My Investments Update – November 2023

Here is my latest monthly update about my investments. You can read my October 2023 Investments Update here if you like

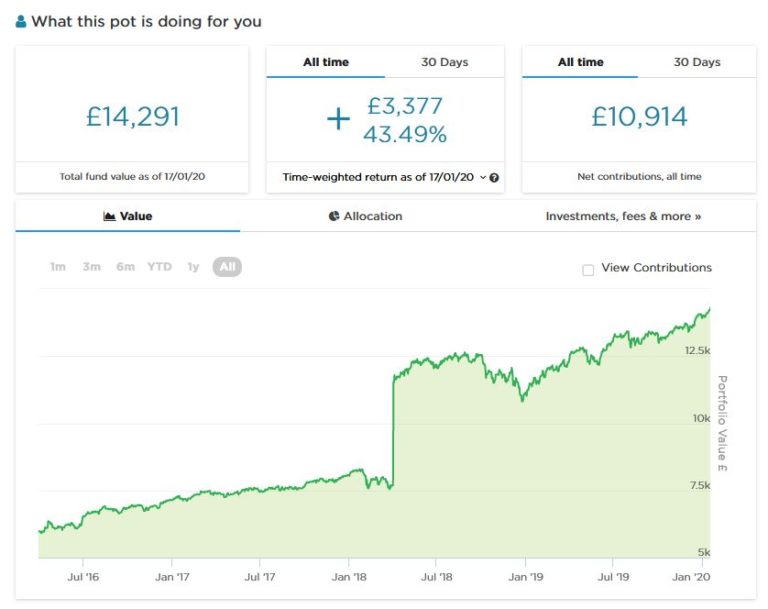

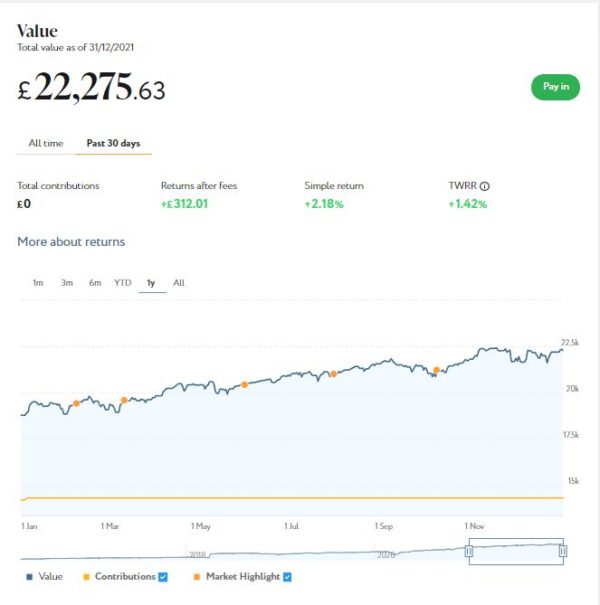

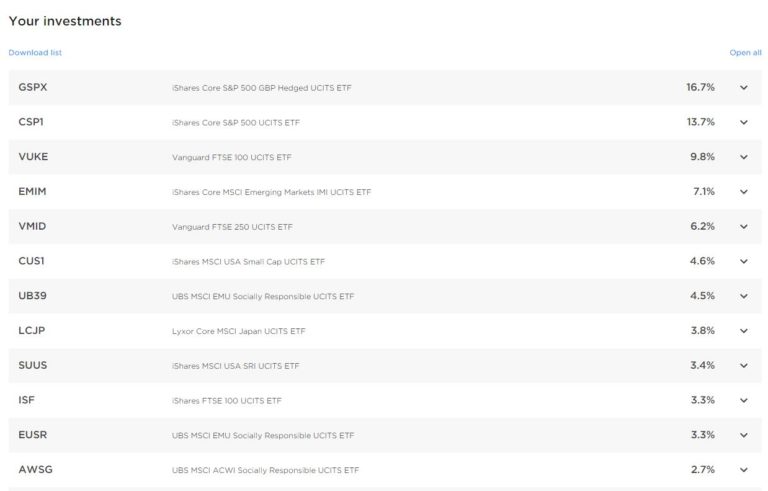

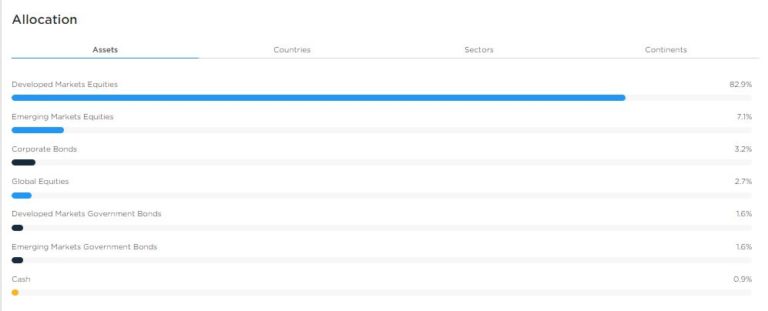

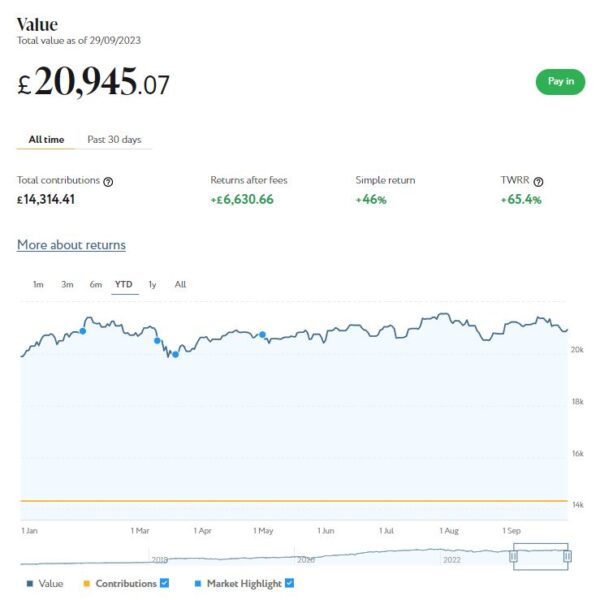

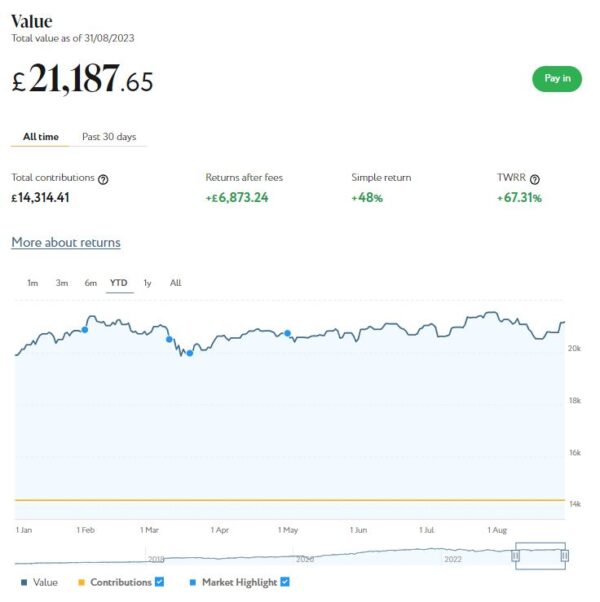

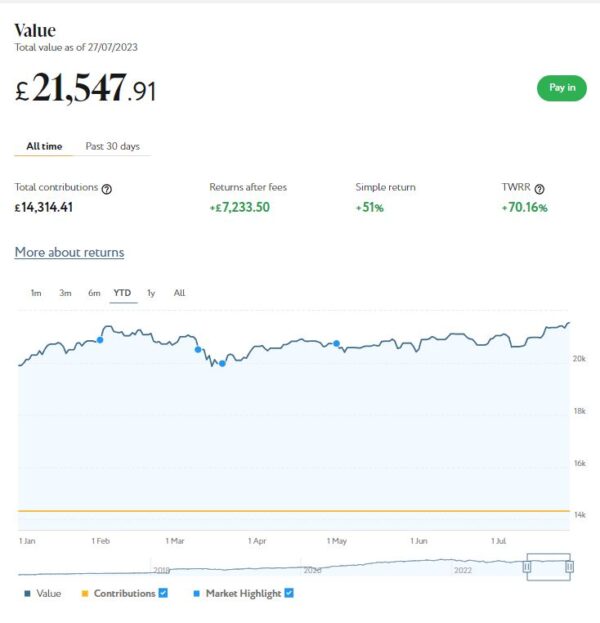

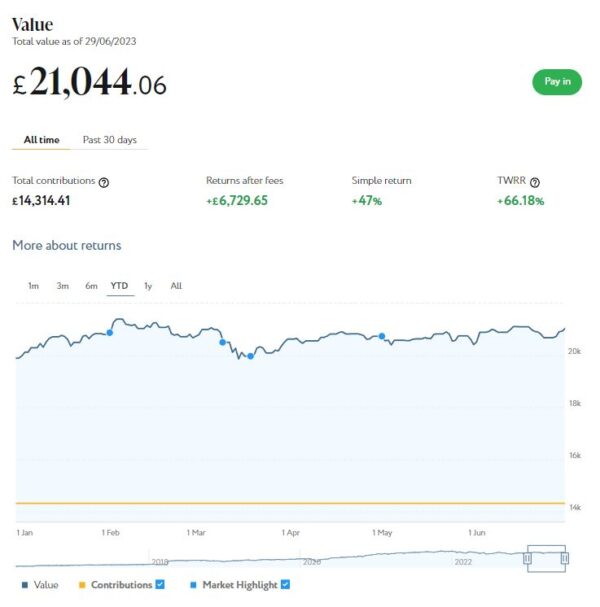

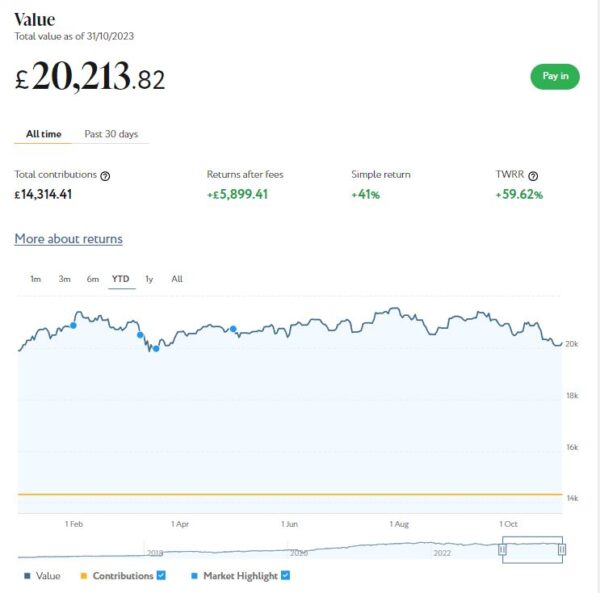

I’ll start as usual with my Nutmeg Stocks and Shares ISA. This is the largest investment I hold other than my Bestinvest SIPP (personal pension).

As the screenshot below for the year to date shows, my main Nutmeg portfolio is currently valued at £20,214. Last month it stood at £20,945 so that is a fall of £731.

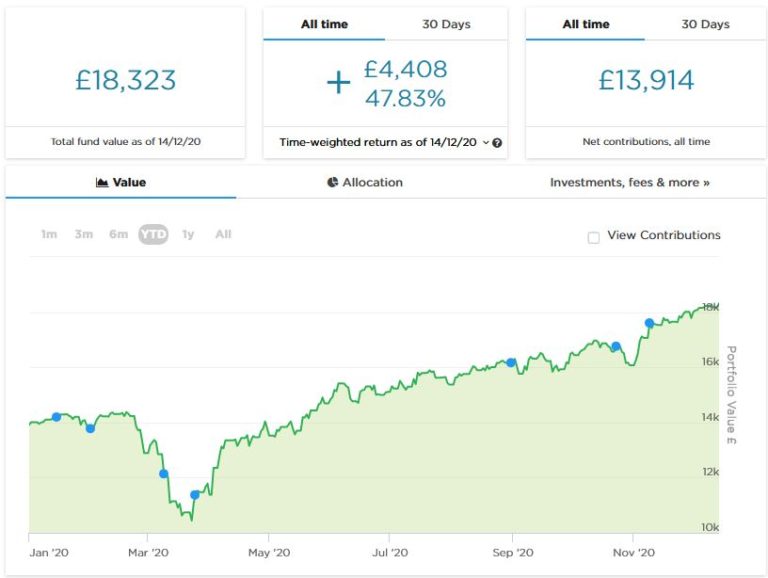

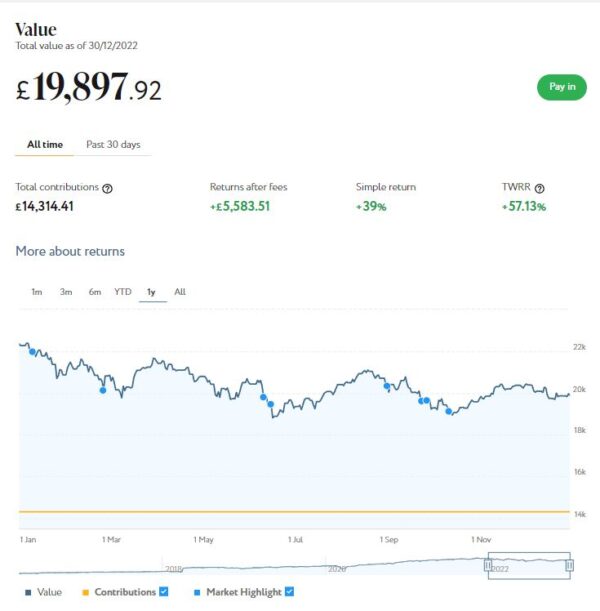

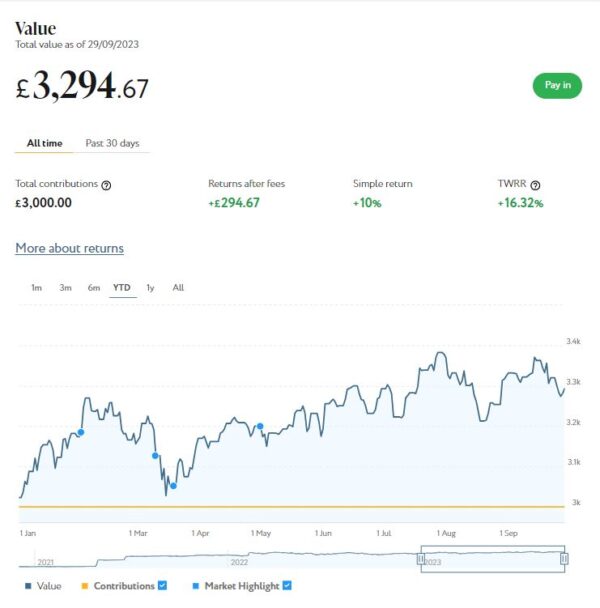

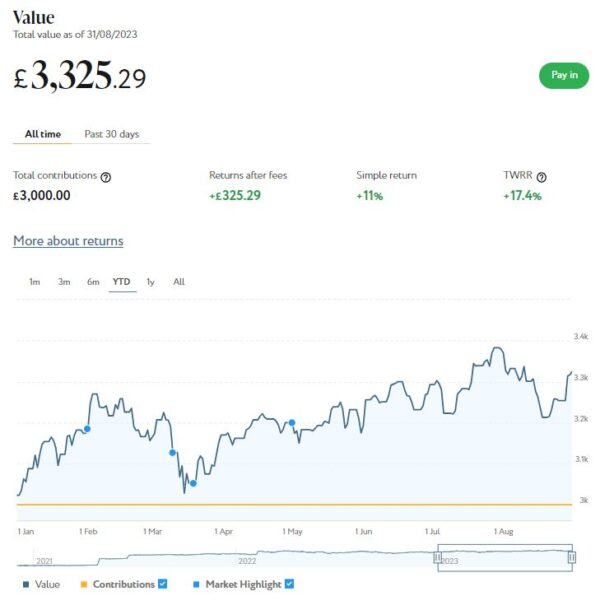

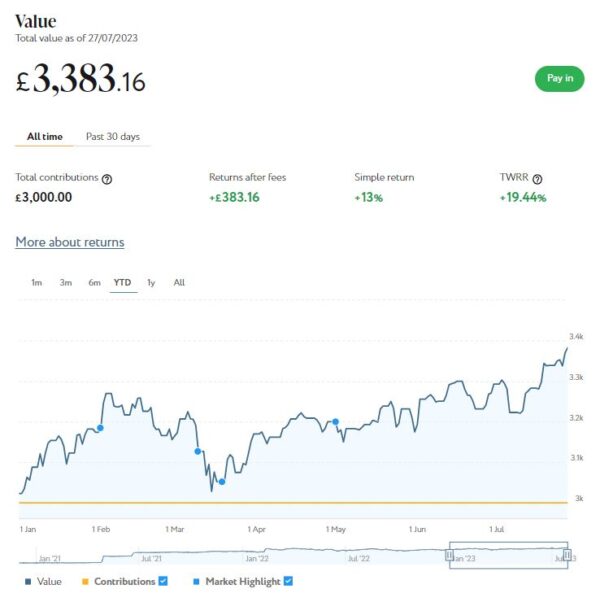

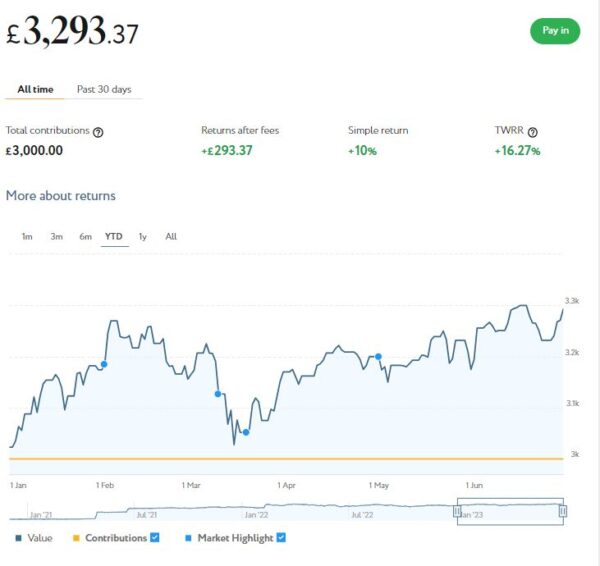

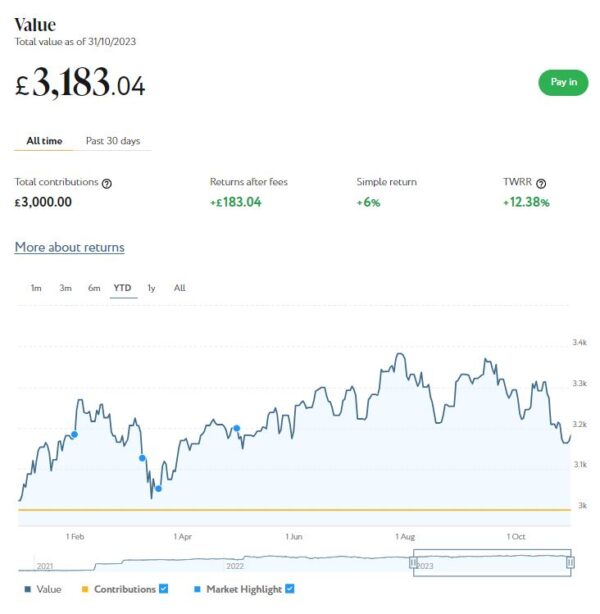

Apart from my main portfolio, I also have a second, smaller pot using Nutmeg’s Smart Alpha option. This is now worth £3,183 compared with £3,295 a month ago, a fall of £112. Here is a screen capture showing performance since the start of this year.

The net value of all my Nutmeg investments has fallen this month by £843 or 3.47% month on month. That’s obviously disappointing, but both pots are still up on where they were at the start of the year. Their total value has risen by £476 (2.08%) since 1st January 2023. I’m not saying that’s anything to cheer about, but due to world events nearly all stock market investments have taken a hit in the last few weeks, and Nutmeg is no exception.

As I always say, investing is (or should be) a long-term endeavour. Over a period of years stock market investments such as those used by Nutmeg typically produce better returns than cash accounts, often by substantial margins. But there are never any guarantees, and in in the short to medium term at least, losses are always possible.

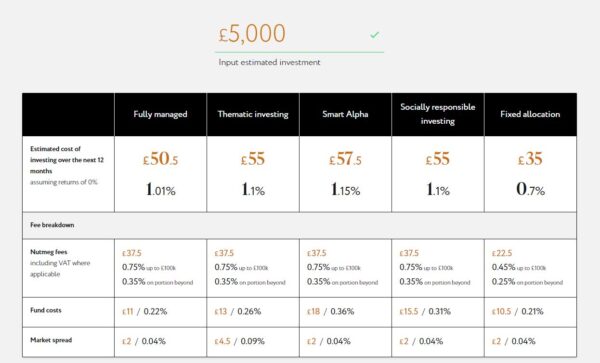

As you may know, I recently revised and updated my full Nutmeg review. This was mainly to incorporate details of their new thematic investment option, but I took the opportunity to update some other information and performance stats as well.

As it says in the updated review, the new thematic style provides a globally diversified, risk adjusted portfolio with a tilt (up to 20% of equity exposure) towards your chosen theme. The majority of the portfolio will be actively managed by Nutmeg’s investment team, whilst the ’tilted’ part of the portfolio will be made up of ETFs that their investment team believes will deliver the best returns from the trend in question (to be reviewed annually).

Currently three themes are available, these being Technical Innovation, Resource Transformation and Evolving Consumer. For more details about what each of these comprises, check out the Nutmeg website.

Nutmeg thematic portfolios are only available on Risk Level 5 or above. There’s a minimum investment of £100 for Junior ISAs and Lifetime ISAs or £500 for stocks and shares ISAs and pensions. There is a 0.75% management fee.

I do quite like the new thematic styles on Nutmeg and may well be investing in one myself. They are similar in concept to the so-called smart portfolios on eToro, which I discussed in this recent blog post. Nutmeg’s thematic styles appear to be more broadly diversified, however, so may be a good choice for those who are new to thematic investing and want to dip a cautious toe in the water first.

You can read my full Nutmeg review here (including a special offer at the end for PAS readers). If you are looking for a home for your annual ISA allowance, based on my overall experience over the last seven years, they are certainly worth considering. They offer self-invested personal pensions (SIPPs), Lifetime ISAs and Junior ISAs as well.

I also have investments with the property crowdlending platform Kuflink. They continue to do well, with new projects launching every week. I currently have around £1,400 invested with them in 12 different projects paying interest rates typically around 7%. I also have just over £600 in my cash account after several loans were recently repaid.

To date I have never lost any money with Kuflink, though some loan terms have been extended once or twice. On the plus side, when this happens additional interest is paid for the period in question.

As mentioned last time, Kuflink recently changed their terms and conditions. There is now an initial minimum investment of £1,000 and a minimum investment per project of £500.

Kuflink say they are doing this to streamline their operation and minimize costs. I can understand that, though it does mean the option to ‘test the water’ with a small first investment has been removed. It will also make it harder for small investors (like myself) to build a well-diversified portfolio on a limited budget.

One possible way around this is to invest using Kuflink’s Auto/IFISA facility. Your money here is automatically invested across a basket of loans over a period from one to three years. The rates currently on offer are shown in the graphic below.

As you may gather, you can invest tax-free in a Kuflink Auto IFISA. Or if you have already used your annual iFISA allowance elsewhere, you can invest via a taxable Auto account. You can read my full Kuflink review here if you wish.

Moving on, my Assetz Exchange investments continue to generate steady returns. Regular readers will know that this is a P2P property investment platform focusing on lower-risk properties (e.g. sheltered housing). I put an initial £100 into this in mid-February 2021 and another £400 in April. In June 2021 I added another £500, bringing my total investment up to £1,000.

Since I opened my account, my AE portfolio has generated a respectable £145.22 in revenue from rental income. As I said in last month’s update, capital growth has slowed, though, in line with UK property values generally.

At the time of writing, 6 of ‘my’ properties are showing gains, 2 are breaking even, and the remaining 16 are showing losses. My portfolio is currently showing a net decrease in value of £37.80, meaning that overall (rental income minus capital value decrease) I am up by £107.42. That’s still a decent return on my £1,000 and does illustrate the value of P2P property investments for diversifying your portfolio. And it doesn’t hurt that with Assetz Exchange most projects are socially beneficial as well.

Obviously the fall in capital value of my AE investments is disappointing. But it’s important to remember that until/unless I choose to sell the investments in question, it is largely theoretical, based on the most recent price at which shares in the property concerned have changed hands. The rental income, on the other hand, is real money (which in my case I have chosen to reinvest in other AE projects to further diversify my portfolio).

To control risk with all my property crowdfunding investments nowadays, I invest relatively modest amounts in individual projects. This is a particular attraction of AE as far as i am concerned (especially now that Kuflink have raised their minimum investment per project to £500). You can actually invest from as little as 80p per property if you really want to proceed cautiously.

My investment on Assetz Exchange is in the form of an IFISA so there won’t be any tax to pay on profits, dividends or capital gains. I’ve been impressed by my experiences with Assetz Exchange and the returns generated so far, and intend to continue investing with them. You can read my full review of Assetz Exchange here. You can also sign up for an account on Assetz Exchange directly via this link [affiliate].

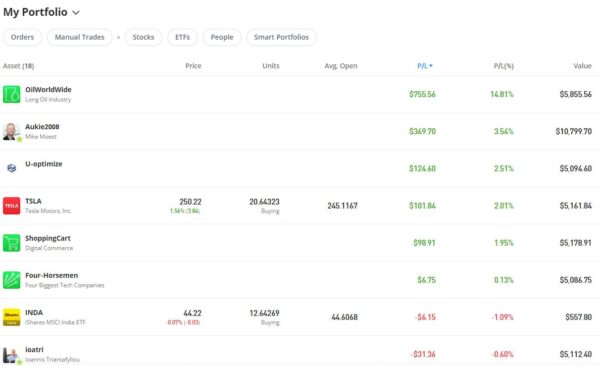

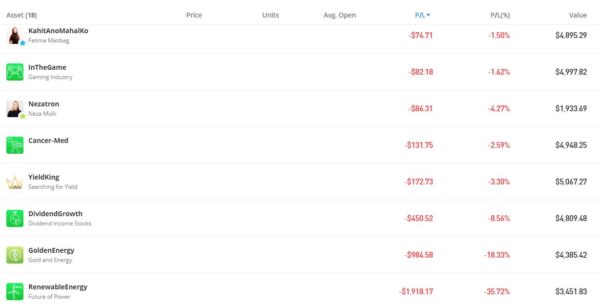

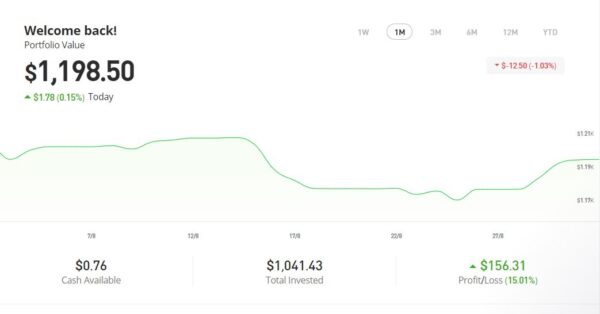

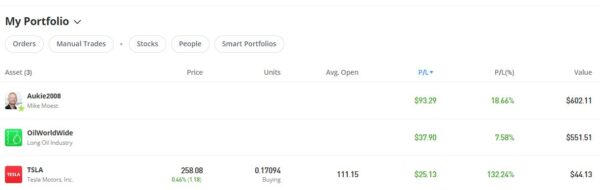

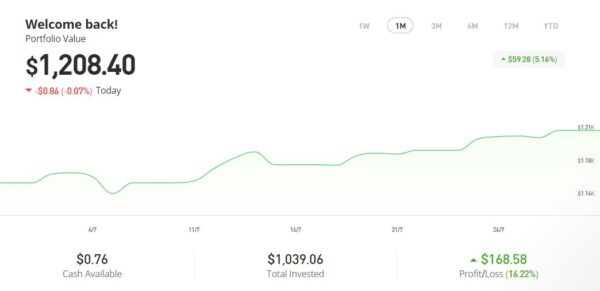

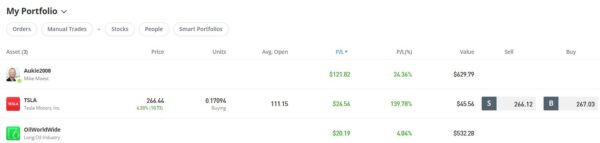

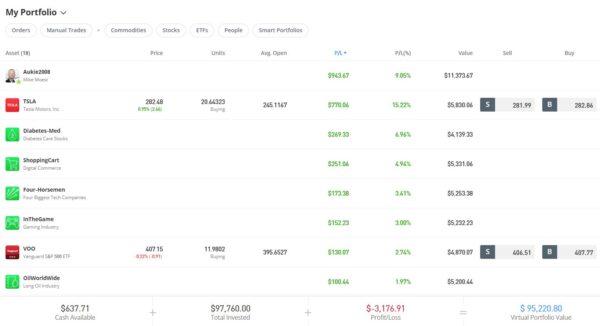

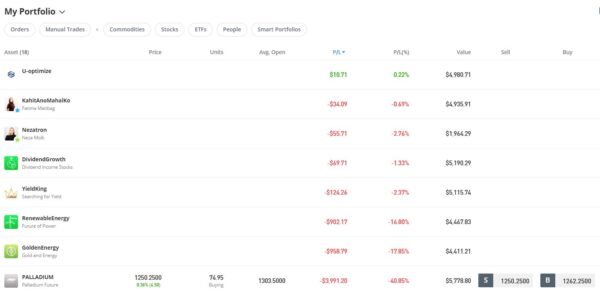

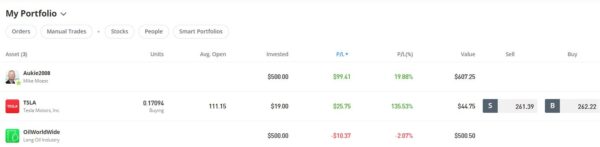

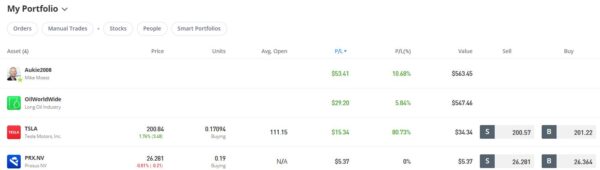

Last year I set up an account with investment and trading platform eToro, using their popular ‘copy trader’ facility. I chose to invest $500 (then about £412) copying an experienced eToro trader called Aukie2008 (real name Mike Moest).

In January 2023 I added to this with another $500 investment in one of their thematic portfolios, Oil Worldwide. I also invested a small amount I had left over in Tesla shares.

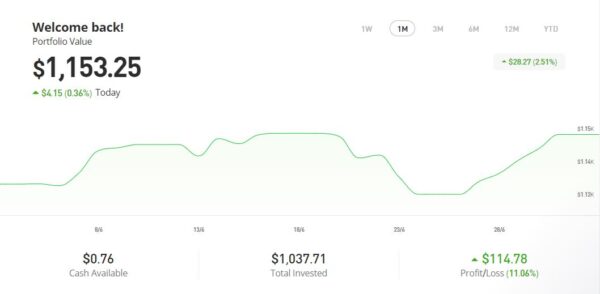

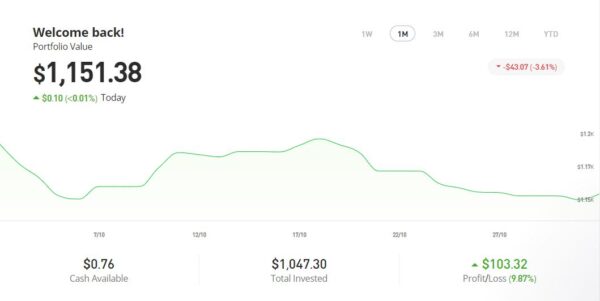

As you can see from the screen captures below, my original investment totalling $1,022.26 is today worth $1,151.38, an overall increase of $129.12 or 12.63%. in these turbulent times I am happy enough with that.

Incidentally, if you’re wondering what the bottom item in the list is (PRX.NV), it’s a partial share in Dutch internet company Prosus NV. I don’t honestly know where this has come from – it’s not something I deliberately bought. I assume it may be some sort of bonus from eToro, or maybe it’s connected with my copy trading account with Dutch investor Mike Moest. But I’m happy to have it in my portfolio, obviously!

You can read my full review of eToro here. You may also like to check out my more in-depth look at eToro copy trading. I also discussed thematic investing with eToro using Smart Portfolios in this recent post. The latter also reveals why I took the somewhat contrarian step of choosing the oil industry for my first thematic investment.

- eToro also recently introduced the eToro Money app. This allows you to deposit money to your eToro account without paying any currency conversion fees, saving you up to £5 for every £1,000 you deposit. You can also use the app to withdraw funds from your eToro account instantly to your bank account. I tried this myself and was impressed with how quickly and seamlessly it worked. You can read my blog post about eToro Money here.

I had two more articles published in October on the excellent Mouthy Money website. The first was How to Make Money From Retail Deal Arbitrage. This is a relatively under-used approach to online auction trading (though you don’t necessarily have to use online auctions at all). It normally proceeds one item at a time, so you don’t need large amounts of space (or capital) for stock. You can ramp it up to multiple items later if you like, though.

I also wrote Could You Make Money as a Freelance Proofreader and Editor. This can be a great sideline, or even a full-time business, for anyone who enjoys working with words. No special tools or equipment are required, so it’s quick, cheap and easy to get started. It’s reasonably paid, and you can work from home at hours to suit yourself. It’s also suitable for older people and people with disabilities (with the one proviso that it becomes harder if – as in my own case – your eyesight isn’t as good as it once was).

I also updated my article published last month titled Will a Heat Pump Save You Money? This is obviously a hot topic and one where policy is constantly changing. I thought I should update it with the latest information about government bribes – sorry, incentives – to get one. Do take a look if you haven’t already!

As I’ve said before, Mouthy Money is a great resource for anyone interested in money-making and money-saving. I particularly like the ‘Deals of the Week’ feature compiled by Jordon Cox (‘Britain’s Coupon Kid’) which lists all the best current money-saving offers for savvy shoppers. Check out the latest edition here

I am also a fan of my fellow MM contributor and money blogger Shoestring Jane. She writes mainly about money saving and frugal living. Her articles – such as this one on Frugal Swaps to Save You Money – are always worth a read. You can see all her articles for Mouthy Money via this web page.

I also published various posts on Pounds and Sense in October. I won’t bother to mention those that are out of date now, but the rest are listed below.

Exploring the Potential of Investing in Alternative Rental Properties was a guest post by my colleague Jackie Edwards. Jackie is a semi-retired property developer and restorer. In her article she presents the case for businesses and individuals to invest in rental properties for the growing over-50s market. At the end of the article I also suggest an alternative method for those whose pockets may not be as deep to invest in this field.

I also republished my post about the opportunity to Get a Free Share Worth up to £100 with Trading 212. This reopened after closing briefly. It is now available till 27 November 2023.

I also published Will You Get the Warm Home Discount? The 2023/24 WHD scheme opened in October. As last year, those eligible will receive a £150 discount off their energy bills. Most people no longer have to apply for WHD and should receive it automatically. Read the article to learn more, along with other support towards the cost of your energy bills that you may also qualify for.

Finally, I published a short post about Over 60s Discounts, a new website dedicated to helping older people save money. It’s free to sign up, and there are loads of savings, discounts and concessions on offer. Read my blog post for more info, and check out the website yourself!

On other matters, the opportunity to Get a Free ETF Share Worth up to £200 with Wealthyhood is still open. This DIY wealth-building app is aimed especially at people new to stock market investing. The minimum investment to qualify for the free share offer was raised recently from £20 to £50 – but on the plus side, they now guarantee that your free ETF share will be worth at least £10. What’s more, for the next two months Wealthyhood say they will plant a tree for every new account opened, so what’s not to like 🙂 🏝

Another thing that happened in October is that I finally got some of my money back from the Bricklane property REIT. I invested several thousand pounds in this a few years ago. At first all went well, but then came the Grenfell Tower tragedy followed by the cladding scandal.

Bricklane (or more precisely investors such as me) owned a number of properties which required (expensive) remedial work. Bricklane didn’t go into liquidation, but they felt they had no option but to sell their entire property portfolio and distribute whatever funds were generated (after all costs had been covered) to investors.

Anyway, to cut a long story short, investors in the Bricklane London fund (including me) should all now have been repaid. I got about £880 of my £1,000 investment back, which I suppose isn’t too bad considering. The Bricklane Regional Capitals fund, in which I also invested, is taking a bit longer to wind up, and I am not expecting to see any return from this until some time next year.

Finally, a quick reminder that you can also follow Pounds and Sense on Facebook or Twitter (or X as we have to learn to call it now). Twitter/X is my number one social media platform these days and I post regularly there. I share the latest news and information on financial (and other) matters, and other things that interest, amuse or concern me. So if you aren’t following my PAS account, you are definitely missing out!

That’s all for today. As always, if you have any comments or queries, feel free to leave them below. I am always delighted to hear from PAS readers

Disclaimer: I am not a qualified financial adviser and nothing in this blog post should be construed as personal financial advice. Everyone should do their own ‘due diligence’ before investing and seek professional advice if in any doubt how best to proceed. All investing carries a risk of loss.

Note also that posts may include affiliate links. If you click through and perform a qualifying transaction, I may receive a commission for introducing you. This will not affect the product or service you receive or the terms you are offered, but it does help support me in publishing PAS and paying my bills. Thank you!