How to Claim Your State Pension

Next month (God willing) I will reach my 66th birthday and start receiving the new state pension. I have been told that I will get my first payment on Christmas Eve, which I find quite a pleasing thought 🎅

Pounds and Sense is of course aimed primarily at older readers, some of whom will be coming up to state pension age as well. So I thought it might be useful to set out here what the process involves (and my experience with it).

The first thing to say is that you won’t automatically start receiving the state pension from the relevant (currently 66th) birthday. You do have to claim it. Fortunately, for the great majority of people, this is a simple, straightforward process.

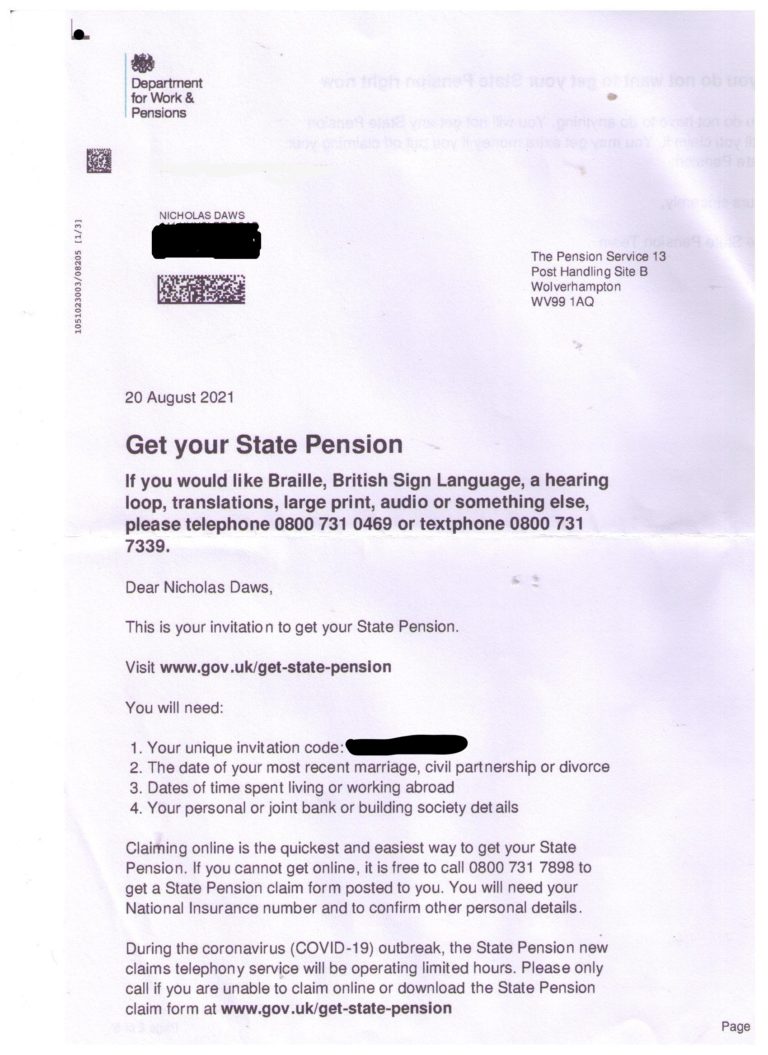

Assuming the system works correctly (as it did for me), if you are eligible for a UK state pension you should receive a letter from the Department for Work & Pensions (DWP) explaining how to claim. This should arrive about four months before your qualifying birthday. I have copied the first page of the letter I received below.

As you can see, the letter explains what you have to do to claim your pension online (it also explains other methods of claiming). Even if you don’t receive a letter, you can do this as long as you are within four months of reaching your state pension age.

You will need to visit the website https://www.gov.uk/get-state-pension and fill in the simple claim form there. You will be asked to enter a few items of information including.

- The invitation code on the letter

- The date of your most recent marriage, civil partnership or divorce

- Dates of time spent living or working abroad

- Your personal or joint bank or building society details (where you want the pension paid into)

If you haven’t had the letter so don’t have an invitation code, you can still apply via the website but will need to provide other identifying information.

And that is basically all there is to it. In my case, after I submitted my claim online, I received another letter about two weeks later telling me when I would start receiving my pension (and how much it would be). The state pension is paid every four weeks in arrears, but I was told I would receive a partial payment initially (on Christmas Eve) and then go on to a regular four-week cycle.

Other Points

If you don’t want to claim your stare pension as soon as you’re eligible, you don’t have to. If you simply delay claiming, DWP will assume you wish to defer. Your state pension will increase for every week you defer, as long as you defer for a minimum of 9 weeks. Your pension will increase by the equivalent of 1% for every 9 weeks you defer, which works out as just under 5.8% for every 52 weeks.

Although that might sound appealing, it will actually take quite a few years to ‘replace’ the pension you didn’t take – by my calculation, around 17 years. I discussed this a while ago in this blog post. In brief, though, I don’t recommend deferring for most people, unless perhaps you are in a well-paid job, and claiming the state pension on top would result in hefty tax charges. If that’s the case, I recommend seeking advice from a financial adviser or an accountant.

If you aren’t sure what date you will qualify to receive the state pension, if you enter your date of birth on this government website it will tell you.

If you want to know how much you are on track to receive (at current rates) this government website can give you that information (although you will need to provide proof of ID to use it). I also wrote a blog post on this subject. One important point is that if you don’t have enough National Insurance contributions on your record to qualify for the full new state pension, you may be able to make extra voluntary NI contributions to top up. If you are in this position, it will almost certainly be worth your while to do so.

I hope you have found these thoughts of interest, especially if you are approaching state pension age yourself. As always, if you have any comments or questions, please do leave them below. Bear in mind that I am not a qualified professional financial adviser, however, so cannot give personal financial advice.

November 13, 2021 @ 1:27 pm

I’m a good way off getting my state pension but this is the first time I’ve seen a letter about how to claim it and for once it doesn’t read as though you need a masters degree in further maths to

Figure it out!

November 13, 2021 @ 10:11 pm

Thanks, Rachel. Yes, thankfully it’s pretty straightforward.

November 13, 2021 @ 8:46 pm

I’ve still got a while until I can claim my state pension at age 67 but I’m glad to hear it shouldn’t be difficult once I get to that point. I’m trying to build my private one now.

November 13, 2021 @ 10:10 pm

Yep. Everybody should have both!

October 6, 2024 @ 8:43 am

What does deferring your pension actually mean,I will be 66 in April 2025 but intend to work for another year due to my wife not reaching pension age till 2026,so what happens to my pension.

October 6, 2024 @ 8:38 pm

Hi Brian. If you defer (i.e. delay) taking your state pension, you get a bigger pension once you start taking it. If you defer for a year, you will get an extra 5.8 percent on your state pension when you start taking it. See this official website for more info: https://www.gov.uk/deferring-state-pension/what-you-get

January 9, 2025 @ 1:39 am

Will I get my state pension on June 9 1959 I was born this year at 66

January 9, 2025 @ 9:25 am

Hi Gillian. You can check this yourself at https://www.gov.uk/state-pension-age When I did this on your behalf, it said your state pension will be payable from 9 June 2025, so in five months’ time. As it says in my post, you should get a letter from DWP before that date confirming your eligibility and requesting your bank details and so on. Happy retirement!