasn’t Cardeo’s fault, and has in fact happened to me before with MBNA. Hopefully you will be luckier!

My Thoughts

If you’re a regular credit card user, and especially if you pay interest on an outstanding balance (or balances), in my view Cardeo offers a great way to minimize the charges you pay and help reduce your debts as quickly as possible.

As I have noted before on Pounds and Sense, credit card borrowing can be very expensive, especially over a long period. So if you are in debt on your cards, it is important to take all possible steps to pay this off as quickly as possible, and Cardeo will certainly help you with this. It can also help build your credit score by ensuring you don’t miss any payments.

A further benefit is that Cardeo will save you administrative time and hassle. You simply make one monthly payment and this is automatically allocated by the app across all your credit cards.

I know some people are uneasy about open banking, and if this is a major concern then Cardeo may not be for you. Open banking is, however, now a well-established option allowing consumers to gain an overview of their financial products. If you’re trying to get (and keep) your finances under better control, this can only be beneficial. Cardeo require your permission to use open banking and you can remove this at any time. Your data is encrypted and your login details are kept hidden. You can read more about the security and privacy protections here if you wish.

As always if you have any comments or questions about this post, or Cardeo more generally, please do leave them below.

Disclosure: This post includes affiliate links. If you click through and download the Cardeo app or perform some other qualifying transaction, I may receive a commission for introducing you. This will not affect the product or service you receive in any way.

September 28, 2022 @ 2:53 pm

Honestly you had me at payment reminders, that for me is one of the most useful things as I am so bad at forgetting when payments are due.

September 28, 2022 @ 3:04 pm

Lol. Yep, me too!

September 29, 2022 @ 2:42 pm

I think open banking can be so handy to keep everything in one place and have full visibility. Some really great features of cardeo x

September 29, 2022 @ 6:49 pm

Thanks, Rhian.