My Coronavirus Crisis Experience: August Update

Regular readers will know that I have been posting about my personal experience of the coronavirus crisis since lockdown started (you can read my July update here if you like).

I said I hoped that update might be my final one, but in light of events over the last few weeks that may have been a bit optimistic. So I have decided to continue publishing monthly updates for a while longer.

As previously I will discuss what has been happening with my finances and my life generally over the last few weeks. As always, I will start with the money side of things.

Financial

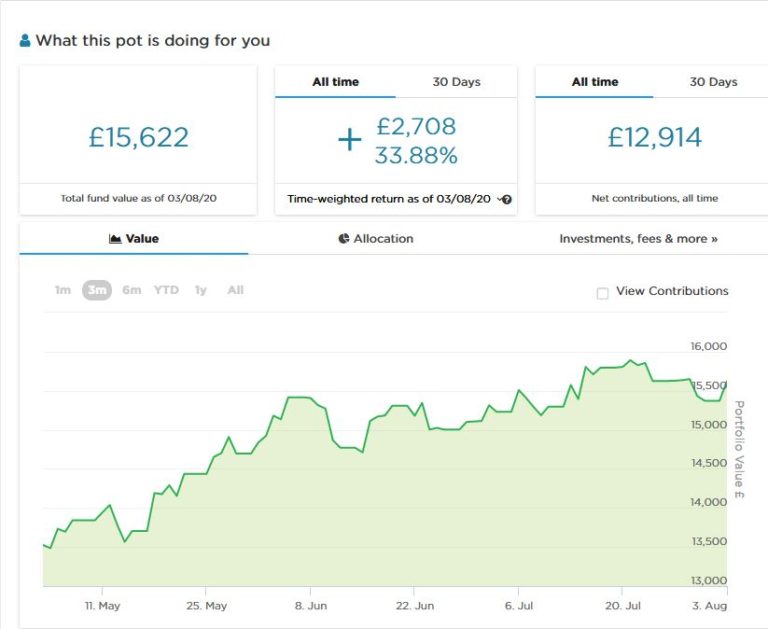

Again, things haven’t changed dramatically since my update last month. Here’s the latest chart showing how my Nutmeg stocks and shares ISA is faring…

Through July there have been ups and downs, but as of today my Nutmeg ISA is £400 up compared with my last update in early July. This represents a good overall recovery after it lost over a third of its value early in the pandemic (admittedly I helped things along by investing another £1,000 when the markets were near their lowest point). Even allowing for this extra £1,000, my portfolio is now a little above where it was before the crisis started.

I remain cautiously optimistic that the recovery will continue over the longer term. Obviously, if there is a big ‘second wave’ of the virus all bets are off, but personally I think this is unlikely. And even if it does happen, the NHS is much better placed to cope. So I plan to stay in the markets and continue to invest cautiously where I see value. I haven’t put any more money into my Nutmeg ISA just yet but will probably do so soon. Do take a look at my in-depth Nutmeg review if you haven’t already.

My monthly payments from my two Buy2LetCars investments (totalling around £420) continue to appear in my bank account every month like clockwork. I have had no issues at all with this platform, and am glad also to be supporting key workers by providing reasonably priced transport for them. Again, if you’d like to learn more, you can read my review of Buy2LetCars here and my more recent article about the company here. The minimum investment is £7,000 so this opportunity isn’t going to be for everyone – but if I had that sort of money burning a hole in my pocket right now, I wouldn’t hesitate to invest through them again. Each car generates a monthly income, with a large lump sum at the end of the three-year term. Interest rates range from 7 to 12 percent per year.

My other equity-based investments generally continue to do about as well as could be expected. As I said last time, my Bestinvest SIPP hasn’t lost any significant value when you allow for the fact that it’s in drawdown and I am currently withdrawing £200 a month from it. I’m not claiming any special skills as a stock picker, but having a broad range of funds in my portfolio has undoubtedly served me well. Years ago, also, I decided to invest some of my pension money in specialist healthcare funds, and these have done better than average over the last few months.

My property crowdfunding investments are still sluggish, though I was pleased to hear that Property Partner are recommencing the five-year anniversary process, starting on 1st October 2020. They also intend to start paying out dividends again on some properties from 30 September 2020 (though only those with strong enough financial reserves to justify this). Properties on their resale market are currently selling at up to 20% below the independent pre-Covid valuations, so theoretically there could be short-term profit opportunities here. But of course, there is no guarantee that properties will still sell at pre-Covid prices. I am not intending to invest any more on the PP resale market at this time, though I might review that if the initial five-year sales pass off successfully.

My Kuflink investments are still ticking along nicely, and it has been reassuring to see a steady stream of new loans going live on the platform over the last few weeks. I have been investing modestly in them, along with loan portions that have just a few months left to run via the Kuflink Marketplace. See my Kuflink review here for more information. Their up-to-£4,000 cashback offer for new investors is still open, incidentally.

I also have property crowdfunding investments with The House Crowd and Crowdlords. As mentioned last time, one of my House Crowd properties is in the process of being sold, so I should get around £1,000 from that. Checking on the THC website today, I see the buyer has now requested vacant possession, meaning the tenant has to be given notice to leave. So I am not expecting the sale to go through any time soon, especially as tenants have been given additional protection due to the pandemic (quite rightly, of course). They are continuing to pay rent, so this should at least help to defray some of the sale costs.

I received an email from Crowdlords a couple of weeks ago which came as a shock. It said that, ‘following recent announcements by the FCA to propose permanent changes of the mass-marketing of speculative illiquid securities, Crowdlords is ceasing all FCA regulated activity with immediate effect.’ The message went on to say that they are ‘currently exploring our options regarding the types of investments we will offer in the future and we will be in touch very soon with more details as appropriate.’

As regards existing CL investments – of which I have two – these will continue to be managed by Crowdlords. It is, though, disappointing that there have been no updates about either of my CL investments since before the pandemic, either on the website or by email. My investments are in bricks and mortar so I have no doubt I will get my money back eventually, hopefully with profits. But again, I’m not holding my breath. I will be writing to Crowdlords to see if any further information is available and will add an update here or in next month’s update as seems appropriate.

- One other thing I have mentioned before is that I still have a few invitations available for an unusual sideline-earning opportunity based on matched betting. I have been asked not to divulge too many details about it on the blog for very good reasons I will explain privately to anyone who may be interested (and no, it’s not illegal!). What I can say is that it doesn’t require any financial outlay, is entirely hands-off, and will provide an income of £50 a month. No knowledge of betting is required, and you won’t have to place any bets yourself. Just note that the opportunity is only open to people who haven’t done matched betting before and have no more than two accounts already with online bookmakers. For more info (and receive a no-obligation invitation) drop me a line including your email address via my Contact Me page 🙂

Personal

As I’ve said before, I live on my own since my partner, Jayne, passed away a few years ago. I am lucky to live in a fairly large house with a good-sized garden, so being mostly confined to home hasn’t been as big a challenge for me as I’m sure it has for some. Also, I am well used to working from home, having done this for the last 30 years or so.

As you may know, I am a semi-retired freelance writer and editor (age 64). I’ve had very little work since the lockdown started, and was duly grateful to receive some financial support from the government’s SEISS scheme. I also intend to apply for the second tranche of SEISS payments when applications open on August 17th.

- I am still available for freelance writing, editing or proofreading work, although not taking on book-length projects any more. Feel free to drop me a line if you think my services might be of interest to you 🙂

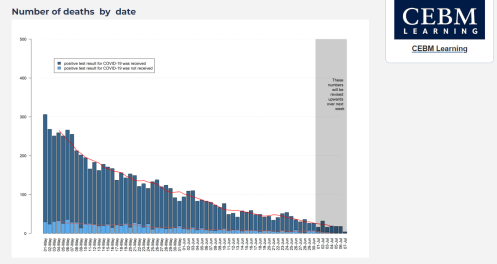

Last time I said it appeared the worst of the pandemic was behind us and things were starting to feel more normal again. I do still believe this, but of course in recent weeks there have been local ‘spikes’ leading to restrictions being reimposed in the areas concerned (including Leicester, my old university city). This has led to media scare stories about an imminent ‘second wave’ of the virus, for which there is still no actual evidence. I prefer to believe Professor Karol Sikora about this. He says such local upticks are entirely to be expected at this stage of the pandemic and should be controllable with the aid of track and trace and other suitable measures in affected areas.

One thing that has happened nationally in England since my last update is that face coverings have been made mandatory in shops and supermarkets. As you may know, I am very dubious about this. The evidence that masks offer any real benefit in this setting is weak at best. What’s more, many people misuse them, typically fiddling with them and re-using them without washing them (if that’s possible). Doing this can actually increase the risk of transmitting the virus. In addition, there are growing reports about people contracting other serious lung conditions through long-term use of masks.

What’s more, the imposition of mandatory masks has changed the atmosphere in shops and supermarkets, which had been starting to feel more relaxed. The tension in the air when shopping is palpable now. Although shop staff have generally displayed commonsense and tact when enforcing the rules, that hasn’t stopped some self-appointed ‘mask police’ from harassing people they think are breaking the rules.

I witnessed a particularly unsavoury incident in my local Morrisons, when a man confronted a woman who was shopping without a mask. He screamed insults at her, removing his own mask to do so – whether to berate her more effectively or (heaven forbid) ‘to see how she liked it’. The woman’s child was clearly distressed by the incident, and it left a bad taste in my mouth too.

For the record, while face coverings are now mandatory in shops, people with medical or psychological conditions that are exacerbated by masks don’t have to wear them (neither do they have to provide proof of this). My own suggestion, FWIW, would be for supermarkets to have a designated hour that is strictly ‘masks only’, so that people whose sensibilities are offended by others not wearing masks don’t have to see this. The rest of the time commonsense can be applied and people who can’t wear masks can be left to get on with their shopping without fear of being harangued by staff or other customers.

Personally I have a mild lung condition which means it is inadvisable for me to wear a tight face covering for more than a few minutes. I can be in the supermarket for over an hour when shopping for elderly friends as well as myself, and I’m not willing to put my health at risk for no good reason by wearing a mask for that long. So I am now wearing a clear plastic face shield/visor, which allows me to breathe but still provides a physical barrier. I think that’s a reasonable compromise personally. As a matter of interest, here is a link to the ones I ordered from Amazon, which I highly recommend [affiliate link].

You can also buy badges and lanyards from the Disability Horizons online shop which clearly show your mask exempt status (see picture below). There is no requirement to wear anything like this, but some people may wish to do so to reduce the likelihood of being challenged.

I understand the government hoped that making masks mandatory in shops would encourage more people to go, but I don’t see that myself, and evidence appears to confirm that the opposite is the case. Personally I have found shopping a far less enjoyable experience since this measure was introduced, and am now going to the shops as little as possible. Their loss is Amazon’s gain, I’m afraid.

Moving on, I just had my first haircut since March, which was very much needed and appreciated. I have also been enjoying swimming again at my local David Lloyd club. It’s been great to be doing something normal again, and staff and management there have been doing a brilliant job. They are taking mitigation measures to protect against the virus, but these are generally unobtrusive and sensible (no mandatory masks for members or staff anywhere). The last time I went I also enjoyed a half-price cappuccino and cake in their coffee shop, by courtesy of the government’s Eat Out to Help Out scheme.

I am looking forward to my short break in Minehead at the start of September, which I booked before this crisis happened. I am also still mulling over whether to try to book a couple of days away in Wales. August is filling up now, including meeting friends I haven’t seen for ages, so this may have to wait till later in September. A weekend in Llandudno or Aberystwyth could definitely be on the cards.

Finally, I’m sure you’re dying to know, so I’m on the ninth and final season of Bergerac now. Jim has left the Jersey police and is living in France with new squeeze Danielle. The show did lose something when it moved away from Jersey, though of course the writers found plenty of opportunities to bring our hero back to the island. Some good new characters were introduced in the final series, notably the inimitable Roger Sloman playing Jim’s replacement, Inspector Deffand, with lip-curling disdain. I shall be sorry when I finish this box set. I do have others lined up, and am also mulling over subscribing to Britbox, mainly so I can relive my childhood with all the classic Doctor Who episodes there!

So that has been my experience of the coronavirus crisis to date. I do of course appreciate that I am in a fortunate position compared with many others, and hope you and your family are coping in these strange and worrying times. Here’s hoping that things continue to improve and we can all return in due course to something approximating normal life.

As ever, I’d love to hear your thoughts and experiences. If you have any comments or questions, as always, please do post them below.