Could You Be a Holiday Let Landlord?

Tourism in many parts of the UK is booming right now.

As we come out of the pandemic some people are venturing abroad again. But many others (perhaps deterred by the remaining restrictions and long queues and cancellations at airports) have been discovering (or rediscovering) what this country has to offer. This in turn has led to a growing demand for holiday rentals. That is only likely to increase as overseas visitors start to return as well.

There is undoubtedly money to be made from holiday lets, so in my post today I shall be looking at this subject in more detail. The article is written in association with my friends at the Suffolk Building Society and I shall be quoting from their detailed research on this subject (and using some of their graphics!).

Let’s start with the most crucial consideration for would-be holiday let landlords…

Table of Contents

Setting

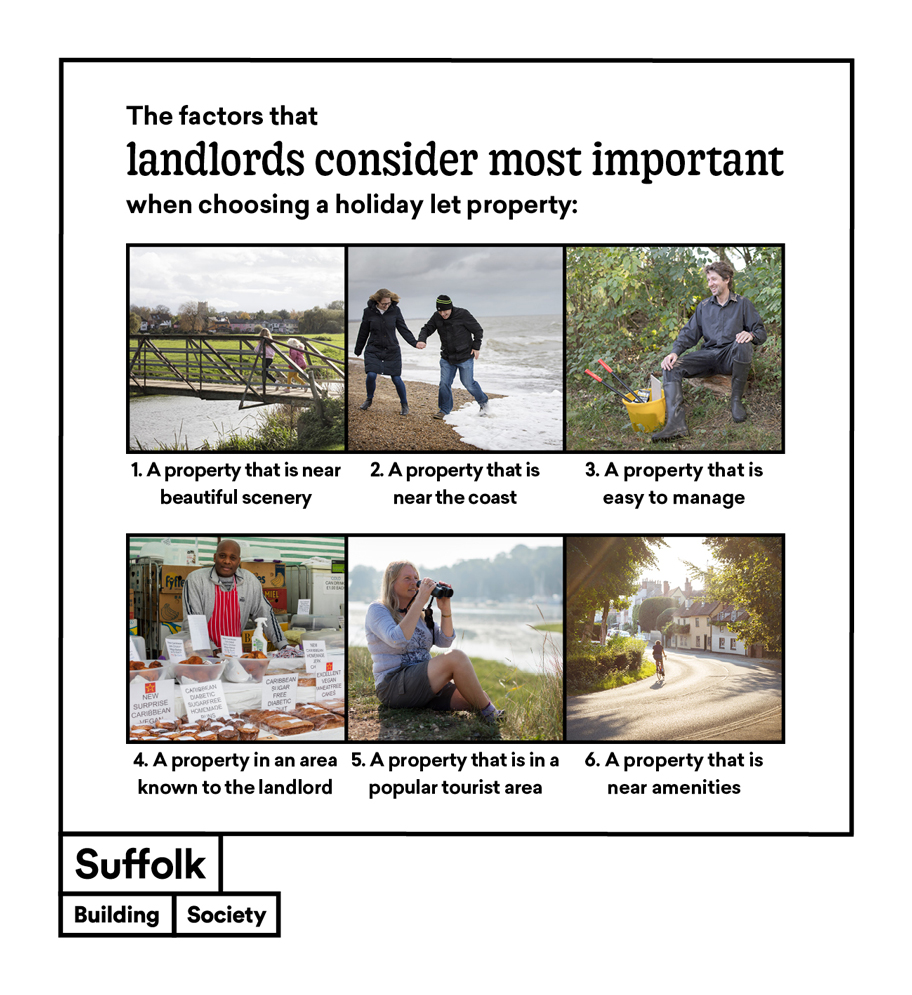

A recent study by the Suffolk Building Society found that the setting of a property was more important for potential landlords than other factors such as renovation potential or proximity to amenities. The key aspects for would-be landlords when considering buying a holiday let were:

-

A property that is in or near beautiful scenery (31%)

-

A property that is near the beach or coast (30%)

-

A property that is easy to manage and doesn’t require much upkeep (28%)

-

A property that is in an area that the landlord already personally knows or loves (27%)

-

A property that is in a popular tourist or holiday destination (23%)

This is summed up in the graphic below.

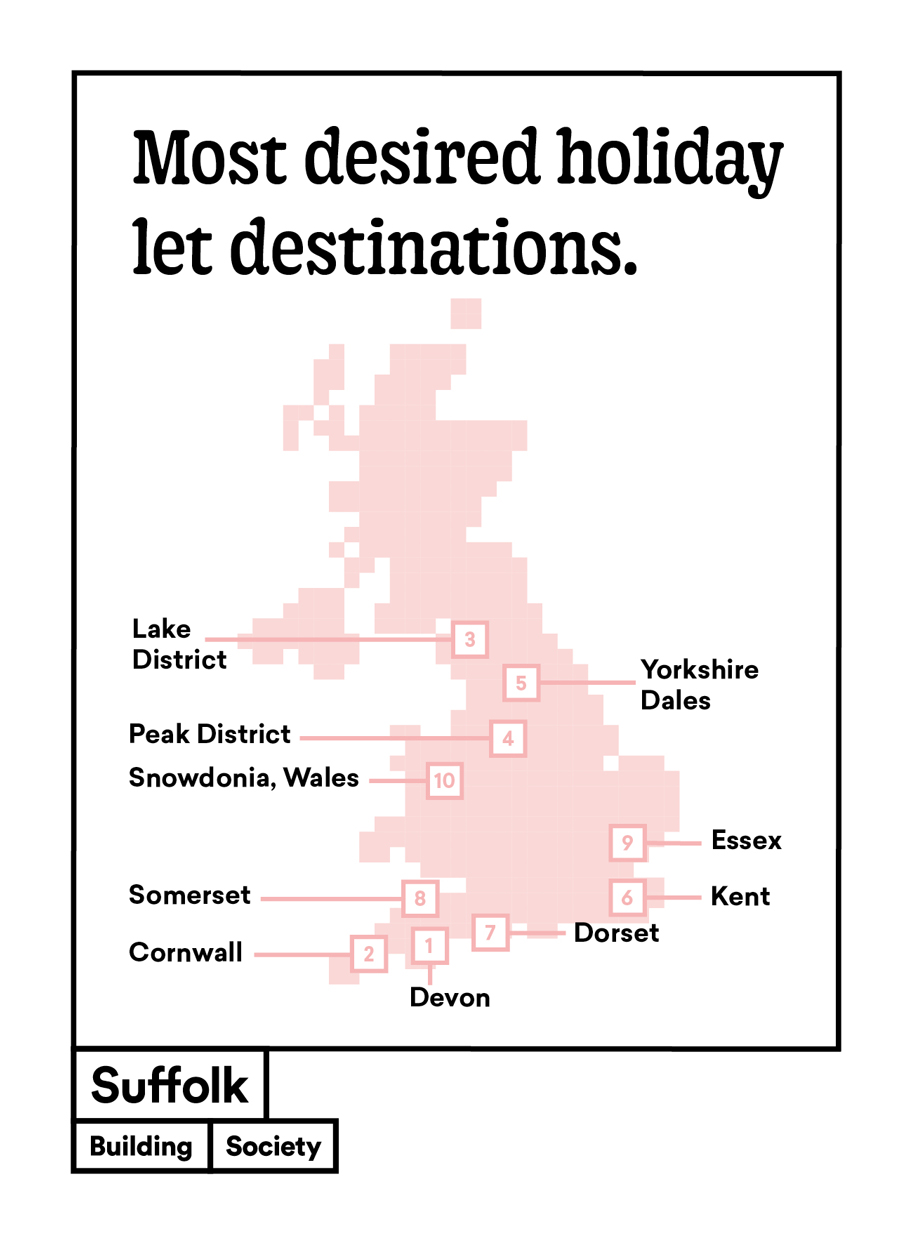

Location

As you can see in the graphic below, Devon and Cornwall were the locations most aspiring holiday let landlords were considering, followed by the Lake District, Peak District and Yorkshire Dales.

How Much Can You Make?

Being a holiday let landlord has many attractions, including significantly higher returns than are achievable from residential lets.

An apartment in a popular tourist area, for example, can generate £1,000 a week or more (in peak season at least). A recent report in Which? found that the average annual yield on a holiday let was just over 10%. This compares favourably with residential buy-to-lets, where around 7% a year is more typical. The Which? article mentioned above forecasts holiday let yields rising in future to 14% or more.

According to Sykes Holiday Cottages, the average holiday let owner is earning approximately £21,000 per year. You can also enjoy cheap holidays staying at the property yourself. And there are tax advantages too, as running a furnished holiday let (FHL) is considered a trade rather than an investment. This means you can offset mortgage interest costs against your income, as well as council tax and other bills.

On the downside, being a holiday let landlord is likely to be more hands-on. New tenants will move in every few days and the property will need to be cleaned, tidied and restocked on a regular basis. Covid precautions have added an extra dimension to this (though rules are now easing). There will be more admin dealing with a steady stream of enquiries and visitors. You will need to budget for advertising too, or risk ‘voids’ when your property is empty and you are losing rather than making money. And finally, any garden at the property will need tending as well.

You can of course outsource some (or all) of this work to a management agency, but naturally there will be a cost to this, impacting your bottom line

Tips for Would-be Holiday Let Landlords

If you are planning to buy a holiday let property with a mortgage (as most people do), there are some important things to bear in mind. Buying a holiday let differs in some significant ways from buying a home to live in or even a traditional buy-to-let.

-

Be aware that many holiday let mortgages require a landlord to have a mortgage, own their main residential property first, or have buy-to-let properties already – and in some instances, a combination of these.

-

Understand that some lenders also have age restrictions for first time landlords, even if they are already residential home owners.

-

Affordability assessments for holiday-let properties are usually calculated on the property’s rental potential rather than personal income and outgoings, but the lender will still want to understand the applicant’s financial position.

-

Applicants may have to demonstrate a minimum income set by the lender, but this income can often be from a combination of employment, self-employment, investments, pensions, and so on.

-

Be prepared to show third-party evidence of rental value in low, mid and high seasons from a verified lettings agent – even if not planning on using an agency to manage the property.

-

Expect that the property will also be assessed by the mortgage lender. Properties in holiday parks, caravans or lodges, and those of unusual construction method may not always be accepted.

-

Applicants should not assume they can market their property on short-term lettings sites such as Airbnb and Vrbo – some mortgage lenders have rules that prohibit this.

-

Check the amount of personal use allowed so as not to breach terms and conditions. Mortgage companies will always allow the owner a certain amount of personal use but this can vary.

-

Check whether the mortgage lender has a limit on the number of holiday let and/or buy to let properties that the landlord is allowed to own.

-

Specialist holiday letting insurance must be arranged with public liability cover (typically minimum £1 million) included.

Suffolk Building Society’s Head of Mortgages, Charlotte Grimshaw, says: ‘Before jumping on the [holiday let] bandwagon, potential owners should do their due diligence; consider the financial commitments of not just the purchase but the maintenance, taxes, and other expenses such as cleaners and gardeners. It’s also worth taking the time to understand the market, and check out the competition before falling in love with a property that isn’t viable in terms of lettings.’

And she adds: ‘Applying for a holiday let mortgage can be a little more complex than applying for a traditional residential property or buy to let, so it can be helpful to approach an independent mortgage adviser to ensure the application has the best chance of success. A mortgage adviser will also have a good understanding of the different criteria that mortgage companies request, helping landlords find the most suitable product.’

Final Thoughts

Thank you again to my friends at Suffolk Building Society for their help with this article. I hope it has opened your eyes to the money-making potential of holiday lets. And if you are among the 17% of UK adults who (according to the SBS survey) considered buying a holiday let property during the pandemic, I hope it has given you some points to think about.

SBS offer holiday let mortgages themselves (along with standard buy-to-let and other mortgages). You can read more about their holiday let mortgages here.

- You might also enjoy reading my blog post Can You Still Make Money From Buy to Let? although this is more about letting residential property.

As always, if you have any comments or questions about this post, please do leave them below.

May 13, 2022 @ 2:57 pm

This is something I always wanted to do when I was younger. I’d love to move to Great Yarmouth one day, and if I can afford to buy a couple of holiday lets when I get there, it’s definitely something I’ll consider doing. After all, people are always looking for a place to stay when they go to the seaside! 🙂

Louise x

May 13, 2022 @ 3:49 pm

Thanks, Louise. Yes, it’s an attractive idea, isn’t it?

May 15, 2022 @ 8:05 pm

I think this is something we would like to do, especially as we holiday in the UK a lot so it would mean a bolthole for us too in the down season! But sadly we’re not in a position to do it right now. I will bookmark this for the future though 🙂