Kuflink: My Review of this P2P Property Investment Platform

Today I am looking at P2P property investment platform Kuflink.

I have been investing with Kuflink for five years now, so this is a fully updated repost of my original review.

What is Kuflink?

Kuflink is an online platform offering opportunities to invest in loans secured against property. These loans are typically made to developers who require short- to medium-term bridging finance, e.g. to complete a major property renovation project, before refinancing with a commercial mortgage.

Kuflink offer three types of investment, as follows:

- Select-Invest (individual loans)

- Auto-Invest

- Tax-free IFISA (Innovative Finance ISA)

Auto Invest and IFISAs both automatically invest your money across a number of loans and pay a fixed interest rate, typically between 7 and 9%. You can choose a 1-year, 2-year or 3-year term, and interest is paid annually (it is automatically reinvested at the end of each year with the two-year and three-year products). The Auto-Invest product is basically the same as the IFISA, but without the tax-free wrapper.

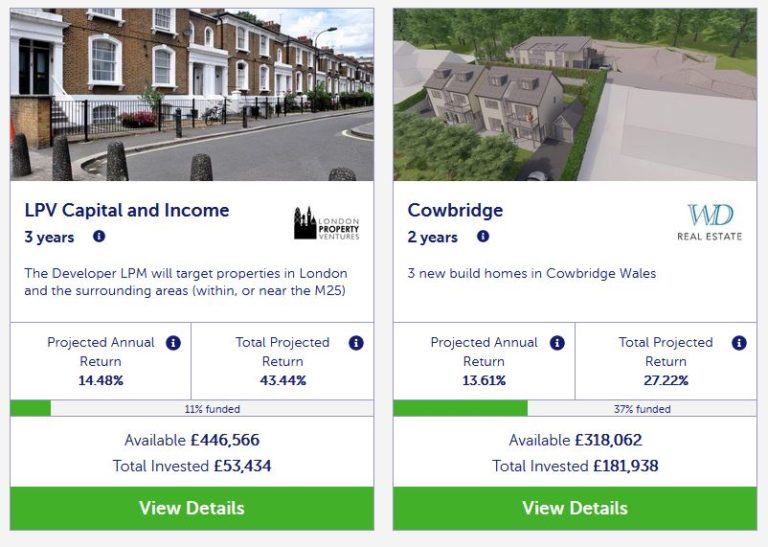

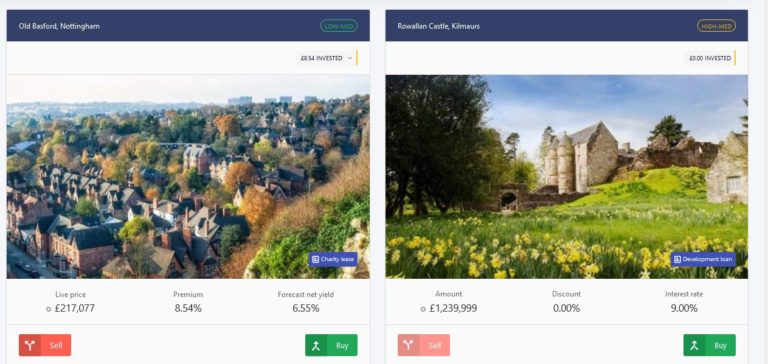

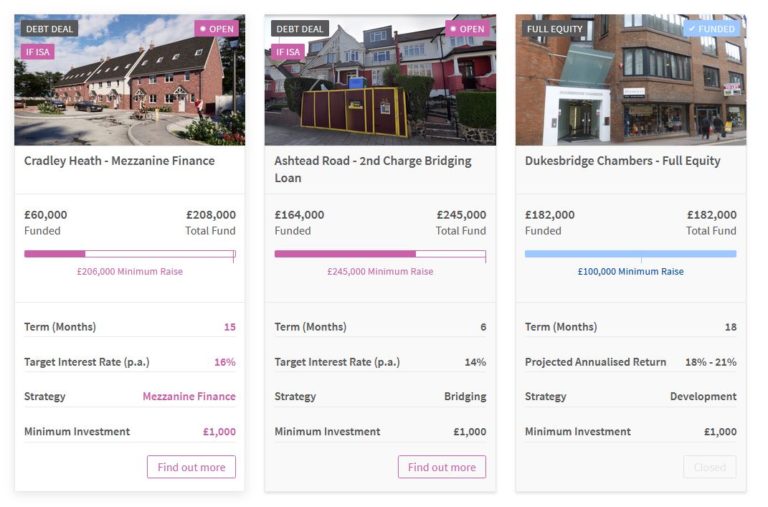

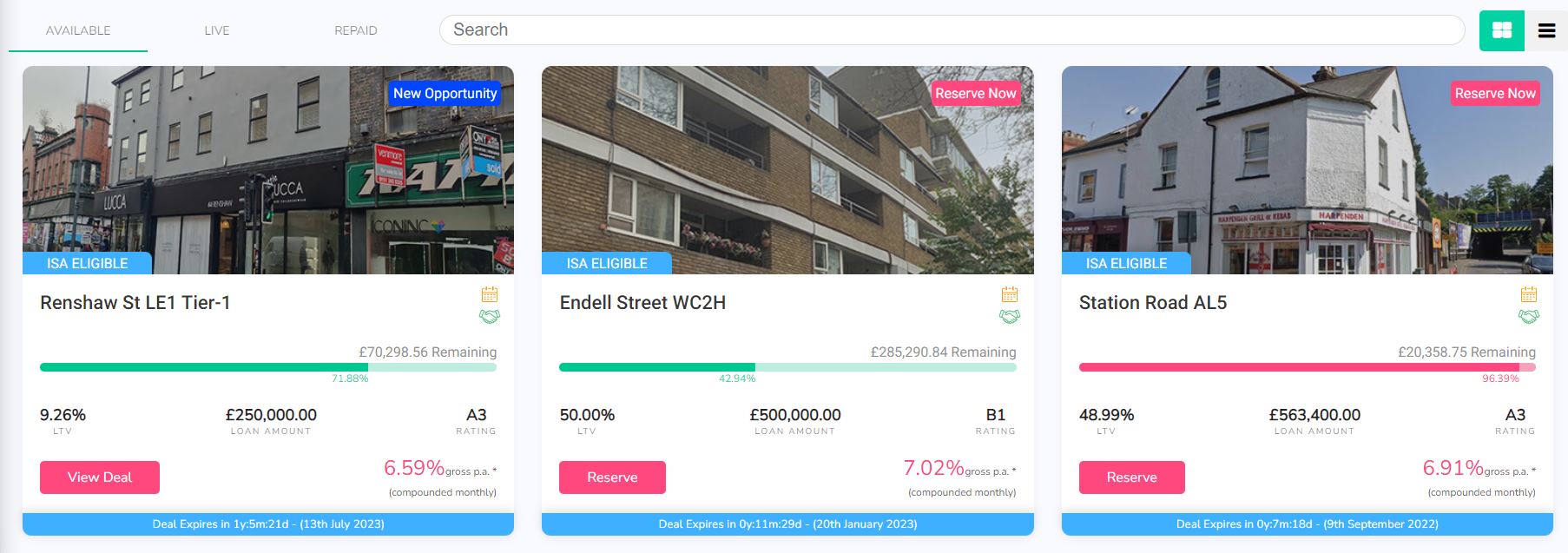

- At one time only the Auto-Invest option was available for IFISAs, but nowadays you can choose your own investments if you prefer. The great majority of Self-Select loans on the Kuflink platform are IFISA-eligible. If you check out the Self-Select listings on the Kuflink website (see image below), this will tell you whether any particular loan is IFISA-eligible or not.

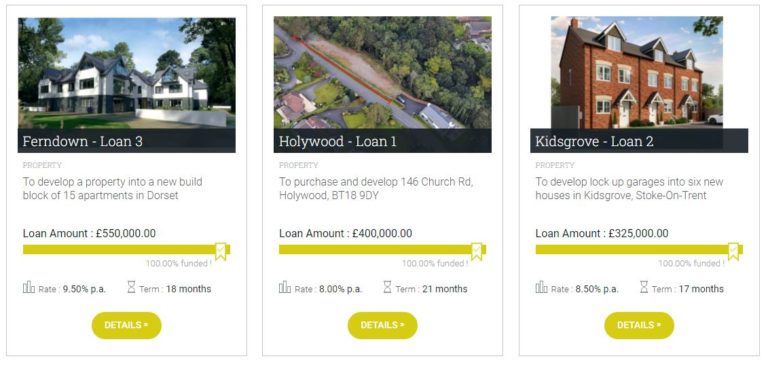

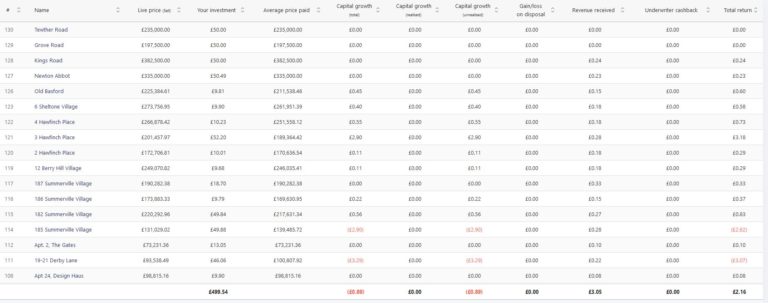

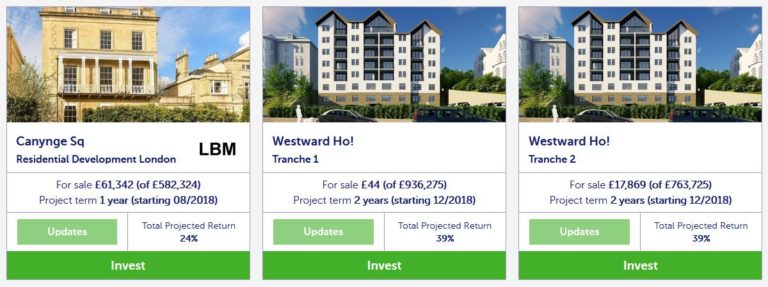

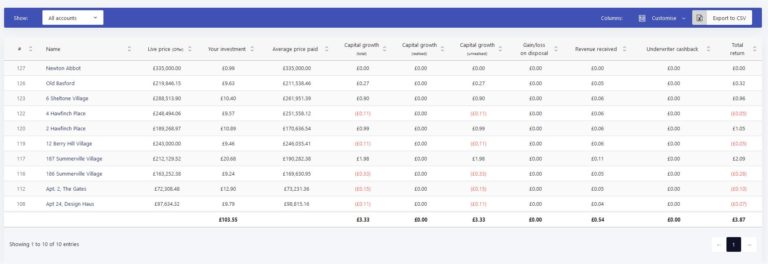

Individual Select-Invest loans pay interest rates varying between about 6 and 7.2%, depending largely on the LTV of the loan (loan to value, a measure of how secure the loan would be in the event of a default). The higher the LTV, the riskier the loan, and – other things being equal – the higher the interest rate paid in consequence. You can see a screen capture below of three Select-Invest loans available on the platform at the time of writing.

As a reasonably experienced P2P investor, I put my money into Select-Invest loans. These typically have a duration of six months to a year and (as mentioned above) pay interest from around 6 to 7.20 percent. That obviously isn’t as much as some P2P property platforms (e.g. BLEND), but I think it represents a fair balance between risk and reward. Kuflink also invest in every loan themselves up to 5% of the value of each loan – so, as the expression goes, they have skin in the game.

My Kuflink Review

I found signing up with Kuflink a quick and easy process. They do the obligatory money-laundering checks, but in my case anyway this was all done electronically behind the scenes. I uploaded a copy of my passport and was approved almost immediately. I started by depositing £500, but you can start with as little as £100 if you like.

Initially I put my money into a 12-month loan paying 7% annual interest. One good feature I didn’t grasp initially is that with Select-Invest loans interest is paid monthly. So once a month I receive interest payments on all the loans I am currently invested in. This is paid into a wallet, from which you can either withdraw to your bank account or reinvest.

- Kuflink recently introduced an option to have monthly loan repayments automatically reinvested rather than paid into your account as cash. This effectively boosts your interest rate by the power of compounding, as you then receive interest on the reinvested payments as well. Currently this option is available for most, but not all, loans on the platform. You can see which of your loans compounding is available for via your Kuflink dashboard.

I have continued to invest in Kuflink, and have also reinvested in new loans when the original ones were paid off. Another good feature is that money invested in a loan but not yet released to the borrower attracts interest which is paid as cashback once the loan has gone live.

There have been no defaults so far on any of my loans, and Kuflink say on their website that to date nobody has lost a penny on their platform. I have experienced short delays with loans being repaid, but in such cases you continue to earn interest, of course.

Secondary Market

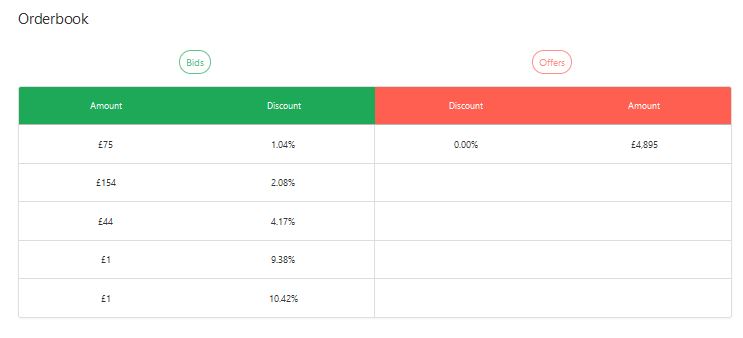

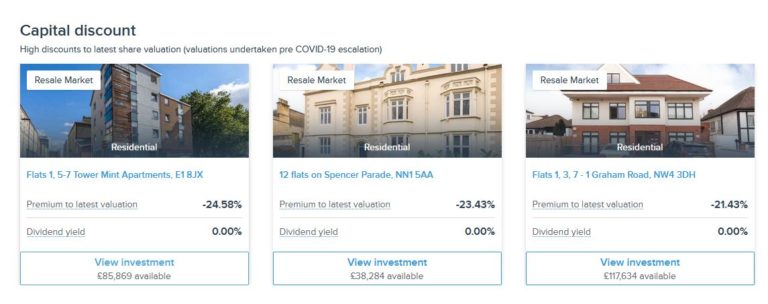

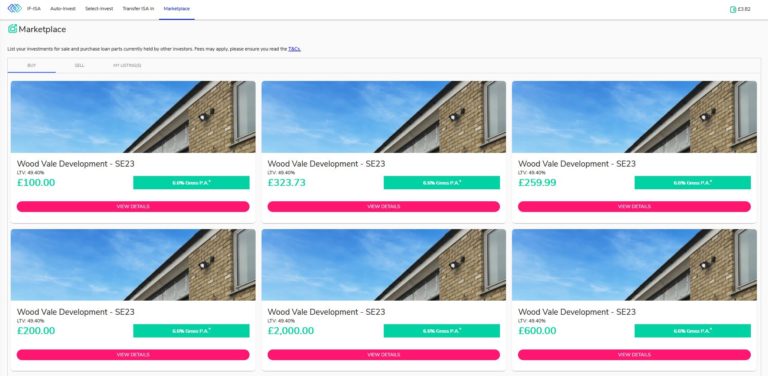

A new feature on Kuflink I like is the Marketplace (secondary market). Here you can buy loan parts from other investors who want to sell up early. You can also put up for sale any (or all) of your own loan parts.

The number of loan parts listed in the Marketplace went up in the early months of the pandemic, as many investors understandably wanted (or needed) to access their cash. This created short-term buying opportunities which I was happy to take advantage of. Loan parts offered via the Marketplace typically have only a few months to run, so you can expect to get your capital back quickly (and can then reinvest it if you wish). Only loans in good standing with monthly repayments up to date may be listed on the Marketplace, so that offers some reassurance against default – though of course it is by no means a guarantee.

In recent months the number of loan parts listed on the Marketplace has reduced considerably. And those that are tend to be snapped up quickly. As a would-be investor this is slightly disappointing, but it does indicate that people are keen to take advantage of the opportunities on offer. It also means that if you want (or need) to exit a loan early, accessing your money should be a quick and easy process.

Pros and Cons

Based on my experiences, here is my list of pros and cons for the Kuflink investment platform.

Pros

1. Easy sign-up process.

2. Low minimum investment.

3. All loans secured against property.

4. Choice of investments and approaches.

5. Manual and auto-invest options.

6. Kuflink invest in all loans themselves, so they have a strong incentive to ensure they are safe and secure.

7. They also cover the first 5% of losses on any loan before investors are affected (although this has never happened yet).

8. Money invested but not yet released to the borrower attracts interest which is paid as cashback once the loan has gone live.

9. In-depth information is provided on the website about all loans, so you can see exactly how your money will be used (and by whom).

10. There have been (according to Kuflink) no investor losses to date.

11. Customer service (in my experience anyway) is fast, friendly and helpful.

12. There is a 14-day cooling off period for new investors.

13. Marketplace (secondary market) for buying and selling loan parts.

14. No charges to investors lending on the primary market and only a 0.25% fee if you resell a loan part on the secondary market.

15. On most loans you can opt to reinvest monthly repayments to boost your net interest rate.

16. Tax-free IFISA option available.

Cons

1. Rates paid aren’t the highest in P2P lending.

2. Delays with some loans being repaid (although investors do earn extra interest if this happens).

3. No mobile app [UPDATE FEB 2023 – An app is now available.]

Conclusion

Overall, my experiences with Kuflink so far have been entirely positive and my investments have been generating the promised returns. I started cautiously with them, but have gradually built up the amount I have invested on the platform. Although – like all property P2P platforms – they were adversely affected by the pandemic, they appear to have come through it strongly, with new loans now being added almost daily.

As mentioned above, although Kuflink don’t pay the highest rates in P2P lending, I think the returns on offer are realistic and sustainable. The steady expansion of the platform seems to testify to this, as does the fact that they have received several industry awards. These include Best Alternative Business Funding Provider in the Business Moneyfacts Awards in both 2018 and 2019 and Best Service From an Alternative Funding Provider in 2020.

Kuflink are also highly rated on the independent TrustPilot website, with an average 4.6 out of 5 (‘Excellent’). At the time of writing 82% of reviewers award them the maximum five-star rating, which is among the highest figures I have seen for a financial services platform.

As with all P2P lending, your money does not enjoy the same level of protection as bank and building society accounts, which are covered (up to £85,000) by the Financial Services Compensation Scheme. Nonetheless, the rates of return on offer are significantly better than those from most financial institutions. And the fact that all loans are secured against bricks and mortar – and Kuflink themselves have cash invested in them – clearly offers some reassurance.

From my experience, Self-Select loans tend to fill up quickly. On the positive side, this shows investors have confidence in Kuflink and want to invest through the platform. On the minus side, it means there are typically no more than two or three new loans open for investment at any time.

Clearly, no-one should put all their spare cash into Kuflink (or any other P2P investment platform). Nonetheless, it is certainly worth considering as part of a diversified portfolio. Not only are the rates of return much higher than those offered by banks and building societies, they are relatively unaffected by ups and downs in the stock market. P2P loans aren’t a way of hedging your equity-based investments directly, but they do help spread the risk.

If you have any comments or questions about this review or Kuflink in general, as always, please do leave them below.

Disclosure: As stated above, I am an investor with Kuflink myself, and if you invest £500 or more via my link above I will receive a bonus for introducing you. Money is at risk. You should always do your own ‘due diligence’ before investing, and seek advice from a qualified financial adviser if in any doubt how best to proceed.