Spotlight: eToro Trading and Investment Platform

[Updated 4 January 2023] Today I’m looking at eToro, a popular online trading and investment platform. I recently opened an account on eToro and started investing with them, partly in order to review their service.

eToro is a Israeli fintech company based in Cyprus. The company also has registered offices in the UK, US and Australia. It is regulated and authorised by the Financial Conduct Authority (FCA) in the UK and is covered by the Financial Services Compensation Scheme (FSCS). That means if eToro were to go bust any deposits with them up to £85,000 would be protected. Of course, the FSCS doesn’t protect you if you lose money simply due to your investments performing poorly.

eToro is particularly known for its copy trading feature. This allows you to automatically copy any of various established traders on eToro and benefit from any profits they (hopefully) make. More about this later.

Table of Contents

What Does eToro Offer?

eToro offers just one type of general trading account. Unlike other platforms such as Bestinvest, there is no option to set up UK tax-free accounts such as ISAs and SIPPs (Self-Invested Personal Pensions). That being said, there are still plenty of investment options available.

For starters, eToro lets you invest in over 2,000 different stocks and shares from the world’s leading exchanges including the UK and US. You can access major stocks, including Apple, Amazon, Google, Tesla, Barclays, Airbus, Microsoft and Adidas.

If you don’t want to pick and choose stocks yourself, you can also invest in ready-made, themed portfolios. Some examples include:

- Diabetes Med – diabetes care stocks

- MetaverseLife – invest in virtual worlds

- Oil Worldwide – global oil industry

- Utilities – public utility stocks

- Renewable Energy – clean energy production

- LatamEconomy – Latin American region

You can also trade over 50 different cryptocurrencies, including Bitcoin, Ethereum, Cardano, and so on (eToro creates a crypto wallet for you for trading purposes). You can also buy and sell various indices (e.g. UK100) and commodities.

And for advanced traders with an appetite for risk, contracts for difference (CFDs) are available. Just be aware that these investments are leveraged, so you can lose a lot more than your original stake if a market moves against you.

What Are The Charges?

A big selling point for eToro is that they offer commission-free trading. This makes them especially attractive to active traders who buy and sell regularly.

Of course, eToro do have to make their money somehow, so other charges apply. It’s important to be aware of these. The main charges are listed below.

- Withdrawal fees – any time you make a withdrawal from eToro, you are charged a withdrawal fee of $5 (about £4).

- Inactivity fees – If you haven’t logged into your account for a year, you will be charged a monthly inactivity fee. Of course, this won’t apply to most people but is something to bear in mind if you are investing for the long term.

- Currency conversion fees – You can deposit on eToro in pounds sterling, but the platform operates in US dollars only and currency conversion fees apply. UPDATE: If you use the new eToro Money app, you can avoid fees for depositing to the platform, potentially saving up to £5 per £1,000.

- There are also buy and sell spreads with some types of investment, e.g. cryptocurrency and CFDs.

None of this is to say you shouldn’t invest via eToro. Their offering is still extremely competitive, but you do need to take these charges into account.

Information and Advice

eToro is obviously aimed at people who are comfortable choosing their own investments.

As mentioned above, they have a range of ready-made, themed portfolios you can choose from. The minimum investment with these is $500 (around £420).

They also have plenty of educational resources about investing. Users can also learn from one another through the eToro newsfeed and other social features.

There is also in-depth information (and charts) about specific shares and other investments. One-to-one personal advice (free or paid-for) is not on offer, though.

Copy Trading

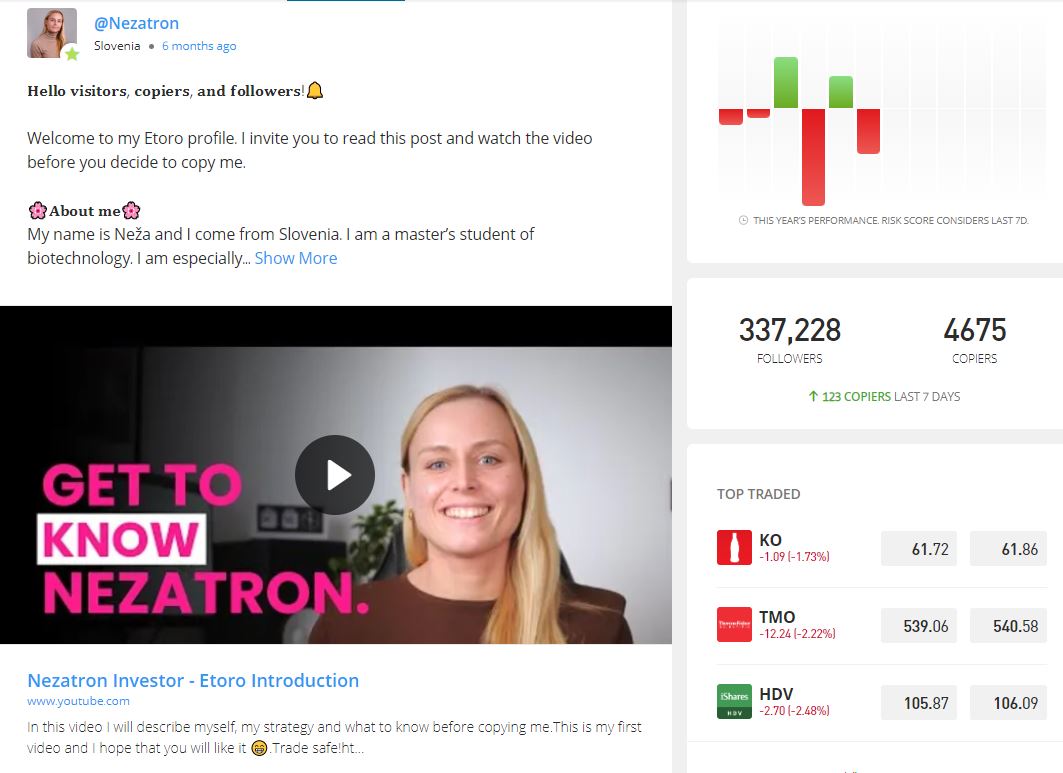

As mentioned above, copy trading is a very popular feature of eToro. This allows you to automatically copy the trades of an established eToro investor. An example is shown below…

As with smart portfolios, there is a minimum investment of $200 (about £170) for copy trading on eToro. However, many approved traders recommend a higher minimum than this. That’s because when you sign up to copy a trader, eToro automatically duplicates all of that person’s trades in proportion to the size of your investment. eToro has a minimum investment size of $1 and if a trade would work out less than that pro rata it will not be executed. It follows that traders whose strategies typically involve placing large numbers of relatively small trades generally recommend a higher minimum starting investment.

All approved traders who allow copying have a homepage on which they specify their recommended minimum investment. This can be anything from $200 to $1500 or more, depending on the strategy they use.

What Are the Pros and Cons of eToro?

Pros

- Established platform with a large, international client base

- Well-designed, user-friendly website and app

- No dealing fees when buying or selling shares

- No monthly or yearly portfolio fees

- No deposit fees

- Access to US and other world markets

- Cryptocurrency trading and CFDs also available

- Low minimum investment (just $10 or around £8)

- Social trading features, including easy copying of top traders

- Range of ready-made portfolios available

- Plenty of research tools and information

- Stop Loss and Take Profit features

- Free $100,000 ‘virtual account’ lets you practise without risking any real money

- Covered against collapse by the UK’s Financial Services Compensation Scheme (FSCS)

Cons

- No UK tax-free accounts such as SIPPs and ISAs

- Can’t invest in UK investment trusts and similar pooled investments

- Trading on the platform is in US dollars only and currency conversion fees may apply (though not if you use the new eToro Money app)

- Withdrawal fees and inactivity fees are also charged

What Do Users Think?

On the independent TrustPilot website, eToro has an average rating of 4.2 (‘Great’) at the time of writing, with 55% of users awarding them a maximum five stars rating.

Positive comments typically emphasize the simplicity and user-friendliness of the website, the low charges, the quality of the customer service, and the range of information available. The social trading aspects are also highly praised. Some of the negative comments concern customer service, and in particular issues experienced when trading Russian stocks due to sanctions imposed on Russia over the war in Ukraine. To be fair I am not sure to what extent eToro can be blamed for this.

eToro has also received various industry awards. These include:

- ADVFN International Financial Awards Best Social Trading Platform 2019 Winner

- ADVFN International Financial Awards Best Platform for Trading Cryptocurrencies 2019 Winner

- Ultimate Fintech Awards 2021 – Best Stockbroker

- Ultimate Fintech Awards 2021 – Best Copy Trading Platform

- Ultimate Fintech Awards 2021 – Best Multi-Asset Trading Platform

- World Finance foreign exchange award for best mobile trading platform and best software provider 2011 Winner

- Star Awards Best Trading Platform 2013

Closing Thoughts

The commission-free share trading at eToro makes it an attractive option for people who wish to buy and sell shares regularly. Yes, they do have some other charges, but even so for regular traders it represents a great-value proposition.

The inability to open a tax-free ISA or SIPP is obviously disappointing for long-term investors, for whom a UK-based platform such as Bestinvest or Hargreaves Lansdown might be a better option. Nonetheless, eToro does offer a good range of medium- to long-term investment opportunities as well, including copy trading and Smart Portfolios.

- It should also be said that profits made buying and selling shares and other assets such as cryptocurrencies are generally taxed in the UK as capital gains. Everyone has a substantial annual CGT allowance (£12,300 in 2022/23). So in practice the majority of UK residents who trade currently on eToro are unlikely to generate a tax liability. But with tax-free CGT allowances due to be substantially cut over the next couple of years, it may become more of an issue.

Smart Portfolios are an attractive option for novice investors and those who don’t have time to research all their investments themselves. As a prediabetic myself, I was quite tempted by their Diabetes Medicines portfolio, which I mentioned above. But equally, if you are happy to pick your own stocks and shares (and other asset types), eToro has all the information and tools you will need.

The social trading features of eToro are clearly a major attraction of the platform, particularly copy trading. But in addition you can chat with fellow investors and pick up tips and advice from them (though don’t take everything you read as gospel!). I also like the Stop Loss and Take Profit features, which allow you to automatically close losing positions before they deteriorate further or take a profit any time a pre-set target is achieved.

If you want to trade cryptocurrencies, eToro offers a simple, straightforward method for doing so. The risk of a platform collapse (as has happened with some crypto exchanges) is probably less, and UK investors also have protection in the form of the FSCS. The buy/sell spreads on eToro mean it may not be the most economical method for crypto trading, though. As I don’t personally touch cryptocurrencies due to the risks involved, I don’t intend to say any more than that. But the option is there if you want it (and many do!).

As for me, I recently started my journey on eToro by investing $500 on copy trading a member called Aukie2008 (real name Mike Moest). He has a good track record, over 1000 people copy him already, and he promises a relatively low-risk strategy. I was tempted to copy Nezatron (see screen capture above) but she has a higher minimum recommended investment of $700 and I wanted to start cautiously. I will let you know in future updates how my investment fares and any other investments I may make on the platform.

As always, if you have any comments or questions about this post, please do leave them below. I should also be very interested to hear from anyone else who has tried eToro. What markets are you investing in, and what results have you obtained? Are there any particular drawbacks or good points to the platform you would like to highlight? All comments are welcome!

Disclaimer: I am not a qualified financial adviser and nothing in this blog post should be construed as personal financial advice. Everyone should do their own ‘due diligence’ before investing and seek professional advice if in any doubt how best to proceed. All investing carries a risk of loss.

Note also that this post includes affiliate links. If you click through and perform a qualifying transaction, I may receive a commission for introducing you. This will not affect the product or service you receive or the terms you are offered.

June 14, 2022 @ 8:05 pm

I’ve heard a bit about eToro before but never looked into it much. I keep thinking I should get to know more about trading and investing as I am such it would be a good thing to try and build a portfolio.

June 14, 2022 @ 9:12 pm

Thanks, Sarah. I am new to eToro myself, but have been impressed by what they have to offer. I expect to invest more with them in future.

November 28, 2023 @ 6:24 pm

Hi Nick, this is Aukie2008. (Mike Moest)

Thanks for mentioning me and thanks for copying on eToro.

I hope you are still satisfied with the eToro results.

2023 is going to be another green year for my portfolio so you should have made some money.

By now I made more than 100% profit in about 3 years. Anyone who copied me at least a year or more, should have made some money.

Thanks and good luck !

Mike

November 29, 2023 @ 1:29 pm

Thanks, Mike. Great to hear from you! Yes, I’m very happy with how my eToro investments are doing. And a large part of that is down to copy-trading your account, of course!

June 15, 2022 @ 3:31 pm

Shame it is only in US Dollars, the exchange rate is so appalling right now, but intrigued to see that eToro has won so many awards!

June 15, 2022 @ 3:47 pm

Thanks, Rachel. The exchange rate isn’t that big a deal in my view, unless I suppose the pound-dollar rate goes down dramatically between when you invest and when you withdraw. But it could just as well go the other way, of course! I wouldn’t let this put you off personally.