My Coronavirus Crisis Experience: November Update

Another month, another coronavirus crisis update. Regular readers will know I have been posting these updates since the first lockdown started (you can read my October update here if you like).

As always, I will discuss what has been happening with my finances and my life generally over the last few weeks.

Financial

I’ll begin as usual with my Nutmeg stocks and shares ISA, as from feedback received I know many of you like to follow this.

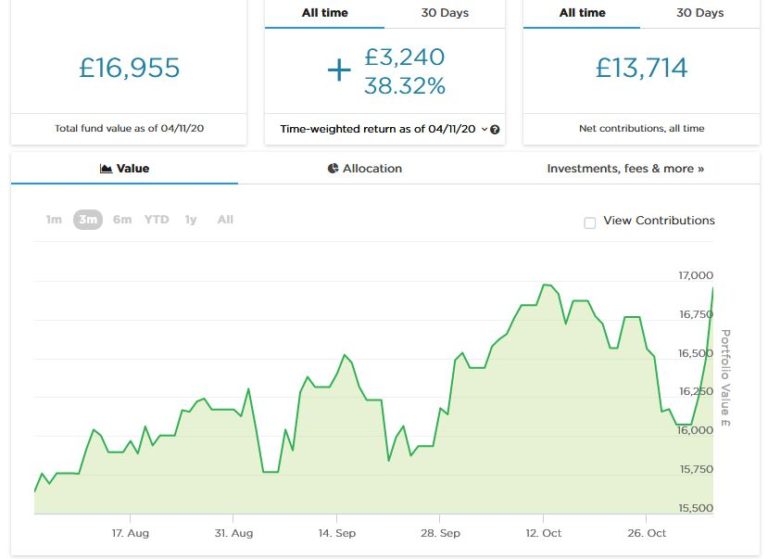

As the screenshot below shows, my portfolio has been on a roller-coaster ride over the last few weeks but is currently valued at £16,955, about £500 up on last month. Considering national and world events at the moment I am very happy with this. You can read my in-depth Nutmeg review here (including a special offer for PAS readers).

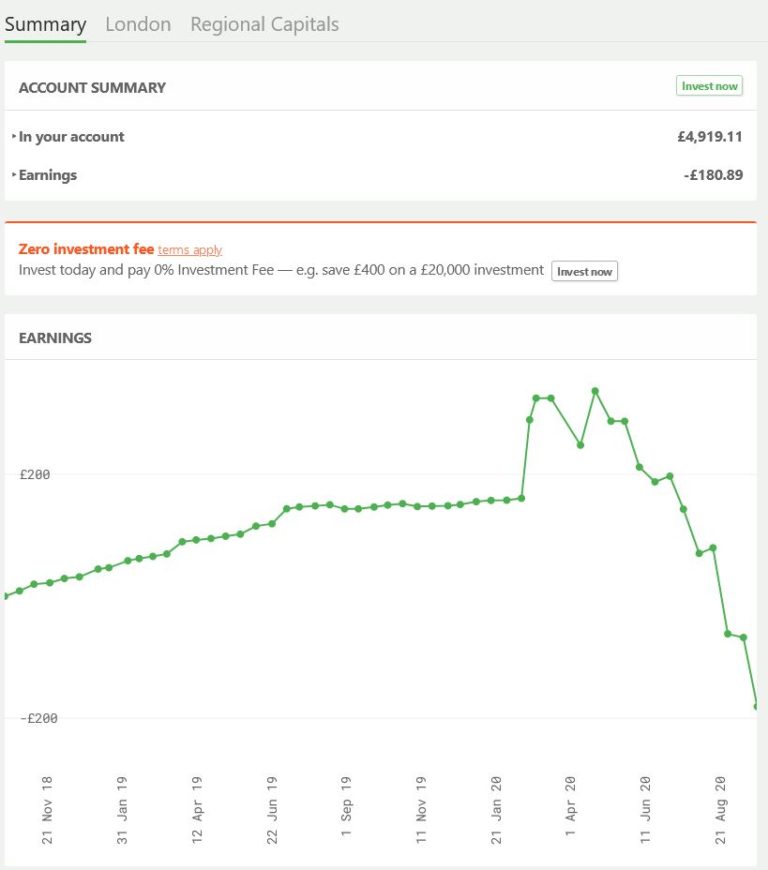

I haven’t mentioned my Bricklane Property ISA for a while, so I thought I should rectify that this month. As discussed in my blog review, Bricklane – not be confused with Brickowner – is a REIT (Real Estate Investment Trust). Investors’ money is pooled to purchase properties. Rental income is then distributed to investors, who also stand to benefit if the value of the REIT goes up. As you can see from the chart, though, this year the trajectory has been largely downward.

.

.

At first glance this looks alarming, but of course it’s important to note that the vertical axis of the graph goes from minus £200 to plus £200, so in reality the losses aren’t as bad as that scary-looking precipice might suggest. Allowing for the fact that I received a £100 welcome bonus when I signed up with Bricklane, overall I am about £80 down on my £5,000 investment. Of course, that’s not what you would hope for, but this has been a particularly tough year for anyone investing in property. Among other things, rising unemployment, company failures, more people working from home, and rising defaults on loans and mortgages (along with mandatory payment holidays) have all affected demand and reduced rental returns and property values.

A recent email from Bricklane gave further insight into the problems they are facing. It turns out that the Regional Capitals fund (in which I am invested) includes a number of properties that may need extensive refurbishment in light of the Grenfell Tower tragedy. As I understand it, they have cladding which needs assessing by specialists and may have to be removed and replaced. This is a time-consuming and costly business. Of course, the owners (who include me as an investor) have no option but to undertake this, and inevitably this is having an impact on the value of the fund.

This does of course illustrate that any investment in a single asset class such as property carries additional sector-specific risks compared with broader-based investments, and you may see greater volatility as a result. On the plus side, when investing in property your money is secured by bricks and mortar, so it’s very unlikely you will lose your shirt.

I guess if I was braver and had a longer time horizon, I might look at Bricklane as a value-investing opportunity just now. As it is, I am leaving my money where it is but won’t be investing any more with them for the foreseeable future. I am not planning to sell up as I don’t currently need the money and that would only crystallize my losses.

Otherwise there is nothing dramatic to report on the financial front. My two Buy2LetCars investments are still delivering the promised monthly returns without any hassle. To recap, investors with Buy2LetCars put up the money to finance a car for a key worker such as a nurse or police officer. They then receive 36 monthly capital repayments followed by a final balancing payment of interest and capital. I heard from the company today that they are allowed to continue trading in England’s second lockdown and are already experiencing an upsurge of enquiries from key workers needing transport. So if you are looking for an income-producing investment with a substantial lump sum payment after three years, they are well worth checking out (and likewise if you’re a key worker looking for a lease car yourself). If you’d like to learn more, you can read my review of Buy2LetCars here and my more recent article about the company here. And here is a link to Wheels4Sure, their car-leasing website.

My Property Partner and Kuflink investments are still both ticking along satisfactorily. Unsurprisingly there have been delays in repaying some of my Kuflink loans, but I continue to receive monthly interest payments on them and am not unduly concerned. As regards The House Crowd, I assume that the sales of the two properties in which I hold £1,000 shares are progressing, but can understand that it is a slow process. As with Kuflink, rental payments are still accruing, which should help to defray some of the selling costs.

There has been no further word either regarding my investments with Crowdlords. As I said last month, I have two remaining investments with them, Kennington Road eco-houses and Trent House. I was told they hope to have exit options for these properties by the end of the year, but I’m not holding my breath. On the plus side, they are paying 6 percent interest on my Trent House investment, which is quite generous in these days of ultra-low interest rates.

Personal

Thankfully this month has been less eventful for me than the previous one. Touch wood my left eye is recovering well after the laser treatment (thank you to those who have asked and/or sent me good wishes about this). I am going back to Burton Hospital in a week’s time for what I hope will be a final check-up.

I still have floaters in both eyes – worse in the left – but that is not unusual for people of my age. It’s annoying but not dangerous in itself, and there isn’t really any treatment (I understand lasers can be used in extreme cases to ‘blast’ them, but it’s rare to do this as it risks causing other damage). I did read online about a Chinese study which found that eating pineapple can help reduce floaters, so I was happy to have an excuse to eat more of this delicious fruit!

As I write this, England is going into its second lockdown. I am dubious about the wisdom of this and worried for people whose physical and mental health is likely to suffer, especially as it appears the second wave has already peaked and new case numbers are starting to fall.

I am at least thankful that the schools have been exempted this time. I live quite near a secondary school, and it lifts my spirit when I see the young people bursting out of the school gates at the end of the day. chatting to their friends, larking around, and generally doing all the things young people do. And not a mask in sight!

Today I am off to see my accountant to discuss my annual accounts. He works from home and neither of us was sure what rules applied in this situation, so in the end we agreed to meet outside on his front drive. At least this will help to ensure that the meeting doesn’t go on a minute longer than it needs to 🙂

I had a winter flu jab last month (the first time I’ve qualified for a free one as I reach 65 later this year). It seemed a sensible thing to do, especially as it may give some protection from Covid too. I did have a reaction to it, though. I woke up at around 2 am shivering violently, and then I started to get nausea as well. By morning I was feeling a lot better, apart from having had almost no sleep. Apparently these are quite common side effects of the vaccine, though two friends (both older than me) didn’t get any effects at all.

I went for my last pre-lockdown swim on Tuesday. The centre was busier than usual, so I guess I wasn’t the only one who decided to take the opportunity while it was still available. I am very disappointed that pools have been made to close again as there is no evidence the virus is spreading this way and many people (me included) depend on swimming for our physical and mental health. I just hope they reopen at the start of December and the lockdown isn’t extended. Personally I expect the numbers of new cases to continue falling over the next few weeks, not due to the lockdown but simply because that is the trend now. If that is the case, there will be no excuse for prolonging the lockdown. But I guess by the time of my December update we will know one way or the other!

Finally I am still dutifully completing the UCL Virus Watch weekly questionnaire saying whether I have any possible Covid symptoms (none so far). And I am still waiting to hear when I will be able to take the blood test to see if I have any antibodies or other natural resistance to the virus. But I gather they wouldn’t be able to do that until a few weeks have elapsed after the flu jab anyhow, so it may be just as well I’ve heard nothing yet.

So that’s it for this month really. I hope you and your loved ones are staying safe and well. As always, if you have any comments or questions about this post, please do leave them below.

Disclosure: This post includes affiliate links. If you click through and make a purchase, I may receive a commission for introducing you. This will not affect the price you pay or the product or service you receive.

November 5, 2020 @ 7:47 pm

I can imagine with the US election your investments have been a bit more turbulent too, not just because of the pandemic! (Ours have been a bit up and down this week that’s for sure!) Stay safe 🙂

November 6, 2020 @ 3:01 pm

Considering the year I think your investments are doing pretty well actually. For us it’s tough as my fiancé is self employed so although he’s allowed to work of places shut the work might not be there for him x

November 7, 2020 @ 11:13 am

Thanks, both. Yes, these are certainly turbulent times. My Nutmeg ISA had been going down steadily in the last few weeks, and then over a couple of days it jumped by over £1,000. I still don’t really know why that was!