Watch Out for the Catch in This Cashback Scheme!

I had a phone call last week from an elderly friend wanting advice. She had just bought some medical supplies on eBay and an ad had come up offering her money back plus a cash bonus. She was keen to know whether this was genuine or not.

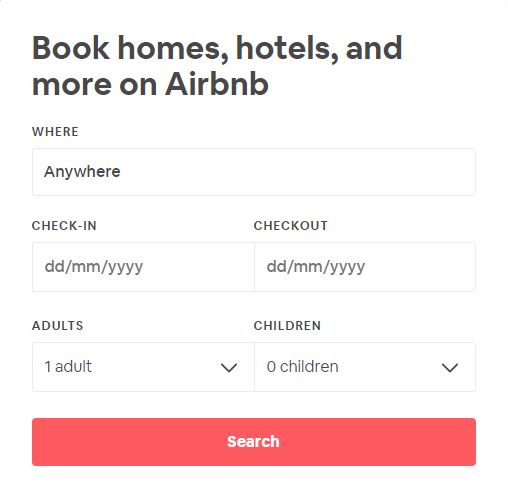

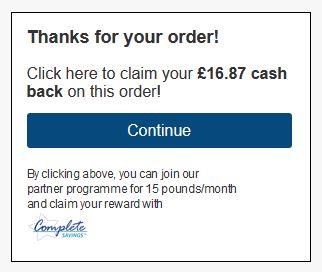

Unfortunately I had to tell her that it wasn’t as good an offer as it appeared. This ad – which I have seen many times myself – appears when you have made a purchase at any of a range of online stores, including eBay. Here’s what it looks like…

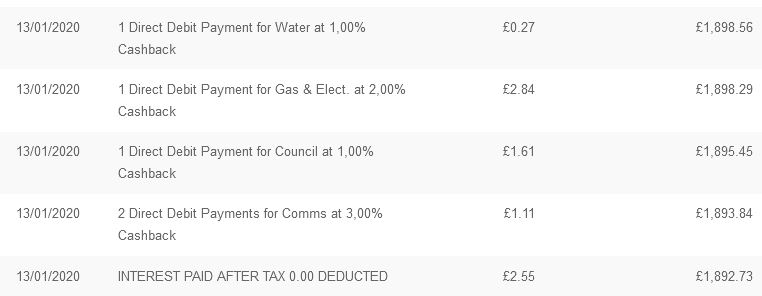

As you may be able to see from the (tiny) logo at the bottom, this ad comes from a company called Complete Savings. They describe themselves as a cashback site, but as the smaller message below the eye-catching headline reveals, they charge your credit or debit card £15 a month for membership until you cancel.

So Is This a Scam?

I would hesitate to describe Complete Savings as a scam, but the fact remains that – as this Which? article from 2018 confirms – a lot of people are being caught out by it. If you’re in a hurry, it’s easy just to see the eye-catching headline and click straight through to the application form. One lady mentioned in the Which? article didn’t notice she was being charged for five months and ended up £90 out of pocket.

Or you might be like my elderly friend. Her eyesight is poor and she can’t easily read the small print in ads, especially on her mobile phone. She is also relatively new to online shopping (while having to do much more as she is self-isolating). It isn’t hard to see how people such as her could be inadvertently drawn in.

I should make clear that you aren’t automatically signed up just by clicking on the ad. An online application form will appear, and this will hopefully alert you to the fact that you are registering for a subscription-based service. But if you’re in a hurry, or confused, or misunderstand what’s on offer, you could complete the form without realising what exactly you’re signing up for. According to the Which? article mentioned above, they receive a steady stream of complaints from people who have done exactly this.

So Is It Worth Joining?

For your £15 a month, Complete Savings offer discounts from a range of online retailers, including Superdrug, Wickes, B&Q, Hermes, and eBay. Judging from the Complete Savings homepage the standard discount seems to be 10%, although the website says this is the minimum.

To get discounts, you first have to go to the Complete Savings site and click through to the merchant concerned from there. The merchants pay commission to Complete Savings for people buying via their link. All being well, a share of this will be credited to your account as cashback in due course. You can then withdraw this to your bank account once you have earned at least £5.

If you shop online a lot, the cashback could potentially cover the £15 a month fee and be worth your while overall. If you just buy the odd thing online that’s unlikely to be the case, though.

My Thoughts

In my view there are many better ways to get discounts/cashback than Complete Savings (or its sister site Shopper Rewards & Discounts)

As mentioned in this blog post, popular cashback sites such as Quidco and Top Cashback are free to join and offer cashback from a huge range of merchants – in many cases at better rates than Complete Savings. I recommend signing up with all three, and also checking out Cashback Angel, which lets you compare which free cashback platform is offering the best deal for any particular merchant.

Overall, then, my advice is to be very wary of this offer and don’t click on the ads unless you really want to pay £15 a month for a cashback programme when better, free ones are available. And if you know any elderly people or people new to online shopping who may be tempted, warn them it’s not as great a deal as may at first appear. Do them a favour and recommend they sign up with a free cashback site instead!

As always, if you have any comments or questions about this post, please do leave them below.