Nutmeg Review: My Experiences with this Robo-Adviser Investment Platform

Updated 21 May 2024

In April 2016 I invested some money with the Nutmeg investment platform. It turned out to be one of my better investments, so in this update I thought I’d say a bit more about it.

Table of Contents

What Is Nutmeg?

Nutmeg is a low-cost online investment platform. It is aimed at people who want to invest to take advantage of the potentially better returns, but don’t want the hassle of researching every investment themselves. Nutmeg has 200,000 investors as of May 2024 and over £5 billion in Assets Under Management (AUM).

With Nutmeg you simply choose the type of account you want and your investment style and how long you want to invest your money for (you don’t have to stick to this, of course, although they recommend to remain invested for at least 3 years). You can deposit a lump sum and/or set up monthly payments. Nutmeg then invests your money in a range of Exchange Traded Funds (ETFs).

For those who don’t know, ETFs are a package of shares from a particular section of the stock market. For example, an ‘Asia Pacific ETF’ is a collection of shares from the Asia-Pacific region. ETFs are different to most investment funds in that they don’t usually have a manager running them. Instead, most ETFs are run by computers that regularly balance their portfolios automatically. This helps keep costs low, though there is of course no guarantee of returns. You can learn more about ETFs here if you wish.

Nutmeg currently has five different types of investment product on offer. They are as follows:

ISA (individual Savings Account) – These accounts have to be funded from your after-tax income, but they grow tax efficiently and withdrawals are free of tax. Everyone has a maximum annual ISA allowance, which is currently a generous £20,000.

SIPP (Self Invested Personal Pension) – A SIPP has the big attraction that you get tax relief on your contributions, so the government effectively tops up every contribution you make. On the downside, you can’t withdraw money from a SIPP until you are at least 55, and only a quarter of the money you withdraw is tax-free, with the balance counting towards your total taxable income.

Lifetime ISA – A Lifetime ISA, sometimes called a LISA for short, is a tax-efficient vehicle launched in 2016. You can use a LISA for one of two specific purposes – buying your first home or saving for retirement. You have to be under 40 to open a Lifetime ISA. The government will then top up any contributions you make with an extra 25%. The maximum you can contribute to a LISA is £4,000 per year.

Junior ISA – A Junior ISA is an ISA opened by a parent or guardian on behalf of a child under 18. In the 2022 to 2023 tax year, the savings limit for Junior ISAs is £9,000.

General Investment Account (GIA) – This is for when you have used up all your other tax-free allowances. You can use this for whatever you like, but there are no tax benefits or top-ups.

- As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Tax treatment depends on your individual circumstances and may be subject to change in the future.

My Own Experience

I invested £6,188 in a Fully Managed Nutmeg Stocks and Shares ISA in April 2016. If you’re wondering why it was such an odd sum, I put in £6,000 from my savings. The other £188 came from another small ISA account I thought I might as well transfer at the same time.

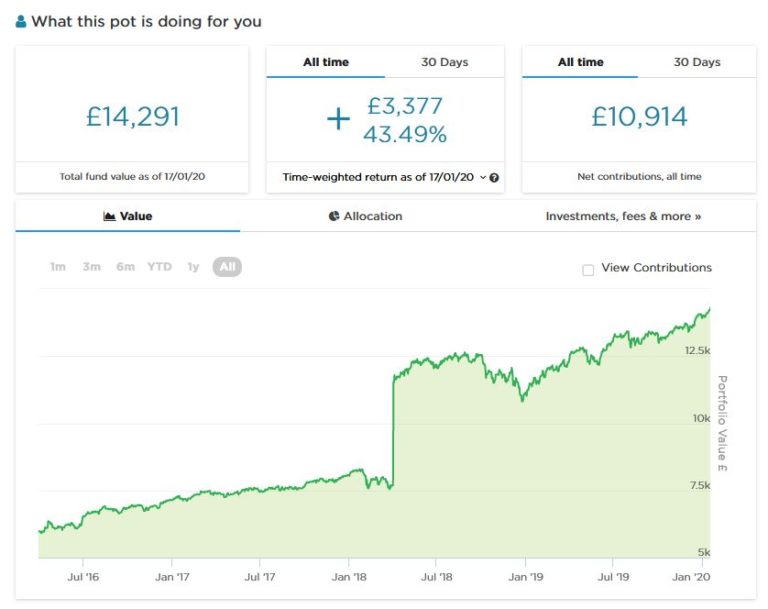

I was pleased by how my initial investment performed, so in April 2018 I transferred £4,000 from another stocks and shares ISA that had been under-performing. By January 2020 my investment had grown by £3,377 to £14,291. Here’s a chart showing how my investment performed up to 17th January 2020.

I accepted a high risk level (9/10) with this account, which may partly explain the performance achieved.

- A few months ago I did a ‘deep dive’ into performance stats for Nutmeg fully managed portfolios from level 1 (lowest risk) to level 10 (highest risk). This confirmed that risk level does actually make a big difference to results obtained. You can read my article about this here and I strongly recommend that you do so if you are considering investing with Nutmeg. Obviously everyone needs to make their own decision about what level of risk they are comfortable with – but looking back over the last 10 years (since Nutmeg started) the higher the risk level you chose, the better the results you would have obtained over any three-year or longer period. Of course, past performance is no guarantee of what will happen in future, but it is certainly food for thought.

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Tax treatment depends on your individual circumstances and may be subject to change in the future.

2020 – Year of the Virus

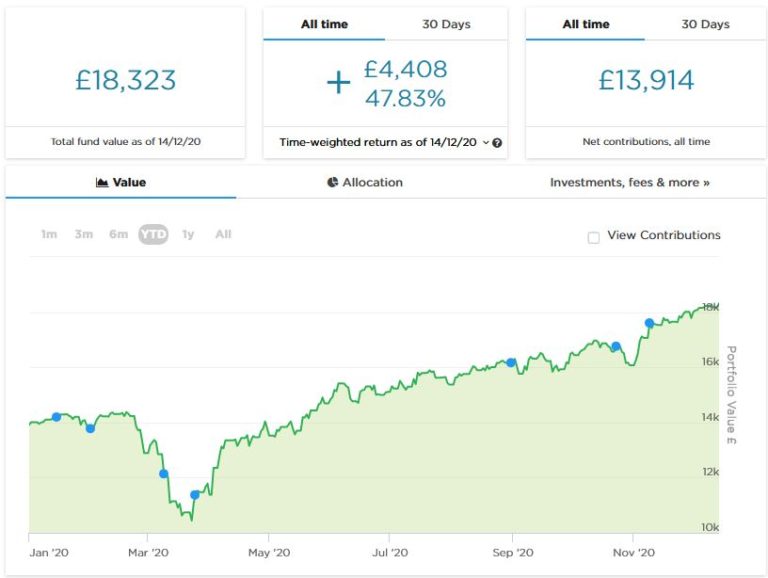

In 2020 the markets were thrown into turmoil by the world-wide coronavirus pandemic. Inevitably, my Nutmeg portfolio was affected by this. Here is a chart showing performance from January to December 2020…

As you can see, through late February and March my Nutmeg ISA plummeted in value, going from around £14,000 to just over £10,000. That was obviously a worrying time, but nonetheless I decided to risk investing another £3,000 when the markets were (as things stand now) near their lowest ebb.

From late March – and even allowing for my £3,000 top-up – my ISA made a remarkable recovery. By mid-December 2020 it was worth £18,323. Even if you take off the extra £3,000, that means my portfolio as a whole was worth over £1,000 more than it was before the pandemic struck.

- As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Tax treatment depends on your individual circumstances and may be subject to change in the future.

2021 – Lockdown and Recovery

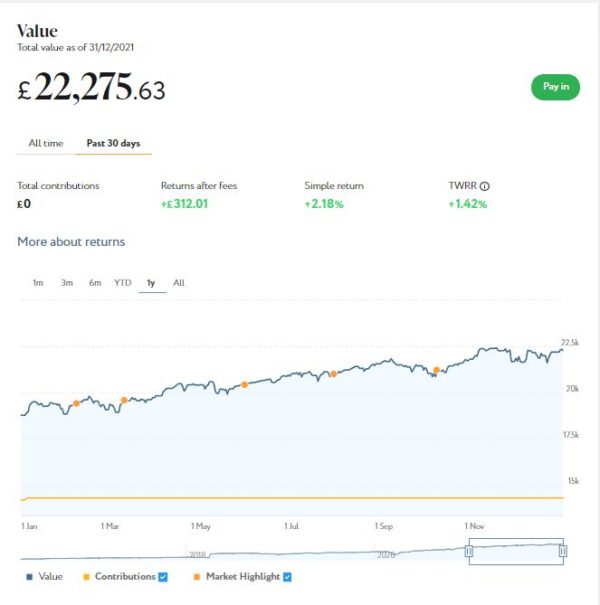

My Nutmeg ISA continued on a largely upward trajectory in 2021. Here is a screen capture showing how it stood at the end of December 2021. As you will see, Nutmeg have changed how performance is displayed on the website slightly.

I added a further £400 to my ISA eariy in the year. But even if you deduct this, the total fund value rose to £21,875.63, an increase of £3552 (over 21%) since December 2020.

- As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Tax treatment depends on your individual circumstances and may be subject to change in the future.

2022 – Ukraine and Cost of Living Crisis

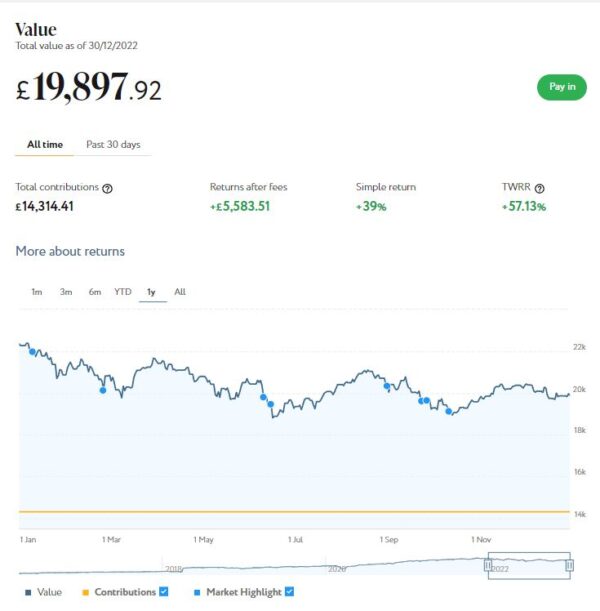

2022 was a challenging year for my Nutmeg investments. A variety of factors – including the war in Ukraine, rising inflation and the aftermath of the pandemic – have caused turmoil in world markets, and Nutmeg was obviously not immune. This is how my main portfolio performed in the year to 30 December 2022.

As you can see, my portfolio fell In value from £22,275.63 to £19,897.92. That’s a drop of £2377.71 or 10.68%.

That’s clearly disappointing, but it’s worth noting that it is still a lot less than the amount by which it went up in 2021. And at that point I was still over £5,500 in profit overall. I was therefore philosophical about this, recognizing that all investments have their ups and downs, and Nutmeg was hardly alone in seeing a drop in values in 2022. But I do understand why people who only started investing with them at the start of 2022 may have felt disappointed.

- Quick update: As of 21 May 2024 the value of my main Nutmeg portfolio has risen to £24,249, an increase of £4,352 (21.44%) since 1 January 2023.

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Tax treatment depends on your individual circumstances and may be subject to change in the future.

Nutmeg Fees and Investments

Nutmeg charge a fee of 0.75% a year on Fully Managed portfolios (see Portfolio Options, below) of up to £100,000, and 0.35% on investments beyond that. That’s competitive compared with traditional mutual funds, although you can find cheaper investment opportunities and platforms if you look around. You may or may not get such good overall results, of course.

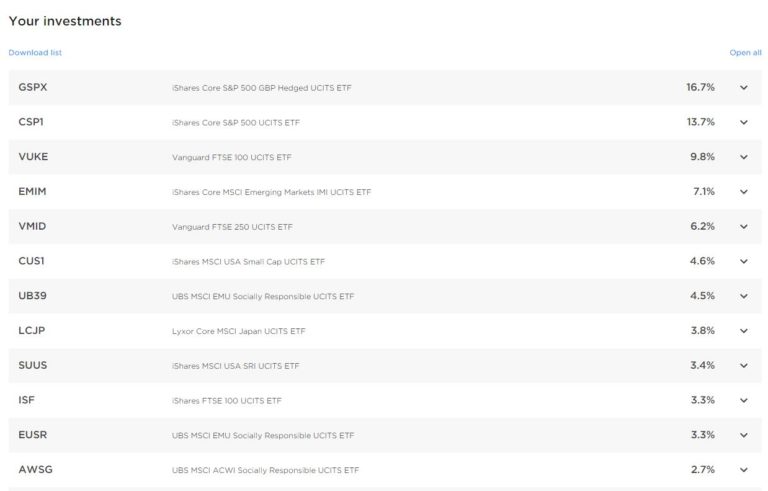

A reader asked if Nutmeg reveal what ETFs your money is invested in. The answer is that they do. In case you are interested, here is a list from the website showing how my money is invested. Note that these are the top 12 funds. There are others in my portfolio as well, but this was the most I could capture in one screengrab 🙂

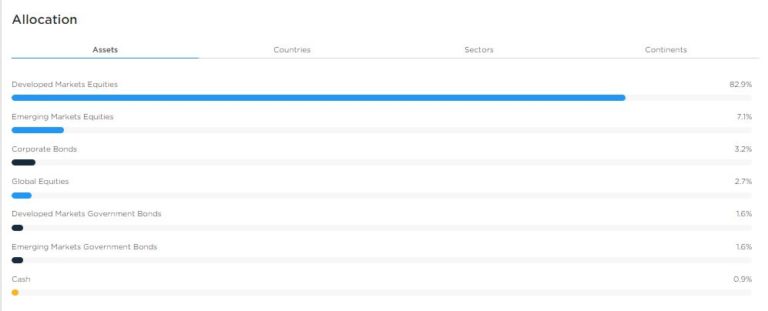

As a matter of interest, here is a copy of the table showing how the investments in my portfolio are allocated by asset class.

As you will see, quite a large proportion of my portfolio is invested in equity markets. As I said earlier, I opted for a high-risk, high-returns strategy. If I had chosen a lower risk level, a larger proportion would undoubtedly be in bonds and cash. Note that high-risk can also mean higher loss.

- You can make changes to the risk level and investment style of any Nutmeg pot at any time. Nutmeg do just caution that making frequent changes to your portfolio may impact your returns. So they suggest you review your risk level when your goals change and avoid trying to ‘time’ the market.

It’s also worth noting that Nutmeg invests mainly in accumulation rather than income-generating funds. Most do not produce dividends, and with those that do, the money is automatically reinvested back into your portfolio. Nutmeg is really intended for people who are aiming to build a ‘pot’ – a nest-egg, if you prefer – rather than looking for a source of income. But you can of course sell all or part of your investment at any time.

- Capital at risk. Past performance is not a reliable indicator of future performance.

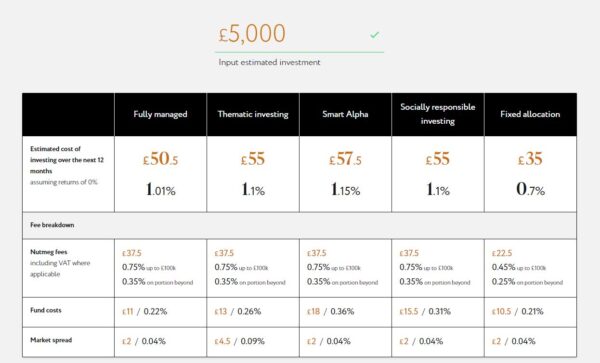

Portfolio Options

Since I first signed up, Nutmeg have added some other options to their offering. In particular, they now offer five different types of ISA portfolio: Fixed Allocation, Fully Managed, Thematic (launched 2023), Smart Alpha, Socially Responsible and Fixed Allocation. To save time, I have copied the information on the Nutmeg website about each of these portfolio types below. Note that by default the estimated total fees per year refer to a portfolio worth £5,000. You can change this if you wish by entering a new figure at the top.

Please note that the figures above are correct as of 19 March 2024 but may have changed subsequently. As you will note, the Fixed Allocation portfolio has lower charges than the other three.

The Socially Responsible portfolio aims to optimize your investments according to various environmental, social and governance (ESG) factors. So it focuses on companies with a good track record and proactive strategy in such areas as water use, pollution, greenhouse gas emissions, proportion of female board members, and so on.

Nutmeg’s Smart Alpha portfolios are powered by J.P. Morgan Asset Management. They include five risk-rated portfolios, each holding between 10 and 14 passive and active ETFs. They are managed by J.P. Morgan’s multi-asset solutions team, giving Nutmeg clients access to the investment giant’s experience and expertise. You can read more about the Smart Alpha range in this blog post. The new Nutmeg Thematic Investments are discussed in more detail further down.

As mentioned above, my own ISA is in the Fully Managed category (the only one available when I opened my account). I have considered switching to Socially Responsible, but as my investment has performed well overall I am reluctant to rock the boat. You might see this differently, of course.

- I did, though, create a new pot within my ISA with Smart Alpha as the investment style. The risk level is 4/5, which roughly corresponds with the 9/10 risk level in my Fully Managed portfolio. I started in December 2020 with £1,000 and as all was going well added a further £1,000 in April and another £500 in June. By the end of 2021 my Smart Alpha portfolio was worth £2,837. That is an increase of £337 or around 13% expressed as an annual rate. In February 2022 I added another £500, bringing my total investment to £3,000. During 2022, like most stock market investments, the value of my SA portfolio fell back, but like my main portfolio it has recovered in 2023. At the time of writing (16 November 2023) it is worth £3,361, a net increase on capital of £361 (12.03%). Considering how turbulent the last two years have been for investors, I am happy enough with that.

I will of course continue to report on PAS about how my Nutmeg investments perform. Obviously, if my Smart Alpha pot seems to be doing significantly better than my Fully Managed one, or vice versa, I will switch my money between them. I am also considering investing in a new thematic investment pot. It is one of the attractions of Nutmeg that you can have multiple pots within a single ISA with different investment styles and risk levels attached to them.

- Capital at risk. Past performance is not a reliable indicator of future performance.

New: Nutmeg Thematic Portfolios

As of 23 October 2023, Nutmeg introduced a new portfolio option. Nutmeg’s Thematic Investment style gives you a globally diversified, risk adjusted portfolio with a tilt (up to 20% of equity exposure) towards your chosen theme. They say the majority of the portfolio will be actively managed by Nutmeg’s investment team, whilst the ’tilted’ part of the portfolio will be made up of ETFs that the investment team believes will deliver the best returns from the growth of the trend in question (to be reviewed annually).

Currently three themes are available, these being Technical Innovation, Resource Transformation and Evolving Consumer. For more details about what each of these comprises, check out the Nutmeg website.

Nutmeg thematic portfolios are only available on Risk Level 5 or above. There is a minimum investment of £100 for Junior ISAs and Lifetime ISAs or £500 for stocks and shares ISAs and pensions. There is a 0.75% management fee.

- Thematic investing carries specific risks and is not for everyone.

Withdrawing Money From Nutmeg

You can withdraw any or all of your money from your Nutmeg ISA at any time on request. Investments are sold on a twice-weekly cycle, so depending on when you submit your request Nutmeg say it will typically take 3-7 business days for the money to appear in your bank account. This means the value of your investments may change during this period, and you might not therefore receive the exact amount requested.

If you are withdrawing from an ISA, it’s important to remember that any allowance used in the current tax year will remain used; you won’t get it back if you later pay back into your ISA. As mentioned earlier, everyone has a generous annual £20,000 ISA allowance, so this rule may or may not be of concern to you.

- Other types of account such as SIPPs and Lifetime ISAs have specific legal restrictions on withdrawals set down by the government, e.g. you can’t normally withdraw money from a SIPP until you reach the age of 55.

In Conclusion

I am obviously a fan of Nutmeg and – as I said above – plan to continue investing with them. Of course, I am not a qualified financial adviser and everyone should do their own research (and/or take professional advice) before deciding to invest with Nutmeg. Based on my own experiences, though, I am happy to recommend them. They provide a simple, easy to understand investment platform, the customer service is excellent, and certainly in my case the results achieved have been good (even allowing for the downturn last year).

- Nutmeg also has an excellent mobile phone app with an App Store average rating of 4.8 (16K reviews) and a Google Play Store rating of 4.3 (2.6K reviews). On the independent Trust Pilot website Nutmeg averages 3.9 stars (‘Great’). This figure fell a bit as some members expressed dissatisfaction with the performance of their portfolios last year during the cost-of-living crisis. It is, though, worth noting that 69% of Trust Pilot reviewers still give Nutmeg the maximum 5 stars (‘Excellent’) rating. All figures and ratings are correct as of 21 February 2024.

If you have any comments or questions about this post or Nutmeg in general, please do leave them below.

PLEASE NOTE: As with all investing, your capital is at risk. Tax treatment depends on your individual circumstances and may be subject to change in the future. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest.

Note also that I am not a qualified independent financial adviser and nothing in this review should be construed as personal financial advice. You should always do your own ‘due diligence’ before investing and take professional advice if in any way uncertain how best to proceed. All investing carries a risk of loss.

Please note also that posts on Pounds and Sense may include affiliate links. If you click through and make an investment or perform some other qualifying transaction, I may receive a commission for introducing you. This will not affect in any way the terms you are offered or any fees you may be charged.

This is a fully updated repost of my original Nutmeg review.

December 20, 2017 @ 10:43 am

I’ve been looking into Robo-Adviser platforms myself. I was wondering if Nutmeg tells you exactly which funds your money is invested in?

December 20, 2017 @ 1:32 pm

Yes, they do. My money is invested across a dozen different funds.

December 21, 2017 @ 5:19 pm

I have just updated the post with a screen capture showing how my money is invested by Nutmeg.

December 21, 2017 @ 5:17 pm

Investments are so over my head and yet this has certainly piqued my interest. I’ll have to add this to my NY list of things to look at.x

December 22, 2017 @ 9:56 am

Thanks! Yes, investments can be hard to get your head around, and yet with the recent reforms to the pensions system it’s something we all have to try and grasp. If you want any more info about Nutmeg, just let me know.

April 27, 2019 @ 3:48 pm

I’m glad you updated this as it’s always fascinating to see how/if money can grow, and an increase by £2,646 isn’t bad! x

May 1, 2019 @ 5:08 pm

Thanks, Caz. Yes, there have been some ups and downs, but I’m very pleased with the performance of my Nutmeg portfolio overall.

January 19, 2020 @ 3:55 pm

My husband and I have always been quite risk adverse, but your return just shows why it is good to be wlling to take a risk sometimes. Great job. Mich x

January 19, 2020 @ 4:50 pm

Thanks, Michelle. Yes, if you are investing for the longer term, there is a lot to be said for putting some of your money into something like a Nutmeg stocks and shares ISA. It is riskier than keeping it in the bank but the potential returns are much better. And with a longer timeframe the inevitable ups and downs in the markets should even out.

January 19, 2020 @ 4:01 pm

So you’re ISA rose again by £3,476? It’s interesting to see how it does long term, especially given you opted for a higher risk one with potentially much more lucrative rewards. Nicely done! x

January 19, 2020 @ 4:40 pm

Thanks, Carol. Yes, my investment has done very well over the last year in particular. Hoping that trend will continue!

January 20, 2020 @ 2:03 pm

That isn’t a bad return at all is it? I hope it continues for you and I found this really easy to follow and understand which is quite the testament to you!

January 20, 2020 @ 2:05 pm

Thanks! Yes, it’s definitely been one of my better investments. I am glad you found my review easy to follow and understand.

March 7, 2020 @ 1:29 pm

Hi, just read your article with interest. Do you get annual dividends paid to you or have you left dividend payments in your ISA? Thanks Anna

March 7, 2020 @ 2:20 pm

Thanks for your comment, Anna. Most Nutmeg ETFs are accumulation rather than income funds, so any dividend income is automatically reinvested within the fund. Where a fund does produce cash dividends they are reinvested by Nutmeg. Nutmeg doesn’t pay cash dividends to investors, but you can see when your portfolio has received dividends under the Investment Activity tab when you are logged in. This is explained in more detail on this web page: https://support.nutmeg.com/hc/en-us/articles/115000350931-Investment-income-dividends Nutmeg isn’t really intended for people looking to invest for income. It is more for those looking to build up their ‘pot’ over a period of years. But you can, of course, withdraw some or all of your money any time if you need to.

June 26, 2020 @ 1:40 pm

Great post Nick, I’m going to check out Nutmeg!

June 26, 2020 @ 2:53 pm

Glad you liked it!

June 26, 2020 @ 3:54 pm

This sounds like an amazing app and one to use for stocks and shares which I know my dad would love. You explain it well.

June 26, 2020 @ 5:54 pm

Thanks for the comment. Yes, I’m a fan of Nutmeg and happy to recommend it for people who want a simple, low-cost option for investing in stocks and shares.

June 26, 2020 @ 5:53 pm

I have never invested because I don’t understand it. But your post is very helpful for people like me! – Sarah Flanagan

June 27, 2020 @ 8:50 am

Thanks, Sarah. I appreciate that.

December 28, 2020 @ 10:42 pm

Thanks Nick – this is very clearly and simply written and easy to follow the journey. May well take the plunge in investing soon!

December 29, 2020 @ 7:42 am

Thanks, Jay. I am glad you found my article helpful.

May 6, 2021 @ 12:22 pm

Nick, excellent article – really informative. But I wonder if you can tell from your figures whether the high risk level you chose had an impact on your return? Or would you have had a similar return on a lower risk level?

May 6, 2021 @ 12:43 pm

Thanks for the kind comments, Kevin. Yes, for fully managed portfolios like mine, you can see this for yourself on the following page of the Nutmeg website: https://www.nutmeg.com/fully-managed-portfolios. Use the slider to set the risk level and you will be able to see the net return for a range of periods. For my portfolio this clearly shows that choosing a higher risk level (9/10) has given me a much better return over the five years I have invested, but of course with greater volatility.

May 6, 2021 @ 8:58 pm

Thanks Nick, the slider results are interesting – i currently have a Nutmeg fully managed portfolio set at 5/10 – and its doing ok (3% plus pa return) – but I am thinking it might be worth raising the risk level higher. Though i note that Nutmeg say this may lead to additional costs. In reality i probably am a more moderate risk kind of person when it comes to money – so probably best to hold steady.

May 7, 2021 @ 9:01 am

No worries. I agree that the slider results are very interesting. I must admit I was quite surprised to see that across most time periods the higher-risk portfolios have out-performed by a significant margin. I may well do a new blog post about this soon!

Obviously I am not a registered financial adviser and cannot give personalised financial advice. In addition, everyone’s personal circumstances and tolerance for risk are different, so what is right for one person will not be right for another. As I always have to say, all investment carries a risk, and you should seek advice from a qualified financial adviser/planner if in any doubt how best to proceed.

What I would say, however, is that if you are happy with the returns you are getting and increasing the risk level might cause you sleepless nights, there is clearly a case for keeping things as they stand. But if you want to ‘test the water’ you could also create a new pot with a higher risk level just to see how it compares. You could use new money for this and/or transfer some of your current pot over. You don’t have to switch your entire portfolio to a higher risk level if this would worry you. I am not saying you ‘should’ do this, but Nutmeg does offer a lot of flexibility to account-holders and you can take advantage of this any time.

Good luck anyway, whatever you decide!

May 7, 2021 @ 9:08 am

Incidentally, I wouldn’t worry unduly about the ‘additional costs’ warning. Nutmeg are concerned to avoid people constantly chopping and changing risk levels and investment styles, but the occasional switch isn’t likely to do any harm.

August 13, 2021 @ 5:41 pm

This is really helpful. As I have mentioned to you before, I don’t know much about investments and find them a little confusing! However this review made it seem much easier to understand and Nutmeg sounds great.

August 14, 2021 @ 6:13 am

Thanks, Rebecca.

August 29, 2021 @ 11:38 am

Great solid review, I personally invest in Nutmeg and am happy with the outcome. Quick question, mybwife wishes to invest but she is based in southeast Asia, does Nutmeg accept payments from abroad?

August 29, 2021 @ 2:05 pm

Thanks! This page on the Nutmeg website covers the question you ask: https://support.nutmeg.com/hc/en-us?article=115000349691-Accounts-for-non-UK-residents Briefly, though, it appears that if she lives in southeast Asia she would probably not be eligible to open an account with Nutmeg. Sorry 🙁

October 4, 2021 @ 9:27 pm

I really enjoyed reading your nutmeg journey – I’m fairly new to Nutmeg myself. How has September 2021 been for your pot? I’m not doing too well with my cautious pot.

October 5, 2021 @ 9:43 am

Hi Jill. Thanks for your kind comment.

September 2021 was a disappointing month for my Nutmeg investments too. To be fair, the same applies to most other equity-based investments, with stock markets across the world unsettled for a range of reasons. You may like to read my latest Investments Update for more thoughts and information about this: https://www.poundsandsense.com/my-investments-update-october-2021/

While I’m not allowed to give personal financial advice, as it says in the article linked to above, I strongly advise against panicking. All equity-based investments have their ups and downs, but in the longer term (over at least a five-year period) they have nearly always outperformed cash. Withdrawing your money now will simply crystallize your losses, whereas if you stay invested you will be able to benefit when (as I expect) the markets get back on a more even keel.

Do You Want A Career In Real Estate Investment? - Read This - 365 Business | Business Tips & Advice

April 25, 2022 @ 5:52 pm

[…] investing is another great option. But unlike the property broker and the agent in this field, you need a […]

October 28, 2022 @ 8:19 am

It’s amazing to see how all the various things going on in the world have affected your investment. But I’m glad to hear and see that your investment is still doing well overall x

October 28, 2022 @ 9:28 am

Thanks, Rhian. Yes, the last few years have been nothing if not eventful!

October 30, 2022 @ 8:00 am

It’s really interesting to see how your investments have been affected by recent events. I look forward to reading another update in a few months.

October 30, 2022 @ 8:14 am

Thanks, Jenny.

January 9, 2024 @ 12:10 pm

I recently had the opportunity to explore Nutmeg, a prominent robo-adviser investment platform, and I wanted to share my experiences with fellow investors. As someone who values a seamless and user-friendly investment experience, Nutmeg left a positive impression on several fronts.

Are you making the most of your annual ISA allowance? - Mouthy Money

February 21, 2024 @ 11:39 am

[…] and shares ISA with Nutmeg, a robo-manager platform that has produced good returns for me. You can read my in-depth review and article about Nutmeg on my Pounds and Sense blog if you […]