Buy Now Pay Later – What Is It and Should You Use It?

Today I am looking at Buy Now Pay Later (BNPL). This is a retail payment option that has grown massively in popularity over the last year or two. It is most often used online but is also available at some physical stores (e.g. New Look).

I am indebted to my friends at HSBC UK for their assistance in researching this post (and the graphics). The stats in the article refer to an online survey of 1,000 people conducted by HSBC UK in March 2022.

What Is BNPL?

Most people’s first contact with BNPL comes when they are shopping online and it appears in the list of payment options.

As the name suggests, BNPL allows you to buy a product (or products) now and pay later. This typically involves paying a deposit followed by a short series of instalments. You may also be offered the opportunity to pay the entire sum after 30 days with no initial deposit.

So if – for example – the product/s in your basket cost £90, with BNPL you may be able to purchase with a down payment of just £30 and two further instalments of £30 at 30-day intervals.

One big attraction of BNPL compared with credit cards is that generally if you pay your instalments on time, you will not be charged interest. The BNPL firms make money by taking a commission from the retailer, which means they don’t need to charge anything to customers.

Another possible attraction of BNPL is that you won’t normally be required to complete a formal (‘hard’) credit check. You will just be asked a few quick questions and will be told there and then if you are eligible. The fact that you applied for BNPL won’t generally appear in your credit file or affect your personal credit score (whereas applying for a credit card certainly will).

- This is likely to change in future, however, with greater regulation coming to the sector from 2023. Hard credit checks may be required from then on, in response to fears that BNPL is encouraging some people to spend more than they can afford.

BNPL is offered by a range of financial services companies, the best known of which in the UK are Klarna, Clearpay and LayBuy.

Who Uses BNPL and For What?

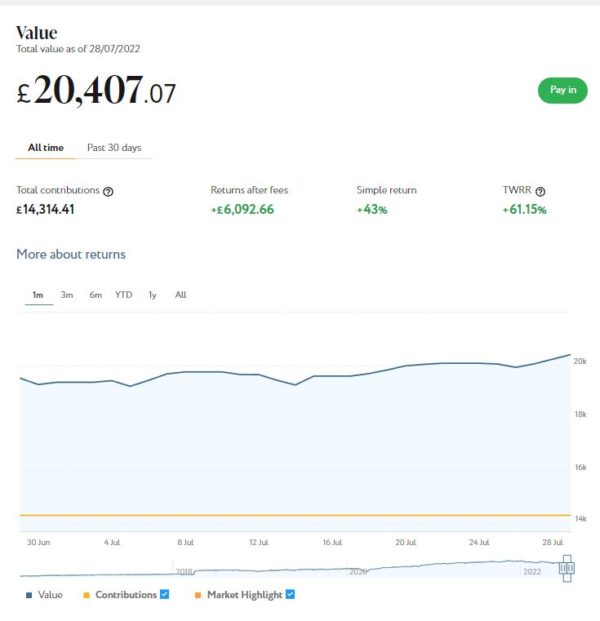

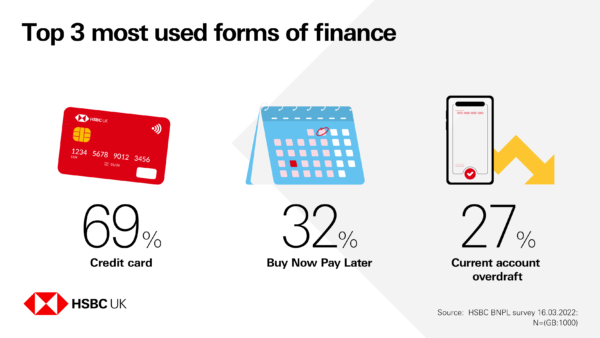

Research from HSBC shows BNPL has become the second most used form of finance behind credit cards (see graphic below). Women are more than twice as likely as men (43% v 21%) to use it.

The HSBC survey found that BNPL was most popular among 25-34-year-olds, with nearly half saying they had used it in the past year (49%), followed by 18-24s (45%) and 35-44s (45%).

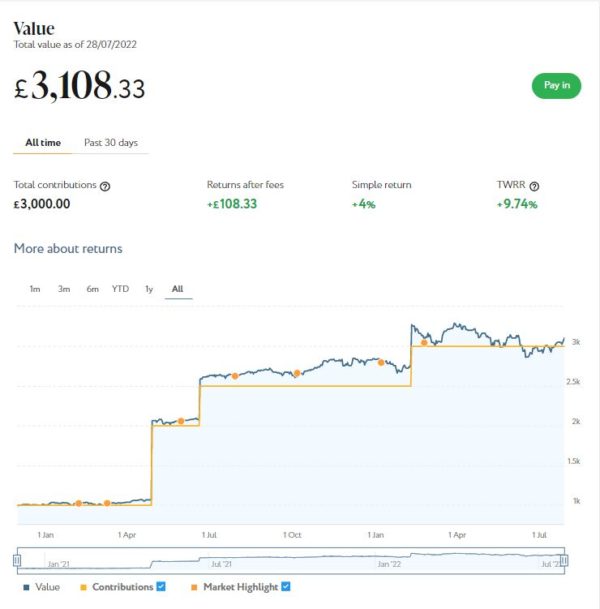

As regards what it is used for, the survey found that clothing was the most frequent purchase type with BNPL, followed by food & beverages, shoes, appliances & electronics, and games & toys. This is summed up in the graphic below.

What Are the Pros and Cons of BNPL?

In the HSBC survey, those using BNPL said they valued it over other forms of finance because of the ability to spread payments (20%). They found it quick and easy to use (15%) and more affordable (13%) – with 87% of people who had used it in the past 12 months saying they were likely to use it again in the next year.

- BNPL is also popular among people who like to try before they buy (typically with clothing). By buying this way, you may be able to try your purchase without any monetary outlay and return it with no further commitment if you don’t like it.

Sixty percent of BNPL users in the HSBC survey did express some caution, however, saying one of the top three drawbacks was it was too easy to get into debt or overspend. One in five listed lack of availability as a key disadvantage (20%), while one in ten (12%) said the fact it didn’t build their credit score was an issue.

These concerns were also raised by those who hadn’t yet used a BNPL service – with 62% saying one of the main barriers to use was it appeared to be too easy to get into debt or overspend, and nearly one in three (30%) saying that was the primary factor.

- One other possible drawback with BNPL is that anything you buy this way will not enjoy the same legal protections you get when buying with a credit card. The latter only applies to purchases of over £100, of course.

My Thoughts

Thanks again to my friends at HSBC UK for allowing me to share their survey results and graphics.

With the current cost-of-living crisis, many of us are feeling the pinch at the moment. So it is easy to see the attraction of BNPL for helping budgets stretch a little bit further.

In my view, BNPL can be a sensible option if you need short-term credit and are confident you will be able to repay the money over the period specified. One big attraction is that most BNPL offers do not involve paying any interest as long as you stick to the terms of the agreement. Neither is using BNPL likely to affect your credit score (though it won’t help build it either). And, as mentioned above, payment-in-30-day offers can allow you to try before you buy without any up-front financial outlay.

- Some BNPL firms also offer longer-term credit up to 18 months. A hard credit check is required for this and interest will be charged, so this is more like a personal loan. Interest rates tend to be high and you may end up paying back considerably more than you borrowed. I do not recommend going down this route, unless you really don’t have any viable alternative.

Of course, BNPL does have the potential for encouraging overspending and drawing you into debt you then find difficult to repay. If you miss any of the scheduled payments, penalty fees and/or interest may be charged and your credit rating may also be adversely affected. Ultimately, a debt recovery agency may be called in. If you think this is a risk, it may be better to wait and save up before making a purchase in the traditional way.

As always, please feel free to leave any comments or questions about this post below. I would also be very interested to hear from any readers who have used BNPL themselves. What did you use it for and why? And would you do it again?!

- You might also like to check out this article from HSBC UK about their BNPL survey.