Spotlight: Brickowner Property Investment Platform

I have written about property crowdfunding on various occasions on Pounds and Sense. It’s a way for ordinary individuals to invest in bricks and mortar without requiring huge amounts of capital.

Table of Contents

Why Property Crowdfunding?

Property investors get a double benefit – rent from tenants for as long as they own the property, and – in most cases – a profit if and when they sell.

Of course, property doesn’t come cheap. And even if you can stretch to buying a modest house or flat for investment purposes, you are taking the risk of putting all your eggs in one basket. As a result, many people of more modest means have concluded that property investment is not for them.

Property crowdfunding has changed all that, however. A number of platforms now exist that allow ordinary individuals the chance to buy a share (or fraction) in an investment property. Investors then receive a proportion of the rental income generated and also get a share of any profit when the property is sold (or refinanced).

A further attraction of property crowdfunding is that the platform (and its agents) take care of managing the property and tenants on your behalf. Unlike direct property ownership, property crowdfunding (or crowdlending if you prefer) is a genuine hands-free investment.

Brickowner Review

Brickowner is one of a number of property crowdfunding platforms that also includes Property Partner, Assetz Exchange and CrowdProperty. They allow investors to buy a share of individual property investments.

Brickowner focuses on institutional investments. They buy shares in large, high-return property investment deals that were traditionally only offered to institutions or high-net-worth individuals. They then offer smaller shares in these (a minimum of £500) to members wanting to invest in them.

How It Works

Before you can access the Brickowner platform, you will need to register on the site and confirm that you are allowed by law to invest in this type of product. This is a requirement imposed by the Financial Conduct Authority (FCA), which regulates this type of investment. In practical terms it means you will have to confirm that you meet one of the following descriptions:

High Net Worth Individual – This includes individuals who have an annual income of £100,000 or more or net assets of £250,000 or more and have made a declaration acknowledging the consequences of making investments based on financial promotions that have not been approved by an FCA-authorised firm.

Self-certified Sophisticated Investor – This includes individuals who have prior relevant investment experience and have made a declaration acknowledging the consequences of making investments based on financial promotions that have not been approved by an FCA-authorised firm.

Representative of a High Net Worth Body – This includes companies and partnerships with at least £5 million net assets and trusts with assets of £10 million.

Investment Professional – Including corporate investors and SIPP or SSAS professional service providers.

You will also be required to answer some questions to confirm that you understand the nature of the investments that can be made on the platform.

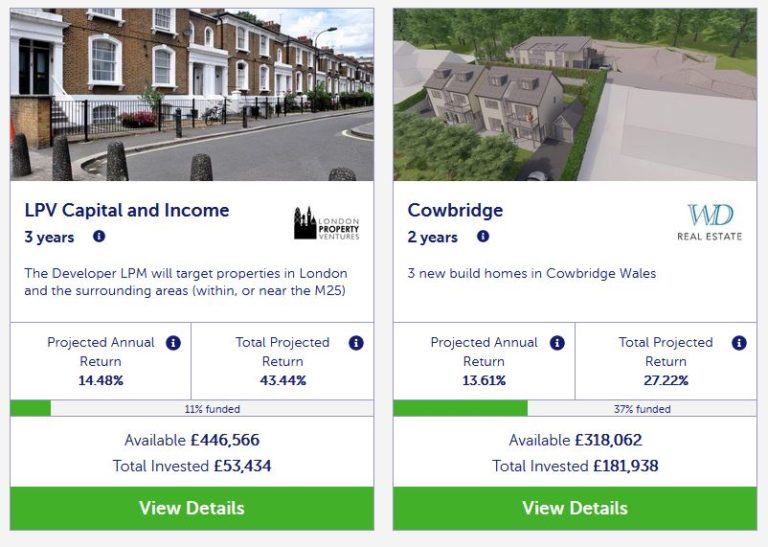

Once you are registered (and not before) you will be able to browse from the range of currently available property investments, such as the example below:

If you see a current project you like, you can invest in it, from £500 up to the maximum available. You can (and probably should) build a diversified portfolio by investing in a number of different properties. You can add funds and increase the size of your portfolio any time you want.

Investments have a fixed term: anything from one to five years. During that time you may receive dividends from any rental income received. These are added to your account and available to withdraw or reinvest. You also receive a share of any profits along with return of your capital at the end of the investment period.

- In common with other property crowdfunding platforms, the pandemic has caused delays – in some cases a year or longer – to some projects on Brickowner, As far as I am aware no projects have failed completely, though.

Secondary Market

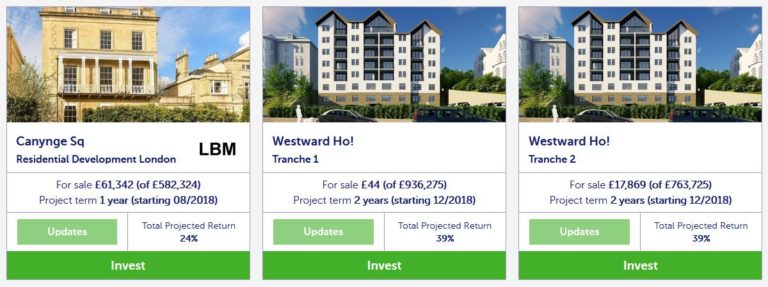

Brickowner recently introduced a secondary market where investors who need to release funds before the end of an investment term can put their share up for sale to other members. Here is a screen capture showing part of the secondary market currently.

As you may notice, some of the projects on the secondary market have less than £500 available. I asked if this meant you could therefore invest less than £500 in these cases, but was told no. Here is the exact reply I received:

£500 is the minimum investment in both the primary and secondary market. The reason there are smaller amounts on the secondary market is that there is a taxi-rank system, whereby available shares are listed and allocated in order of listing to a queue of buyers. So if I wanted to invest, say, £520 in Tamlaght, and there were no other prospective Tamlaght share buyers ahead of me BUT there were only £120 worth of shares available, I would have to wait until £520 worth of shares were available before my transaction went through. Prospective Tamlaght buyers in the queue would have to wait until my order had been filled before they moved forward in the queue.

In effect, then, you would have to place a bid for at least £500 of the project in question, and would have to wait till additional sellers materialized before getting anything. That is probably not ideal, but I can understand that Brickowner want to avoid the situation where some investors end up with tiny holdings in certain projects.

Charges

Brickowner fees are outlined within the property term sheet for each specific investment. There is no charge for depositing money with Brickowner, and no charge at the end of the investment period when your money and (hopefully) profits are returned to you.

My Thoughts

Brickowner offers an interesting option for people who want to add property to their investment portfolio. As mentioned above, there is a good case for doing this both in terms of dividends and capital growth, and to diversify your overall portfolio.

The Brickowner website is attractive and professional looking. One thing I have noticed is that most of their investment opportunities fill up very quickly. That is good insofar as it indicates that Brickowner is succeeding in attracting investors who believe in the proposition being offered. On the other hand, it does mean that at any particular time there may not be many (or any) projects to invest in. You will therefore need to build your portfolio gradually.

As mentioned above, Brickowner has a minimum investment of £500. This is not as low as some platforms (e.g. Assetz Exchange will let you invest as little as 80p) so it may be less suited to investors on a limited budget. But on the positive side, they are transparent about the fees they charge, and it is good that no fees are imposed for depositing or withdrawing money. It’s also good that a secondary market now exists for investors who wish (or need) to exit early.

As you can see from the screen capture above, the projected returns on investments with Brickowner are at the higher end for property crowdfunding platforms. Of course, this generally means the risks are higher as well. In any event it is important to read the financial information on each project carefully, to ensure that the investment aligns with your own needs and goals. Bear in mind also that some projects offer income as well as the potential for capital appreciation, while others aim for capital growth only.

- During the coronavirus pandemic and lockdown, property transactions slowed considerably and many commercial property values in particular fell. However, there is clear evidence that a recovery is now under way. My own view is that there are good opportunities at present for property investors, but obviously in this uncertain time there are never any guarantees. Every investor needs to assess the situation carefully in light of their personal circumstances and tolerance for risk and proceed accordingly.

Investor Protection

The returns on offer from Brickowner are significantly better than you would get from a bank savings account at present, but clearly they don’t carry the same level of protection. For example, you are not protected by the Financial Services Compensation Scheme, which will refund up to £85,000 if a bank with which you have an account goes bust.

On the other hand, your money is invested in bricks and mortar, so it’s unlikely you would lose it all. A further level of protection is that – in common with other property crowdfunding platforms – your money is invested via an SPV (Special Purposes Vehicle). This is effectively an independent company with responsibility for the project in question. If Brickowner were to go bust, funds in the SPV would be protected and returned to investors once the property was sold.

Even if Brickowner were to go under before your money was invested, your funds are paid into a separate, ring-fenced client account. If the platform went belly-up the day after you sent the money, your funds would simply be returned to you.

Overall, then, whilst investing in Brickowner is clearly not as safe as leaving your money in the bank, the measures set out above do provide a reasonable level of protection (and reassurance). As with any investment, however, the higher potential returns on offer come with a greater risk of loss. In my view (and I’m not a qualified financial adviser, just an individual who has put thousands of pounds of his own money into property crowdfunding) Brickowner offers a reasonable balance between risk and reward. But clearly, you should invest only as part of a balanced portfolio combined with other, more liquid types of investment. .

If you would like more information about Brickowner and to set up an account, just click through any of the links in this post.

Disclosure: The links in this post are affiliate links. If you click through and set up an account at Brickowner and make an investment with them, I may receive a fee for introducing you. This will not affect the terms or returns you are offered. Please note also that I am not a registered financial adviser and nothing in this post should be construed as personal financial advice. Before making any investment it is important to do your own due diligence, and seek advice from a qualified financial adviser if you are in any doubt how best to proceed. All investment carries a risk of loss.

If you have any comments or questions about Brickowner or property crowdfunding in general, as always, please do post them below.

Note: This is a fully revised and updated repost of my original article about Brickowner.

April 17, 2021 @ 12:34 pm

This sounds like a great way to property invest without buying a whole property yourself and being responsible for it. I wish I fit one of those categories so I could invest through them x

April 17, 2021 @ 3:46 pm

Thanks, Rhian. I guess you could always try Assetz Exchange, which has a minimum investment of about £1 per property! You can sign up with them as an Everyday Investor.

April 22, 2021 @ 7:06 pm

I love coming to your blog, I seem to find out something new each time. This is such a good idea, I’m going to discuss it with my husband. Thanks, Mich

April 22, 2021 @ 9:32 pm

Thanks, Michelle.

November 3, 2022 @ 9:52 pm

Brickowner is a full scam. They extend the expected closing date of projects at the infinite and investors fully loose their funds. You should not advise to invest on such type of marketplace.

April 5, 2023 @ 7:56 pm

Lost a lot of money with this company, to be avoided

May 10, 2024 @ 12:25 am

Me too. Completely agree. DO NOT USE them. They extend completion dates and eventually return nothing to you at all. 100% loss. Do not trust them with your money.

September 12, 2023 @ 4:00 pm

Update on my previous comment. Brickowner is a company to avoid if you wish to invest in property. Having been delaying the investment pay out – now 4 years late – they managed to lose 90% of investors money; at a time when the property market had been achieving great gains.