From Saving to Spending: The Retirement Mindset Shift

Today I’m looking at a subject that may affect many readers of this blog who have recently (or not so recently) retired. It’s certainly a concern that I’ve faced myself (discussed later in the article).

For decades, many of us save diligently for retirement, carefully managing our finances to ensure what we hope will be a comfortable future. But once we finally reach retirement, a surprising challenge can emerge: shifting from a saving mentality to a spending one.

This transition can be difficult, even stressful, leading to problems such as excessive frugality, missed opportunities for enjoyment and unnecessary financial anxiety. Understanding why this happens – and how to navigate it – can help retirees make the most of their ‘golden years’.

Why Can it be Hard to Spend in Retirement?

For most of our working lives, we are conditioned to save for the future. The importance of building a pension pot, maximizing savings and preparing for the unexpected is constantly emphasized. Over time, this mindset becomes deeply ingrained, making it hard to reverse once retirement begins.

Here are some key reasons why many retirees struggle with spending…

Fear of Running Out of Money – With no regular salary coming in, retirees often worry that their savings won’t last. This fear can be worsened by rising living costs, potential healthcare expenses, and uncertainty about how long they will need their money to last.

A Lifetime Habit of Frugality – Many people have spent decades budgeting carefully, avoiding unnecessary expenses and prioritizing financial security. Suddenly being told it’s ‘okay’ to start spending feels unnatural, even reckless.

Uncertainty About the Future – Unlike a working salary, which can be replenished, a pension pot or savings account feels (and generally is) finite. Economic uncertainty, stock market fluctuations and potential care costs make it difficult for retirees to gauge how much they can safely spend.

The Problems of Excessive Frugality

While being cautious with money is clearly advisable, being overly frugal can unnecessarily reduce quality of life. Some retirees deny themselves experiences, comforts and even essentials because they feel they ‘shouldn’t’ spend. Here are some reasons why this can be problematic…

Missed Opportunities – Retirement is meant to be enjoyed, yet some people avoid holidays, hobbies or social outings because they fear dipping into their savings.

Health and Well-being Risks – Reluctance to spend on home improvements, heating or even nutritious food can have serious consequences for health and safety.

Unnecessary Financial Stress – Constantly worrying about money can take a toll on our mental well-being, even when there are sufficient funds available.

Regret Later in Life – Some realize too late that they were overly cautious and could have enjoyed their retirement more. By the time they feel comfortable spending, they may no longer be fit and healthy enough to do so.

How to Develop a Healthy Spending Mindset

Making the shift from saver to spender requires a conscious effort, but is possible with the right approach. Here are some suggested guidelines to embrace the opportunities presented by retirement whilst still maintaining financial security…

Create a Retirement Spending Plan

Just as saving required a strategy, so too does spending. Work out a realistic budget that includes essentials, discretionary spending and an emergency fund. This can provide reassurance that spending on enjoyment is both affordable and sustainable.

Think of Your Savings as a Paycheque

Rather than seeing savings as a lump sum to be preserved, treat it like an income stream. Regular withdrawals – whether from a pension or other savings – can make spending feel more structured and less daunting.

Prioritize Experiences

Research shows that spending money on experiences rather than possessions leads to greater happiness. Travel, hobbies and social activities can provide fulfilment while keeping finances under control.

Reframe Money as a Tool for Happiness

Rather than viewing savings as something to hoard, retirees can shift their perspective to see money as a resource for a fulfilling and comfortable life. This change in mindset can help ease spending anxieties.

Consider Gradual Adjustments

If spending feels uncomfortable, starting small can help. For example, try increasing your leisure budget gradually or treating yourself to one extra luxury per month. Over time, this can help you feel more at ease with enjoying your wealth.

Take Financial Advice

A professional financial adviser can help retirees feel confident about how much they can afford to spend while ensuring their money lasts. Regular reviews of pensions and investments can provide reassurance (see My Experience, below).

Give Yourself Permission to Enjoy the Rewards of Saving

Remember why you saved in the first place – to have security and enjoyment in later life. A balanced approach ensures financial stability while allowing for a fulfilling retirement.

My Experience

I have been officially retired for several years now. I still do a bit of freelance work (and run this blog) but my freelance income has tapered off. I am fortunate to have some savings and investments, the bulk of which I acquired through inheritances (though some from money I saved over the years).

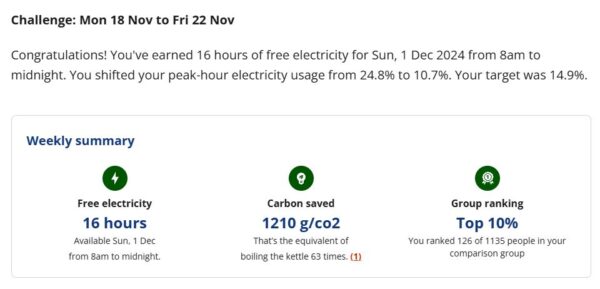

As regular readers will know, although I’m a money blogger with a particular interest in such matters, I do have a personal financial adviser myself (I talked about this a while ago in this article). His name is Mike, and in my recent annual review he gently suggested that I could afford to withdraw a bit more from my investments. Essentially, he told me that I wasn’t getting any younger (I’m 70 this year) and there would be no benefit to dying with a lot of money left in my account. In some ways I found this advice encouraging, in others a bit depressing!

I do accept the gist of Mike’s advice, though. Even though I’m basically in good health, none of us knows what the future may hold. So I have promised Mike that I will think about what he has said and consider whether to draw more from my investments, while still leaving enough to cover my possible health and care needs in future. Of course, without a functioning crystal ball this isn’t an easy task, especially with the very high cost of care in the UK. But it’s important to take a balanced view and ensure you aren’t depriving yourself unnecessarily now whilst still retaining sufficient funds in case circumstances change in future.

Closing Thoughts

As I said at the start, the shift from saving to spending can be one of the biggest psychological adjustments in retirement.

Retirement is meant to be enjoyed, but many retirees find themselves trapped in a frugality mindset that stops them fully embracing the opportunities presented by this stage of life.

While financial prudence is important, excessive caution can lead to missed opportunities and unnecessary sacrifice. By shifting perspectives, planning carefully and embracing the idea that money is there to be used and enjoyed, retirees can – hopefully – strike a balance between financial security and enjoying their hard-earned wealth.

As ever, I’d love to hear any views (or tips) from readers about walking the tightrope between preserving your savings and making the most of life while you can.