My Investments Update – February 2023

Here is my latest monthly update about my investments. You can read my January 2023 Investments Update here if you like

I’ll begin as usual with my Nutmeg Stocks and Shares ISA. This is the largest investment I hold other than my Bestinvest SIPP (personal pension), from which I recently started withdrawing again.

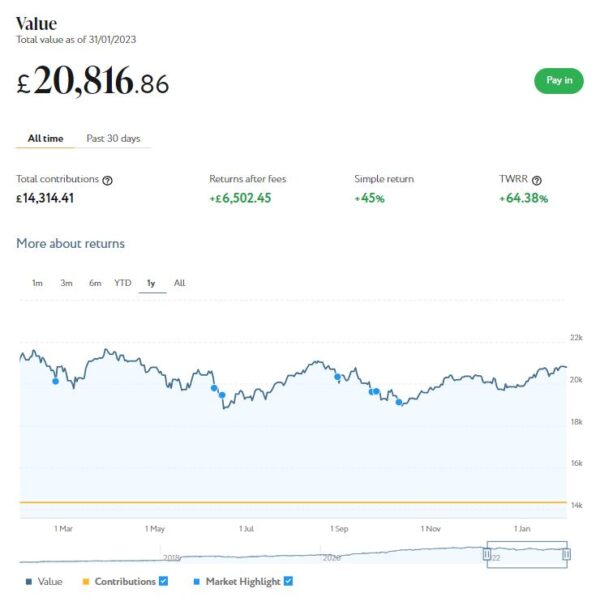

As the screenshot below of performance over the last year shows, my main Nutmeg portfolio is currently valued at £20,817. Last month it stood at £19,898 so that is a rise of £919.

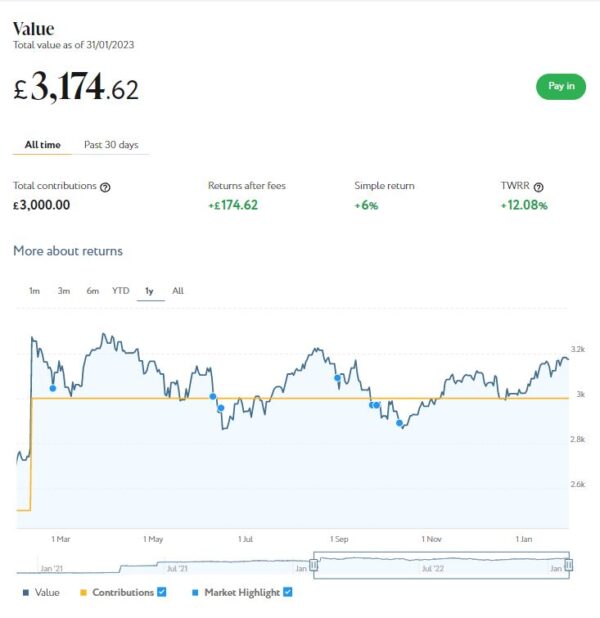

Apart from my main portfolio, I also have a second, smaller pot using Nutmeg’s Smart Alpha option. This is now worth £3,175 compared with £3,023 a month ago, a rise of £152.

Here is a screen capture showing performance over the last year. As you can see from the ochre line, I topped up this account in February 2022.

Clearly 2023 has started well, with the total value of my Nutmeg investments increasing by over £1,000. The strong start for equities in general in 2023 is due to various factors, including inflation rates world-wide starting to fall, the ending of most Covid restrictions in China, and a growing belief that any post-pandemic recession may not be as severe as was once thought. Of course, the war in Ukraine is still a major concern, but if that is resolved in the coming year it should give markets a further boost.

2023 is still likely to be an uncertain year for investors, with more ups and downs very much on the cards. Nonetheless, with share prices generally still below where they were a year ago, there are likely to be opportunities for investors to capitalize in the months ahead. I shall definitely be looking to invest more in Nutmeg and other equity-based platforms in the coming year.

- It’s not just me thinking this way, incidentally. See, for example, this article on the popular Motley Fool website Three Reasons to Start Investing in 2023.

Of course, all investing is (or should be) a long-term endeavour. Over a period of years stock market investments such as those used by Nutmeg typically produce better returns than cash accounts, often by substantial margins. But there are never any guarantees, and in in the short to medium term at least, losses are always possible.

You can read my full Nutmeg review here (including a special offer at the end for PAS readers). If you are looking for a home for your annual ISA allowance, based on my overall experience over the last six years, they are certainly worth considering. They offer self-invested personal pensions (SIPPs) as well.

Moving on, my Assetz Exchange investments continue to generate steady returns. Regular readers will know that this is a P2P property investment platform focusing on lower-risk properties (e.g. sheltered housing). I put an initial £100 into this in mid-February 2021 and another £400 in April. In June 2021 I added another £500, bringing my total investment up to £1,000.

Since I opened my account, my AE portfolio has generated a very respectable £96.79 in revenue from rental income. As I said in last month’s update, capital growth has slowed, though, in line with UK property values generally. Even so, it’s not all bad news. At the time of writing 16 of ‘my’ properties are showing gains, 7 are showing losses, and two are breaking even. My portfolio is currently showing a small net increase in value of £13.36, meaning that overall (rental income plus capital gains) I am up by £110.15. That is still a very decent rate of return on my £1,000 and does illustrate the value of P2P property investments for diversifying your portfolio. And it doesn’t hurt that with Assetz Exchange most projects are socially beneficial as well.

- To control risk with all my property crowdfunding investments nowadays, I invest relatively modest amounts in individual projects. This is a particular attraction of AE as far as i am concerned. You can actually invest from as little as 80p per property if you really want to proceed cautiously.

My investment on Assetz Exchange is in the form of an IFISA so there won’t be any tax to pay on profits, dividends or capital gains. I’ve been impressed by my experiences with Assetz Exchange and the returns generated so far, and intend to continue investing with them. You can read my full review of Assetz Exchange here. You can also sign up for an account on Assetz Exchange directly via this link [affiliate].

Another property platform I have investments with is Kuflink. They continue to do well, with new projects launching almost every day. I currently have around £2,400 invested with them in 18 different projects (I withdrew £200 in December to help pay for Christmas). To date I have never lost any money with Kuflink, though some loan terms have been extended once or twice. On the plus side, when this happens additional interest is paid for the period in question.

My loans with Kuflink pay annual interest rates of 6 to 7.5 percent. These days I invest no more than £200 per loan (and often less). That is not because of any issues with Kuflink but more to do with losses of larger amounts on other P2P property platforms in the past. My days of putting four-figure sums into any single property investment are behind me now!

- Nowadays I mainly opt to reinvest the monthly repayments I receive from Kuflink, which has the effect of boosting the percentage rate of return on the projects in question

Obviously a possible drawback with Kuflink and similar platforms is that your money is tied up in bricks and mortar, so not as easily accessible as cash savings or even (to some extent) shares. They do, however, have a secondary market on which you can offer any loan part for sale (as long as the loan in question is performing and not in arrears). Clearly that does depend on someone else wanting to buy it, but my experience has been that any loan parts offered are typically snapped up very quickly. So if an urgent need arises, withdrawing your money (or part of it) is unlikely to be an issue.

You can read my full Kuflink review here. They offer a variety of investment options, including a tax-free IFISA paying up to 7% interest per year with built-in automatic diversification. Alternatively you can now build your own IFISA, with most loans on the platform (including the one shown above) being IFISA-eligible.

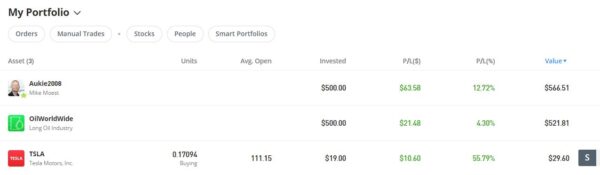

Last year I set up an account with investment and trading platform eToro, using their popular ‘copy trader’ facility. I chose to invest $500 (then about £412) copying an experienced eToro trader called Aukie2008 (real name Mike Moest).

In January I added to this with another $500 investment in one of their thematic portfolios. I also invested a small amount I had left over in Tesla shares. My original investment of $1,022.26 is today worth $1,118.62, an increase of $96.36 or 9.63%. in these turbulent times I am very happy with that.

In any event, I’m looking on this as a long-term investment so won’t be judging it yet. You can read my full review of eToro here. You may also like to check out my recent more in-depth look at eToro copy trading. I shall be publishing a post about my latest investment in an eToro thematic portfolio soon.

- eToro also recently introduced the eToro Money app. This allows you to deposit money to your eToro account without paying any currency conversion fees, saving you up to £5 for every £1,000 you deposit. You can also use the app to withdraw funds from your eToro account instantly to your bank account. I tried this myself recently and was impressed with how quickly and seamlessly it worked. You can read my blog post about eToro Money here.

I had two more articles published in January on the always-excellent Mouthy Money website. One is A Three-Step Plan to Help Boost Your Finances in 2023. This article actually came out of an online presentation I did a few months ago to a club for older people. I hope you will find the ideas and advice it contains useful.

My other piece was Switch to Profit – How to Make Money Moving Your Bank Account. With the banks now starting to offer switching bonuses again to attract new customers, there are hundreds of pounds to be made by doing this. The article quotes my sister Annie, who is a serial switcher and shares some top tips based on her experiences. Many thanks, Annie!

- My other blog posts from January include Planning a UK Holiday This Year? Here Are Some Ideas for You! and Ways to Prevent Scams From Reducing Your Savings. Another is How Well Do British People Understand Home Insurance, published in association with my friends at HSBC Life. And finally, while I obviously hope it won’t apply to you personally, this expert guest post by a senior divorce lawyer is also well worth a read: Silver Splitters – How to Navigate Divorce at a Later Stage in Life.

That’s all for today. I hope you and your family are coping in these undoubtedly challenging times. Don’t forget to check out the government’s Help for Households website, which sets out various types of financial assistance you may be entitled to and is regularly updated.

As always, if you have any comments or queries, feel free to leave them below. I am always delighted to hear from PAS readers

Disclaimer: I am not a qualified financial adviser and nothing in this blog post should be construed as personal financial advice. Everyone should do their own ‘due diligence’ before investing and seek professional advice if in any doubt how best to proceed. All investing carries a risk of loss.

Note also that posts may include affiliate links. If you click through and perform a qualifying transaction, I may receive a commission for introducing you. This will not affect the product or service you receive or the terms you are offered, but it does help support me in publishing PAS and paying my bills. Thank you!

February 2, 2023 @ 5:08 pm

Despite the turbulent times, it’s certainly a strong and steady start to the new year for your investments. I’ve never really known anything other than what you’ve said with regards to P2P property investment platforms but even that has done nicely from a smaller investment. All looking good, Nick – Well done! x

February 2, 2023 @ 5:20 pm

Many thanks, Caz. Yes, it’s been a good month for my Nutmeg investments especially. I’m also pleased with how my P2P property investments with Assetz Exchange and Kuflink are doing, though admittedly I have lost money with other property investment platforms in the past. I learned some expensive but important lessons from this, especially about the importance of diversification and not putting all your eggs in one basket! Thanks again for your kind comments. I do hope life is treating you well.

February 3, 2023 @ 4:05 pm

Could you give some more insight on how much Nutmeg fees amount in your portfolio?

I have been with Nutmeg since October so currently still in a 12 months no-fee period, but I’m worried that on the long run fees will eat a significant chunk of the profits.

And a small comment about format: it would be great if you could report the month to month difference in percentage terms as well instead of just absolute.

And thank you for fixing the email subscription feature, seems to work now 🙂

February 3, 2023 @ 4:38 pm

Hi Matteo. Glad the update feature seems to be working now 🙂

As regards Nutmeg fees, in the seven years I have been investing with them. I have been charged a total of around £700. That’s an average of £100 a year or about £8 a month. At today’s values I am about £7200 in profit, which I am very happy with.

Okay, without those charges that profit figure would be £7900, but all investment platforms impose some fees. Personally I don’t worry about the fees because I have still made very good returns on my investment.

On your other request, I will consider doing this going forward, for the total monthly profit/loss figure anyway.

February 6, 2023 @ 11:31 am

Thank you. I guess it’s not huge fees but they do add up on the long run.

What I’m wondering is if someone is better off investing on the same ETFs manually via another platform without fees (like Trading212 for example, if you don’t consider FX fees). They already provide the information of which funds your portfolio is split into, so it’d be only matter of copying that. Something I’ll definitely ponder on once the no-fee period runs out for me.

Thank you again

February 6, 2023 @ 4:07 pm

Fair enough! But bear in mind that Nutmeg are constantly adjusting the type and balance of ETFs within portfolios, so you would need to monitor this on a weekly basis and copy accordingly. Personally I think it’s a lot of effort to save maybe £100 a year (in my case). But if you don’t mind that, you could certainly try this strategy!