My Coronavirus Crisis Experience: December Update

December is here, so it’s time for another of my monthly coronavirus crisis updates. Regular readers will know I have been posting these updates since the first lockdown started (you can read my November update here if you like).

As ever, I will start by discussing financial matters and then life more generally over the last few weeks.

Financial

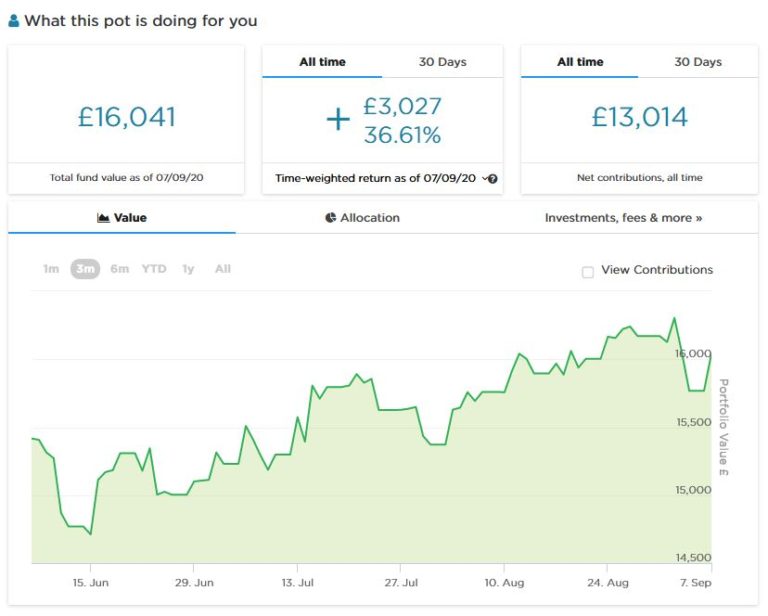

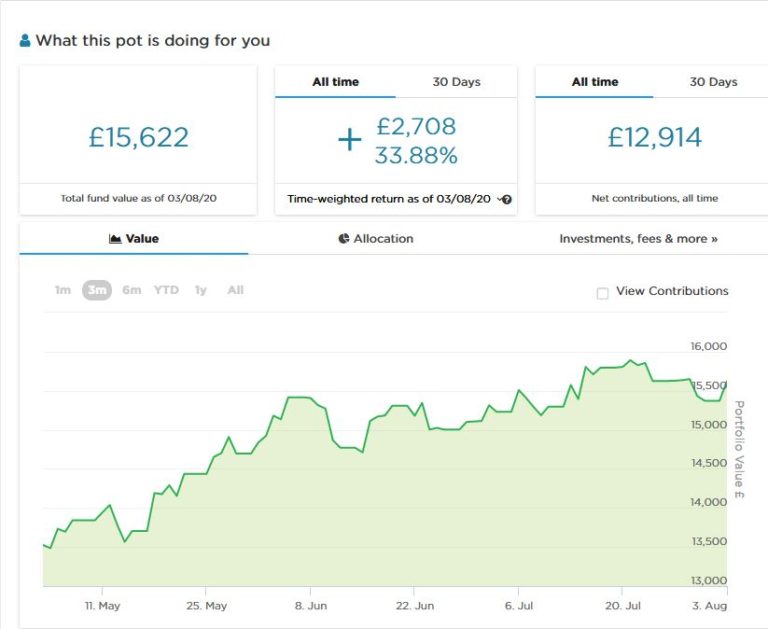

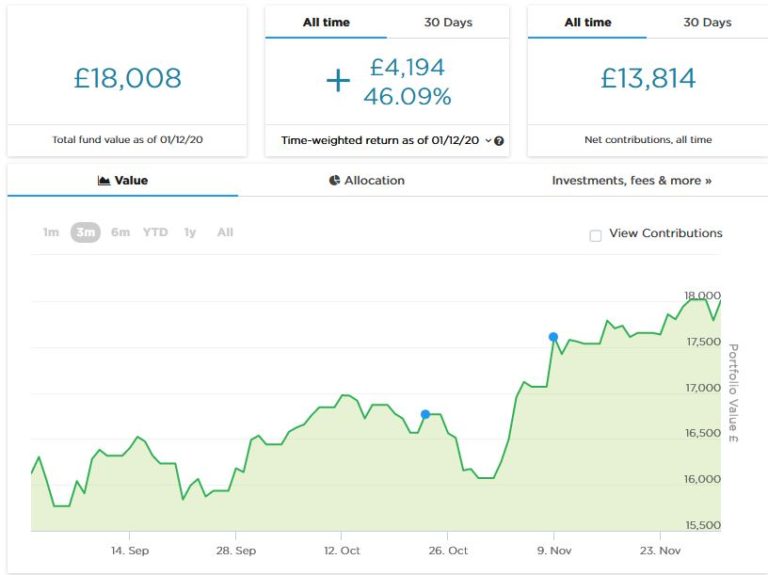

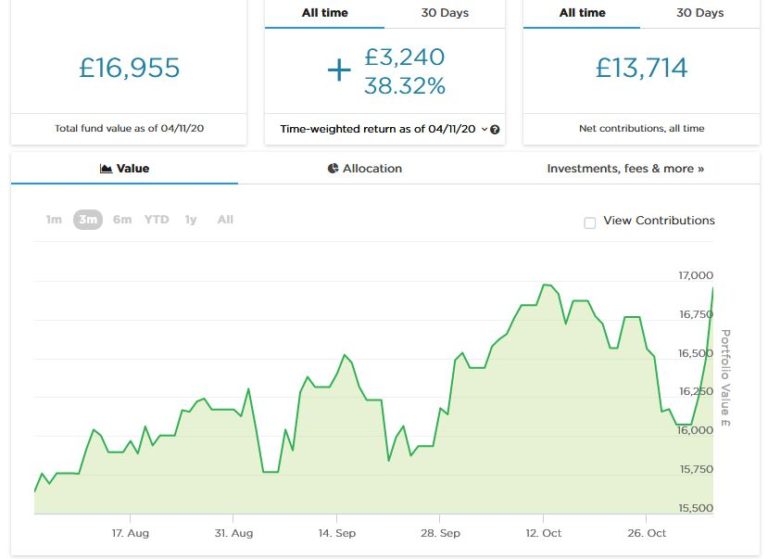

I’ll begin as usual with my Nutmeg stocks and shares ISA, as I know many of you like to follow this.

As the screenshot below shows, since last month’s update my portfolio has been on a generally upward trajectory and is currently valued at £18,008. Last month it stood at £16,955, so it has gone up over £1,000 in value since then. Considering national and world events at the moment, I am more than happy with this.

As you may recall, I recently put £1,000 into a second Nutmeg pot to try out Nutmeg’s new Smart Alpha option. It is too early to comment on this yet, but I will include an update about it next time.

You can read my in-depth Nutmeg review here (including a special offer for PAS readers).

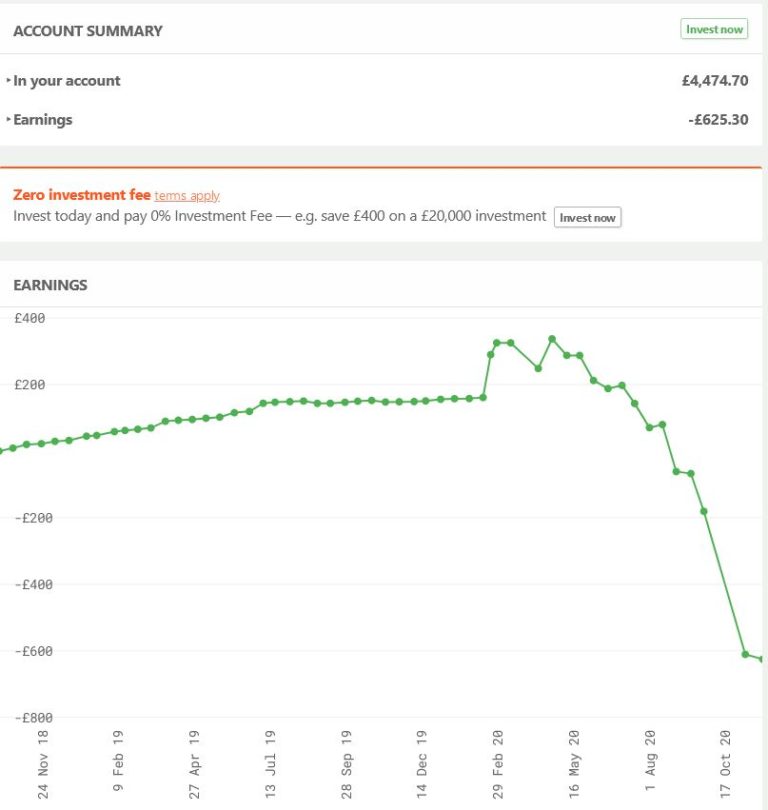

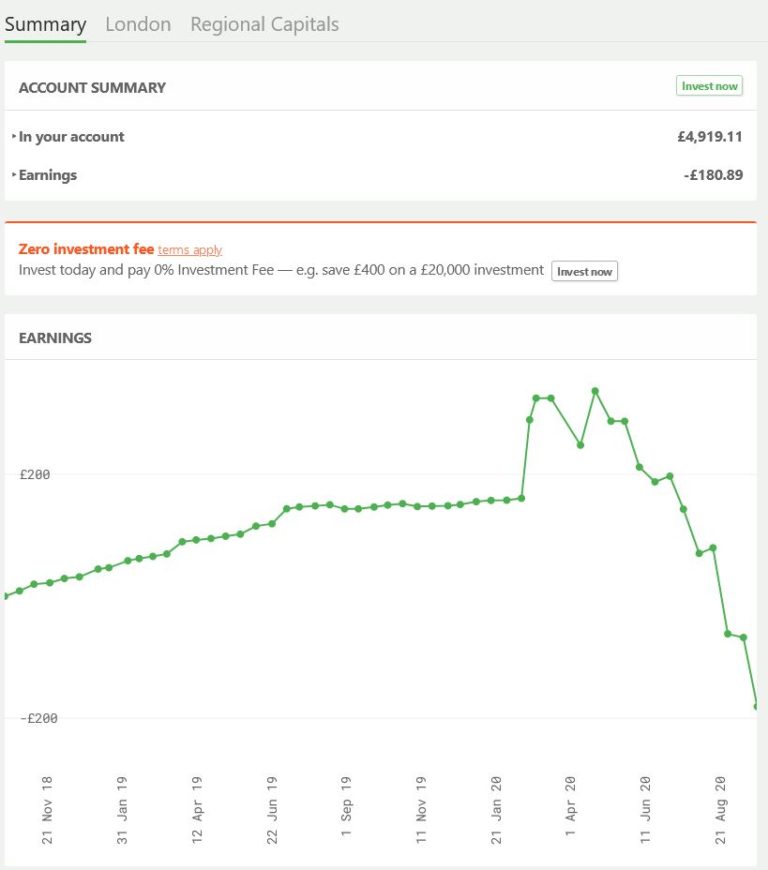

The news hasn’t been so good with my Bricklane Property ISA, which I talked about last time. As stated in in my blog review, Bricklane – not be confused with Brickowner – is a REIT (Real Estate Investment Trust). Investors’ money is pooled to purchase properties. Rental income is then distributed to investors, who also stand to benefit if the value of the REIT goes up. Last month I was down by about £80 on my £5,000 investment, but this month – as you can see from the screen capture below – the figure is over £600.

This is obviously disappointing, though not unexpected. As I said last time, the pandemic has hit property investors hard, especially investors in large commercial properties (as are most in the Bricklane portfolios). But, in addition, the current price factors in the liability of Bricklane and its investors to assess and where necessary replace exterior cladding in some buildings in light of the Grenfell Tower tragedy. I understand that almost half of the properties in the Bricklane Regional Capitals fund (in which I invested) fall into this category.

About the only good thing to be said is that right now Bricklane’s price reflects its liabilities in the worst case scenario. In particular, it has been argued that lease-owners should not bear sole responsibility for paying for this work, as the rules were only changed after Grenfell and it isn’t the owners’ fault that some properties were built to different specifications which were regarded as perfectly safe (and legal) at the time. If the government accepts that argument, in whole or in part, then Bricklane will not have to set aside large sums of money for remedial work, and the share price will rise accordingly. I have written to my MP about this, of course 🙂

As I said last time, if I was braver and had a longer investment horizon, I might look at Bricklane as a value opportunity just now. As it is, I am leaving my money where it is but won’t be investing any more with them for the foreseeable future. I am not planning to sell up as I don’t currently need the money and that would only crystallize my losses. i just hope there will be some better news on this front soon.

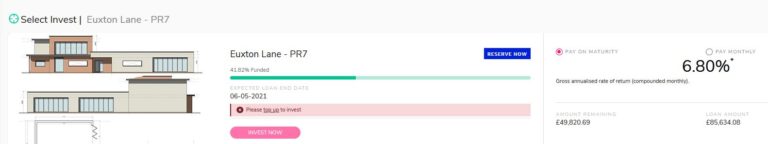

I also wanted to say a word about Kuflink this month. This property loan investment platform is still performing well and returning the promised monthly dividends. A couple of loan terms have been extended due to the pandemic but interest continues to be paid and I am not unduly concerned about this. I also had a couple of investments repaid after the loans in question were paid off. So I decided to reinvest in a new six-month loan to help finance the construction of a children’s day nursery in Chorley. Some details of this project from my Kuflink dashboard are shown below…

As you can see, the interest rate being paid is 6.80%. When I invested yesterday the offer had only just launched, so it’s interesting to see it is already up to almost 42% funded now. Although the loan hasn’t gone live yet, as is Kuflink’s normal practice I will received cashback equivalent to the interest on offer until it does, so I am already making money from this loan 🙂

Incidentally, I am not saying this project has any special merit compared with others on the Kuflink platform. But I decided to invest on the basis that it looks reasonably secure with a loan-to-gross-development-value ratio of 36%. And from a more personal perspective, wherever possible I like to invest in projects that will have a socially beneficial outcome, and a new children’s day nursery certainly ticks that box.

i did want to mention as well that I recently updated my full Kuflink review. You can read it here if you like. I’d particularly like to draw your attention to their new and more generous cashback offer for new investors. They are now paying cashback on new investments from as little as £500 (it used to be £1,000). And if you are looking to invest larger amounts, you can actually earn up to a maximum of £4,000 in cashback. That is one of the best cashback offers I have seen anywhere (though admittedly you will need to invest £100,000 or more to receive this!).

My two Buy2LetCars investments are still delivering the promised monthly returns without any issues. As you will remember, investors with Buy2LetCars put up the money to finance a car for a key worker such as a nurse or police officer. They then receive 36 monthly capital repayments followed by a final balancing payment of interest and capital. If you are looking for an income-producing investment with a substantial lump sum payment after three years – and you like the idea of doing a bit of good with your money too – they are well worth checking out (and likewise if you’re a key worker looking for a lease car yourself). If you’d like to learn more, you can read my review of Buy2LetCars here and my more recent article about the company here. And here is a link to Wheels4Sure, their car-leasing website.

Otherwise, there is nothing especially notable to report on the financial front this month, so let’s move on to the more personal stuff…

Personal

Since my last monthly update England has been mostly in lockdown, so I haven’t been doing anything especially exciting 🙁

I went for my latest checkup at the eye clinic at Burton Hospital in the first few days of the new lockdown. As you may remember, I was diagnosed with a perforated retina after a routine eye test at my optician’s.

I wasn’t allowed to drive, as they put drops in your eyes which blur your vision for a few hours. The trip to Burton involved a bus ride, two train journeys and a one-mile walk, so it took up a whole day. The train journeys in particular felt odd and at times almost post-apocalyptic. I was literally the only person on Lichfield Station waiting for a train to Birmingham, and had the whole carriage (and possibly train) to myself. The train to Burton was a little busier, but you do start to wonder how long the railway network can go on with such minuscule passenger numbers.

It was very quiet at the hospital too, so I was seen straight away. The doctor seemed happy with what he could see, though it’s not easy to tell when he – and everyone else – was wearing a mask. I was told I will have to go back again in January, and if everything is still okay then, they will discharge me. So I guess that’s good news, although they did say that last time as well…

During the lockdown month I aimed to go for a walk every day, and apart from a couple of days of foul weather I achieved that. I have been wearing my new music hat – described in this recent post and pictured below – and enjoying listening to my choice of music. My preferred genre is prog rock (classic and current) but I enjoy jazz and blues as well. I do just find I have to be a bit careful when walking on the narrow country lanes where I live, as with my music playing I don’t always hear cars coming up behind me. Still, I haven’t had any really close calls yet!

I was pleased to be able to go for a swim again this week at my local David Lloyd leisure centre. It was very quiet, and all the staff, including those at reception, are now wearing masks. I suppose some people would find that reassuring. I just find it rather sad and dispiriting. Still, I really enjoyed my swim, and it was great to see a couple of members I know and exchange a few words with them. Even small social interactions like that offer a welcome morsel of normal life in these strange times.

Afterwards I ordered my usual hot drink from the centre’s coffee shop, but because I’m in a Tier 3 area I was told I couldn’t sit down to drink it. I was afraid I might be forced to take it to the freezing cold car park to consume, but was informed there was no objection to me drinking it while standing up in the centre, so long as I didn’t stay in one place for too long. You might think this is barking mad – I couldn’t possibly comment.

There has of course been some good news on the virus front in the last few weeks. As I said last time, new cases (in England anyway) are on a clear downward path. The government are of course trying to spin this as a success for lockdown, but I am sceptical about that. As I said in my November update, cases were already starting to decline pre-lockdown, so what we are seeing now is simply a continuation of that welcome trend.

It’s also interesting that the – admittedly shorter – Welsh lockdown appears to have failed totally, with cases there on the rise again. So they are now imposing even harsher restrictions, including a total ban on pubs and restaurants serving alcohol. I would therefore like to extend my sincere commiserations to Welsh readers (and especially those working in tourism or hospitality) at this time. It is a shame that the four nations of the UK couldn’t have come up with a more coherent, co-ordinated policy to combat the virus – although in my view lockdowns shouldn’t ever be a part of this due to all the collateral damage they cause.

There has been good news about vaccines this week, with the first one from Pfizer/BioNTech receiving regulatory approval in the UK and due to start rolling out next week. I am not an anti-vaxxer and will (probably) accept the vaccine when it is offered. There are, though, some reasons to be sceptical about some of the claims being made for vaccines, nicely summed up in this cautionary blog post by my old friend John ‘Platinum’ Goss. In particular, we still don’t know about any possible long-term side-effects of the vaccines. And with case numbers dropping dramatically in England, you have to wonder how much Covid will still be around in a few months’ time anyway…

In my view, this pandemic will only end when some sort of herd immunity has been achieved. That will be partly through growing numbers of people achieving immunity through contracting the virus, and in addition (hopefully) people acquiring immunity through vaccination. If that is the case, the virus will have nobody left to infect and will ultimately die out (though maybe returning occasionally in milder variants, as happens with other cold and flu viruses). That’s the best-case scenario, anyhow, and I hope it plays out that way.

- Before leaving this topic, I would just like to include a quick shout-out for the excellent Lockdown Sceptics website. This site is updated daily and is the first thing I look at when I switch on my computer in the morning. It includes articles from a wide range of academics and other commentators, and offers a sceptical slant on official policies and announcements that is often missing in the mainstream media. Even if you don’t agree with all the views expressed, it’s well worth a read.

As for Christmas, I am expecting to have an even quieter one than usual. I don’t normally socialize a lot at this time anyway. My only remaining close family consists of my three sisters, but they are all in different parts of the country and have their own families and social circles. I have put up my lights and decorations, though, and am looking forward to receiving plenty of cards and letters. I shall also ensure I have a good stock of box-sets to watch!

Well, I guess that’s it for now. I do hope you and your loved ones are staying safe and well and looking forward to the festive season. As always, if you have any comments or questions about this post, please do leave them below.

.

.