My Investments Update – May 2022

Here is my latest monthly update about my investments. You can read my April 2022 Investments Update here if you like

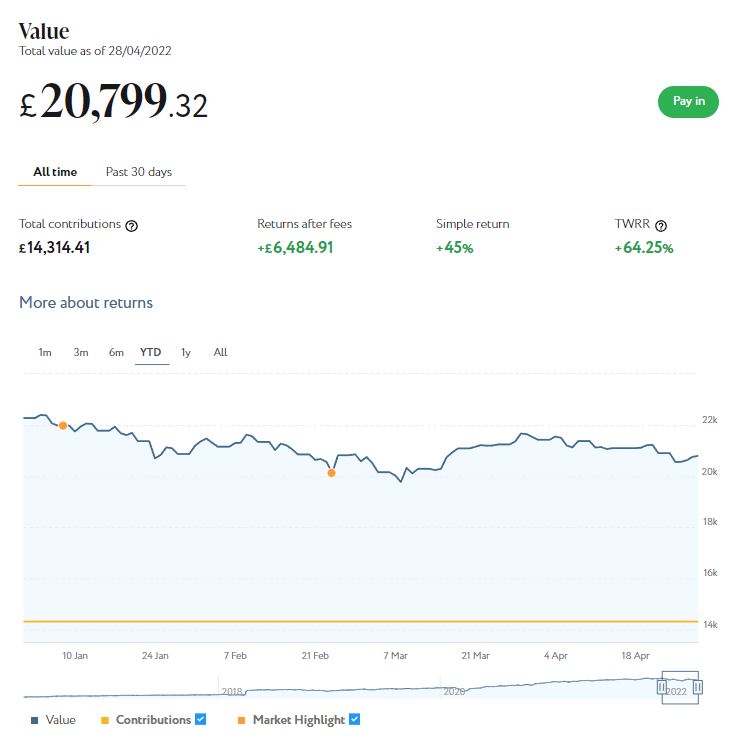

I’ll begin as usual with my Nutmeg Stocks and Shares ISA. This is the largest investment I hold other than my Bestinvest SIPP (personal pension).

As the screenshot below shows, my main portfolio is currently valued at £20,799. Last month it stood at £21,646, so that is a fall of £847.

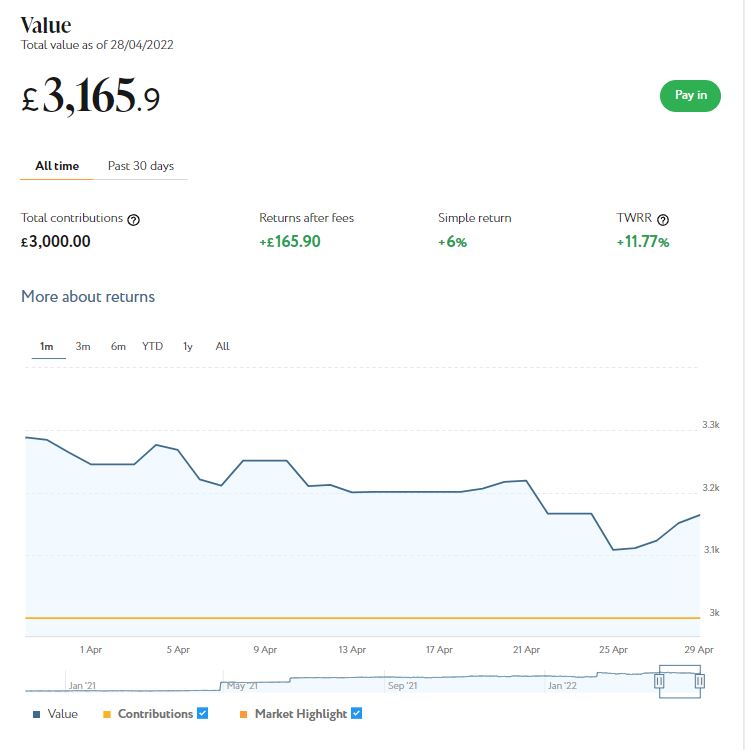

Apart from my main portfolio, I also have a second, smaller pot using Nutmeg’s Smart Alpha option. This is now worth £3,166 compared with £3,286 last month, a fall of £120

Here is a screen capture showing performance over the last month.

Obviously the falls are disappointing (although they come after broadly similar rises the month before). As I’ve noted previously on PAS, you do have to expect ups and downs with equity-based investments, and certainly over the last few months there has been no shortage of volatility in world markets. And it’s also worth noting that since I started investing with Nutmeg in 2016 I have still enjoyed a total return on my main portfolio of 45% (or 64.25% time-weighted).

I should also mention that I selected quite a high risk level for both my Nutmeg accounts (9/10 for the main one and 5/5 for Smart Alpha). This has served me well generally, but I’m sure investors who selected lower risk levels will have seen smaller falls last month.

- If you also have a Nutmeg portfolio and plan to withdraw from it in the next few months, there is certainly a case for switching to a lower risk level right now.

You can read my full Nutmeg review here (including a special offer at the end for PAS readers). If you are looking for a home for your annual ISA allowance, based on my experience over the last six years, they are certainly worth considering.

If you haven’t yet seen it, check out also my blog post in which I looked at the performance of Nutmeg fully managed portfolios at every risk level from 1 to 10 (as mentioned, my main port is level 9). I was actually pretty amazed by the difference the risk level you choose makes. If you are investing for the long term (and you almost certainly should be) opting for a hyper-cautious low-risk strategy may not be the smartest thing to do.

I won’t go into detail about my Assetz Exchange investments this month. Briefly, though, regular readers will know that this is a P2P property investment platform focusing on lower-risk properties (e.g. sheltered housing). I put an initial £100 into this in mid-February 2021 and another £400 in April. In June 2021 I added another £500, bringing my total investment up to £1,000. Since I opened my account, my AE portfolio has generated £51.50 in revenue from rental and £82.29 in capital growth, a total of £133.79. That’s a decent rate of return on my £1,000 investment and does illustrate the value of P2P property investment for diversifying your portfolio when equity markets are volatile. You can read my full review of Assetz Exchange here. You can also sign up for an account on Assetz Exchange directly via this link [affiliate].

Another property platform I have investments with is Kuflink. They have been doing well recently, with new projects launching almost every day. I currently have over £2,150 invested with them, a significant proportion of which comes from reinvested profits. To date I have never lost any money with Kuflink, although some loan terms have been extended once or twice. On the plus side, when this happens additional interest is paid for the period in question. At present all my Kuflink loans are performing to schedule, with several due to mature in the next few months.

Kuflink recently announced that they were ending their cashback incentive for new members. This used to pay up to £4,000. I know several PAS readers availed themselves of this offer. It’s obviously disappointing it’s now ended, but in a way it’s good news as well. It demonstrates that Kuflink is thriving and they don’t need to offer ‘bribes’ to bring in new investors. As they themselves said in a recent email, ‘We feel now is the right time for us to move away from these campaigns [cashback and refer-a-friend] and utilise the funds within the business to make further enhancements to our products and the platform.’

Even without the cashback incentive, I do still recommend Kuflink and will continue to invest with them. You can read my full Kuflink review here. They offer a variety of investment options, including a tax-free IFISA paying up to 7% interest per year with built-in automatic diversification. Alternatively you can now build your own IFISA, with most loans on the platform being IFISA-eligible.

Another platform in which I have a modest investment is the European crowdlending platform Nibble. This has continued to perform as promised. Several of the loans I invested in have matured and each time I have reinvested the proceeds.

Nibble recently added a new loan category to their offering. This is in the debt collection market; Nibble describe it as their Legal Strategy. This involves investing in loans that are overdue and facing legal action for recovery. Nibble buy these loans at a fraction of their value and then attempt to recover as much of the outstanding debt as possible.

Nibble investors can buy portions of these loans for prices starting at 100 euro (about £84). The company say that investors will receive annual interest rates of between 8 and 14.5% according to how successful their recovery efforts prove. But in any event they offer a ‘buyback guarantee’ that even in the worst case you will receive 8% interest and return of your original investment. I will be trying this out myself soon and also updating my original review, which you can read here if you wish. You can also sign up directly on the Nibble website if you like [affiliate link].

Also this month I wanted to mention that the under-the-radar matched betting opportunity I have described a few times on PAS has closed. My contact there tells me the bookies have tightened up so much on their offers that it is no longer feasible to go on running a free service that makes money for both clients and the company. Final payments went out by the end of April to all existing members (which of course include a number of PAS readers). Again this is obviously disappointing, but I have seen myself that it is getting harder and harder (though not yet impossible) to generate profits from matched betting, especially once you have exhausted the welcome offers.

Anyway, the better news is that the guys behind the business have a new project in the pipeline that will make use of the clever software they developed for the matched betting service. It will work a bit differently from the original programme, but again will be free to join and entirely risk-free for members. They say they expect it to work over a three-month period and generate a one-off payout of between £500 and £1500 per person. In addition, because the new programme will work differently, it will also be open to people who do matched betting themselves (or have done in the past). I will share more details on PAS when I have them – but for now if you would like to be put on my priority list for info, just drop me a line with your email address via my Contact Me page.

Another bit of news is that I have temporarily suspended withdrawals from my Bestinvest SIPP, which is now in drawdown. This is partly in response to volatility in world markets caused by the war in Ukraine and inflation fears (among other things). But also I don’t need the money as much at the moment, as I am now receiving the full state pension. With my other income streams as well, continuing to draw an income from my SIPP would have generated a tax liability, so I thought it better to let the money grow tax-free in my pension fund until I really need it. My personal financial adviser Mike agrees and approves, incidentally 🙂

- You might also enjoy reading this comprehensive guide to managing your money in retirement by my friends at Companion Stairlifts, in which I am quoted:

Lastly, I enjoyed my short break in lovely Llandudno a week ago. I was reasonably lucky with the weather, although it was quite windy. But it was great to see the resort almost back to normal after the lockdowns and other disruptions of the last two years. There were plenty of people out and about enjoying the spring sunshine, as this photo taken at the end of the pier shows 🙂

One other thing that struck me in Llandudno was how widely cash was accepted and indeed welcomed. In the Midlands town where I live most businesses don’t seem to want cash any more and insist on payment by card. I actually had to go to a cashpoint in Llandudno to draw more money. I can’t remember the last time I did that at home!

That’s enough for now, so I’ll sign off till next time. I hope you are keeping safe and well, and making the most of the better weather and lifting of Covid restrictions. If you’re planning any UK holidays yourself, don’t forget I have a list of places I have visited and recommend here 🙂

Disclaimer: I am not a qualified financial adviser and nothing in this blog post should be construed as personal financial advice. Everyone should do their own ‘due diligence’ before investing and seek professional advice if in any doubt how best to proceed. All investing carries a risk of loss.

Note also that posts may include affiliate links. If you click through and perform a qualifying transaction, I may receive a commission for introducing you. This will not affect the product or service you receive or the terms you are offered.

May 11, 2022 @ 11:47 am

I was interested to read about Kuflink from someone who has actually invested. I do like the idea of participating in something similar in the future.

May 11, 2022 @ 2:16 pm

Thanks, Erica. Yes, based on my experience, I am happy to recommend Kuflink.

May 13, 2022 @ 1:41 pm

This is a really interesting post and great to read about investing from a personal perspective. Hopefully when I have some free cash I can start looking into it more seriously!

Claire, G is for Gingers

May 13, 2022 @ 1:48 pm

Thanks, Claire. Glad you found it interesting. Of course money is tight for many of us right now, but it’s still important to think about investing, as in the long term it’s likely to be the only way to grow your wealth faster than the rate of inflation.