Ten Reasons Over-50s May Need an Independent Financial Adviser

I’ve mentioned several times on PAS why I believe having an independent financial adviser makes sense, even if – like me – you consider yourself reasonably money-savvy.

So today I thought I would set out some reasons over-50s (in particular) may benefit from having an independent financial adviser (IFA) or at least speaking to one.

This post has been created in association with my colleagues at Unbiased.co.uk, a well-established financial services website that can put you in touch with suitable IFAs in your area.

Reasons for Having an IFA

1. Helping Your Children Through College or University

If you have children, you will naturally want to help them complete their education safely and with a reasonable degree of comfort. Sadly the days of student grants (which I was lucky enough to benefit from in the 1970s) are well behind us now. There are various options for helping finance your children’s college or university education and a financial adviser will be able to explore these with you. They will also explain the pros and cons of the student loans system.

2 – Pension Planning

If you are over 50 you will inevitably be thinking about pension options, including when you can retire and how much income you can expect. An IFA will go through your finances with you and look at ways you may be able to boost your pension pot. From 55 onwards you can normally start to draw your pension, but you shouldn’t do this unless a financial adviser has assured you it will last you through retirement.

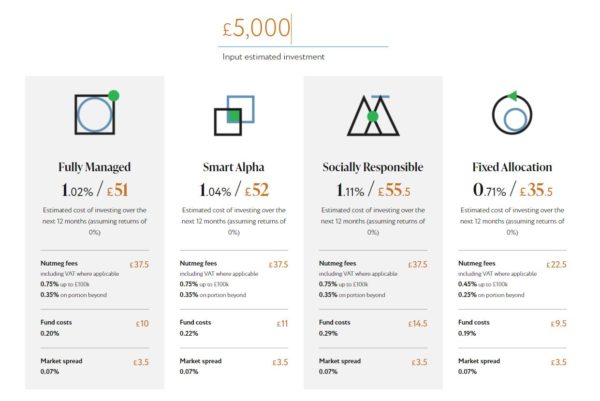

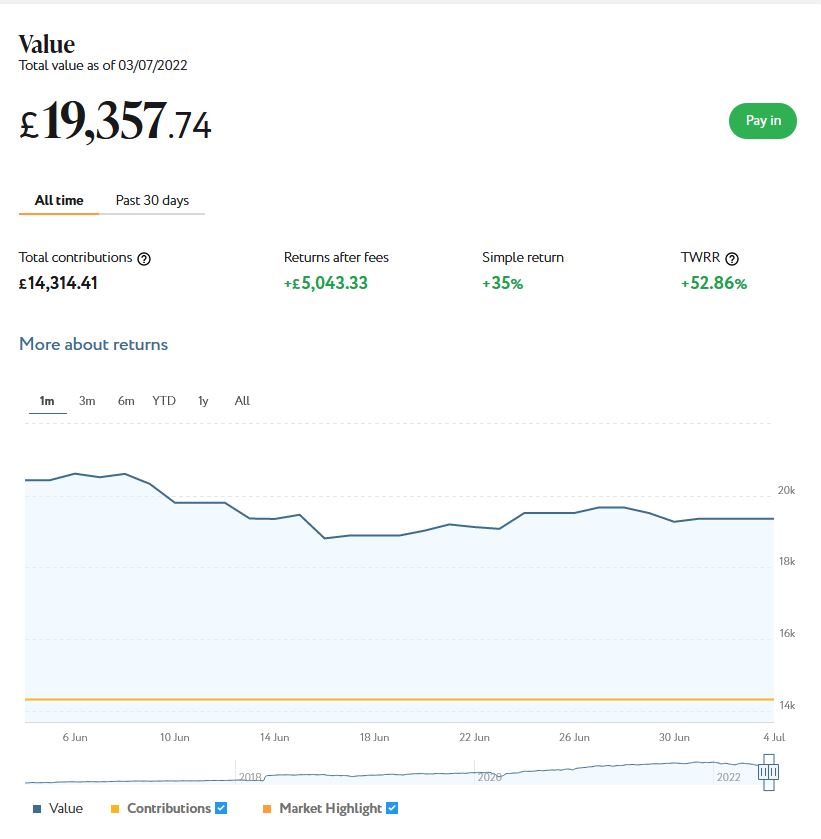

3. Investing

Hopefully by your fifties you will be earning a decent salary and may also have paid off your mortgage. You may also receive an inheritance or other windfall. Either way, if you find yourself with some spare cash you will want to invest it to get the best possible returns from it. An IFA will have access to all the latest information about a vast range of investment opportunities. They will guide you towards investments that are suitable for you based on your financial goals, your investment timeframe and your appetite for risk.

4. Starting Your Own Business

Especially at this time of upheaval due to Covid, many people are looking to start their own businesses in mid-life. That may be in response to redundancy or unemployment, or simply in search of a better work/life balance. An IFA can help you with the financial aspects of doing this, including raising money for tools, premises, transport and so on, or perhaps buying a franchise.

5. Emigrating or Retiring Abroad

Another way to revitalize your life may be to start afresh somewhere else, with new challenges and opportunities (and perhaps a better climate as well!). Or you may be looking to move to a favourite vacation destination to enjoy your retirement. Either way, an IFA will be happy to discuss the pros and cons with you, point out all the things you will need to take into account, and assist you with the financial arrangements.

6. Divorce

Sadly middle age sees the largest number of divorces. Your first priority here will be appointing a good solicitor to act on your behalf and protect your interests. Beyond that, though, divorce can have major ramifications for your finances. An IFA can help you assess your situation objectively and plan for a financially secure and stable future.

7. Downsizing

As the children grow up and leave home you may want to move to a smaller property – to make life simpler, save time on housework and free up money for more exciting things. An IFA can help you explore the implications of doing this and make the necessary financial arrangements.

8. Equity Release

If you don’t want to move – and are over 55 – equity release is another option for releasing funds. In recent years it has grown a lot in popularity. There are various possibilities, including home reversion plans and flexible lifetime mortgages. Most now come with a no-negative-equity guarantee, ensuring you won’t end up passing on debts to your next of kin. An IFA can go over the options with you and point out the pros and cons before you contact any providers.

9. Estate Planning

This obviously includes writing your will, but depending on your circumstances it can cover a lot of other things as well. Nobody wants to see all their money and assets falling into the hands of the taxman rather than going to their nearest and dearest. Speaking to an IFA who specializes in estate planning can give peace of mind and ensure that your loved ones are well provided for when you are no longer here yourself.

10. Helping Elderly Relatives

If you have elderly parents (or other relatives) you may find they are increasingly reliant on you for help and support. It may be up to you to arrange care for them and/or set up power of attorney so you can manage their affairs if this becomes necessary. They may also need help with estate planning (see above). An IFA can assist with all these things as well.

Getting a Free Financial Check-Up

Independent financial advisers do of course charge for their services. They are by definition unaffiliated and do not receive commission, so any recommendations they make are based solely on their client’s best interests. As I have said before on PAS, I certainly don’t begrudge paying my own financial adviser, Mike, as he has undoubtedly saved (and made) me a lot more money than he has cost me over the years.

Nonetheless, most IFAs will be happy to see you for an initial financial healthcheck free of charge. This can focus on a particular area of concern, so you could request an investments review, a pension review or a mortgage review. Alternatively, if you’re not sure which aspect of your finances needs more attention – or indeed whether you need advice at all – you could simply request a broad financial healthcheck.

Here’s what. Adrian Kidd, a financial planner at Radcliffe & Newlands, says about his approach on the Unbiased website:

‘I’d generally offer one or possibly two free consultations, taking about an hour, and these can be as specific or as broad as required. When someone books a financial healthcheck with me, I ask them to bring along all their documents relating to their finances – savings, investments, mortgages, loans, insurance, pensions, the works – so I can build up a complete picture of their affairs. I then go through these in more detail after the consultation, and follow up with an email that gives a summary of their overall financial situation.’

In these free check-ups: advisers won’t generally talk to you about products at all. The process of choosing the right products comes later, after the adviser has built up an understanding of you as a person and your financial planning needs. Only then will they recommend products, if asked to do so.

If you follow my link to the Unbiased website, you can complete a short, step-by-step questionnaire designed to identify the best type of financial adviser for your needs. You will then be shown a selection of suitable advisers in your area with contact information. They will be happy to answer any queries you may have and arrange an initial meeting without obligation.

As ever, if you have any comments or questions about this post, please do leave them below.

Disclosure: This is a sponsored post on behalf of Unbiased.co.uk. If you click through my link and end up becoming a client of a financial adviser listed on the Unbiased site, I may receive a commission for introducing you. This will not affect the service you receive or any fees you are charged if you decide to proceed further.

- This is a fully updated version of a post originally published in 2020.