My Investments Update March 2024

Here is my latest monthly update about my investments. You can read my February 2024 Investments Update here if you like

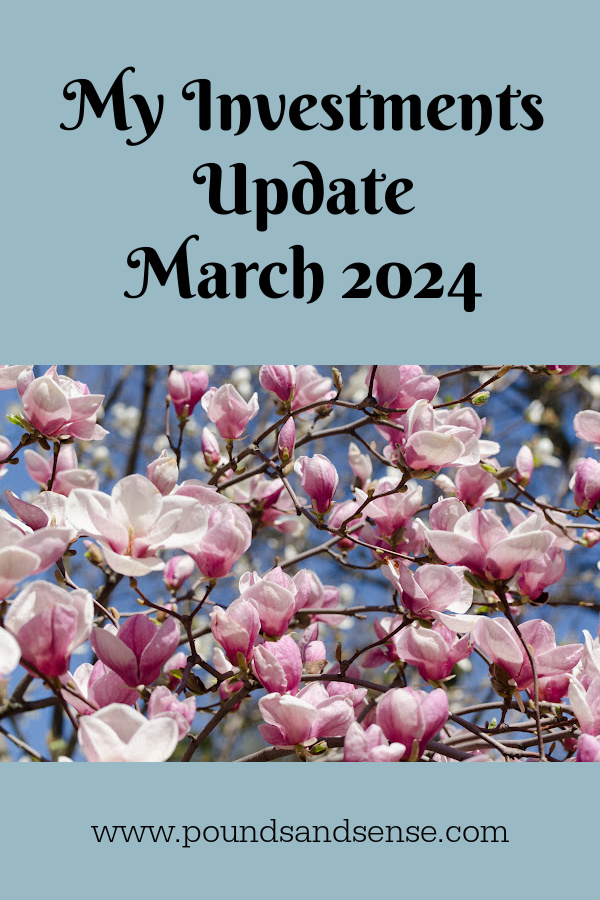

I’ll begin as usual with my Nutmeg Stocks and Shares ISA. This is the largest investment I hold other than my Bestinvest SIPP (personal pension).

As the screenshot below for the last 12 months shows, my main Nutmeg portfolio is currently valued at £ £22,994. Last month it stood at £22,386 so that is a welcome increase of £608.

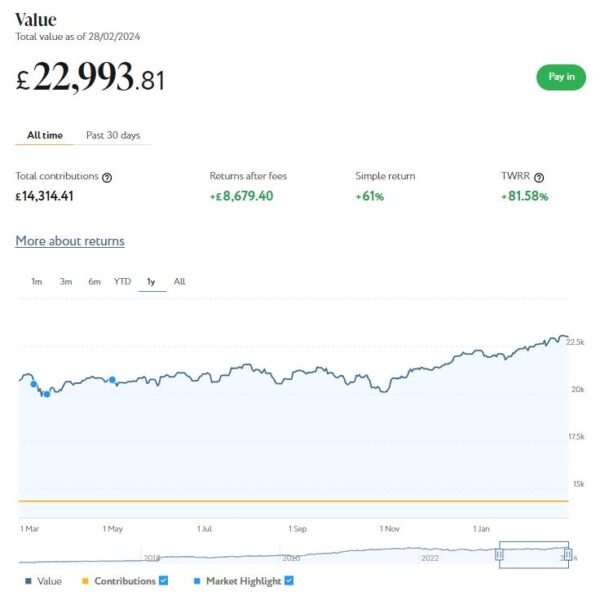

Apart from my main portfolio, I also have a second, smaller pot using Nutmeg’s Smart Alpha option. This is now worth £3,640 compared with £3,530 a month ago, a rise of £110. Here is a screen capture showing performance over the last 12 months.

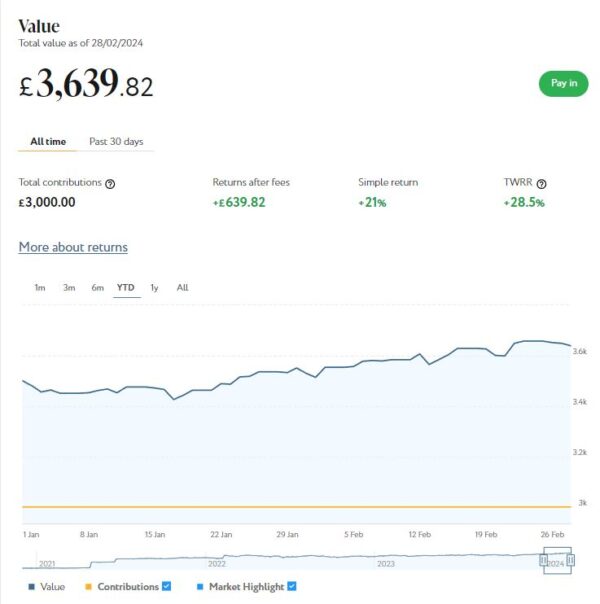

Finally, at the start of December 2023 I invested £500 in one of Nutmeg’s new thematic portfolios (Resource Transformation). As you can see from the screen capture below, this is now worth £530, an increase of £11 since last month and £30 or 6% over the three-month period since I first invested.

February was obviously a good month for my Nutmeg investments. Overall I was up £737 or 2.79%. In these turbulent times I am more than happy with that.

You can read my full Nutmeg review here. If you are looking for a home for your annual ISA allowance, based on my overall experience over the last seven years, they are certainly worth considering. They offer self-invested personal pensions (SIPPs), Lifetime ISAs and Junior ISAs as well.

- Don’t forget, the current tax year ends on 5 April 2024 and after that the 2023/24 tax-free ISA allowance of £20,000 will be gone forever!

I also have investments with the property crowdlending platform Kuflink. They continue to do well, with new projects launching every week. I currently have around £1,570 invested with them in 10 different projects paying interest rates averaging around 7%. I also have £14 in my Kuflink cash account.

To date I have never lost any money with Kuflink, though some loan terms have been extended once or twice. On the plus side, when this happens additional interest is paid for the period in question.

There is now an initial minimum investment of £1,000 and a minimum investment per project of £500. Kuflink say they are doing this to streamline their operation and minimize costs. I can understand that, though it does mean that the option to test the water with a small first investment has been removed. It also makes it harder for small investors (like myself) to build a well-diversified portfolio on a limited budget.

One possible way around this is to invest using Kuflink’s Auto/IFISA facility. Your money here is automatically invested across a basket of loans over a period from one to five years. Interest rates range from 7% to around 10%, depending on the length of term you choose. Full up-to-date details can be found on the Kuflink website.

You can invest tax-free in a Kuflink Auto IFISA. Or if you have already used your annual iFISA allowance elsewhere, you can invest via a taxable Auto account. You can read my full Kuflink review here if you wish.

Moving on, my Assetz Exchange investments continue to generate steady returns. Regular readers will know that this is a P2P property investment platform focusing on lower-risk properties (e.g. sheltered housing). I put an initial £100 into this in mid-February 2021 and another £400 in April. In June 2021 I added another £500, bringing my total investment up to £1,000.

Since I opened my account, my AE portfolio has generated a respectable £168.53 in revenue from rental income. As I said in last month’s update, capital growth has slowed, though, in line with UK property values generally.

At the time of writing, 10 of ‘my’ properties are showing gains, 4 are breaking even, and the remaining 15 are showing losses. My portfolio is currently showing a net decrease in value of £40.01, meaning that overall (rental income minus capital value decrease) I am up by £128.52. That’s still a decent return on my £1,000 and does illustrate the value of P2P property investments for diversifying your portfolio. And it doesn’t hurt that with Assetz Exchange most projects are socially beneficial as well.

The overall fall in capital value of my AE investments is obviously a little disappointing. But it’s important to remember that until/unless I choose to sell the investments in question, it is largely theoretical, based on the most recent price at which shares in the property concerned have changed hands. The rental income, on the other hand, is real money (which in my case I’ve reinvested in other AE projects to further diversify my portfolio).

To control risk with all my property crowdfunding investments nowadays, I invest relatively modest amounts in individual projects. This is a particular attraction of AE as far as i am concerned (especially now that Kuflink have raised their minimum investment per project to £500). You can actually invest from as little as 80p per property if you really want to proceed cautiously.

- As I noted in this recent post, Assetz Exchange is particularly good if you want to compound your returns by reinvesting rental income. This effectively boosts the interest rate you are receiving. Personally, once I have accrued a minimum of £10 in rental payments, I reinvest this money in either a new AE project or one I have already invested in (thus increasing my holding). Over time, even if I don’t invest any more capital, this will ensure my investment with AE grows at an accelerating rate.

My investment on Assetz Exchange is in the form of an IFISA so there won’t be any tax to pay on profits, dividends or capital gains. I’ve been impressed by my experiences with Assetz Exchange and the returns generated so far, and intend to continue investing with them. You can read my full review of Assetz Exchange here. You can also sign up for an account on Assetz Exchange directly via this link [affiliate].

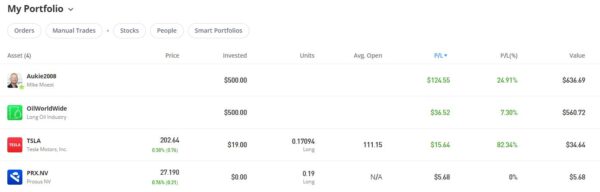

In 2022 I set up an account with investment and trading platform eToro, using their popular ‘copy trader’ facility. I chose to invest $500 (then about £412) copying an experienced eToro trader called Aukie2008 (real name Mike Moest).

In January 2023 I added to this with another $500 investment in one of their thematic portfolios, Oil Worldwide. I also invested a small amount I had left over in Tesla shares.

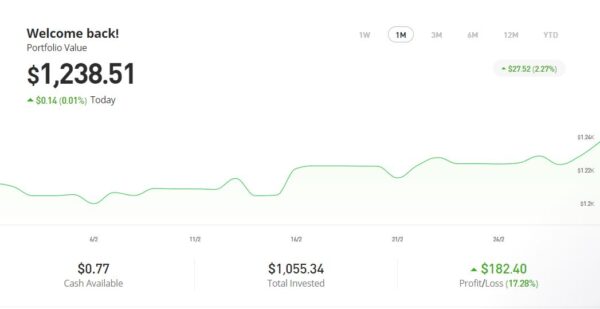

As you can see from the screen captures below, my original investment totalling $1,022.26 is today worth $1,238.51, an overall increase of $216.25 or 21.15%.

You can read my full review of eToro here. You may also like to check out my more in-depth look at eToro copy trading. I also discussed thematic investing with eToro using Smart Portfolios in this recent post. The latter also reveals why I took the somewhat contrarian step of choosing the oil industry for my first thematic investment with them.

- eToro also offer the free eToro Money app. This allows you to deposit money to your eToro account without paying any currency conversion fees, saving you up to £5 for every £1,000 you deposit. You can also use the app to withdraw funds from your eToro account instantly to your bank account. I tried this myself and was impressed with how quickly and seamlessly it worked. You can read my blog post about eToro Money here. Note that it can also serve as a cryptocurrency wallet, allowing you to send and receive crypto from any other wallet address in the world.

I had three more articles published in January on the excellent Mouthy Money website. The first is How to Save Money on Motoring. Like everything else in life the cost of motoring is going up and up, so in this article I set out a variety of ways – from ride-sharing to driving for fuel economy – you may be able to reduce it.

Also in February Mouthy Money published Are You Making the Most of Your Annual ISA Allowance?. As mentioned earlier, the 2023/24 tax year ends in just a few weeks’ time. And after that the £20,000 tax-free ISA allowance for that year will be gone forever. In this article I describe the different types of ISA – Cash ISA, Stocks and Shares ISA, Innovative Finance ISA (IFISA) and Lifetime ISA (LISA) – and explain how they work and the differences between them. I also provide some tips and advice for making the most of your annual ISA allowance.

My final article published on Mouthy Money last month was Can You Save Money on Your Shopping with JamDoughnut? Regular PAS readers will know that I am a fan of the JamDoughnut app, which enables you to save up to 20% on purchases with a growing range of retailers. The article also reveals how you can get a £2 head-start by using my referral code.

As I’ve said before, Mouthy Money is a great resource for anyone interested in money-making and money-saving. I am a particular fan of my fellow MM contributor and money blogger Shoestring Jane. She writes mainly about money saving and frugal living. Her latest article Frugal Skills to Save You Money sets out a selection of life skills that can save you money (and aren’t hard to learn). You can see all of Jane’s articles for Mouthy Money via this web page.

I also published several posts on Pounds and Sense in February. I won’t bother mentioning those that are no longer relevant now, but the others are listed below.

In Get Your Will Written Free of Charge in March I revealed how you can get your will written (or updated) free of charge during Free Wills Month. This regular event supports a range of leading charities. Obviously the hope is that you will include a bequest to charity in your will, but there is absolutely no obligation to do this. Free Wills Month is now up and running. If you want to take advantage and get your will written free, I recommend acting now as there are only limited spots available.

Also in March I published a guest post titled Building Your Own Home – It’s Not Just for the Super Rich! This post was written on behalf of Suffolk Building Society, who are trying to raise awareness of the self-build option in the UK. As they say in the article, they can provide mortgages to purchase land suitable for self-build projects. SBS emphasize that this option is suitable and available for ‘ordinary people’, not just the super-rich folk you see on TV shows like Grand Designs!

I also published Saving for a Rainy Day or a Stormy Breakup? The Surprising Facts About Secret Savings Accounts. This post is based on some eye-opening research from my friends at Smart Money People, which revealed (among other things) that one in ten people in a serious relationship, including marriage, civil partnerships, or cohabitation, maintain a secret savings account. Find out more in this post.

Finally, in What is AER and Why Is It Important to Savers and Investors? I revealed what AER is and why both savers and investors need to understand it. This was really a follow-up to my article last month about the importance of compounding to investors. The article reveals how more frequent compounding increases AER (annual equivalent rate) and includes the formula used to calculate this.

- Also, from January this year I became a regular contributor to the new Over 60s Discounts website. You can read my latest article here: Who Cares for the Carers? This is about help available for unpaid carers in the UK, both financial and practical. I highly recommend registering at Over 60s Discounts, by the way – they list a growing range of discounts and bonuses for older people, including some that are unique to O60D.

One other thing is that this month I switched my Santander 123 Lite current account to a Santander Edge current account. I will try to find time to write a separate post about this soon. But briefly, my main reason was because having an Edge current account allows you to open an Edge savings account, which offers a market-leading 7% interest rate (AER) for amounts of up to £4,000 for one year (it then falls to 4.5% AER).

The Santander Edge account has slightly higher fees (£3 a month as opposed to £2) and the cashback on offer is slightly less. However, when I crunched the numbers, the value of having an Edge savings account easily outweighed this. Though I am fortunate in that I had £4,000 I could put into it immediately from another, lower-paying savings account. If I hadn’t had that, it wouldn’t have been worth switching to the Edge account.

Finally, a quick reminder that you can also follow Pounds and Sense on Facebook or Twitter/X. Twitter/X is my number one social media platform these days and I post regularly there. I share the latest news and information on financial (and other) matters, and other things that interest, amuse or concern me. So if you aren’t following my PAS account, you are definitely missing out!

That’s all for today. As always, if you have any comments or queries, feel free to leave them below. I am always delighted to hear from PAS readers

Disclaimer: I am not a qualified financial adviser and nothing in this blog post should be construed as personal financial advice. Everyone should do their own ‘due diligence’ before investing and seek professional advice if in any doubt how best to proceed. All investing carries a risk of loss.

Note also that posts may include affiliate links. If you click through and perform a qualifying transaction, I may receive a commission for introducing you. This will not affect the product or service you receive or the terms you are offered, but it does help support me in publishing PAS and paying my bills. Thank you!