Spotlight: The Blend Network P2P Property Investment Platform

Today I am spotlighting BLEND, a peer-to-peer property platform that lends to established businesses (mostly experienced property developers). BLEND’s loan-based crowdfunding platform was founded by a team of former investment bankers with substantial experience in real estate and finance.

What Does BLEND Offer?

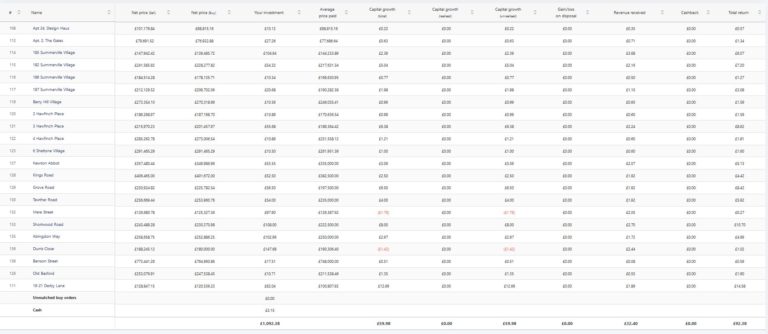

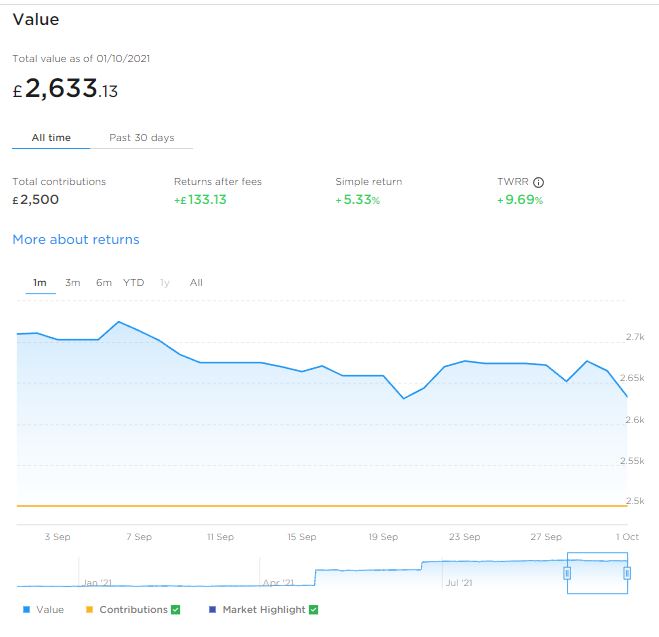

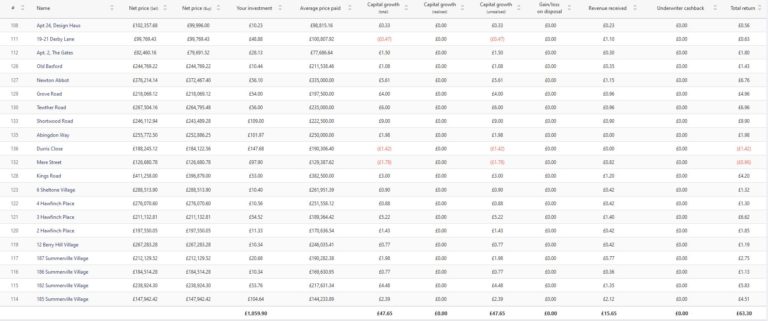

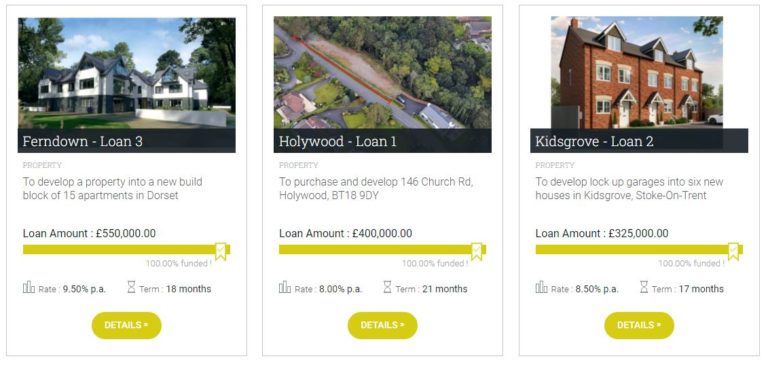

BLEND offers individuals the chance to invest in loans secured against property. They specialize in loans in geographical areas that banks and other lending platforms typically pay less attention to, e.g. Northern Ireland, though they fund projects across the whole of the UK. Loans are typically for small developments or building renovation/conversion projects. Some examples are shown in the screen capture below.

As mentioned above, all loans are secured against property. The LTV (loan-to-value ratio) is usually quite low, giving greater security for investors. Interest rates on offer range from 7 to 12 percent.

BLEND has some similarities with Kuflink, which I reviewed in this blog post a while ago (and invest in myself). Both offer the opportunity to invest in secured loans. Kuflink typically offers lower interest rates, however, between 5 and 7 percent. The risk level with Kuflink loans is (arguably) lower, but it should be said that BLEND so far has an unblemished record, with no loans in arrears or default.

The minimum investment on BLEND is £1,000, which means it is really aimed at high net worth and professional investors. It’s also worth noting that only a small number of new loans tends to be available at any given time and they typically sell out very quickly.

- Using the AutoLend feature is recommended to ensure that you don’t miss out when a new loan comes on to the market.

Secondary Market

One drawback with any type of property investment is that it’s not as liquid as (say) equity-based investments. BLEND does offer a way around this with its secondary market, however.

Lenders who wish to liquidate early can sell their loan parts on the secondary market. Note that finding a buyer on the secondary market may take time and there is always a risk of no-one wanting to buy your loan part. You can start selling a loan in multiples of £1,000 on the secondary market as soon as funds have been released to the borrower.

Unlike the primary market, as a lender you will be charged a secondary market fee of 0.60% (or £6 for every £1,000 of capital) on capital outstanding. BLEND only charge this upon the successful resale of the loan portion you have listed in the secondary market. The secondary market is free for buyers.

Pros and Cons

A full list of Pros and Cons for BLEND is shown below.

Pros

1. Easy sign-up process

2. Well designed, user-friendly website

3. All loans secured against property

4. Low LTV ratios for added security

5. Manual and auto-invest options

6. In-depth info provided on the website about loans, so you can see exactly how your money will be used (and by whom)

7. No investor losses to date

8. Marketplace (secondary market) for buying and selling loan parts

9. No charges to investors lending on the primary market and only a 0.6% fee if you resell a loan part on the secondary market

10. Rates of return of up to 12% are at the upper end for P2P lending

11. Can invest via a SIPP or SSAS (private pension scheme)

Cons

1. Minimum investment of £1,000

2. Limited supply of new loans to invest in

3. No tax-free IFISA option

Final Thoughts

With a minimum investment of £1,000 (per project), BLEND obviously won’t be suitable for everyone. But if you have that sort of money available, the promised returns of up to 12 percent are undoubtedly enticing.

I like the fact that BLEND are very selective in the projects they back, even if that does mean the flow of new opportunities is limited. It’s also good that they perform in-depth ‘due diligence’ on every loan and publish full details about this on the website, including independent valuations. This means investors know exactly what the potential risks and rewards of a project are.

The absence of any charges to investors (apart from on the secondary market) is another big plus. And the presence of a secondary market offers the opportunity to exit loans early if your circumstances change (though, as noted above, you aren’t guaranteed to find a buyer).

BLEND is probably at the riskier end of the P2P property spectrum, but in my opinion the returns on offer fairly reflect this. Risks are also mitigated by generally low LTV ratios and the detailed research mentioned above. The fact that no loan has so far gone into default or even into arrears is impressive, though there is of course no guarantee this couldn’t happen in future. It does offer some reassurance though.

Finally, BLEND has an average Trustpilot rating of 4.6 (‘Excellent’), with 95% of people awarding them a maximum five stars rating. This is among the highest ratings I have seen for an investment platform on Trustpilot.

As always, if you have any questions or comments about this post or P2P property investment more generally, please do leave them below.

Disclaimer: I am not a qualified financial adviser and nothing in the article above should be construed as personal financial advice. You should always do your own ‘due diligence’ before investing and seek professional advice if in any doubt how best to proceed. All investing carries a risk of loss.

Please note also that this post includes affiliate links. If you click through and perform a qualifying transaction, I may receive a commission for introducing you. This will not affect in any way the terms you are offered or the product/service you receive.