UK Bloggers’ Back to School Giveaway 2023

Yes, it’ s time for another exciting giveaway on Pounds and Sense. This one has a ‘back to school’ theme. In most parts of the UK, of course, this occurs in early September. Scottish schools generally return a little earlier, around mid-August.

Again I have clubbed together with some of my fellow UK bloggers to provide a smorgasbord of great prizes. And the best news is, it’s entirely free to enter. The giveaway is open now and will close on August 30 2023.

The prizes have been hand-picked for children and young people returning to school this autumn, so they should be ideal for your children or grandchildren. But if you want to keep any for yourself, we promise we won’t tell!

This event has (again) been organized by Rowena Becker, who blogs at My Balancing Act. No small amount of effort has been involved in arranging and co-ordinating it, so many thanks again to Rowena for her hard work and dedication.

Without further ado, then, I’ll hand you over to Rowena to introduce the giveaway…

Back to School Giveaway

With only a couple of weeks left until the start of the new school year, some of the top UK bloggers have come together to offer one lucky winner an amazing bundle of prizes to send their kids back to school in style. This is not only a giveaway but also a great Back to School Guide to help you get ideas and inspiration for your kid’s new school year.

The Prizes

Microsoft Surface Go 2 Intel Pentium Gold from Tier1

Tier1, refurbishers of laptops, desktops and tablets and more, are the perfect solution for parents looking to equip their kids with great but affordable technology as they head back to school. Tier1 take pre-owned devices and put them through a rigorous process of testing, cleaning, and repairing to ensure they are in excellent working condition. Not only do these devices offer significant savings compared to buying brand new, but they also provide a reliable and efficient way for students to engage in online learning, complete assignments, and explore educational resources.

With Tier1, parents can find high-quality laptops and tablets that meet their children’s needs without breaking the bank, allowing them to invest in their education without compromising on affordability. We have the Microsoft Surface Go 2 Intel Pentium Gold from Tier1 for our lucky winner. Right now, Tier1 have their summer sale on, making those back to school savings even greater!

Futliit LED Backpack

Introducing the Futliit LED Backpack, the perfect accessory for those walking or cycling home after school. Safety is paramount, especially when it comes to being visible in the dark. Are you worried about your kids walking home in the dark? Don’t worry! The Futliit LED backpack is here to keep them visible to passing traffic, ensuring their safety.

Equipped with two strands of LED lights and reflective panels, the backpack guarantees maximum visibility on your journey. But that’s not all – the backpacks come loaded with features. With a spacious main compartment, a padded device sleeve, and ample storage space, your kids can keep all their school essentials secure.

Don’t miss out on this chance! Enter our giveaway for an opportunity to win the Futliit LED Backpack. Ensure your kid’s safety and embrace the #BeFutliit movement!

Premium Start-Rite School Shoes

‘Motivate‘ and ‘Encourage‘ deliver the very best protection Start-Rite has to offer, and here’s your chance to win either style of your choice! These robust shoes are packed with the best Start-Rite intelligence, from Air Rite technology to biomechanical soles, reflective tabs, toe and heel bumpers, padded ankles, dyed through leather and adjustable rip-tape fastenings.

The durable designs of these two new styles launched by Start-Rite, in collaboration with ‘The Daily Mile’, strengthen the joint ambition to support healthy development and physical activity for all school children.

‘Motivate’ – available size S10 – L4 (Standard and Wide width fitting)

‘Encourage’ – available size S9 – L2 (Standard and Wide width fitting)

To browse the full Start-Rite school shoe range – https://www.startriteshoes.com/school-shoes

Create-A-Space™ See-Thru Storage Caddy

Keep your kid’s art and crafts supplies organised when they go back to school with the Create-A-Space™ See-Thru Storage Caddy from Learning Resources. The set comes with 4 very handy see-through storage bins on a portable base with a carry handle. It’s the perfect caddy for creative kids, and we have one to give to our lucky winner!

SMASH Lunchbags and Water Bottles

Going back to school with SMASH means you’re going back in style! Our lucky winner can grab their kids the following lunchtime accessories:

The water bottles have an easy carry handle and a fast-flow straw sipper. The lunch bags are not only super cool and super stylish but they are also fully insulated with an anti-bacterial lining. Oh, and super easy to clean too! If you can’t wait to see if you’re a winner, these affordable lunch bags and water bottles are all available from Dunelm.

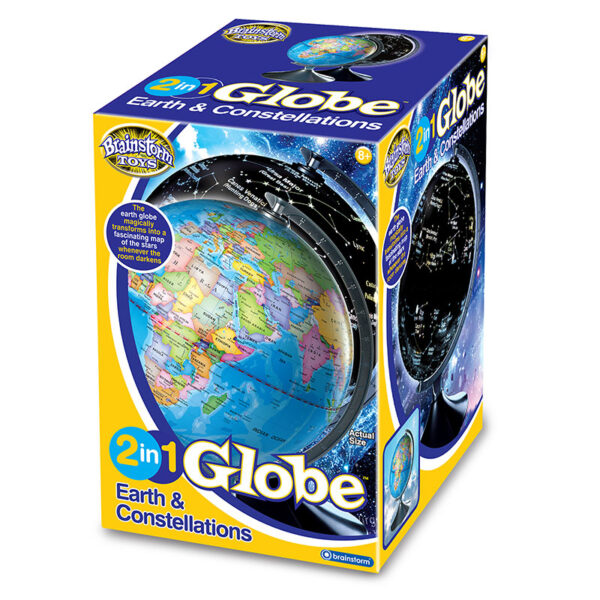

Brainstorm Toys E2001 Light Up 2 in 1 Globe Earth & Constellations, Multicolour

Help your kids learn when they go back to school with Brainstorm Toys Light Up 2 in 1 Globe of the Earth and constellations. The Earth and Constellation Globe is two globes in one with a day-time and night-time view. In the daylight, the 22.8 cm diameter globe shows political boundaries, oceans, equator, longitude and latitude lines, country names, capital cities and other major cities for each country in the world. By night the illuminated star map shows constellations with their common names. The globe is at a scale of 1:55,900,00, and it sits on a sturdy, stylish silver stand with a matching graduated meridian.

The Earth and Constellation Globe has an automatic light sensor, so when the globe is turned on and the surrounding area is dark, the globe will transform into a beautiful glowing globe showing the star constellations. It is a great learning tool for geographers and astronomers, but also a great feature for your child’s bedroom. And we have one for our lucky winner!

The Bloggers

In order to be able to bring you this incredible giveaway, some of the UK’s top bloggers got together and contributed. A massive thank you to our bloggers! The bloggers taking part are:

My Balancing Act | The Mum Diaries | Life with Jupiter and Dann | Mummy Fever | Jenny in Neverland | Suburban Mum | Stay Positive | Wotawoman Diary | Catch Up With Claire | Synderella Slims | Make Money Without A Job | The Festive Feelings | Thrifty Husband | A Thrifty Gamer | Mrs Pinch | We Made This Life | My Life Your Way | We Made This Vegan | Effervescent Kelly | Diary of the Evans-Crittens | Best things to do in Cambridge | Two Plus Dogs | The Financial Wilderness | Cats Kids and Chaos | Ideas For A Good Life | My Money Cottage | Clean Plates All Round | Boxnip | Everything Enchanting | Pounds and Sense | Life Loving | Spillinglifetea | Missljbeauty | A Suffolk Mum | Sustainable Business Magazine | BLUEBEARWOOD | THE TOY SCOOP | mummy and me x2 | Crazy Little Thing Called Love | Hannah and the Twiglets | The Geordie Grandma | In The Playroom | Catbaba | Birds and Lilies | The Happy Budget | Testing Time | PrettyCore | Remote Working Guru | Mummy Saver Money Maker | Moms Money Makeover | Real Girls Wobble | Lifestyle Original | Anything and Everything Else | Cyprus Property Blog

How to Enter

You can enter the Giveaway by completing as many Rafflecopter widget entry options below as you like. All entries will be collected and one winner will be randomly chosen. Good luck!

Terms and Conditions

- UK entries only

- The giveaway will run from 7 pm 20th August 2023 to 11.59 am 30th August 2023.

- The winners will be notified by email from rowena@mybalancingact.co.uk

- The winner will have 7 days to respond after which time we reserve the right to select an alternative winner.

- This prize draw is in no way sponsored, endorsed or administered by, or associated with, Facebook, Instagram, Twitter, YouTube, BlogLovin or Pinterest or any other social media platform.

- Prize open to over 18s only. Age verification may be required to receive some prizes.

- If any prizes are out of stock then we will do our best to find a suitable replacement but cannot guarantee it.

- Anyone who unfollows before the giveaway ends or doesn’t complete the required entry action will be disqualified.

- The prize is non-transferable, non-refundable and cannot be exchanged for monetary value.

- We may be using a parcel service or Royal Mail for some of the prizes and their standard compensation will apply in the event of loss or damage.

- Some items may be sent directly by the supplier and we do not have responsibility if these go missing and we cannot replace these.

- In the unlikely event one of the companies withdraws a prize, we cannot offer an alternative.

- The winner’s name will be stated on some or all of our bloggers’ websites and announced on Twitter/X and other social media channels. It will also be displayed on the Rafflecopter Entry. By entering this prize draw, you give your permission for this.

- Please note the winner may have the same name as you, so if you see your name displayed, be aware that you are not the winner unless you have been notified by us. There may be some delays in receiving prizes.

Good luck, and I hope a Pounds and Sense reader wins this fabulous prize bundle!