Is This a Good Time to Invest in Property Crowdfunding?

Right now it’s difficult for savers and investors to know which way to turn. World stock markets have been in free fall, while bank and building society interest rates are at an all-time low.

Regular readers will know that I’m something of a fan of property crowdfunding and have invested through a number of such platforms (notably The House Crowd, Property Partner, Crowdlords and Kuflink). For anyone seeking half-way decent rates of return, I believe they represent an opportunity worth considering at least, especially in the current uncertain economic climate.

But before I come to that, a few words for those new to this field…

Table of Contents

What Is Property Crowdfunding?

As the name says, in property crowdfunding a number of investors pool their money to invest in property and share in the returns pro rata to the size of their investment.

In the last ten years a number of property crowdfunding platforms have been launched to facilitate this. As well as publicizing such opportunities, these companies typically identify suitable properties, advertise and administer projects, and manage properties once they have been purchased. They also distribute payments due to investors from rent received and (eventually) from selling up. Unlike ordinary buy-to-lets, property crowdfunding projects are typically hands-off, passive investments.

There are various methods of property crowdfunding. The traditional method (if you can describe something that’s been around for under ten years as traditional) is equity crowdfunding. Here investors’ money is pooled to buy a house or larger property. Investors then (usually) receive rental income in proportion to the amount they invested plus a share of any capital gains when the property is sold.

The other main method is debt crowdfunding. Here investors lend money to a landlord or property developer so that they can complete a particular project. The money might be used for a bridging loan, or to make improvements to a property prior to selling or remortgaging it. In this type of crowdfunding, the investors never actually own the property. They play a role similar to a bank, lending money and (all being well) being repaid with interest once the project is concluded.

There are also development projects, where investors’ money is used to fund larger-scale property developments. This might involve building a new property (or properties) from scratch, or perhaps converting existing buildings to a new use. Either way, if all goes well, at the conclusion of the development the investors get their capital back along with interest. Development crowdfunding is riskier than equity crowdfunding, but the profits to be made can be bigger.

Property crowdfunding is a form of investment, and like all investments it carries risks. Clearly it’s not as safe as bank or building society savings (which are covered up to £85,000 by the Financial Services Compensation Scheme). All investments are though secured against bricks and mortar, so in the event of a borrower defaulting you should still get your money (or most of it) back once the property concerned has been sold.

The rates of return with property crowdfunding are significantly higher than those from banks and building societies, and they’re also relatively unaffected by fluctuations in the stock market. Property crowdfunding isn’t a way of hedging equity-based investments directly, but it does help spread the risk.

Property and the Coronavirus

These are undoubtedly challenging times for property investors, be they traditional buy-to-let landlords or property crowdfunders.

Even before the virus struck, property prices were at best steady or going down. And measures taken by the government in the last few years, including progressive cuts in mortgage interest tax relief and an additional 3% stamp duty on buy-to-let properties (dubbed ‘The Landlord Tax’) considerably reduced the attraction of buy-to-let for private landlords especially.

The coronavirus crisis has added a whole new layer of difficulty. In particular, measures taken by the government to mitigate the worst effects of the crisis have hit both tenants and property owners hard. Many tenants are obviously suffering financial hardship, and may therefore be having difficulty paying their rent (and other bills). Tenants are, though, currently protected from eviction, and landlords are required to provide rent holidays where appropriate. These measures are sensible and humane, but at a stroke they have reduced or cut entirely many landlords’ income streams, and there is no government scheme to assist them. Obviously I don’t expect many tears to be shed for landlords, but life has undoubtedly become a lot more challenging for them.

In addition, due to social distancing and the lockdown, only limited construction work is continuing. It’s also difficult (or impossible) for surveyors and valuers to do their jobs, or for potential buyers to visit and inspect homes and other properties. All of this means that to a great extent the UK property market has currently ground to a halt.

Despite that, it’s not all bad news. At some point – maybe quite soon – the lockdown restrictions will be eased. The government is (rightly) keen to get the economy moving again as soon as possible. And there are still plenty of people looking to move home, buy property, begin new development projects, and so on. Much as the depressed state of the stock market has presented opportunities for those willing to take a chance on buying now while prices are low, there is certainly a case that property will bounce back in the coming months and years too, rewarding those who invest in the sector now.

Property Crowdfunding Opportunities

Clearly property crowdfunding investors are not immune to the effects of the coronavirus crisis. Developments and sales have been delayed, and in some cases at least rental income has been reduced. It’s quite possible – likely even – that in the longer term the rate of defaults on loans will go up too.

Nonetheless, property crowdfunding investors are unlikely to be as badly affected as private landlords. For one thing, if they are sensibly diversified across a range of properties (and platforms) they won’t be as susceptible as someone with a single buy-to-let. And like all property investors, their money is secured by bricks and mortar, so they will get it back (or most of it) eventually – though in the current crisis, that might take some time. For most property crowdfunding investors at the moment, sitting tight is likely to be the best (or only) option.

As I said above, the crisis is also creating opportunities for those who believe that property will prove to be the resilient investment it has generally been in the past. Rather than prolong this post too much, I will focus my attentions on the four platforms I am currently invested in, and which I am therefore most familiar with.

- Property Partner

Property Partner is an interesting case. They have just announced that they are suspending all dividend payments for the next three months (potentially longer). This is, of course, mainly money from rent received, which (for reasons stated above) is likely to take a hit in the coming months. Property Partner say they are taking this action to ensure that investors are protected in the longer term and all properties have sufficient cash reserves to cover any necessary expenditure.

As I said in this post a few months ago, many of the properties on Property Partner are coming up to their five-year anniversaries. This is a significant milestone, because after a property has been owned for five years, all investors have the chance to exit at a fair market price (determined by an independent surveyor). Property Partner have said they are suspending this process until June at the earliest.

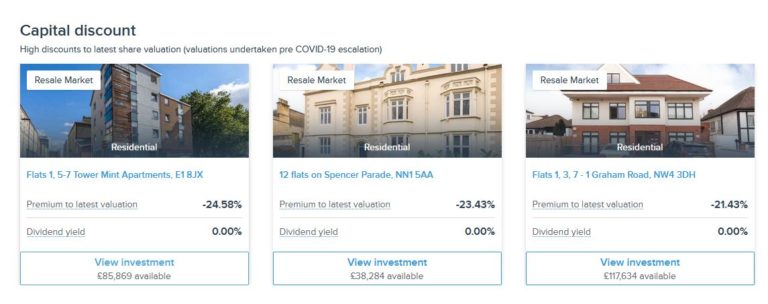

You can still buy and sell properties on Property Partner’s secondary market, and on the face of it there are some good-value buying opportunities here, with properties listed at up to 25% off their current valuations (see screen capture below).

In theory, you could buy shares in these properties on the secondary market at a big discount, and sell them at their current valuation for a good profit when the five-year sale process is reinstated.

Unfortunately it’s not quite a straightforward as that, though. For one thing, the current valuations were made before the coronavirus crisis hit, so they may no longer be an accurate reflection of a property’s value. In addition, the five-year exit mechanism depends on other investors wanting to buy the shares at the valuation stated. Failing that, the property will be sold on the open market, but that could take a long time in the current economic climate. Neither is there any guarantee what price would be achieved.

My personal view is that I do believe property prices will bounce back but it may not be for quite a while. I am looking seriously at some of the buying opportunities on Property Partner’s secondary market where I think they represent good value in the medium- to long-term, but I am not rushing to invest at the moment.

Please check out my Property Partner review for more information about the platform.

- Kuflink

Kuflink is another property crowdfunding platform I have a soft spot for. Although I don’t have huge amounts invested with them, so far all of my investments have paid out as promised, with just a short (one-month) delay in one case.

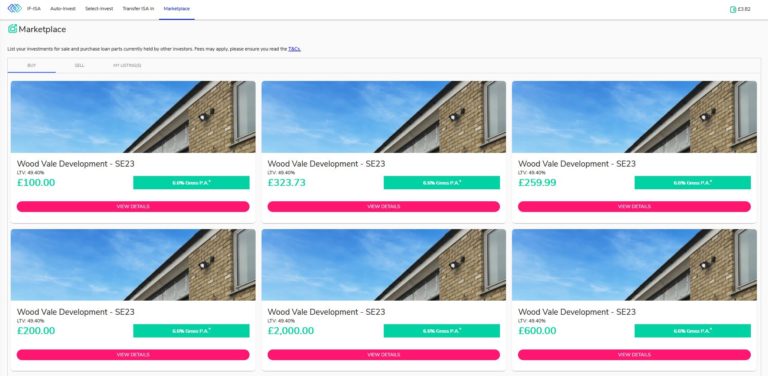

Kuflink is a property loans platform. So far anyway I have not heard of any defaults, although the longer the crisis continues, the greater the risk this may happen. Nonetheless, based on my experiences to date, I am continuing to invest (cautiously) with them. In particular, I like their new secondary market, where you can buy loan parts from other investors who want to sell up early (see screen capture below)

As you may imagine, this has been happening a lot recently, as many investors have wanted (or needed) to access their capital urgently. This has created short-term buying opportunities which I have been busily taking advantage of. These loan parts typically have only a few months to run, so you can expect to get your capital back quite quickly (and can then reinvest it). Only loans in good standing with monthly repayments up to date may be listed on the secondary market, so that offers some reassurance against default – though of course it is by no means a guarantee.

Secondary market aside, Kuflink also still has a steady stream of new investment opportunities coming to the table. Of all the property platforms, they appear to be the ones least affected by the current crisis. I am not exactly sure how they have achieved this, but obviously I hope they continue to do so!

If you haven’t invested in Kuflink before, it’s also worth mentioning that they have a generous welcome offer which is still operating. You can earn up to £4,000 in cashback with this. See my Kuflink review for full details.

- The House Crowd

The House Crowd is actually the first property crowdfunding platform I invested with. My experience with them has generally been good, although as mentioned in my House Crowd review there have been some delays and defaults.

Although they started as a traditional crowdfunding platform, The House Crowd have increasingly moved towards development projects, and these have inevitably been hit by the current crisis. THC say that at present they are following a strategy of ‘prudently maintaining The House Crowd platform to ensure its continued and efficient operation as we see our way out of the other side of the lock down.’

That means there are fewer investment opportunities on THC at the moment. You can though if you wish still invest in their automatically diversified ‘Auto-Invest’ products, with target interest rates of 5% (Cautious) to 7% (Bold), or the new THC Fusion account, which offers even greater diversification with a target interest rate of 4% to 4.5%. More information about these can be read on the House Crowd website.

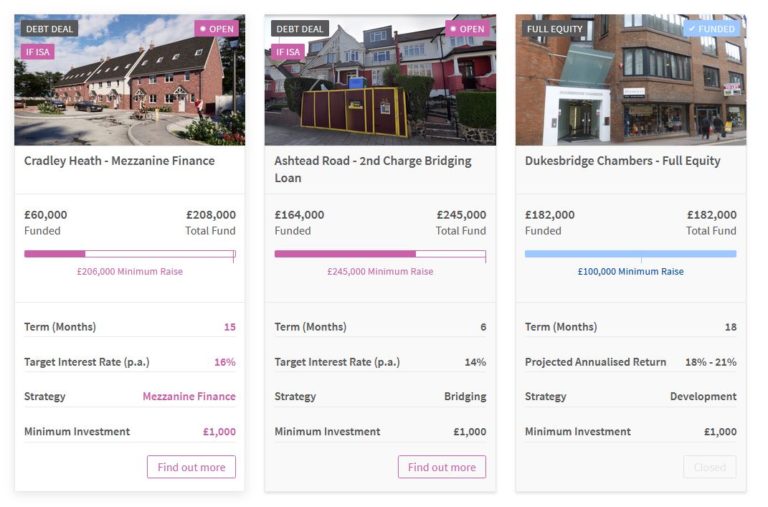

At the time of writing THC also have a couple of development projects open for investment, including their flagship project The Downs in Altrincham town centre, paying a target rate of 10% per year (see screen capture below).

Personally I am not investing any more money in The House Crowd at the moment, but I am keeping this under review. You can read my full review of The House Crowd here

- Crowdlords

Finally, Crowdlords say they have experienced a significant reduction in investment levels since February, which they put down to uncertainty caused by the pandemic. They do still have a couple of lending opportunities listed (see capture below), but not much else. I guess like The House Crowd they are hunkering down and waiting for the current restrictions to be lifted and the property market to start moving again.

Again, I am not currently planning to invest any more in Crowdlords, but am keeping an eye on any opportunities that may crop up in the months ahead. You can read my full review of Crowdlords here.

Final Thoughts

I thought I’d close by sharing a couple of nuggets of information I found while researching this post.

First, the ratings agency Fitch has downgraded the rating of UK debt to AA-. However, Fitch estimated growth next year would bounce back to 3 percent if the UK can begin to unwind the measures to tackle the health crisis in the second half of the year. The UK’s Coronavirus Job Retention scheme – a three-month programme to support employees hit by the pandemic – will cost about 1.3 per cent of GDP, according to Fitch estimates.

Second, estate agents Knight Frank have predicted that many house sales will be lost this year and the UK’s property market will see little to no growth in 2020. However, a sharp recovery has been predicted for 2021. Liam Bailey, global head of research at Knight Frank, said, “We expect a revival in activity to continue, with volumes next year expected to be 18 per cent above the level seen in 2019.”

All of this (and other sources) suggests that while property markets are in the doldrums now and probably for most of 2020, there is every chance that by next year we will see a recovery. There are undoubtedly good opportunities on offer in property investment now if you agree with this evaluation and are able to be patient in the shorter term.

In any event, if you’re looking for better returns than the banks and lower volatility than the stock markets, then property generally – and property crowdfunding in particular – remains in my view well worth considering as part of a balanced investment portfolio.

As always, if you have any comments or questions about this post, please do leave them below.

Disclosure: I am not a regulated financial adviser and nothing in this post should be construed as individual financial advice. You should always do your own ‘due diligence’ before investing, and seek independent financial advice if in any doubt how best to proceed. All investment carries a risk of loss.