Managing Your Finances and Tackling Debt – a Q & A with MoneyNerd

Today I have a Q and A for you with my fellow money bloggers at MoneyNerd.

MoneyNerd is a UK personal finance blog that aims to help people learn to manage their finances and tackle debt. I asked a number of questions about personal finance and debt, and added my own thoughts as well. Our answers are also being shared separately on the MoneyNerd blog. I hope you find them interesting and informative.

What’s your number 1 financial tip?

MN: It’s hard to give advice that would apply for everyone, because everyone’s finances are different. But I would suggest ‘write it down’, as a fairly universal and important financial tip. Start with your financial goals, then write down the steps you’ll take to get there according to your budget. A lot of people have good financial intentions, but without having clear goals on paper, it’s easy to get led astray.

PAS: Agreed. I would also say, keep on top of your money. Know what’s going in and what’s going out every month, and budget accordingly. Always be on the lookout for ways you can maximize your income and minimize your expenditure. And try to put some money aside for the proverbial rainy day. Everyone should really have at least three months’ worth of income set aside in case of emergencies. Sorry, that’s at least three tips, I know!

What do you think are the main causes people find themselves in financial difficulty?

MN: I think financial difficulties are mainly caused by unforeseen life-events, such as bereavement, unemployment, and relationship breakdowns. These kinds of bumps-in-the-road can severely throw people off course, particularly if their financial situation was fragile in the first place. Unfortunately, all three of these examples have sky-rocketed due to the pandemic, and many people in the UK will be facing financial difficulties over the coming year.

PAS: Not much I can add to that. Although sometimes failing to monitor your income and expenditure closely enough can lead to debts mounting up before you realise it.

What personal finance tools do you currently use to track and manage your money?

MN: I’m quite old-school and still use spreadsheets for a lot of money-related things! There are some good apps out there though – Money Dashboard is a particularly good one.

PAS: I am the same and use spreadsheets a lot. I started with Microsoft Excel, but these days mainly use Google Sheets. As regards personal finance tools, I like Snoop [referral link], a relatively new app that helps you keep track of your finances and suggests easy ways you can make savings.

Any tips for people coming to financial management later in their lives?

MN: It might be a little harder to undo old habits and reinstate new ones if you’re approaching financial management from an older perspective. So start by setting simple goals, and work at them consistently. It’s probably worth taking a little time to assess what’s important to you right now, too: what range of outgoings does your money need to cover in later life that you didn’t need to consider before?

PAS: I am 64 and have friends in their seventies and eighties, so I have seen the sorts of problems older people can face. In particular, so many aspects of our personal finances are dealt with online now, from banking to applying for state benefits. The pandemic has probably accelerated this trend.

Many older people struggle with the technology and it’s often not as intuitive as it should be, especially for those whose eyesight isn’t as good as it once was. So I would say to any older people, try not to get left behind by technology, and ask younger friends and relatives for help when needed. Last year a group of us clubbed together and bought a friend (a retired builder) a Chromebook for his 80th birthday. He had never engaged with computers or the internet before and I must admit I was expecting him to struggle at first. However, he took to it like a duck to water, and was soon ordering tools and components online from a local builders merchant. So even old dogs can definitely learn new tricks!

2021 is going to be tough for many. Do you have any advice on how to keep things under control?

MN: I’d start with the obvious – plan as much as possible, in order to save as much as possible. This is so that when those ‘bumps-in-the-road’ come along, you have some kind of safety net, however small. Unfortunately, however, I imagine a lot of people will do everything right this year and still fall into difficulty. As and when that happens I would say be proactive in reaching out and seeking help. There are plenty of free services and helplines to reach out to, before matters spiral.

PAS: Yes, definitely. As I said earlier, everyone should have a financial safety net to tide them over when life throws you a curveball.

In my earlier career I worked as a debt counsellor at a citizens advice bureau, so I know that there is lots of help out there if you ask for it. And friends and family can be a good source of practical and emotional support too. Just don’t bury your head in the sand and pretend to everyone that nothing is wrong.

What would be your top tip for someone who is worried about a debt (or debts) they can’t repay?

MN: I have two tips: the first is don’t panic, the second is be proactive. If you can’t afford the repayments for a loan or credit card, contact the company and explain your situation. If you’re struggling to meet the repayment amounts, you may also need to look at whether a debt solution is appropriate for you. Having unaffordable debt can be a scary place in which to find yourself, but by taking action you can dissipate some of that anxiety by feeling you are doing something about the problem.

PAS: Yep. It’s worth bearing in mind also that if you have a debt you can’t repay, it’s not just your problem, it’s a problem for whomever you owe the money to as well. It is therefore in their best interests to work with you to find a method for paying down the debt.

What are some good ways of boosting your income?

MN: Ask yourself: do I own anything I could rent? A parking spot, a vehicle, a garden shed, even a room in your house if you own it. Then ask yourself: do I own anything I could sell? Old clothes, a bicycle, old furniture, anything in storage. Then finally, ask yourself what you could do with your spare time: dog-walking, Uber-driving, delivering takeaways/parcels, painting and decorating,completing online surveys, match betting, free-lancing, etc. I have a whole blog post which goes into this very topic in more detail: Making Money – Tips and Tricks.

PAS: Lots of great ideas there. Like MoneyNerd, I also have a section of my blog devoted to ideas for boosting your income. I like online surveys, with Prolific Academic (a website needing people to take part in academic research) a particular favourite. And I do matched betting as well, though not as much as I used to, as I’ve been restricted (or gubbed as we say in MB’ing) by many of the leading bookmakers!

What is the best way you can help a friend or family member who has debt problems?

MN: Honestly, I don’t think there’s a one-size fits all here. Everyone and everyone’s debt problems are different. But that seems like a cop-out! So I think showing genuine, non-judgemental support, and ensuring they have all the right resources (StepChange, CitizensAdvice, etc.) to hand are two good places to start.

PAS: I agree with this. But based on personal experience with a friend a few years ago, I would also advise thinking hard before lending them money, as this seldom solves the problem and may simply exacerbate it. With my friend, who lived alone, I found that acting as a lender to him changed the nature of our friendship, and not for the better. I also felt that by constantly bailing him out, I was allowing him to avoid addressing his money management issues. Eventually we had a difficult telephone conversation when he asked me to lend him money again and I refused. He took it better than I expected and our friendship actually returned to something more normal after that. He got his finances under better control, although I did on a couple of occasions afterwards send him supermarket vouchers to ensure he had enough to get food. I didn’t expect to be repaid for these, obviously!

If you had a sudden, unexpected windfall of £5,000, what would you do with it?

MN: Firstly I’d pay off any loans or outstanding credit card debts. Then I’d take my family out for a nice meal, and put what’s left-over into a tax-free ISA.

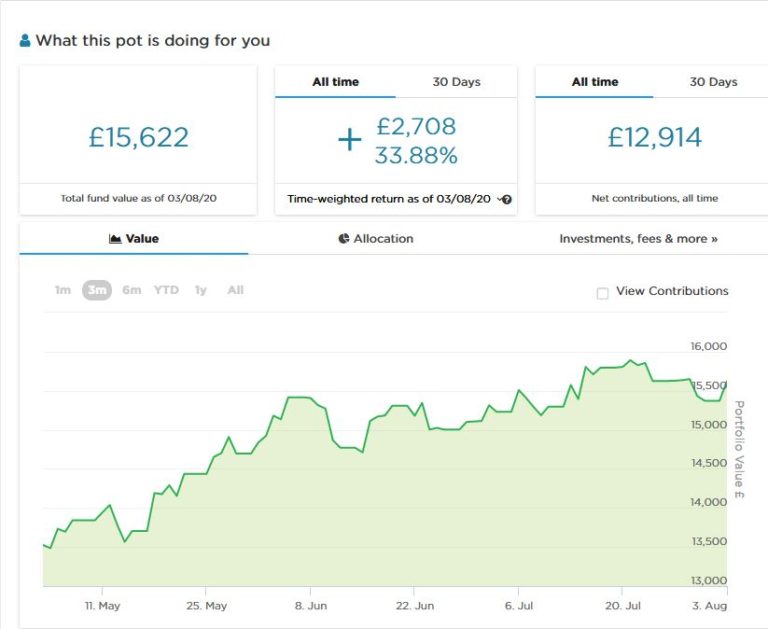

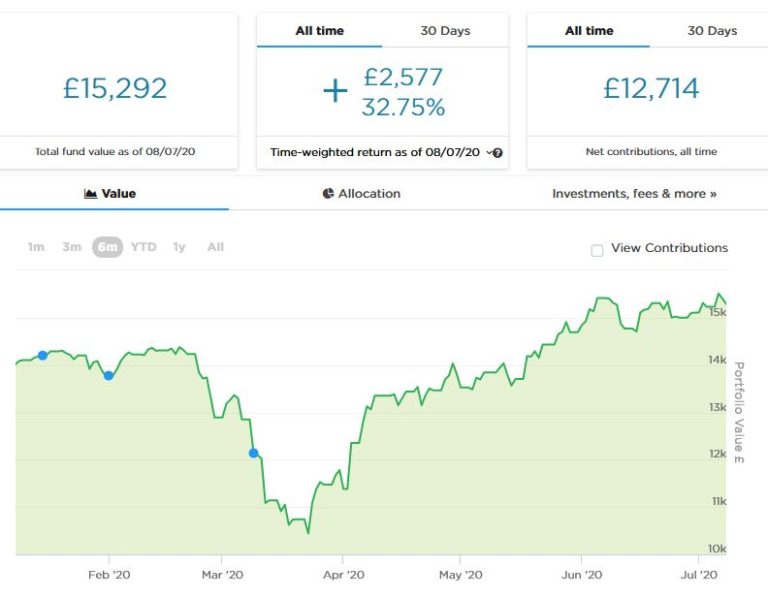

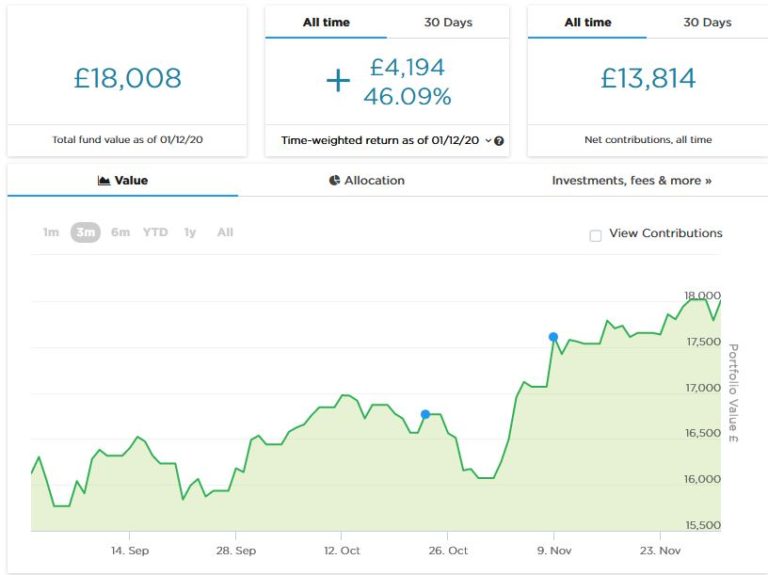

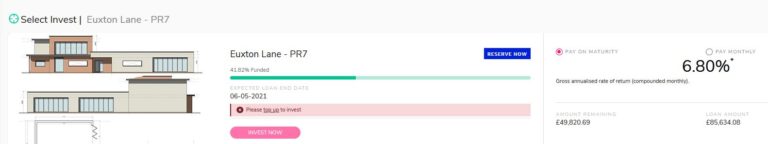

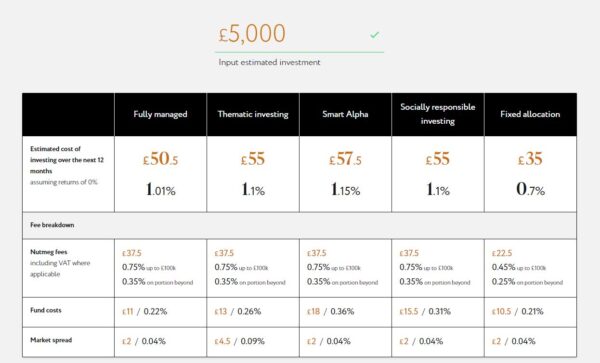

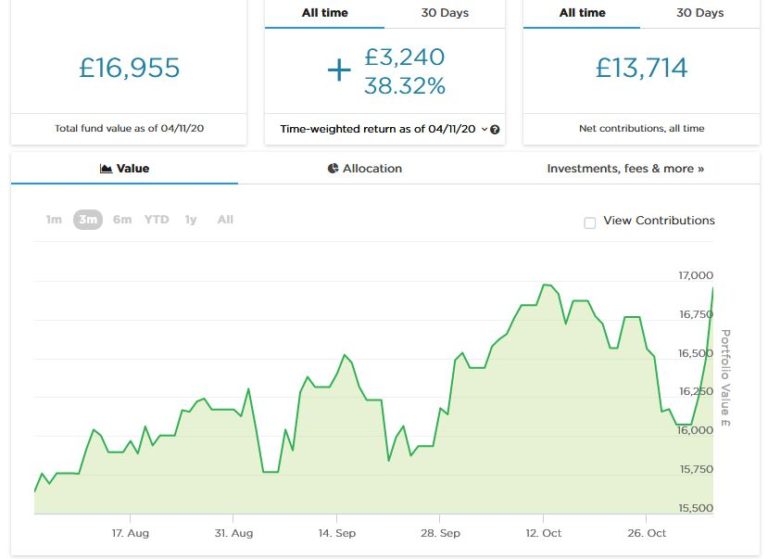

PAS: Paying off debts would be my first priority as well, though I am fortunate not to have any at the moment. I would put most of the rest in my Nutmeg stocks and shares ISA, and some in my Kuflink property loan investment account (from which I have had good results over the last three years) to provide a bit of diversification. Going out for a nice meal with family and friends sounds good too, although as I live in a Tier 3 area I might have to wait a while for that!

What was your best-ever financial decision, and what was your worst?!

MN: My best financial decision was investing in a tech based stocks and shares ISA which has done really well over the last 5 years, although don’t know if I’d recommend the same investing approach in the current economic climate.

On the other hand my worst financial decision was living in London for 10 years where rent and cost of living is exorbitant.

PAS: My best financial decision was probably paying off the mortgage when I had a windfall a few years ago. At a stroke one large item of monthly expenditure was gone, giving me greater financial flexibility as well as saving me a lot in future interest payments.

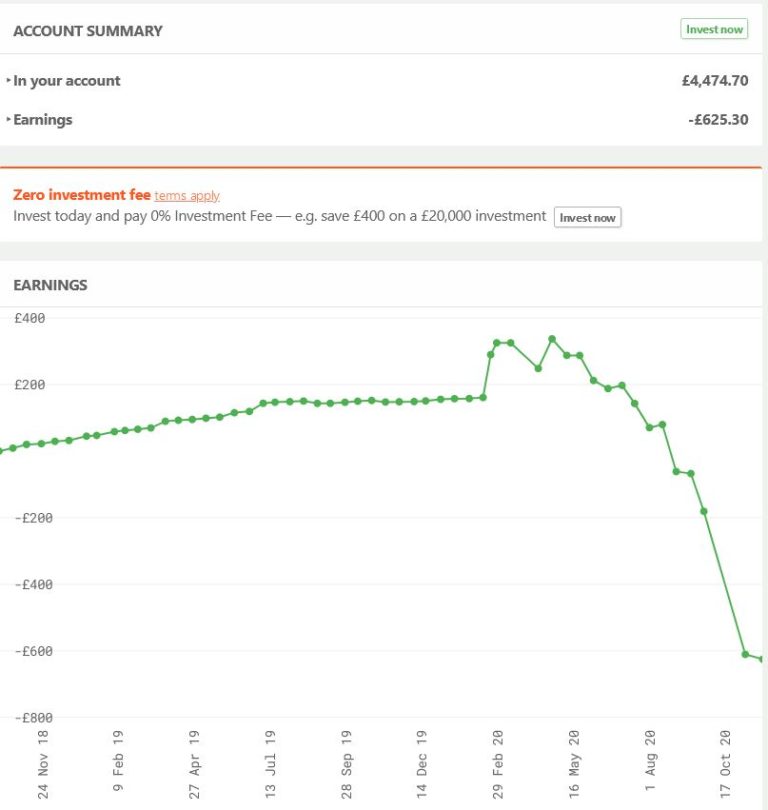

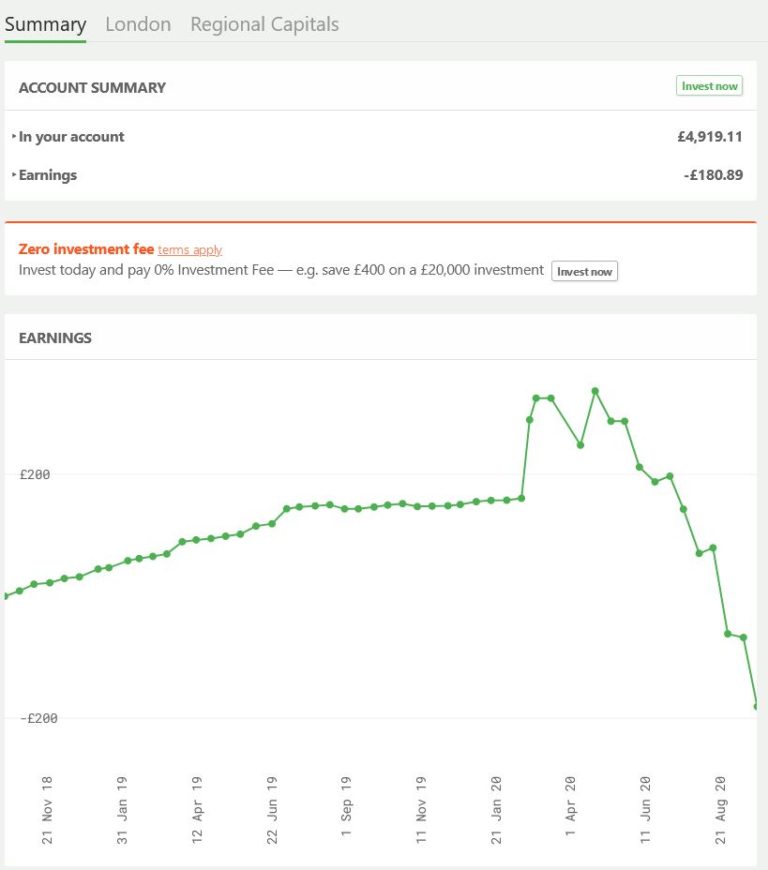

My worst decision was investing too much in property crowdfunding a few years ago when it was still new and exciting. I had money to invest at the time and liked the idea of owning stakes in a portfolio of properties across the UK. Some of my investments worked out but others didn’t, and I am currently sitting on a number I can’t access because the properties in question can’t be sold for one reason or another. The money is still there in bricks and mortar but I have no idea when or how I will be able to access it. That said, I do still believe in the property crowdfunding concept, but I do it a lot more selectively now.

About MoneyNerd

MoneyNerd.co.uk is a personal finance blog that was set up with one aim in mind: to help people learn how to manage their finances and tackle debt. The blog includes a variety of straight-talking articles that cover personal finance topics from credit card guides to mental well-being tips. These can help you understand exactly how financial products work, as well as what your rights are when dealing with debt. We want to offer authentic and truthful information that can help you deal with your situation, whatever that may be.

Many thanks again to MoneyNerd for their insights. Please do check out the MoneyNerd site for much more information about tackling debt and getting your finances under control.

As always, if you have any comments or questions about this post, please do leave them below.

.

.