How to Reduce the Impact of Tax Rises in Rachel Reeves’ First Budget

Updated and expanded 13 October 2024

The first budget under new Labour Chancellor Rachel Reeves is scheduled for Wednesday 30 October 2024.

Speculation is rife about potential tax rises aimed at addressing the country’s economic challenges. But while tax increases appear inevitable, there is still time to take proactive steps to minimize their impact on your finances.

Here are some tips for how to prepare for and reduce the burden of potential tax hikes.

1. Maximize Tax-Efficient Savings and Investments

One of the most effective ways to protect yourself from higher taxes is by taking full advantage of tax-efficient savings and investment vehicles. These include:

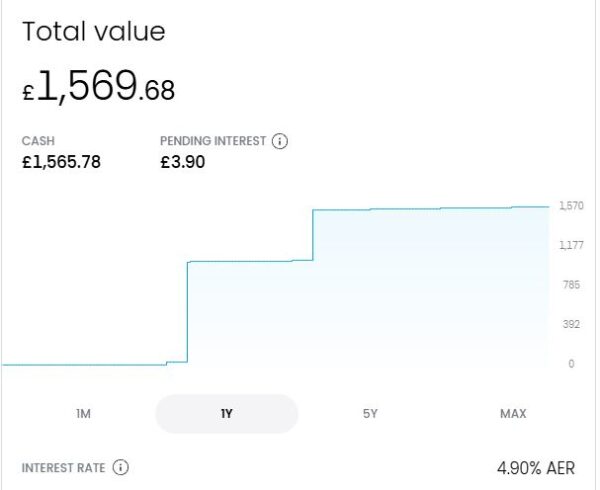

- ISA Allowances: The annual ISA (Individual Savings Account) allowance is currently £20,000. Money saved in an ISA grows tax-free, meaning you won’t pay any income tax, dividend tax or capital gains tax (CGT) on any profits made. As well as Cash ISAs, you can invest in Stocks and Shares ISAs and Innovative Finance ISAs (IFISAs).

- Personal Savings Allowance (PSA): Basic rate taxpayers can earn up to £1,000 in savings interest tax-free. Higher rate taxpayers get a reduced allowance of £500.

- Starting Rate for Savings: For those with a low overall income, the starting rate for savings can be especially beneficial. If your total income (excluding savings interest) is less than £17,570, you may qualify for the starting rate for savings, which can provide up to an additional £5,000 in tax-free interest. This is discussed in more detail in my recent post How to Maximize Your Tax-Free Savings Interest.

- Premium Bonds: These offer a chance to win tax-free prizes each month. While the odds of a big win may be slim, any winnings are tax-free. Some other National Savings and Investments products, like certain Savings Certificates, also offer tax-free interest.

- Venture Capital Schemes: For those willing to take more risk, schemes like the Enterprise Investment Scheme (EIS) and Seed Enterprise Investment Scheme (SEIS) offer significant tax reliefs, including income tax relief and capital gains tax exemption on profits.

2. Diversify Your Investments

Diversification remains a cornerstone of sound investment strategy, especially in times of political and economic uncertainty. By spreading your investments across different asset classes – such as equities, bonds and property – you can reduce the risk of any single investment adversely affecting your portfolio. Consider international diversification as well to hedge against possible downturns in the UK economy.

3. Consider Using a ‘Bed and ISA’ Strategy

If you hold a lot of investments outside an ISA or other tax shelter, this can be a good strategy to reduce your tax liability.

Bed-and-ISA involves selling taxable stocks and shares and then repurchasing them within an ISA wrapper. This allows you to transfer investments into a tax-protected environment, where future gains and income will be sheltered from tax. Note that you cannot transfer taxable stocks and shares directly into an ISA, but Bed-and-ISA performs the same function.

On the minus side, Bed-and-ISA may incur some costs in terms of transaction fees and any difference (spread) between selling and buying prices. You may also become liable for CGT if any profits realized exceed your annual tax-free allowance. The long-term benefits can be substantial, however. This applies especially if – as seems likely – tax-free CGT allowances are reduced and the rates payable are increased. Of course, the Conservatives started doing this when they were in power.

4. Rebalance Your Portfolio Towards Tax-Efficient Assets

Different types of investments are subject to different levels of tax. It’s important to rebalance your portfolio to favour assets that could be less impacted by tax hikes.

- Dividends: The tax-free dividend allowance for 2024/25 is £500, and anything above this is taxed at rates of 8.75% (basic rate taxpayers), 33.75% (higher rate), and 39.35% (additional rate). If dividend tax rises further, you may want to limit investments in dividend-paying stocks outside of tax-free wrappers like ISAs and pensions (see above).

- Capital Gains: The capital gains tax (CGT) allowance has dropped to £3,000 for the 2024/25 tax year, and there are fears it could be cut further. Consider selling assets to crystallize gains while you can still use your allowance, or shift investments into tax-free vehicles like ISAs using the ‘Bed and ISA’ (or ‘Bed and Pension’) strategy discussed above..You can also offset capital gains with capital losses. If you have investments that have performed poorly, selling them to realize a loss can help offset gains elsewhere in your portfolio. Remember that CGT only applies when a profit (or loss) is actually realised.

- Bonds: Government and corporate bonds are often seen as lower-risk investments and may be less vulnerable to tax increases than equity income streams. You might want to consider including more bonds in your portfolio.

- Commodities: Gold and other commodities have traditionally been seen as a safe haven in times of economic upheaval. There are risks, however, and it’s important to do your own ‘due diligence’ and seek professional advice before going down this route.

5. Use Your Pension Allowance

Pensions are one of the most tax-efficient ways to save for the future. Contributions receive tax relief at your marginal income tax rate, which means for every £100 you contribute, the government effectively adds £20 for basic-rate taxpayers, £40 for higher-rate taxpayers, and £45 for additional-rate taxpayers.

Consider increasing your pension contributions to mitigate the impact of other tax rises. Just be sure to keep within the current £60,000 annual pension contribution limit. Note that for those earning over £260,000 (adjusted income), the tax-free allowance tapers. More info about this can be found on the government website.

If you’re self-employed, consider setting up or increasing contributions to a private pension or Self-Invested Personal Pension (SIPP) to take full advantage of these benefits.

6. Plan for Inheritance Tax (IHT) Rises

Inheritance tax has long been a controversial topic, and it may well increase under the new government. Currently, the IHT threshold is £325,000, with an additional £175,000 allowance if you’re passing your main home to direct descendants. Anything above this is currently taxed at 40%.

To mitigate IHT risks:

- Consider making gifts: You can give away up to £3,000 per year tax-free, with additional allowances for wedding gifts and gifts from surplus income. Gifts between spouses are normally exempt from CGT or IHT, allowing you to transfer assets and take advantage of both partners’ allowances.

- Set up a trust: Placing assets in a trust may help reduce IHT liabilities.

- Life insurance policies: Some people take out policies specifically designed to cover future IHT bills. Always seek professional advice, however, as trusts and insurance policies can be complex.

7. Review Your Income Structure

Reeves may target income tax thresholds and reliefs, particularly for higher earners. Reviewing how your income is structured could help mitigate the impact.

- Salary Sacrifice Schemes: Consider participating in salary sacrifice schemes, where you give up part of your salary in exchange for benefits like pension contributions, childcare vouchers, or cycle-to-work schemes. This will reduce your taxable income.

- Dividend Income: If you run a business or own shares, taking income as dividends can be more tax-efficient than a salary, particularly if the dividend tax rates remain lower than income tax rates. Any good accountant will be able to advise you.

- Spousal Income Splitting: If your spouse is in a lower tax bracket, transferring income-generating assets to them can reduce your overall tax burden. This is particularly useful for rental income or dividends from jointly held investments.

8. Prepare for Property Tax Changes

Property taxes, including stamp duty and council tax, could see reforms or increases. Here’s how to plan.

- Bring Forward Property Transactions: If you’re considering buying (or selling) property, it may be wise to do so before any potential stamp duty increases are announced. Locking in current rates could save you significant costs.

- Consider Downsizing: If you anticipate increased council tax rates or other property-related taxes, downsizing to a smaller home could reduce your future tax liabilities and lower your overall living costs. And, of course, doing this should release some of the equity in your property, which you can then use to help maintain your standard of living.

9. Enhance Charitable Giving

If Reeves increases income tax or reduces the thresholds for higher tax rates, charitable giving can become a more attractive option.

- Gift Aid: Donations made under Gift Aid are tax-efficient, as charities can claim an additional 25% from the government. Higher-rate taxpayers can claim back the difference between the basic rate and higher rate of tax on their donations.

- Donor-Advised Funds: These funds allow you to make a charitable contribution, receive an immediate tax deduction, and then recommend grants from the fund over time. It’s a strategic way to manage charitable giving while benefiting from tax relief.

10. Stay Informed and Seek Professional Advice

Tax planning can be complex, especially in an uncertain economic environment. Staying informed about potential changes in the budget and seeking professional financial advice can help you adapt your strategy to minimize your tax liabilities effectively.

- Monitor Budget Announcements: Keep an eye on the budget and any subsequent economic statements to understand how proposed changes might affect you. Quick responses can sometimes yield significant tax savings.

- Consult a Financial Adviser: A qualified financial adviser can help tailor a tax-efficient strategy to your individual circumstances, taking into account your income, assets, and long-term financial goals.

Closing Thoughts

While tax rises in Rachel Reeves’ first budget may be inevitable, UK residents have various strategies at their disposal to mitigate the impact.

By taking advantage of tax-efficient investments, restructuring income and staying informed, you can protect your wealth and ensure that any tax increases have a minimal effect on your financial well-being. As always, professional advice tailored to your specific situation is invaluable in navigating these changes effectively.

If you have any comments or questions about this post, please do leave them below. But bear in mind that I am not a qualified tax adviser and cannot provide personal financial advice. All investing carries a risk of loss.