My Investments Update April 2022

Here is my latest monthly update about my investments. You can read my March 2022 Investments Update here if you like

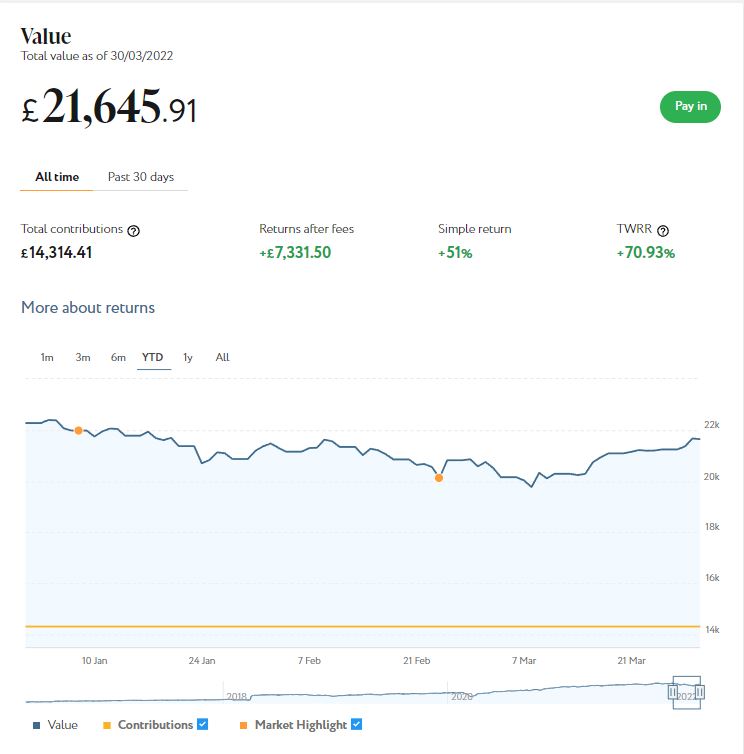

I’ll begin as usual with my Nutmeg Stocks and Shares ISA, as I know many of you like to hear what is happening with this.

As the screenshot below shows, my main portfolio is currently valued at £21,646. Last month it stood at £20,859, so that is a rise of £787.

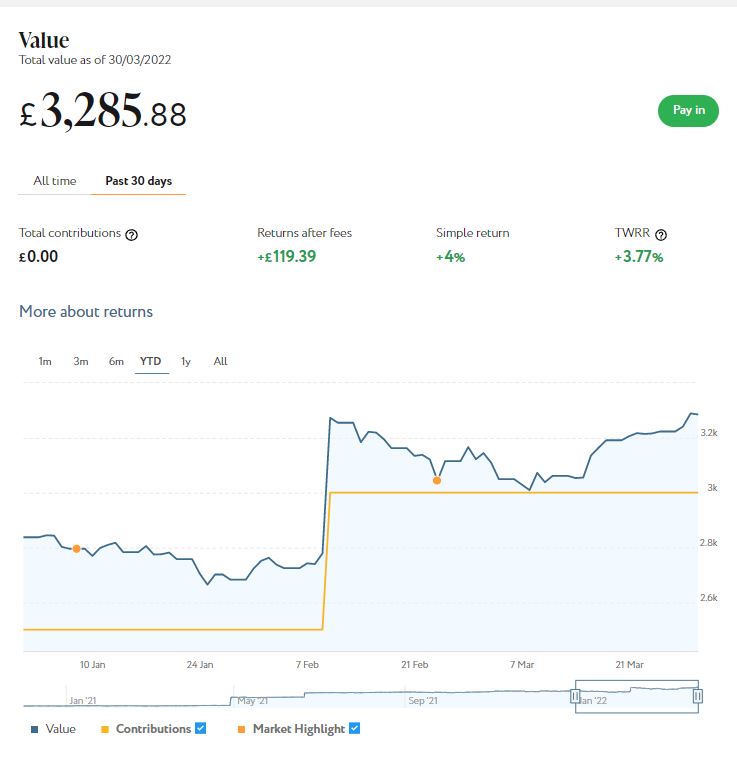

Apart from my main portfolio, I also have a second, smaller pot using Nutmeg’s Smart Alpha option. This is now worth £3,286 compared with £3,166 last month, a rise of £120

Here is a screen capture showing performance over the last month.

Obviously these rises are good news, and cancel out a good part of the falls since January this year. I hope this trend will continue in the coming months! I don’t know the exact reasons for the recovery in share prices, but I guess some of it may be down to the likelihood of nuclear Armageddon in Ukraine receding a bit. In any event, it does demonstrate the importance to investors of holding your nerve when prices fall and not bailing out at the first sign of trouble. As I often say on Pounds and Sense, investing should always be regarded as a medium- to long-term venture.

You can read my full Nutmeg review here (including a special offer at the end for PAS readers). If you are looking for a home for your annual ISA allowance, based on my experience over the last six years, they are certainly worth considering.

If you haven’t yet seen it, check out also my blog post in which I looked at the performance of Nutmeg fully managed portfolios at every risk level from 1 to 10 (as mentioned, my main port is level 9). I was actually pretty amazed by the difference the risk level you choose makes. If you are investing for the long term (and you almost certainly should be) opting for a hyper-cautious low-risk strategy may not be the smartest thing to do.

As regular readers will know, this year I am using Assetz Exchange for my IFISA. This is a P2P property investment platform that focuses on lower-risk properties (e.g. sheltered housing on long leases). I put an initial £100 into this in mid-February 2021 and another £400 in April. Everything went well, so in June 2021 I added another £500, bringing my total investment on the platform up to £1,000.

Since I opened my account, my Assetz Exchange portfolio has generated £47.60 in revenue from rental and £73.85 in capital growth, a total of £121.45. That’s a decent rate of return on my £1,000 investment and does illustrate the value of P2P property investment for diversifying your portfolio when equity markets are volatile.

At one time Assetz Exchange had a problem with demand from investors outstripping supply, but in recent months an influx of new projects has helped alleviate that. AE also has a sensible policy of limiting the amount any one person can invest in a project for the first few weeks (typically £2,000 to £3,000 maximum), to ensure everyone has a fair chance to participate.

I recently invested some of the rental income I’ve received in another project on AE, a housing association property for people with learning difficulties in Doncaster. I now have investments in 22 different projects and all are performing as expected, generating rental income and – in every case but one – showing a profit on capital. So I am very happy with how this investment has been doing. And it doesn’t hurt that most projects are socially beneficial as well.

- To control risk with all my property crowdfunding investments nowadays, I invest relatively modest amounts in individual projects. This is a particular attraction of AE as far as i am concerned. You can actually invest from as little as 80p per property if you really want to proceed cautiously.

As mentioned, my investment on Assetz Exchange is in the form of an IFISA so there won’t be any tax to pay on profits, dividends or capital gains. I’ve been impressed by my experiences with Assetz Exchange and the returns generated so far, and intend to continue investing with them. You can read my full review of Assetz Exchange here. You can also sign up for an account on Assetz Exchange directly via this link [affiliate].

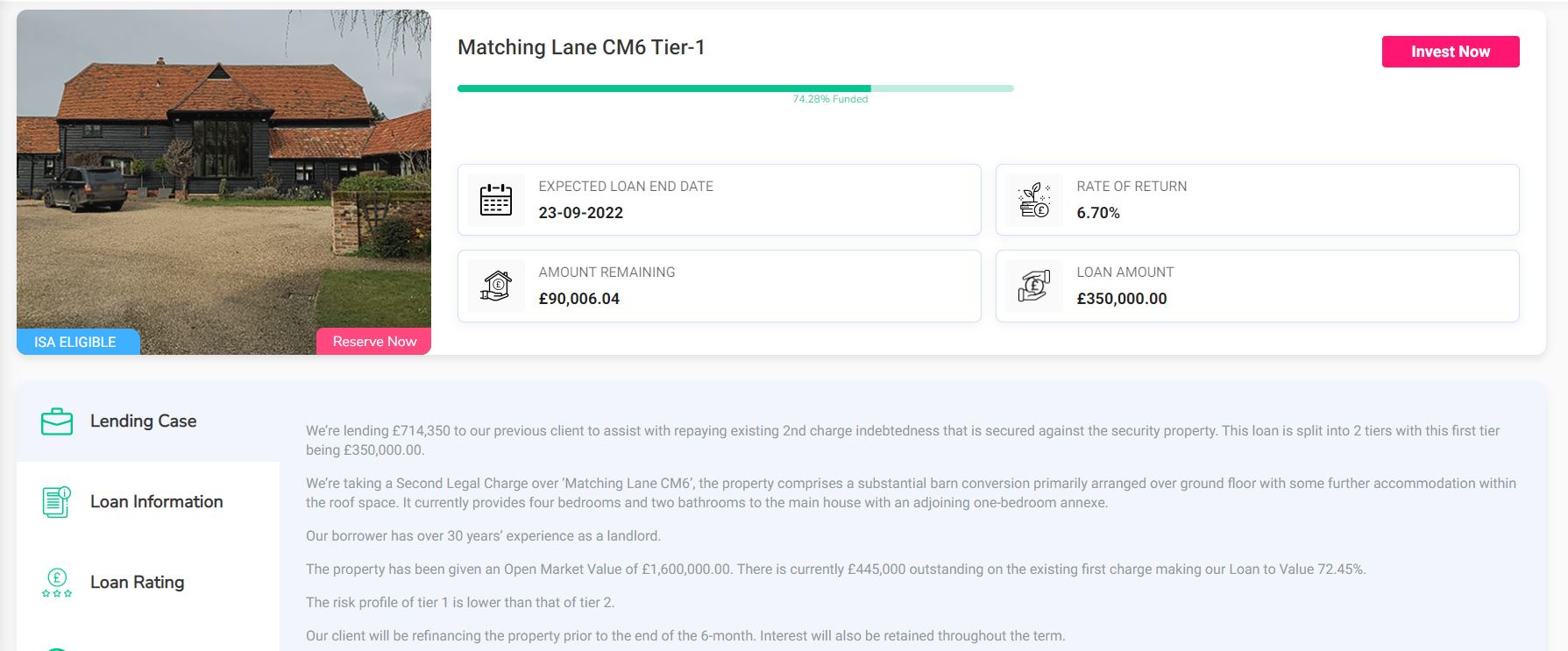

Another property platform I have investments with is Kuflink. They have been doing well recently, with new projects launching almost every day. I currently have over £2,150 invested with them, quite a large proportion of which comes from reinvested profits. To date I have never lost any money with Kuflink, though some loan terms have been extended once or twice. On the plus side, when this happens additional interest is paid for the period in question. At present all my Kuflink loans are performing to schedule, with several due to mature in the next three months. So I will be planning to reinvest with Kuflink as this happens, in projects such as the one below.

My loans with Kuflink pay annual interest rates of 6 to 7.5 percent. As mentioned above, these days I invest no more than around £150 per loan (and often less). That is not because of any issues with Kuflink but more to do with losses of larger amounts on other P2P property platforms in the past. My days of putting four-figure sums into any single property investment are behind me now!

- Nowadays I mainly opt to reinvest the monthly repayments I receive from Kuflink, which has the effect of boosting the percentage rate of return on the projects in question

Obviously a possible drawback with Kuflink and similar platforms is that your money is tied up in bricks and mortar, so not as easily accessible as cash savings or even (to some extent) shares. They do, however, have a secondary market on which you can offer any loan part for sale (as long as the loan in question is performing and not in arrears). Clearly that does depend on someone else wanting to buy it, but my experience has been that any loan parts offered are typically snapped up very quickly. So if an urgent need arises, withdrawing your money (or part of it) is unlikely to be an issue.

You can read my full Kuflink review here. They offer a variety of investment options, including a tax-free IFISA paying up to 7% interest per year with built-in automatic diversification. Alternatively you can now build your own IFISA, with most loans on the platform (including the one shown above) being IFISA-eligible.

I’d also draw your attention to Kuflink’s revised and more generous cashback offer for new investors [affiliate link]. They are now paying cashback on new investments from as little as £500 (it used to be £1,000). And if you are looking to invest larger amounts, you can earn up to a maximum of £4,000 in cashback. That is one of the best cashback offers I have seen anywhere (though admittedly you will need to invest £100,000 or more to receive that!).

- I also recently published a blog post about another P2P property investment platform called BLEND. Like Kuflink, they offer the opportunity to invest in secured loans to experienced property developers. They offer (on average) somewhat higher rates of return than Kuflink, though arguably with a little more risk. As well as my blog post about BLEND, you can also check out what they have to offer on their website [affiliate link].

Moving on, I have two more articles on the always-excellent Mouthy Money website. The first contains my best tips and advice about cruise holidays. As I say in the article, the cruise industry was hit hard by the pandemic, but it is up and running again now and desperate to lure holidaymakers back. So there are some great deals to be had at the moment!

My other Mouthy Money article is about two state benefits that many older people who would be eligible are currently missing out on. You can read this article here.

That’s plenty for now, so I’ll sign off till next time. I hope you are keeping safe and well, and making the most of the better weather and more relaxed Covid restrictions that now apply (apart from in Scotland). I am looking forward to visiting Llandudno in a few weeks time (and duly grateful the Welsh government has recently eased restrictions there). I also have breaks in Criccieth and Lavenham booked for later in the summer, with more to come. If you’re planning any UK holidays, don’t forget I have a list of places I have visited and recommend here 🙂

Disclaimer: I am not a qualified financial adviser and nothing in this blog post should be construed as personal financial advice. Everyone should do their own ‘due diligence’ before investing and seek professional advice if in any doubt how best to proceed. All investing carries a risk of loss.

Note also that this post includes affiliate links (disclosed). If you click through and perform a qualifying transaction, I may receive a commission for introducing you. This will not affect the product or service you receive or the terms you are offered.

April 1, 2022 @ 2:28 pm

It’s good to know that investments are starting to bounce back a little after the reductions in value a little earlier in the year.

April 1, 2022 @ 2:30 pm

Thanks, Erica. Indeed it is!

April 7, 2022 @ 2:00 pm

Sounds like it’s been a pretty good month for your investments. The nutmeg ones seem to be picking up well for you x

April 7, 2022 @ 2:47 pm

Thanks, Rhian. Yes, it’s been good to see a bit of a bounce-back.