Spotlight: The Mintos P2P European Investment Platform

Today I’m looking at Mintos, a European P2P crowdlending platform based in Latvia but open to investors in the UK.

Since its launch in 2015 Mintos has grown to become Europe’s largest P2P investment platform, with over half a million registered users. They offer access to loans (and other investment types) from multiple countries, regions and sectors. While Mintos is not directly regulated in the UK, UK investors can still use Mintos to diversify their investment portfolios.

With Mintos, your money is invested in loans to businesses and private individuals arranged by Mintos’s partner lending companies around the world. Mintos act as intermediaries between lenders and borrowers. They aim to ensure that both groups act responsibly and loans are repaid in a timely way.

Currently Mintos offer the opportunity to invest commission-free in loans, bonds, ETFs and real estate (the latter offering the potential for both income and capital appreciation). Opening and operating an account is free of charge, with personal support available in ten languages.

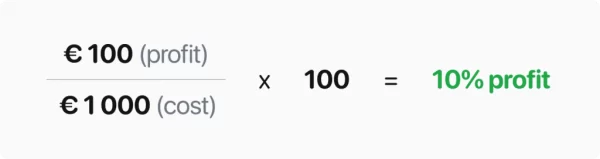

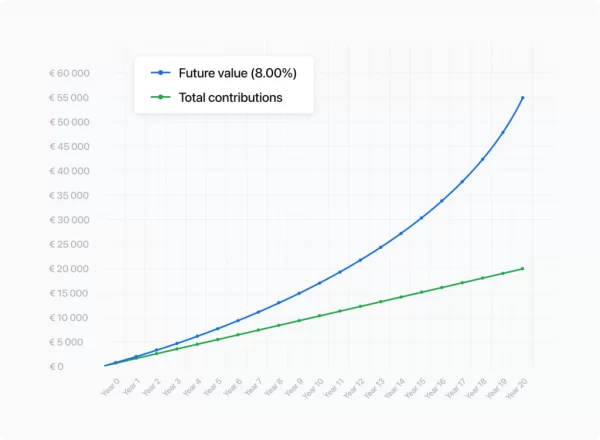

You can begin investing with just €50 (around £42). Since 2015 investors with Mintos have earned an average 11.9% return per year. Of course, past performance is no guarantee of how any investment platform will do in future.

Mintos generally has good reviews on the popular Trust Pilot website, with an average score of 4.1 out of 5 (‘Great’) and 54% five-star ratings. It does also have a few one- and two-star reviews. These are for various things, including issues with the website and complaints about the KYC (‘Know Your Customer’) checks that Mintos is legally obliged to conduct. There are also a few complaints about people losing money on investments in Russia after sanctions were imposed. To be fair this is entirely outside Mintos’s control.

Mintos is licensed and supervised by Latvijas Banka, the central bank of Latvia, and a member of the Latvian national Investor Compensation Scheme. If Mintos fails to provide investment services, retail investors are entitled to compensation of 90% of the irrevocable loss resulting from the non-provision, up to a limit of €20,000. This does not, however, provide protection in the event of poor performance of the underlying loans or investor default.

In addition, as is generally the case with crowdlending/P2P platforms, your assets are held quite separately from Mintos’s assets.

Here are some pros and cons to investing with Mintos.

Pros of Investing with Mintos

- Diversification Opportunities

- Mintos offers a wide range of loan types, including personal loans, business loans, agricultural loans, and mortgages.

- Investors can diversify across different countries and lending companies to spread risk.

- Other types of investment including bonds, real estate and ETFs are available too.

- Potentially High Returns

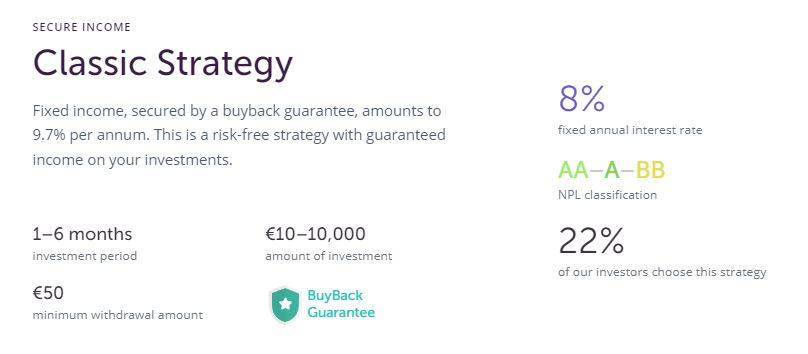

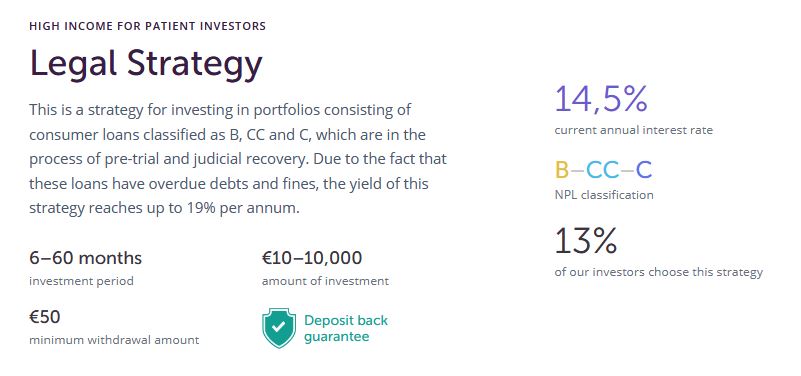

- In recent years Mintos has offered average annual returns on loans of around 10-12%.

- Some loans come with buy-back guarantees, providing additional security in case of borrower default.

- User-Friendly Platform

- The platform provides automated investing tools and diversification settings.

- Detailed loan information and transparency on loan originators help investors make informed decisions.

- Secondary Market

- Investors can buy and sell loans on the Mintos secondary market, providing liquidity if they wish to exit before a loan matures.

Cons of Investing with Mintos

- Currency Risk

- Many loans are denominated in non-GBP currencies, exposing UK investors to currency exchange risks.

- Platform and Regulatory Risk

- Mintos is regulated under the EU’s financial laws but it is not directly regulated by the UK Financial Conduct Authority (FCA). This may limit investor protection.

- Credit and Default Risk

- Loans issued through Mintos are subject to borrower defaults. Although buy-back guarantees mitigate this risk, guarantees are only as reliable as the lending companies that provide them.

- Tax Considerations

- UK investors must declare any income from Mintos to HMRC on their self-assessment tax returns and pay tax on this if they have exhausted their personal tax-free allowance. There are no automatic tax-free wrappers like ISAs or SIPPs available for Mintos investments.

Top Tips for UK Investors

- Start Small: Begin with a small investment to understand how the platform works.

- Diversify Broadly: Spread your investments across multiple loan originators, regions and loan types.

- And Broader Still: Don’t overlook either the diversification opportunities presented by bonds, ETFs and real estate.

- Monitor Currency Exchange Rates: Consider the potential impact of currency fluctuations on your returns.

- Evaluate Loan Originators: Research the financial health and reputation of lending companies offering loans via Mintos.

- Consider Investing via the Mintos Core ETF: This provides instant global diversification aligned with your risk tolerance and investment time-frame.

Closing Thoughts

Mintos can be an attractive platform for investors seeking to diversify their portfolios and potentially achieve higher returns through P2P lending. It’s important, however, to understand the associated risks, particularly around currency exposure and regulatory protection. By conducting thorough research and managing risk through diversification, Mintos can be a useful addition to a well-balanced portfolio.

If you’re looking for a hands-on investment experience with the potential for higher returns, Mintos may be worth exploring. However, cautious investors may prefer more traditional options within regulated UK markets. The lack of availability of tax-efficient wrappers such as ISAs may also be a consideration. Always ensure that any investments align with your financial goals and risk tolerance.

Special Bonus for New Investors!

Until 30 April 2025, if you click through any link to Mintos in this article and invest €1,500 or more in loans, bonds, ETFs or real estate, you can get a bonus of up to €200 paid into your account. Note that you will need to enter the promo code DIVERSIFY to qualify for this.

If you invest €5000, for example, in addition to the returns advertised (currently averaging 11.9% for loans), you will also receive a €50 bonus. Effectively that’s an extra 1% bonus. Remember, this special offer closes on 30 April 2025. Note that to qualify for the bonus you must not withdraw funds from your Mintos account until 31.July 2025. The bonus will then be paid into your Mintos account on 10 August.2025. For full details of the bonus offer, please click through to the Mintos website.

If you have any comments or questions, as always, please do leave them below.

Disclosure: I am not a registered financial adviser and nothing in this article should be construed as personal financial advice. You should always do your own ‘due diligence’ before investing, and if in any doubt seek advice from a registered financial adviser before proceeding. All investing carries a risk of loss.

This post includes affiliate links. If you click through and make an investment (or perform some other designated action) I may receive a commission for introducing you. This will not affect the product or service you receive or any charges you may pay. Note also that the special bonus referred to in this article is only available if you click through one of my links. It will not apply if you go to the Mintos website directly.