How Much Should You Draw From Your Pension Pot in Retirement?

Today I’m addressing an issue that will be critical to many people approaching (or in) retirement. That is, how much to draw from your pension pot (and other investments) to supplement your state pension.

I’ll start by telling you about a conversation I had recently that made me think about this…

Talking to Mike

A few weeks ago I had my annual review with my financial adviser, Mike (if you want to know why a money blogger needs a financial adviser, you can read my post about this here). It was done by video call on this occasion, naturally.

One major topic of conversation was the fact that later this year (God willing) I will reach my 66th birthday and start receiving my state pension. I should qualify for the full state pension, which from April 2021 will be £179.60 a week or £9,339.20 a year.

As Mike pointed out, when you add this to my other income from this blog, my small private pension, other investments and my solar panels, this will put me in quite a strong financial position. So he recommended that at that time I reduce the amount I draw from the other investments or even stop taking anything at all and let them carry on growing year by year (financial downturns permitting).

I could see where Mike was coming from. If I don’t actually need the money it might be sensible to leave it all where it is. For both practical and psychological reasons, however, I told him I don’t want to do that. Here are the two main reasons I gave him:

1. If I take no income from my investments, I will still be somewhat dependent on my blog for income. While I have no plans to stop running Pounds and Sense at the moment, I don’t want to have to rely on it to cover my outgoings as I grow older. Also, the income from my solar panels will end in about ten years – possibly sooner if there are any major technical issues (or I move).

2. I don’t have any particular beneficiaries I wish to leave my money to (I live alone since my partner Jayne died a few years ago and we didn’t have children). I don’t therefore see any merit in accumulating a large ‘pot’ that simply goes to benefit my sisters (much as I love them). I would rather enjoy the money while I can, while aiming to ensure that it lasts me out.

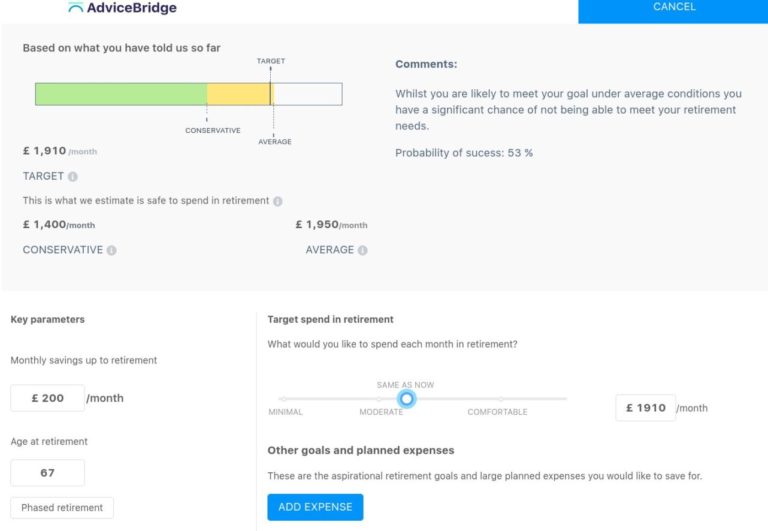

I told him my plan was therefore to reduce my withdrawals to a sensible level where my capital should be preserved and hopefully continue to grow a little. Four percent is a common rule of thumb for this, so I am looking at that as a starting point (though willing to accept Mike’s expert advice on the exact level). I plan to review this every year, based on my needs and circumstances and how my portfolio has been performing.

If I have more money coming in than I require, I don’t see that as a problem. I will spend it (maybe on a few extra holidays), save it or reinvest it, and maybe give some to charity and/or friends/relatives who are in need. As they say, you can’t take it with you, so I have decided that will be one of my guiding principles going forward!

I shared these thoughts in a subsequent email to Mike but haven’t so far received a reply from him. If I do, I’ll update this post accordingly 🙂

That Crucial Question

I am obviously not alone in facing a decision of this nature. With most people nowadays relying on a pension pot to finance retirement rather than a guaranteed lifetime pension, many of us will have to grapple with the question of how much income we should be withdrawing to supplement the state pension.

- And yes, I know the state pension will continue as long as we need it. But while it is obviously an important source of income for most people in retirement, it is nowhere near enough to finance a comfortable retirement on its own.

Of course, none of us comes with a sell-by date. Pension planning would be so much simpler if we did. If we knew the exact date we were going to expire, we could plan our retirement precisely.

So if I knew I was going to die in five years, I could live the (moderately) high life, burn my way through my savings and investments, and leave just enough for my relatives to pay for my funeral!

On the other hand, if I knew I could look forward to another thirty years, that would of course be wonderful, but I would need to plan carefully to ensure my pot didn’t run out before I did. But as none of us knows how long we have on this planet, a long-term strategy is the only sensible option really.

The question of how much to draw from your pension pot (and other investments if any) therefore needs very careful thought. In particular, the following considerations may apply:

- It’s clearly sensible to try to ensure that enough money will remain in your pot to see you through to deep old age (e.g. 100).

- If you’re keen to pass on a legacy to your children (or some cause dear to your heart) you will need to be more cautious about how much you withdraw.

- On the other hand, if you aren’t so worried about passing your wealth on, then there is no point in depriving yourself now.

- Tolerance for risk is another factor. If you worry that the 4% rule is too chancy, you could reduce your withdrawals to 3% or less.

- There may be other considerations too. For example, if you have a life-limiting medical condition, that may alter the equation in favour of a more bullish approach.

- There is also the matter of whether you own your home. If so, you will have the scope to raise extra money if needed by downsizing or using equity release.

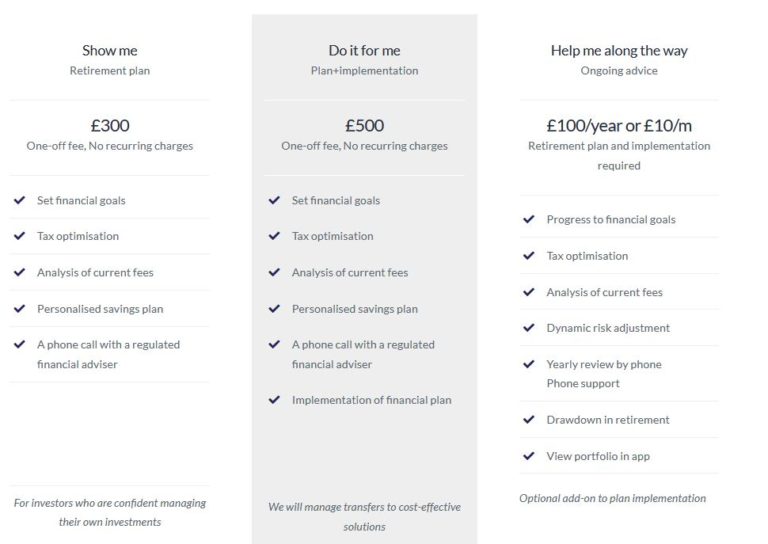

- Tax may be an issue as well. The state pension counts as taxable income and so do most private pensions. If the total amount you draw exceeds your personal allowance, you may have to pay tax on it. This is something you might want to discuss with a financial adviser.

- And finally, if you have a particular ambition or goal you wish to achieve during retirement (going on a world cruise, for example), you will of course need to ensure enough money is set aside to cover that when the time comes.

As mentioned above, a common rule of thumb is that to provide the best chance of preserving the value of your investments, you should limit withdrawals to no more than 4% of your capital per year. So if, for example, you have a pension pot of £50,000 and draw 4% annually from that, that would be £2,000 a year or about £167 a month. Drawing that would hopefully ensure that the value of withdrawals is on average balanced out (at least) by growth in the value of your investments.

- Of course, the 4% rule is only a rough guide and needs reviewing regularly according to how your portfolio performs.

When pension freedoms were introduced in 2015, there was some concern that people might ‘blow’ their pension pot on a luxury car or a yacht, but actually I think the vast majority of older people are more sensible than that. Indeed, I think the opposite mistake is more common – people drawing too little and leading a life in retirement that is unnecessarily frugal rather than enjoying the money they accrued during their working lives. But in any event, this is a question we all need to think very carefully about as we attempt to chart a balanced course into retirement and old age.

So those are my thoughts on this important subject (one I know many people don’t really like to think about). But what is YOUR view? Please post any comments or questions below as usual