How to Invest for Income from High-Yield Share Dividends

Today I have a guest post for you from my fellow money blogger Lewys Lew, who blogs at The Frugal Student.

Lewys has a particular interest in dividend investment. As I know this is a subject of interest to many readers of this blog, I asked him to write about it here.

Over to Lewys, then…

I watched the Conservative party conference in despair!

Not because I’m a Conservative but because once again the vultures circle Theresa May and Brexit seems to be going backwards.

Not that I voted to leave, but this constant uncertainty unsettles me and the market.

To add a cherry on top of bad news, productivity in the UK has begun shrinking and we’re no better off than we were in 2007.

What this means for you and me is that the economy continues to struggle and along with that interest rates remain dire.

Sure, for those of us who save a few pounds a month there are some decent bank accounts out there that offer 2%+ interest but these usually come straddled with a set of conditions and maximum deposits.

For those with large sums lying dormant in bank accounts the deals on offer are pitiful. With the current rate of inflation, your cash-pile may even be worth less.

In this post, I’m going to share with you how you could earn 5% in interest yearly.

Before we begin, there are a few things to note:

- If you use this method your money is at risk.

- To reduce risk, you should be prepared to lock your money up for 5+ years.

- This method may not be suitable if you’ll need to use this money in an emergency

(remember to always keep six months’ worth of expenditure in an easy-access account) - Here’s some key terminology before we start:

Dividend = Money a company pays to you as a reward for being a share-holder.

Dividend Yield/Yield = A dividend as a percentage of a current share price, as so:

Dividend per share/Price per share.

Table of Contents

Right, let’s get stuck in!

Dividend investing is a vast field. Myself, I’m a dividend growth investor. At 24 years old, I seek to buy stakes in companies who are growing their dividend at a rapid pace. Over time these types of stocks often increase their dividends at higher rates than companies who already pay a dividend at a higher yield.

But for those who maybe don’t have the benefit of a 30-year investment horizon, dividend yield investing may be a better choice for you. Frankly, getting just 1% of invested monies back as a dividend each year isn’t going to satisfy you if you’re close to retirement or retired.

The good news is that there’s an alternative dividend investing method that could see you getting 5% of your invested monies back each year, along with some capital gains along the way.

I’ll illustrate dividend yield investing with this example…

National Grid is a very boring, steadily performing utility company. It owns and manages the UK’s grid structure along with some bits in the United States and in return is allowed to make a modest profit from its operations. It’s a monopoly, meaning that we don’t need to worry about competition or anything of that sort.

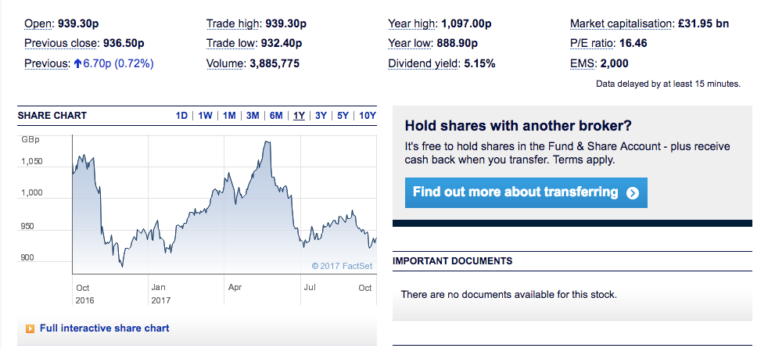

As we can see from the graphic below (from the Hargeaves Lansdown website), National Grid pays a 5.15% dividend. This effectively means that for every £100 you invest, you’ll get £5.15 back every year.

The good news is that National Grid buys back its own shares, pushing up the capital value of your holding and reducing the possibility of capital loss over the long term (5+ years).

Dividend investing can be especially powerful if you use your dividends to buy more shares.

£1,000 worth of National Grid shares would let you buy around 5 additional shares with the dividend after one year. Compound this over the years and you could really start building a decent stream of dividend income.

Pros and Cons of High Yield Investing

Cons

- When dividend yields go over 6%, this can be an indication that the stock is risky, as investors are fleeing the stock, thus reducing the share price and increasing the dividend yield (as this is relative to the price).

- Stock prices could fall below your original purchase price and dividend income combined, leading to a net loss.

- A large capital deposit is needed to make this method really effective; small amounts won’t really go a long way.

- You have to pay to buy/sell stocks.

- Identifying safe higher yield stocks can be difficult and time-consuming.

Pros

- A 5+% dividend yield smashes any bank account out there.

- The combination of steady stock price rises and dividend income can really boost your savings.

- Large and ‘boring’ companies such as National Grid are very resilient and it’s relatively unlikely that you’d find yourself at a capital loss if you held such stocks over five years.

- Remember that other investments can carry large risks and costs too. One such example is buying a rental property, where bad tenants, maintenance costs and the hassle can eat away at returns. By investing in a large company you won’t need to do anything else. Just sit back and soak up the dividends!

How Do I Buy Shares?

If you’re interested in building yourself a dividend income later on in life (40+) then I would certainly recommend chasing higher yields from boring large companies such as National Grid.

In order to buy shares you’ll have to sign up with a broker.

The most popular in the UK is Hargreaves Lansdown, but this platform charges a management fee of 0.45% annually, in the case of National Grid lowering your net income from 5.15% to 4.7%. They also charge £11.95 for share repurchases and 1% for dividend reinvestment.

To really reap the benefits of this strategy, I’d recommend signing up with online brokers De Giro, who only charge £1.75 a trade with no management fee.

If you like the idea of dividend yield investing but the risk is a little too high for you, I recommend you take a look at my Nutmeg Investment Review for a platform that manages your portfolio for you.

Many thanks to Lewys (pictured, right) for an eye-opening article.

Many thanks to Lewys (pictured, right) for an eye-opening article.

Personally I have tended to stick with self-selected funds and ready-made portfolios (including Nutmeg) for my core investments, but I can certainly see the attraction of high-yield share dividend investing for part of my portfolio – especially as (being semi-retired) I am now looking to generate an income from my savings.

Another thing in favour of dividend yield investing is that there is a generous annual tax-free dividend allowance (which most people don’t make use of). Currently you can earn up to £5000 a year in dividends before any tax is due. The government has threatened to reduce this to £2000, but even if that happens the allowance is still well worth taking advantage of, as it comes in addition to other tax-free saving and investment opportunities such as ISAs.

If you have any comments or questions about this post, as always, please do leave them below.

October 10, 2017 @ 11:41 am

This provides a lot of food for thought. I so wish I had been this savvy when I was in my early 20s. At the risk of sounding like an old fart, it was a different world then and saving for the future didn’t seem to be as important somehow. Would be good to try and make up for it now though, interesting insight

October 10, 2017 @ 11:43 am

Thanks, Suzanne. Yes, me too. I would probably be a millionaire by now if that had been the case! I predict a bright future for Lewys!

October 11, 2017 @ 10:26 am

A really interesting read. There I am about to look into buying the shares mentioned where I can get £8 for every £100 I buy and I see the share price is £1000 per share! Ouch!

Would love to read more about it so will head over to Youngster Lewys blog for more.

Thanks for bringing it to my attention.

The Reverend

October 11, 2017 @ 10:45 am

Thanks for this. My understanding is that the share price you refer to is in pence rather than pounds, so currently National Grid shares are priced at around 954p or £9.54 per share. I will ask Lewys to confirm this, but I’m pretty sure that’s the case.

October 11, 2017 @ 11:23 am

From what I read from the investor page it is £941 per share at the moment, however I might be reading it wrong.

http://investors.nationalgrid.com/share-information/calculator/lse-calculator.aspx

I also noticed that the dividend was strong because they gave out a special interim of 84p per share. Usually they give out about 40-45p per share per year but this year it will be well over 110pps. Which is ace but they haven’t had a special interim payment in the 14 years of data they give on the investor page – only the ‘usual’ interim payment but this has been increasing and is over double what it was in 2002

I am slowly reading Lewy’s blog and I am find it interesting reading.

🙂

The Reverend

October 11, 2017 @ 11:32 am

That price is actually 941p or £9.41. That is the way prices are quoted on the London Stock Exchange. This forum page discusses this subject: https://www.askaboutmoney.com/threads/how-to-read-share-price-on-london-stock-exchange.84771/ . If I can find a better reference than that, I will add it here.

The other questions are probably more suitable for Lewys to answer. I have already emailed him and am hoping he will reply soon.

October 11, 2017 @ 11:34 am

Hi Reverend,

The price is displayed in pence not pounds 🙂

so something displaying as 1000p = £10

I still find it confusing now and again!

Lewys

October 11, 2017 @ 11:35 am

Many thanks for confirming this, Lewys 😀

October 11, 2017 @ 9:39 pm

Thanks Lewys for clearing that up.

October 11, 2017 @ 1:19 pm

The 84p relates to a ‘special’ dividend after the sale of some US assets. This isn’t accounted for in the ‘5.15%’ advertised yield.

If there was to be an additional dividend paid then this would be on top of the 5.15% :)!

Hope that makes sense.

October 11, 2017 @ 1:45 pm

Thanks for the clarification. That special dividend looks to have been a nice little bonus for shareholders then. 🙂

October 11, 2017 @ 8:07 pm

Some great tips here. Also, it’s worth considering investing in funds rather than just a few companies to spread the risk.

October 11, 2017 @ 8:37 pm

Thanks for the comment. I guess that might be a good subject for another post 🙂

October 22, 2017 @ 7:55 pm

I’m puzzled as to why so many investing/FIRE blogs use dividend stocks as their main/sole strategy. I can understand that’s a sensible approach for people at/close to retirement like yourself, Nick, as it provides income without depleting capital, but for people who are 20, 10, maybe even 5 years from retirement, I don’t get the logic behind it.

On Lewys’ own blog (which doesn’t seem to have any comments facility, hence why I’m raising the issue here), his guide to investment strategies suggests funds (managed, passive, or robo-invested) as the easiest and safest forms of investing, so why does he go for individual stocks? And why dividends rather than growth? Particularly as dividends are taxed but growth isn’t, and many investment platforms also have a charge for reinvesting them?

It’s not like funds are low-yielding either; the top 10 highest-performing funds are currently giving an annualised return of between 26% and 32% (and no, there isn’t a decimal point missing!). Even allowing for fees (I personally avoid any above 0.8%), that is a much higher yield than those quoted above for dividends.

I’m very happy with how my funds are performing in my ISA, but I have this nagging feeling I must be missing something! Can someone pleae explain why dividends are a good choice for people who don’t actually need that income?

October 23, 2017 @ 11:47 am

Thanks for raising some interesting points. Obviously Lewys knows more about this subject than I do, so I have written to draw his attention to your comments, in case he wishes to respond to them.

I would just like to make a couple of points of my own, though. First, I am with you insofaras generally I prefer to invest in funds rather than individual stocks. However, while some funds have delivered very good returns over the last few years, there is no guarantee that any particular fund will continue to do so. You only have to check out the recent performance of Neil Woodford’s funds to see that past performance is no guarantee of future profits. With “safe” stocks such as the ones Lewys is advocating, on the other hand, you do have a reasonable guarantee that dividends will continue to be paid at around this level year after year, regardless of how the stock market overall performs.

Also, it’s not strictly true that “dividends are taxed but growth isn’t”. In an ISA wrapper neither are taxed, but outside this wrapper both may be. There is currently a £5,000 annual tax-free allowance for dividend income (still quite generous). Price growth of shares or funds outside an ISA may result in a CGT liability if it exceeds the annual allowance, which is currently £11,300. That is obviously even more generous than the dividend allowance, but if you dispose of a large taxable asset in the year in question you could easily use it up. Of course, CGT normally only applies when you dispose of the asset in question, which leaves more scope for tax planning.

Anyway, I’ll leave it to Lewys if he wants to add anything else, but thanks again for taking the trouble to comment in such detail.

October 23, 2017 @ 5:28 pm

@Mareea

Firstly thanks for the question! I always LOVE questions and was unaware that my comment facility on the homepage was down :(.

I’ll take on the points you’ve raised one by one :).

1. “I’m puzzled as to why so many investing/FIRE blogs use dividend stocks as their main/sole strategy. I can understand that’s a sensible approach for people at/close to retirement like yourself, Nick, as it provides income without depleting capital, but for people who are 20, 10, maybe even 5 years from retirement, I don’t get the logic behind it.”

I think the main reason here is due to being able to have an income without the need to ‘drawdown’ from any capital gain.

If we have to sell stocks in order to access money then we incur fees and this money will eventually run out at the early retirement ages many FIRE blogs aim for. If one is seeking to retire at a later age then there’s a lot less risk of this money running out as there are less years of retirement to fund.

For me, I want to retire at 40 years old and even if we estimate a conservative 35 years of retirement, I wouldn’t be comfortable constantly selling for an income ESPECIALLY as the market can easily take a harsh correction and I want to be in a situation to buy more or hold during these years without the need to sell at cheap valuations just in order to live.

2. “On Lewys’ own blog (which doesn’t seem to have any comments facility, hence why I’m raising the issue here), his guide to investment strategies suggests funds (managed, passive, or robo-invested) as the easiest and safest forms of investing, so why does he go for individual stocks? And why dividends rather than growth? Particularly as dividends are taxed but growth isn’t, and many investment platforms also have a charge for reinvesting them?”

VERY good point! The reason I recommend these types of passive investing is that these are the types that require the least effort, the least risk for the most gain. I’m in the very fortunate position (financially) of having no current liabilities (kids + mortgage for example) and can therefore afford to take on this extra risk for potentially a little more reward. I’m also only 24years old, so I can afford to make mistakes here and there as time is on my side. The older I get, the more I’ll transition into funds.

As for growth, growth companies tend to sport high p/e ratios meaning that a lot of the ‘growth’ investors speak of is often baked in. These stocks often take massive dips on even slightly disappointing results. They also tend to be smaller-cap companies with a lot of risk ahead. Why buy these companies when I can buy proven bluechips at more reasonable valuations without the need to bite my finger nails waiting for future growth that may never materialise.

3. It’s not like funds are low-yielding either; the top 10 highest-performing funds are currently giving an annualised return of between 26% and 32% (and no, there isn’t a decimal point missing!). Even allowing for fees (I personally avoid any above 0.8%), that is a much higher yield than those quoted above for dividends.

If you took the top 10 highest performing stocks you’d be looking at returns in the 100s if not 1000s of %. The trick of course is finding these stocks/funds beforehand. If you could identify the funds that will return 32% next year, I’ll certainly be willing to invest!

Thanks so much for your question!

Anything else you’re itching to ask I’ll be more than happy to reply,

Lewys

October 24, 2017 @ 2:53 pm

Hi Lewys and Nick

Many thanks to you both for your comprehensive replies. Couple of observations:

Nick, glad you’re with me on the funds – reassuring! I agree there no guarantees; I have a fairly diverse portfolio – not keeping my eggs in one basket. As a relatively new investor, I also plan to reassess every year and change my ISA distribution (ie, l won’t buy more of the worst performers; I’ll buy something else instead). I tend to go for passive funds too, as they seem to perform as well as actively managed funds over the long term, with far lower fees.

Thanks for the clarification on tax; I was under the impression that dividends were taxed even in an ISA; nice to know that isn’t the case (yet!)

Lewys,

Re point 1: as I mentioned, I get the logic of dividend stocks for people near retirement, but for people a decade or more away, I’m still not clear as to why you wouldn’t go for growth stocks/funds at first and gradually move towards dividends as the finish line gets closer (obviously not selling any off cheap!)? That’s my strategy ATM; I’m aiming to retire early but nowhere near as early as you plan to, so I have a more limited time to increase my pot, hence why I”m aiming for growth rather than income. I do have other sources of potential retirement income; my personal pension is in a more conservative fund (but still returning a fairly steady rate of around 6-7%), so I’m happy to be a bit more adventurous with my ISA as that will fund the gap before I can access the pension.

Re point 2: OK, so you reckon funds are better as one approaches retirement? That’s good, because I’m a bit older than you! 😉

Re point 3; agreed, but what’s the risk ratio with those top-performing stocks vs funds? My worry is that individual stocks would be more volatile than funds because the funds are spread wider. And as you say, it’s a question of identifying those stocks in the first place, and I just don’t have the time! It seems to be a lot easier to identify good-performing funds, as all the newpapers publish lists regularly, and although past performance is no guarantee of future returns (yadda, yadda), I’d rather bet on Man Utd than Accrington Stanley! Hence, all of the funds I’ve chosen have been solid performers for at least 10 years, and importantly have low fees. This seems to be working so far (touch wood); my YTD ROI is 28%, so I’m hoping this will continue!

Thanks again for your time!

October 25, 2017 @ 9:18 am

Thanks, Mareea. Just to clarify the point you raised, you’re quite right that at one time there was a tax on dividends even in ISAs. That was under the old (and confusing) system where a 10% “dividend tax credit” was applied, which investors in individual shares could reclaim but investors in funds couldn’t. That was scrapped from April 2016, though, and now all dividend income in ISAs is tax free, whether via individual shares or funds. That is my understanding anyway.

October 24, 2017 @ 8:33 am

Many thanks to Lewys for his in-depth reply.