Guest Post: How to Guarantee Financial Security Whenever You Retire

Today I am pleased to bring you a guest post from my money blogging colleague Jennifer Kempson. Jennifer blogs at https://mamafurfur.com.

In her article Jennifer sets out some strategies to ensure you have enough money to enjoy your retirement, even if it’s not too far away!

Over to Jennifer, then…

They say hindsight is a wonderful thing, and truly as we reach the later years of working life and approach retirement, we may secretly wish we had made our retirement resources a priority and regarded them as a key resource to help fulfil our passions and achieve our long-term ambitions.

Money, much like health and energy, is one resource that we will look back on and wish we had taken better care of during our younger days, so we can look forward with pleasure and excitement to when the time-freedom of retirement allows us to do whatever we dream of.

Reading this right now you may feel that it is too late for you to recover your potential financial security for your retirement, but I’m excited to share with you a few ways that you can invest in your future even when retirement is on the horizon in the next 10-15 years.

Make a plan and start seeing it happen!

Firstly, I will say that I am a firm believer in “putting your own oxygen mask on before anyone else”. And the very best investment financially or otherwise you can make for your future is to sort your own financial security as a top priority.

You absolutely need to write down your financial goals and desired experiences for your retirement, and start getting excited about this and be as specific as possible, so that you know exactly how much money you will require to make it happen.

Like time spent with our children and loved ones, if we master our relationship with money and the way we feel about it today, this will have a huge compounding effect on our short- and long-term happiness in future. I talk more about the habits and thoughts that can reshape your relationship with money in my new book, The Master Money Blueprint, which sets out the 26 timeless money principles and habits that I believe can change your financial future.

Pay off your liabilities as soon as possible

One of the most beneficial things you can do for your financial future is to become as debt-free as possible.

Make better money relationship habits starting today and commit to overpaying on everything you have as a liability against your name.

This could include your mortgage or car payments, and is especially crucial if you have credit card debts or loans. Commit to paying these down as quickly as possible and never returning to debt again.

A home with its mortgage completely paid off will provide you with safety and security in future, and when the time comes can be left to loved ones. But more important than that would be the mindset that your home is secure and safe for your happiness both now and in the future.

I like to use a great principle called The 10% Rule, mentioned in more detail in my book and on my blog at www.mamafurfur.com. This can and should be applied to every debt you have – any outstanding mortgage, car payments, loans, etc.

Commit to paying 10% over the monthly repayment required each month as a default. That small action will do two things. Firstly, you will not really notice too much discomfort. For a mortgage of, say, £400 a month, finding a further £40 could be as simple as giving up that gym membership and going for walk with friends, getting some free weights in the house, learning yoga from YouTube, and so on. It could be giving up all the unused packages from cable TV for a few months to see if you really miss it. It could be starting a small sideline business at home to make some extra money, or saving on your food and shopping purchases by eating one less takeaway a week. The choices are limitless.

That action of paying 10% more each month means you will make the equivalent of 1.2 extra payments towards reducing your debts per year. For a 25-year mortgage, for example, this could result in the debt being fully paid off in just over 22 years instead. That is a nearly three years off your home loan from a small change without causing too much stress to your day-to-day living. The second benefit is to your mindset, which is priceless – you will quickly see that money really is a resource to deploy based on your goals and long-term plans. Overpaying then becomes a joy, as much as it might be difficult to see that at the start, but the smallest actions usually do change us for the better when we let them.

You can find out more about how to pay off your mortgage and large loans quickly using my blog post and videos dedicated to the topic here.

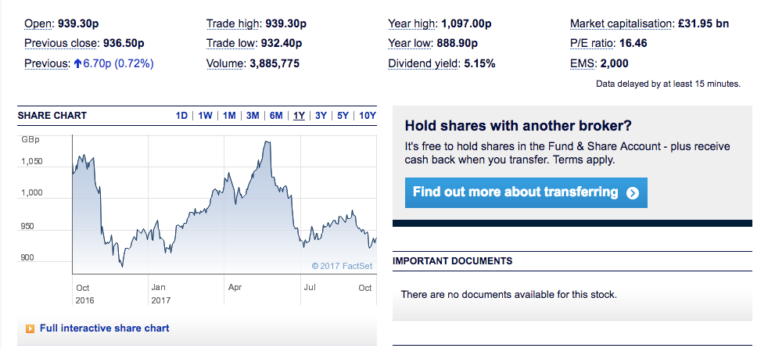

Invest using an investment ISA

An investment ISA (Individual Savings Account) allows you to save up to £20k tax free in stocks and shares every year. This type of savings account could allow you to create a passive income to supplement a pension. You can have a cash ISA and an investment ISA if you wish, as long as you don’t exceed the £20k annual total contributions allowance.

Investments in ISAs are not liable for income tax or dividends tax. Neither do you have to pay capital gains tax when you sell them. They are available from most banks and investment companies.

Like any type of investing, we need to purchase funds based on our goals, requirements for the money long term, and our tolerance for risk.

Investment returns are not guaranteed. However, generally you can expect to see a 4% return on your investments if you pick solid mutual funds (collections of stocks purchased together, spreading your money across a wide range of similar companies) such as Vanguard’s LifeStrategy 100% Equity Fund or reliable low-cost index funds such as the S&P 500. It is also not uncommon to see growth rates of an average of 9.5-10%.

At the later part of your life, if you are hoping to use the power of compound interest and the stock market to gain higher returns than a normal savings account, then I strongly advise doing as much research as you can into the funds you decide to pick.

With investments, we need to assume we are leaving them a minimum of 5-10 years before withdrawing the money, and must not let the ups and downs of the stock market test our emotions.

The value of the stocks once we purchase them is only relevant once we need to sell them, so best mindset practices say to ignore the current day value until you absolutely need them.

Another benefit of using an investment ISA is that you will have access within a few days to your money should your circumstances change and you find you need the money sooner.

I strongly recommend every adult has an investment ISA, as it is currently one of the few ways to get high-interest returns on your long-term savings. It could even allow you to build a substantial ‘pot’ that allows you to achieve complete financial freedom for you and your family in future.

I call an investment ISA a passive income source, as the money generated is created by companies returning some of their profits in dividends, and/or the value of the stocks and shares purchased going up.

We do not have to exchange our time for this income, therefore it is completely passive and grows without any effort from ourselves. The beauty of the stock market is that our money will remain active until we choose to sell our stocks, so it will continue to create more income for us in the background. We can simply withdraw a small portion of it each year to live off, and some of the increase will still remain, adding to our wealth total despite the withdrawn money.

Let’s look at some examples of what we could potentially end up with if we took out an investment ISA even with a short-term goal of accessing the money within 10 years. I will use a withdrawal rate (how much we draw from our account every year as a source of income) of 3.75%. This is regarded as a good average by most financial advisors and institutions.

Starting with no savings at all at age 50, if we contributed the maximum of £20k a year to an Investment ISA with a withdrawal rate of 3.75% a year on average and saw only a 4% return on investment, then using the power of compound interest and reinvesting any dividends or growth, we would have at age 60 a total investment pot of around £246k. If we withdraw 3.75% of this a year, as stated above, after 10 years we could withdraw £9.2k a year of interest (tax free). That would mean an extra £800+ in your pocket every month through your investment ISA savings alone.

Leave the amount until you are officially retiring at age 65, after 15 years of consistent effort and contributions, we could see approximately £411k with an income of £15k a year or £1200 in our pocket every month.

If we were to see a 10% return on investment each year, the total fund within 15 years of maxing out our contributions would be approximately £696k and an income of £65k a year tax free! That is probably more than any retirement could use up, and of course this is purely using our investments as a source of income and not including a state or employer pension. That means you could end up being able to use the interest generated from your investments each year to live off indefinitely!

Another great point to remember is that an ISA is per individual, so if you are a couple you can open one each and double your achievements together.

What better gift than your time and freedom back to use as you wish could you give yourself and your loved ones?!

If you would like to know more about the basics of the stock market, or how to use an investment ISA to retire earlier than planned, please check out my blog posts here:

https://mamafurfur.com/blog/investing-beginnersuk/

https://mamafurfur.com/investing/

Master your money and create your best life – your greatest investment in your future!

Make it a priority to learn how to master your money and use it to direct and create your best life.

Successful people in every walk of life leave clues along the way, so however you feel inspired to live your life, do it with style and use money as the tool to get there, taking your loved ones along with you for the ride.

Think of your upcoming retirement as an opportunity to explore new opportunities and even business ideas. Learn as many new skills as you can in areas that make your future life seem exciting, and watch as the world really opens up to you to design the life you always wanted in your retirement.

Here’s to a great future ahead on your terms, with money as an abundant resource to fuel it!

About the author

Jennifer Kempson, aka Mamafurfur, is a 30-something Scottish working mum with a passion to help others create the work-life balance and lifestyle they desire with time and financial freedom, sharing smarter spending, saving and lifestyle strategies.

Outside of her blog, she recently released her first book titled The Master Money Mindset: How to Master Your Money and Create a Powerful Money Mindset, sharing 26 timeless money principles that will allow you to design and shape your future using money as the resource it should be. The book is available on Amazon Kindle and as a paperback now.

Currently voted UK Money Vlogger (Youtube Creator) 2018, and finalist for the UK Blog Awards Finance Blog of the Year 2019.

Many thanks to Jennifer (right) for a valuable and thought-provoking guest post. Please do check out her blog at www.mamafurfur.com and her YouTube channel at www.youtube.com/c/mamafurfur.

I do agree with Jennifer about the value and importance of paying down your debts. Not only will this reduce the capital outstanding, even more importantly it will reduce the interest you have to pay on that capital in future. Other things being equal it’s best to pay off high-interest loans first (though check whether there are any penalties for doing this). Mortgage rates are historically low at the moment so paying extra every month won’t have as big a benefit, but of course there is still much to be said for going mortgage-free as early as possible.

I also agree with Jennifer about the value of saving as much as possible using ISAs. And for long-term saving especially, you are likely to get much better returns from investment (stocks and shares) ISAs than cash ISAs. Do just bear in mind that pension contributions are another great way of saving for retirement, and you get tax relief from the government up front on them.

Finally, I do of course appreciate that not everyone is going to be able to save £20,000 a year into their ISAs. Whatever you can find, however, putting it into ISAs (and pensions) will ensure you get the maximum benefit in years to come. And the earlier you start, the more time your savings and investments will have to weather any ups and downs in the financial markets and grow. You can read some ideas for boosting your income so you can afford to save more for retirement in the Making Money category on my blog.

As always, if you have any comments or questions about this post, please do leave them below.

Many thanks to Lewys (pictured, right) for an eye-opening article.

Many thanks to Lewys (pictured, right) for an eye-opening article.