Spotlight: How Are People In Britain Saving?

HSBC Bank (in association with pollsters YouGov) recently conducted a survey on saving in Britain. This looked at people’s savings habits and came up with some eye-opening results. I have summarized the main findings below, with graphics where relevant.

What Are the Most Popular Savings Options?

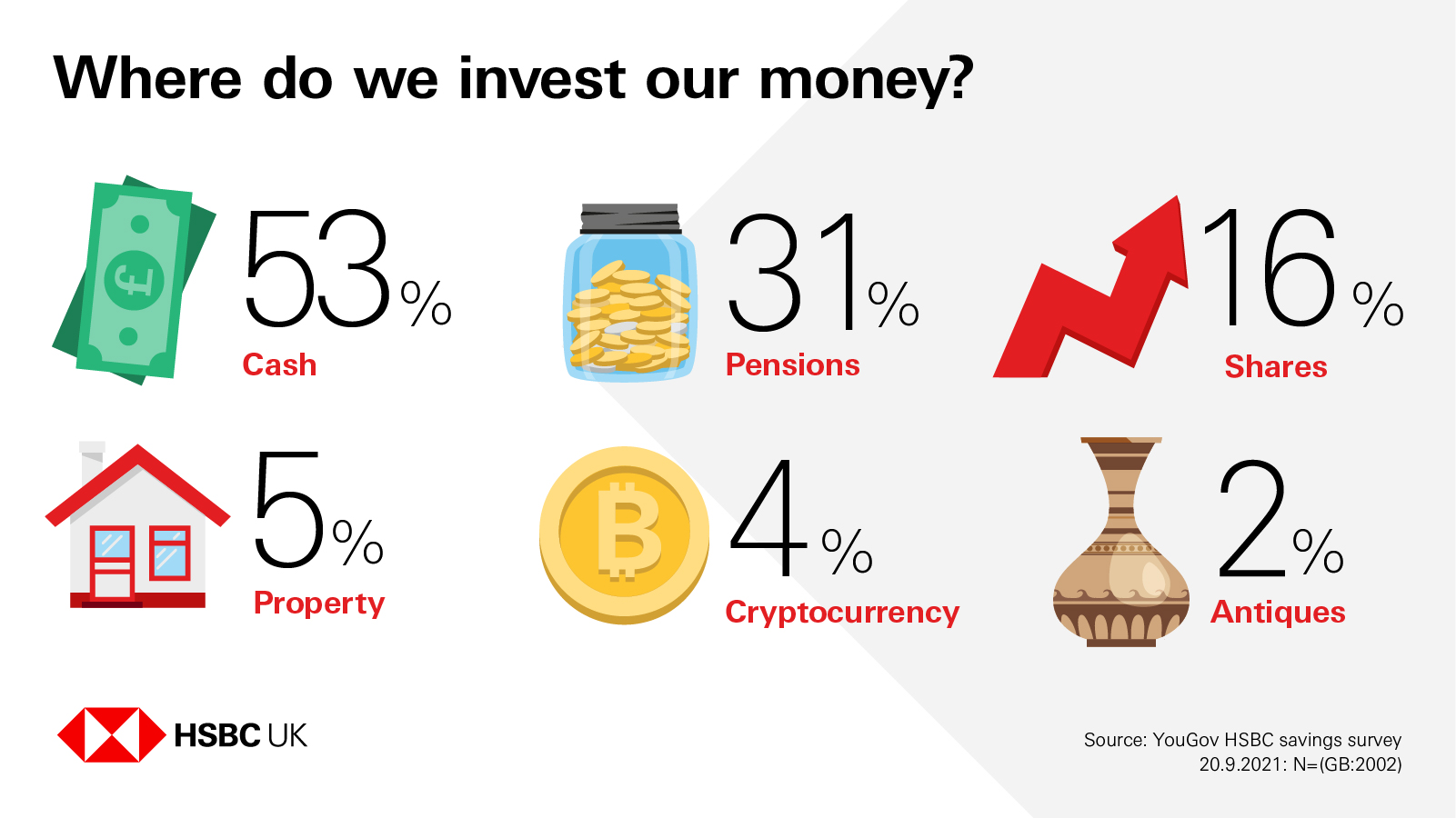

Unsurprisingly, the survey found that cash was Britain’s most popular saving option, with 53% of people saving this way. Other methods are also popular, however, as the graphic below shows.

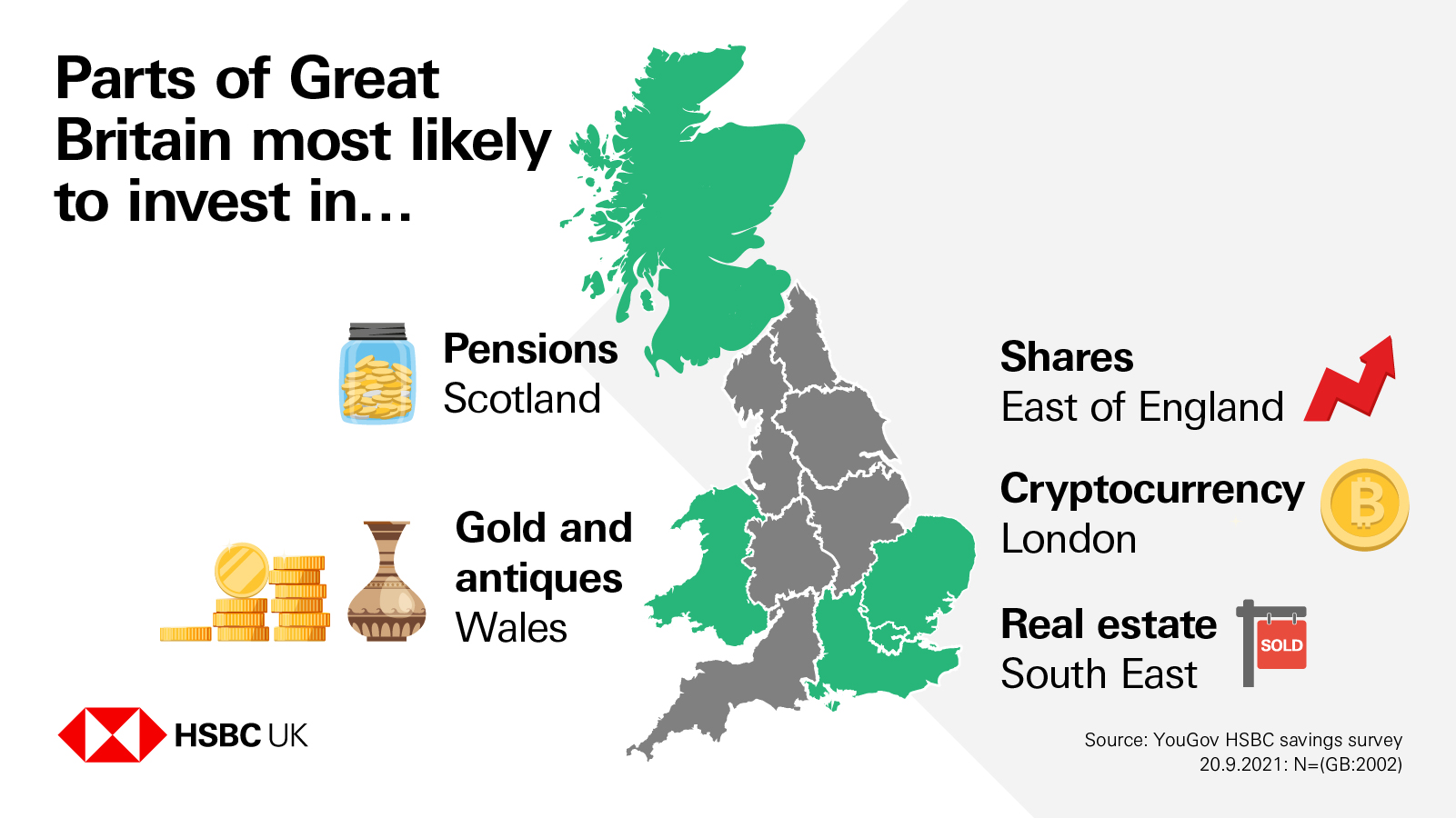

The survey also found noticeable regional differences in savings habits. London appears to lead the way on cryptocurrency, with 6% of residents saving this way. People in the East of England are the most likely to invest in shares (23%), Scotland sees the most people investing in a pension (35%), and Wales has the highest proportion of investors in gold (4%) and antiques (4%).

Couples living together top the table for people trying to save (60%), ahead of those who have never married (57%) and those who are married or in civil partnerships (55%).

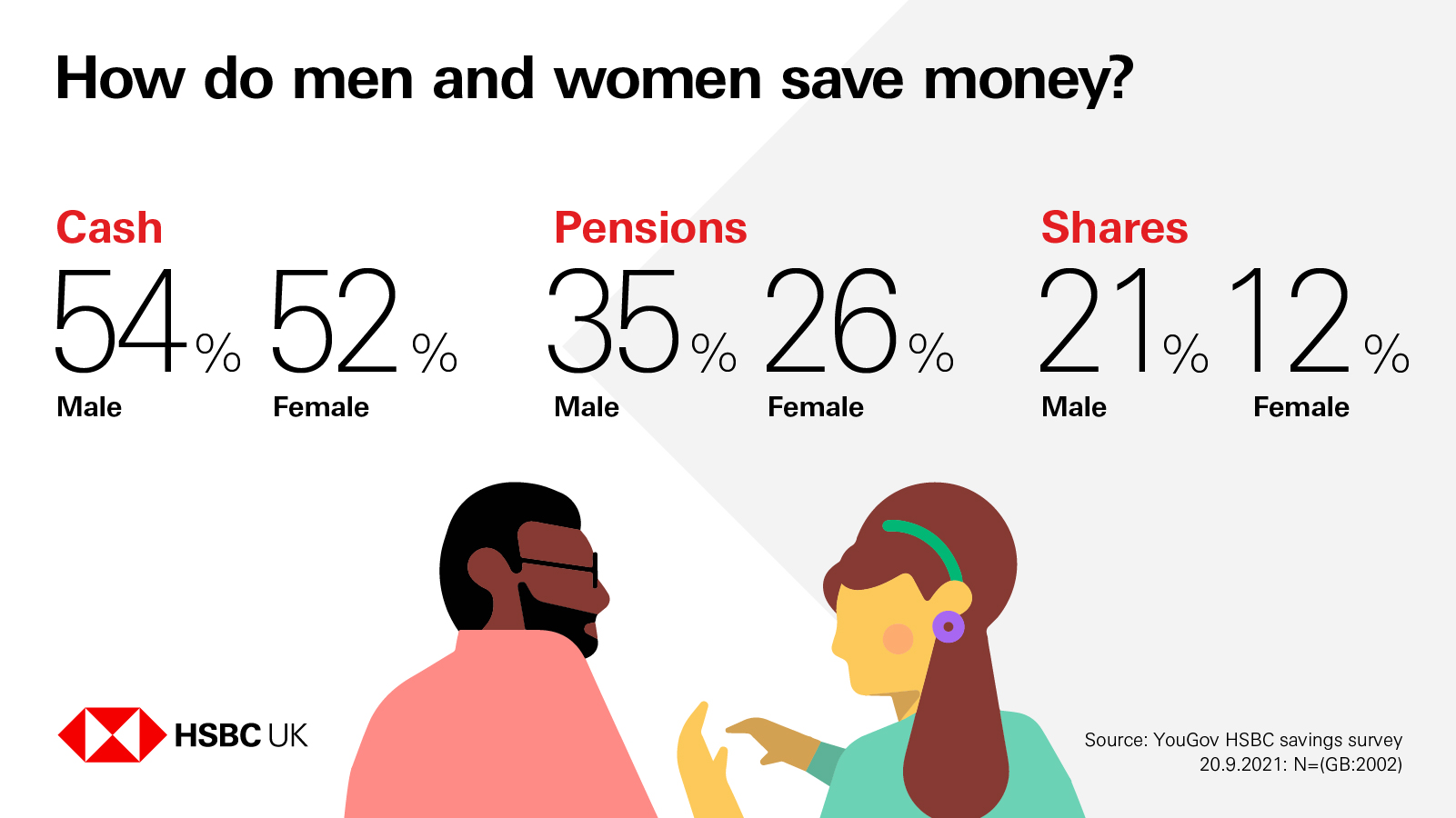

The survey data also suggests a gender divide, with men more likely than women (57% vs 53%) to say they are actively saving in general. Men are also more likely than women to be saving into a pension (35% vs 26%) and are nearly twice as likely to invest in shares (21% vs 12%). This is summed up in the graphic below.

Only just over half (55%) of the population say they are actively saving for the future, but the survey found younger age groups were more likely to be putting cash aside, with 62% of 18-34 year-olds saying they were regularly saving, compared with 55% of those aged 45-54.

And while there’s only a small difference between men and women when it comes to putting money away in cash (54% vs 52%), the data does suggest a wider divide when it comes to other types of investments. As mentioned above, more men than women (35% vs 26%) say they are saving into a pension. Men are also nearly twice as likely to invest in shares (21% vs 12%) and investment funds (12% vs 6%) – while six times more men than women say they have bought into cryptocurrencies.

My Thoughts

As a money blogger, it was interesting for me to see this snapshot of how people in Britain currently save for the future.

One thing that struck me was the relatively small number of people – and women especially – who invest in stocks and shares. Although this can be riskier in the short term, if you are saving for the medium- to long-term, history shows that you are likely to get better results investing in equities (probably via a collective vehicle such as a tracker or investment fund) rather than cash.

Right now, the best interest rate you can get on cash savings is about 1.5%. With inflation in the UK currently up to an eye-watering 9%, this means money kept in a savings account will be losing value in real terms.

Of course, we all need cash savings to fall back on when the unexpected happens (a popular rule of thumb here is three to six months’ worth of expenditure). And there may also be particular things you are saving up for, e.g. a deposit on a house. In that case, you may prefer to save into a cash account, so your money is protected under the Financial Services Compensation Scheme and readily available when the time comes.

But if you are saving for the (indefinite) future and/or retirement, over a period of years investing is very likely to produce better returns for you. To give you an example from my own experience, regular readers will know I have (currently) around £23,500 in the robo-investment platform Nutmeg. Since the start of this year, with the war in Ukraine and inflation fears, the value of my Nutmeg portfolio has fallen by 7.5%. In the six years I have been investing with Nutmeg, however, my portfolio has grown by 60% (time-weighted). Clearly in the last six years I wouldn’t have made anything like that if my money had been in a cash savings account.

Obviously with investing you have to expect ups and downs, which is why you should only invest on a medium- to long-term basis. But over a period of years, investments have almost always out-performed cash savings, often by a considerable margin.

So I do believe everyone should educate themselves about investing and perhaps take professional advice about it too. I would also like to see more taught about investing in schools. And if you have children (or grandchildren), I recommend introducing them to investing from an early age. A Junior ISA can be one very good way of doing this 🙂

One other observation is that the HSBC/YouGov survey makes no mention of crowdlending/peer-to-peer (P2P) saving/investing. This has admittedly lost some of its sheen in recent years, with projects failing and several platforms collapsing. Some people – me included – have lost money with this. However, I do still believe in the potential of investing this way, as long as you are sensible and diversify as much as possible to spread the risk.

Again, regular readers will know that I have modest amounts invested with the property crowdlending platform Kuflink and crowdfunding platform Assetz Exchange. Both of these have been doing well for me and generating returns of 6% or more. I also have a small amount in the European business crowdlending platform Nibble. Clearly this type of investment is riskier than bank savings, as your money is not protected by the FSCS. But returns can be significantly higher, and unlike equity-based investments they are not directly affected by the ups and downs of the stock markets. The latter can be reassuring when markets are volatile, as at present.

- Finally, in case anyone is wondering, I am not a fan of cryptocurrencies and don’t therefore invest in them myself or write about them on PAS. As this recent article indicates, while you can certainly make money with crypto if you’re lucky, it’s also very possible to lose your shirt!

Thank you to my friends at HSBC for allowing me to use their survey results and infographics. They also have some tips here on how to save money and stick to your savings goals.

As ever, if you have any comments about this post and/or any of the survey findings mentioned above, please do share them in the comments as usual.

Disclaimer: I am not a qualified financial adviser and nothing in this post should be construed as individual financial advice. You should always do your own ‘due dligence’ before investing, and seek professional advice if in any doubt how best to proceed. All investing carries a risk of loss.

May 21, 2022 @ 8:06 pm

This is really interesting to see, I have to admit I didn’t think so many people would save cash. I really need to try and think of better ways to save myself.

May 22, 2022 @ 6:13 am

Thanks, Sarah. Yes, saving can be challenging, in the current cost of living crisis especially. But we do all need to try to build up our savings to provide a cushion in these uncertain times.

May 25, 2022 @ 12:06 pm

This is a really useful post and full of quality info. Investing money needs lots of careful consideration and research especially if you dabble in stocks and shares.

May 26, 2022 @ 9:55 am

Thanks for your comment. I do agree that everyone should do their own ‘due diligence’ before investing and ideally take professional advice as well.

To be clear, though, I do not recommend that anyone should ‘dabble’ in stocks and shares, unless perhaps in modest amounts you are prepared to lose in a worst-case scenario. For the great majority of people, if you wish to invest in stocks and shares, the best choice is likely to be a collective investment such as an investment trust, with plenty of diversification built in.