My Investments Update – September 2021

Regular readers will know I’ve been posting ‘Coronavirus Crisis’ Updates since March 2020. These covered my investments and also more personal matters. You can read my August 2021 update here if you like

As I said in that update, since Freedom Day in England has now happened, with the scrapping of most restrictions, it no longer seems appropriate to go on publishing Coronavirus Crisis updates (though the virus hasn’t gone away, I know). So I shall now be publishing monthly investment-only updates, with more personal updates as and when seems appropriate.

Let’s get straight on then. I’ll begin as usual with my Nutmeg stocks and shares ISA, as I know many of you like to hear what is happening with this.

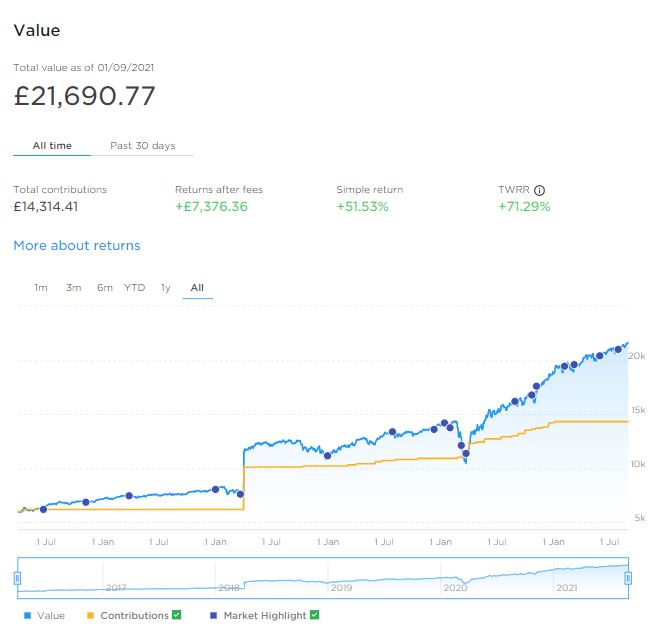

As the screenshot below shows, my main portfolio performed well in August. It is currently valued at £21,690. Last month it stood at £21,015, so that is a rise of £675 (Nutmeg is now showing values including pence as well, but for simplicity I am not including this).

Apart from my main portfolio, I also have a second, smaller pot using Nutmeg’s new Smart Alpha option. This pot also did well in August. It is now worth £2,710, compared with £2,625 last month. That’s an increase of £85 or just over 3%. Here is a screen capture showing performance in August 2021.

You can read my full Nutmeg review here (including a special offer at the end for PAS readers). If you are still looking for a home for your 2021/22 ISA allowance, based on my experience they are certainly worth considering. If you haven’t yet seen it, check out also my recent blog post in which I looked at the performance of Nutmeg fully managed portfolios at every risk level from 1 to 10 (my main port is level 9). I was actually amazed by the difference the risk level you choose makes.

- You might also like to know that during September 2021 Nutmeg is running a special promotion on Junior ISAs (JISAS). If you open one of these for a child with Nutmeg (or transfer an existing Child Trust Fund) you will automatically be entered into a free prize draw to win £9,000 (this tax year’s full JISA allowance). For more information click on this link. I am also planning to write a blog post about this soon.

As regular readers will know, this year I am using Assetz Exchange for my IFISA. This is a P2P property investment platform that focuses on lower-risk properties (e.g. sheltered housing on long leases). I put £100 into this in mid-February and another £400 in April. Touch wood, everything has been going well, so in June I added another £500, bringing my total investment on the platform up to £1,000.

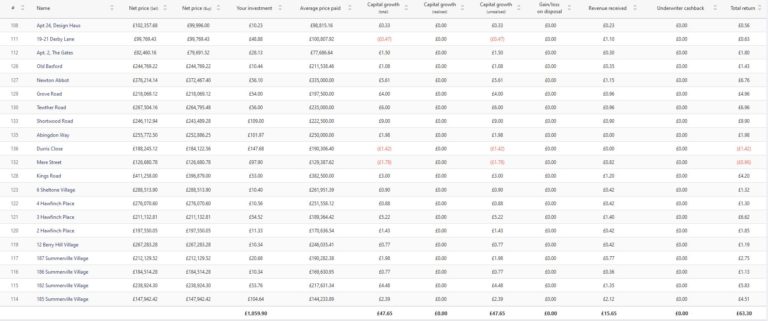

Since I opened my account, my portfolio has generated £15.65 in revenue from rental and £47.65 in capital growth, for a total return of £63.30. Here is my current statement:

To a degree Assetz Exchange has been a victim of its own success. They had a big influx of new members, meaning all available investments were quickly snapped up. At the same time, some of the new projects that were due to launch were delayed. In the last month, however, a small number of new projects went live on the platform, so I am pleased to say my £1,000 (and a bit more from dividends received) is now fully invested.

To control risk with all my property crowdfunding investments nowadays, I am investing relatively modest amounts in individual projects. I don’t therefore put more than around £100 into any one project. As you can see, I already have a well-diversified portfolio with Assetz Exchange comprising 21 different projects. This is a particular attraction of AE in my view. You can actually invest from as little as 80p per property if you really want to proceed cautiously.

My investment on Assetz Exchange is in the form of an IFISA so there won’t be any tax to pay on profits, dividends or capital gains. I’ve been impressed by my experiences with Assetz Exchange and the returns generated so far, and intend to continue investing with them. You can read my full review of Assetz Exchange here if you like. You can also sign up for an account on Assetz Exchange directly via this link [affiliate].

Another property platform I have some investments with is Kuflink. They appear to have been doing well recently, with new projects launching almost every day on the platform.

I have a well-diversified portfolio of loans with Kuflink paying annual interest rates of 6 to 7.5 percent. As mentioned above, these days I invest no more than around £100 per loan (and often less). That is not because of any issues with Kuflink but more to do with losses of larger amounts on other P2P property platforms (such as this one). My days of putting four-figure sums into any single property investment are definitely behind me now!

You can read my full Kuflink review here. They recently passed the milestone of £100 million loaned, and say that since their launch no investor has lost money with them. They offer a variety of investment options, including a tax-free IFISA paying up to 7% interest per year, with built-in automatic diversification. And I’d particularly draw your attention to their revised and more generous cashback offer for new investors. They are now paying cashback on new investments from as little as £500 (it used to be £1,000). And if you are looking to invest larger amounts, you can earn up to a maximum of £4,000 in cashback. That is one of the best cashback offers I have seen anywhere (though admittedly you will need to invest £100,000 or more to receive that!).

In August two more PAS readers signed up with the low-key sideline-earning opportunity mentioned in previous updates. They will have received their initial £100 reward payments about now. I still have a few more invitations available if anyone else would like to take advantage.

This opportunity is based on matched betting, a sideline I have been pursuing for several years myself. I was asked not to divulge too many details about it publicly, for good reasons I will explain privately to anyone who may be interested (and no, it’s not illegal!). It doesn’t require any financial outlay and is risk-free and entirely hands-off (once you have set up your account). No knowledge of betting is required and you don’t have to place any bets yourself (this is all done by the company’s clever software). You just have to set up a separate bank account for bets to go through, but running the account is entirely financed by the company.

The company has changed its terms somewhat for new members. You now get a larger £!00 initial reward payment once your account is up and running, and then £25 every month you remain a member. I think this is a good move personally, as setting up the account does involve a little work on your part (though it’s certainly not like going down the mines). So the £100 in effect compensates you for your time, and once it’s done you continue to get £25 a month for no effort at all. The company is constantly developing its offering, partly in response to feedback from PAS readers. They recently launched a new mobile-friendly website to make it even easier for new members to sign up (once you’re up and running you shouldn’t need to use the website at all). They also recently incorporated an Open Banking app so that members don’t have to provide their online banking info to the company, as some people were concerned about this.

Please note that this opportunity is only open to honest, trustworthy people who haven’t done matched betting before and have no more than two accounts already with online bookmakers. For more information (and to receive a no-obligation invitation) drop me a line including your email address via my Contact Me page. And yes, I will receive a reward for introducing you, but this will not affect the service or the rewards you receive.

- In the interests of full transparency, I should say that if you do matched betting yourself, you may be able to make more money than what is being offered by the company. However, you will have to research the techniques in detail, place all bets yourself, and probably subscribe to a matched betting advisory service such as Profit Accumulator [affiliate link]. This opportunity is really for those who want an easy way to make some extra money without the hassle (or expense) of learning/applying matched-betting methods themselves.

Finally, I have a couple more articles on the always-excellent Mouthy Money website if you’d like to check them out. One is titled How Much Do You Really Need to Retire Comfortably? And the other sets out The Best Discounts and Freebies for Older People. I particularly enjoyed researching that one!

As always, if you have any comments or questions about this post, please do leave them below.

September 5, 2021 @ 8:08 pm

I’m so impressed with how your investments are performing. I wish I had the guts to do something a little more risky with my money as it could really pay off. I’m not sure my heart can take it though! lol

September 5, 2021 @ 9:12 pm

Thanks, Michelle. I have made my share of mistakes with investments in the past so nowadays I try to diversify as much as possible. I am, of course, a fan of all the investment platforms mentioned in this article.

September 5, 2021 @ 9:25 pm

I always find your investment updates really interesting – I like seeing where you choose to invest and how well they are doing.

September 6, 2021 @ 7:34 am

Many thanks, Rebecca.